Best Trading Demo Competitions In March 2026

Trading demo competitions can be a fantastic way to practise strategies without financial risk, while sometimes bringing the possibility of cash prizes.

Here’s how it works – a broker will offer a demo account that comes funded with virtual capital. You then trade financial markets like forex and stocks, competing against other trades who’ve signed up.

To take part, pick from our selection of the best brokers running demo trading contests.

Top Brokers For Demo Competitions

These 6 brokers offer the best demo trading competitions based on our latest tests:

Why Are These Brokers The Best For Demo Trading Competitions?

Here's a quick summary of why we believe these are the best brokers for demo account competitions:

- XM is the best broker with demo trading contests in 2026 - When we tested XM’s demo contests, we found real cash prizes up to $30,000 monthly with no deposit required. Entry was quick, and competition formats were fast-paced, simulating live spreads from 1 pip with MT4/MT5 platforms. Execution and volatility mirrored live conditions closely, offering genuine trading pressure in a risk-free setting.

- RoboForex - During our tests, RoboForex’s demo contests ran monthly with prize funds up to $10,000 and no deposit needed to join. Entry was smooth, and trading took place on MT4/MT5 with spreads from 0.0 pips and fast execution. Market replication was strong, with real-feel volatility and latency, making strategy timing crucial.

- FBS - When we investigated FBS’s demo trading contests, they stood out for frequent events with real-money prizes up to $1,000. Entry was instant, and the conditions closely mirrored live trading—tight spreads from 0.7 pips, no commissions, and solid execution on MT4/MT5. The format encouraged aggressive strategies, rewarding risk-takers in a realistic setting.

- Vantage - During our evaluations, Vantage’s demo trading contests offered frequent access to real-cash prizes, often exceeding $10,000. Signup was seamless, with realistic trading conditions—tight spreads from 0.0 pips and fast execution on MT4/MT5 and ProTrader. Leaderboards updated in real-time, and competitions closely mirrored live markets, making strategy and timing feel genuinely competitive.

- NordFX - In our tests, NordFX’s demo contests ran monthly with prize pools up to $3,000. Entry was fast, and trades executed on MT4 with spreads from 0.9 pips. Market conditions were impressively close to live, including slippage during volatility. The format rewarded both consistency and risk, offering a solid test environment.

- LiteFinance - When we tried LiteFinance’s demo trading tournaments, we found weekly and monthly formats with prize pools often hitting $4,000. Signup was straightforward, and trading conditions mimicked live spreads from 0.8 pips on MT4/MT5. Execution was sharp, with realistic volatility and slippage. The contests favored disciplined risk management over pure aggression.

How Secure Are The Best Demo Competition Brokers?

Even with demo competitions, platform security matters. Here's how the top brokers protect your data and accounts:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| XM | ✘ | ✔ | ✔ | |

| RoboForex | ✘ | ✔ | ✔ | |

| FBS | ✘ | ✔ | ✔ | |

| Vantage | ✘ | ✔ | ✔ | |

| NordFX | ✘ | ✘ | ✘ | |

| LiteFinance | ✘ | ✔ | ✔ |

Are The Best Demo Competition Brokers Good For Beginners?

Demo competitions are a great way to learn. Here's how these brokers support beginners with user-friendly setups:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| XM | ✔ | $5 | 0.01 Lots | ||

| RoboForex | ✔ | $10 | 0.01 Lots | ||

| FBS | ✔ | $5 | 0.01 Lots | ||

| Vantage | ✔ | $50 | 0.01 Lots | ||

| NordFX | ✔ | $10 | $1 | ||

| LiteFinance | ✔ | $50 | 0.01 Lots |

Are The Top Demo Competition Brokers Good For Advanced Traders?

Advanced traders need flexible tools, fast platforms, and real incentives. Here's how these brokers meet those needs:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XM | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:1000 | ✔ | ✘ |

| RoboForex | Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✔ | ✘ | ✘ | 1:2000 | ✘ | ✘ |

| FBS | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:30 (EU & Restricted Countries), 1:3000 (Global) | ✔ | ✘ |

| Vantage | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| NordFX | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| LiteFinance | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:500 (Crypto 1:50) | ✘ | ✘ |

Compare Detailed Ratings Of Top Demo Competition Brokers

See how the best demo competition brokers scored in our hands-on evaluations:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| XM | |||||||||

| RoboForex | |||||||||

| FBS | |||||||||

| Vantage | |||||||||

| NordFX | |||||||||

| LiteFinance |

How Popular Are These Demo Competition Platforms?

