Best Day Trading Platforms and Brokers in France 2026

To actively trade popular financial markets in France like stocks and indices listed on the Euronext Paris, currency pairs involving the euro, or its prominent export commodities like steel, you’ll need to sign up with an online broker.

The Autorité des Marchés Financiers (AMF) regulates financial services providers in France, although other European-regulated brokers can also accept French day traders through the EU’s cross-border initiative.

We’ve pinpointed the best day trading brokers in France following rigorous tests. Many of these platforms cater specifically to active traders in France, offering short-term trading products on European markets, website support in French, and convenient deposits via EUR accounts.

Top 6 Platforms For Day Trading In France

Following our personal evaluations, these 6 trading platforms go the extra mile for French day traders:

-

1

XM

XM -

2

AvaTrade

AvaTrade -

3

IC Trading

IC Trading -

4

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

5

Trade Nation

Trade Nation -

6

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs

Here is a short summary of why we think each broker belongs in this top list:

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

Best Day Trading Platforms and Brokers in France 2026 Comparison

| Broker | Minimum Deposit | EUR Account | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|---|

| XM | $5 | ✔ | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| AvaTrade | $100 | ✔ | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| IC Trading | $200 | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 | FSC |

| Pepperstone | $0 | ✔ | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Trade Nation | $0 | ✔ | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | MT4 | 1:500 (entity dependent) | FCA, ASIC, FSCA, SCB, FSA |

| Eightcap | $100 | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 | ASIC, FCA, CySEC, SCB |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

Cons

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

- Unlike IC Markets, IC Trading does not support social trading through the group’s IC Social app or the third-party copy trading platform ZuluTrade.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Multiple account currencies are accepted for global traders

- There is a low minimum deposit for beginners

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

Cons

- Fewer legal protections with offshore entity

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

Cons

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

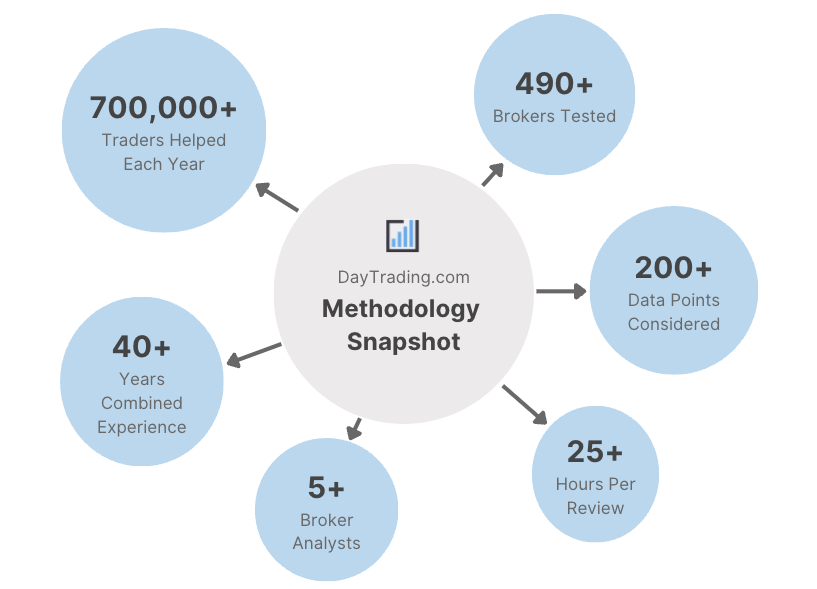

Methodology

To find the best day trading platforms in France, we examined our database of 140 online brokers, focused on all those that accept French day traders, and ranked them by their overall rating.

Our ratings are derived from 100+ collected data points and our hands-on tests in key areas.

- We checked that each broker accepts French day traders.

- We only recommended brokers that our experts trust.

- We focused on brokers with a wide range of markets.

- We prioritized brokers with competitive day trading fees.

- We checked for reliable charting platforms and trading apps.

- We ensured each broker offers clear leverage requirements.

- We investigated the broker’s execution quality.