We looked at which demo competition brokers are gaining the most attention from traders worldwide:

Why Join A Demo Competition With XM?

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

Why Join A Demo Competition With RoboForex?

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

Cons

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

Why Join A Demo Competition With FBS?

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Shares, Commodities |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Account Currencies | USD, EUR |

Pros

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

- The trading firm has picked up over 90 awards and amassed more than 27 million clients, making it one of the largest and most established brokers globally.

- FBS offers lightning-fast execution speeds from just 10 milliseconds, placing it among the industry leaders for highly active traders like scalpers who demand rapid order processing.

Cons

- Although the FBS app offers a terrific mobile trading experience for aspiring traders and MT4/MT5 cater to advanced traders, the absence of cTrader and TradingView, which are increasingly offered by alternatives like Pepperstone, will deter day traders familiar with these platforms.

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

- Despite enhancing the selection of currency pairs, now providing over 70, FBS still trails industry leaders like BlackBull Markets in its market offering with a particularly narrow selection of commodities and indices.

Why Join A Demo Competition With Vantage?

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

Cons

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

Why Join A Demo Competition With NordFX?

"NordFX’s competitive trading conditions are exclusively available to upper-tier account holders, making it a suitable platform for experienced day traders seeking zero-spread trading on the MetaTrader platforms, with a minimum deposit of $100 for MT4 and $200 for MT5."

Tobias Robinson, Reviewer

NordFX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, commodities, cryptos, stocks |

| Regulator | FSC (Mauritius), FSA (Seychelles) |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | $1 |

| Leverage | 1:1000 |

| Account Currencies | USD |

Pros

- There's an impressive range of 25+ payment methods, including local bank transfers, with zero fees and near-instant processing, making for a convenient account funding experience.

- The straightforward copy trading service may appeal to beginners or improving traders, with just a $100 minimum deposit to get started.

- NordFX has bolstered its charting tools for advanced traders, adding MT5 to its existing MT4 integration, with faster, multi-threaded processing.

Cons

- With only around 100 instruments, NordFX’s market coverage is lacklustre at best, with a particularly poor selection of around 20 shares.

- Although NordFX offers competitive pricing in its Zero accounts, it still trails the cheapest brokers like IC Markets, while the Pro accounts feature industry-high spreads from 10 pips.

- The lack of regulatory oversight is a significant concern as clients of NordFX may receive limited safeguards, notably no negative balance protection or segregated accounts.

Why Join A Demo Competition With LiteFinance?

"LiteFinance will suit traders seeking high leverage on forex, stocks, commodities, indices and cryptocurrencies. The social trading system will also suit newer investors looking to learn from seasoned traders."

Tobias Robinson, Reviewer

LiteFinance Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Regulator | CySEC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 (Crypto 1:50) |

| Account Currencies | USD, EUR |

Pros

- Fast and reliable customer support based on testing

- Great trading platform support with MT4, MT5 and a proprietary app

- Good range of forex pairs

Cons

- Some complaints online about difficulties withdrawing funds

- Wide spreads on the Classic account

- Not overseen by any top-tier regulator

How DayTrading.com Chose The Best Demo Competition Brokers

Our team investigated the demo competitions at each shortlisted broker, focusing on platform access, prize structure, rules, and ease of entry.

We recorded our findings through hands-on testing and ranked brokers based on their overall ratings, reflecting the full trading experience.

What To Look For In A Demo Competition

Here are some things to look for when selecting a broker to compete in demo tournaments:

Authenticity & Reliability

When signing up with any broker for a trading demo competition or otherwise, you should first ensure that the broker is trustworthy and reliable. This is especially important for firms who pay their prizes in trading credit because traders will have to use their platform to wager their rewards.

Prospective clients should research brokers, looking at user reviews from external sources as well as recommendations or warnings from trusted websites. The biggest brokers that run trading demo competitions will often be regulated by an independent governing body, so look out for such certification as an indicator of authenticity.

Important aspects of a broker include the reliability of deposits and withdrawals, safe holding of client funds and stability of the platform.

Prizes & Structure

Naturally, traders will be drawn towards the biggest trading demo competition prizes. The largest tournaments can offer prize funds worth thousands of dollars, which is an appealing prospect for entrants.

As well as the size of a prize fund, it is also worth checking out the reward structure of each competition. More leaderboard places being paid means a higher chance of winning but also a smaller share of the fund for each winner. You should choose carefully between these factors, depending on your priorities.

Depth Of Field

Another key aspect when choosing whether to enter a specific trading demo competition is the depth of field. While larger prize pools are attractive to individual traders, this will likely increase the number of competitors for a prize.

Theoretically, traders will have a better chance at winning with a smaller field, so each entrant has to find a balance between the prize pool and the depth of field.

Information on the number of entrants may be available during the sign-up phase to a competition. Alternatively, most competitions will display past leaderboards showing how many entrants there have been in each contest historically.

How Winnings Are Paid Out

An important factor for traders to consider when looking for brokers that offer trading demo competitions is how the prizes are paid out. Some firms will pay prizes in cash or withdrawable funds while others will pay out in trading credit on their platform. Such funds will need to be traded before being withdrawn.

You need to decide whether you are willing to jump through these extra hoops before withdrawing your funds.

Available Trading Platforms

To ensure fairness or to promote a particular trading software, trading demo competitions are often locked into a specific platform. Some of these will be platforms experienced traders are familiar with, such as MetaTrader 4 or MetaTrader 5. Others may be unfamiliar or bespoke to brokers.

You should ensure that you are familiar with the trading platforms that contests use or are willing to learn quickly during the competition.

What Is A Trading Demo Competition?

A trading demo competition is a way to trade popular financial markets, such as forex, stocks, and cryptocurrency, without staking real money.

To take part, brokers provide special demo accounts. Providers can measure performance in different ways, typically profit generated or trading volume.

Durations can range from a single trading day to month or year-long contests. However, we’ve found the biggest competition prizes are often for long running contests.

Prizes are assigned after competitions close and trading results are generally finalized through a publicly accessible leaderboard.

How Do Trading Demo Competitions Work?

Entering

Trading demo competitions often have a window when traders can sign up to take part, which can often be around a week.

Before entering a tournament, potential competitors can look at the rules and terms and conditions of the tournament as well as the offered prize fund. Entrants should read the rules carefully to ensure they are fair and reasonable.

It is normally a straightforward process to sign up, though some brokers that run trading demo competitions require entrants to possess a live trading account with them to qualify.

Many tournaments will also be locked to a set trading platform to ensure a level playing field, so entrants should make sure they are familiar with the specific software. MT4 is widely used from our investigations.

Demo Account Is Assigned

Each competition entrant is provided with a fresh demo account shortly before the competition starts supplied with a fixed amount of virtual capital to trade with.

The account might have limits on available trading leverage in line with competition rules or it may be up to traders to independently ensure that they do not break tournament regulations.

Competition Opens

At a set time, the competition will open and traders will have until the competition ends to make as much profit as they can.

Demo competitions from different brokers will often have their own sets of rules, with some limiting the total number of trades allowed, level of leverage, the use of Expert Advisors (EAs) for algo trading, and available trading assets.

Performance Tracking

Once the trading demo competition is underway, entrants will want to know how they are performing and how their gains or losses stack up against others. The biggest tournaments provide leaderboards where traders can measure their performance against their competitors’ trades.

Entrants can quickly see if they are in a prize-winning position and how aggressively they need to trade if not. Performance data is often also available from past trading demo competitions to give users an idea of the kind of returns that are required to finish in a winning position at the end.

Competition Ends

At the competition close time, all open trades will automatically be closed and no more trading is allowed. The amount in each demo account at this time is final and will be used to calculate a trader’s leaderboard position and potential prize eligibility.

Final Leaderboard Published & Prizes Allocated

Once all trading has ceased, profits/losses are finalized for each user. The final rankings of all competition entrants are now decided with prizes awarded to entrants based on these rankings.

Rewards are often either in the form of withdrawable cash or trading credit to be used on the broker’s platforms. The former is often more appealing to entrants but the latter can also be useful. If a trader is comfortable with the platform and trusts the broker, this credit can be used to generate more profit and then be withdrawn later.

Entrants can be disqualified for breaking competition rules either before the final leaderboard is published or afterwards. Traders that narrowly missed out on prize positions should check back in case someone above them drops out.

Pros Of Demo Trading Contests

- Free To Enter – One of the main pulls of trading demo competitions is that they are completely free to enter. Rarely in trading or investment does anything come completely free, so these tournaments are a rare opportunity to gain something for nothing.

- Gain Experience With No Risk – As trading demo competitions are designed to imitate real market trading closely, traders have the chance to gain valid experience with new markets with no risk attached. For emerging markets such as cryptocurrencies, this can be valuable.

- Perform Under Pressure – One thing that differentiates demo trading contests from normal demo accounts is the pressure that comes with potential rewards. Competing prizes is a great way to expose traders to the pressure that comes with having a real financial outcome when trading. It is easy to maintain a clear head and watertight strategy when nothing is at stake in a standard demo account, introducing prizes adds similar mental pressures to trading real capital.

- Beginner-Friendly – Trading demo competitions are a great place for new and aspiring traders to start. Gaining a solid amount of practice before staking real capital can be crucial for longer term success and these tournaments are the perfect place to learn the fundamentals of forex, cryptocurrency and commodity trading. There is no substitute for a hands-on environment for learning and demo competitions allow beginners to test out their knowledge in a realistic trading scenario.

- Prizes – What may appeal most to some traders is the prospect of being rewarded for no-risk trading. The best trading demo competition prizes can be thousands of dollars, with leaderboard places paid out up to the top ten traders. Competition prizes are either paid out in the form of withdrawable cash or trading capital.

Cons Of Demo Trading Contests

- Limited Prize Positions – If traders are competing in trading demo competitions purely with winning prizes in mind, then this can be a frustrating affair. The biggest demo trading competitions have many thousands of entrants and only a handful are rewarded for their efforts.

- Payouts Can Be In Trading Credit – Many traders will want to be rewarded in cash if they finish in a prize-winning position but some prizes are paid in trading credit. This means that competition prizes have to be traded live before they can be withdrawn, which adds both risk and hassle to being paid out.

- Unrealistic Trading Required To Win – In a demo trading competition, there is nothing to lose and everything to gain from aggressive trading. For the vast majority of traders, the amount of leverage and risk required to compete for a prize position in the biggest trading demo competitions will be an unrealistic strategy when using real funds.

Bottom Line

Trading demo competitions draw many people in with their offer of risk-free trading experience and tantalising prizes. Such tournaments are available for almost all forms of financial instruments, from forex and CFDs to cryptocurrencies and binary options, providing a little something for everyone.

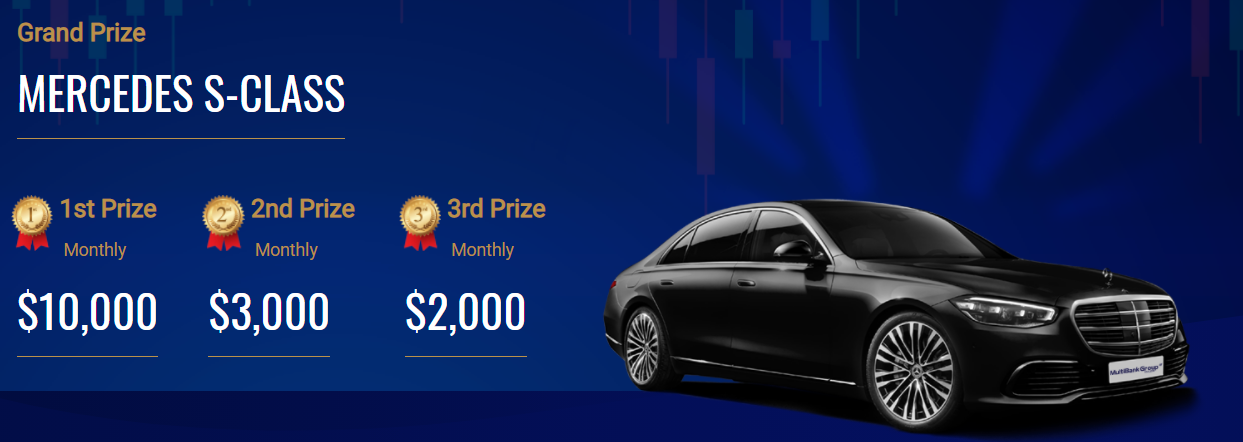

The best trading demo competitions have prize pools worth thousands or tens of thousands of dollars, comprised of pure cash, trading credit or physical items.

For experienced traders, the largest tournaments offer a chance to compete with the best around, while beginners can benefit from its risk-free provision of experience.

To get started, see our pick of the top demo trading contests.