- We made sure each broker’s minimum deposit was accessible for French traders.

How To Choose A Day Trading Broker In France

There are several factors to consider when choosing a day trading platform:

Choose A Trusted Broker

A trusted, well-regulated broker will help ensure that your funds are held on a secure trading platform.

The Autorité des Marchés Financiers (AMF) is a ‘green tier’ regulator that investigates fraudulent investment schemes, taking enforcement action against unauthorized participants. For example, it blacklisted 14 illegal trading platforms in 2023, including one notable scheme that promised high returns through automated forex and crypto derivatives.

French traders can also sign up with other European-regulated brokers who operate under the EU’s passporting scheme. Participating regulators require that brokers provide the same safeguards to retail investors, including limiting leverage trading to 1:30 and offering negative balance protection so you can’t lose more than your balance when day trading volatile French stocks, for example.

- AvaTrade maintains its exemplary trust score, thanks to its multi-licensed status with respected regulators (including CySEC and CBI), plus its long track record since 2006. It also offers a fairly unique risk management tool, AvaProtect, effectively insuring against losses of up to $1 million.

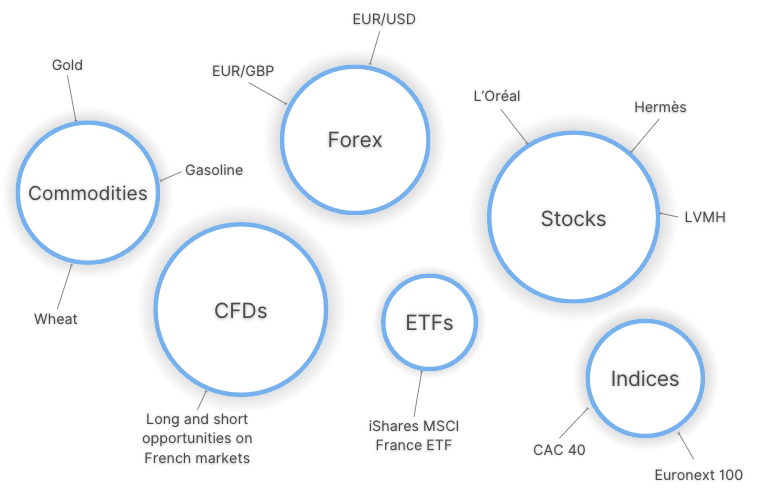

Choose A Broker With A Wide Range Of Markets

It’s important to have access to the financial markets and vehicles you want to trade, with contracts for difference (CFDs) proving particularly popular with short-term traders.

French investors may be interested in popular currency pairs containing the euro (EUR), such as the EUR/USD and EUR/GBP, plus stocks and indices listed on the Euronext Paris, such as LVMH and the CAC 40 Index, with France ranking as the second-largest economy in Europe, trailing only Germany.

Major commodities like steel, gasoline and gold may also allow you to explore other short-term trading opportunities while helping to build a diverse portfolio.

- XM offers a superb range of local markets for French traders, including stock CFDs in 80 popular French companies, the CAC 40 Index, and the most widely traded EUR currency pairs. It’s also got one of the niftiest margin calculators I’ve used – great for helping day traders understand leverage requirements.

Choose A Broker With Competitive Day Trading Fees

Spreads and commissions are among the most frequent fees you will incur day trading. Fortunately, since some EUR currency pairs, notably the EUR/USD, are highly liquid, French traders can enjoy ultra-narrow spreads from 0.0 pips at leading platforms.

Weighing these against the overall day trading environment also allows you to determine whether higher costs are justified. For example, some brokers give you free access to filterable economic calendars or fiscal updates from key institutions, such as the Banque de France, potentially helping you identify and capitalize on intraday trading opportunities.

- Pepperstone’s raw spreads from 0.0 on EUR/USD and 1.0 on the CAC 40 index make it a great choice for French day traders. For no extra fee, I can also access an intuitive economic calendar where I can filter for major financial events in France, such as interest rate decisions from the central bank.

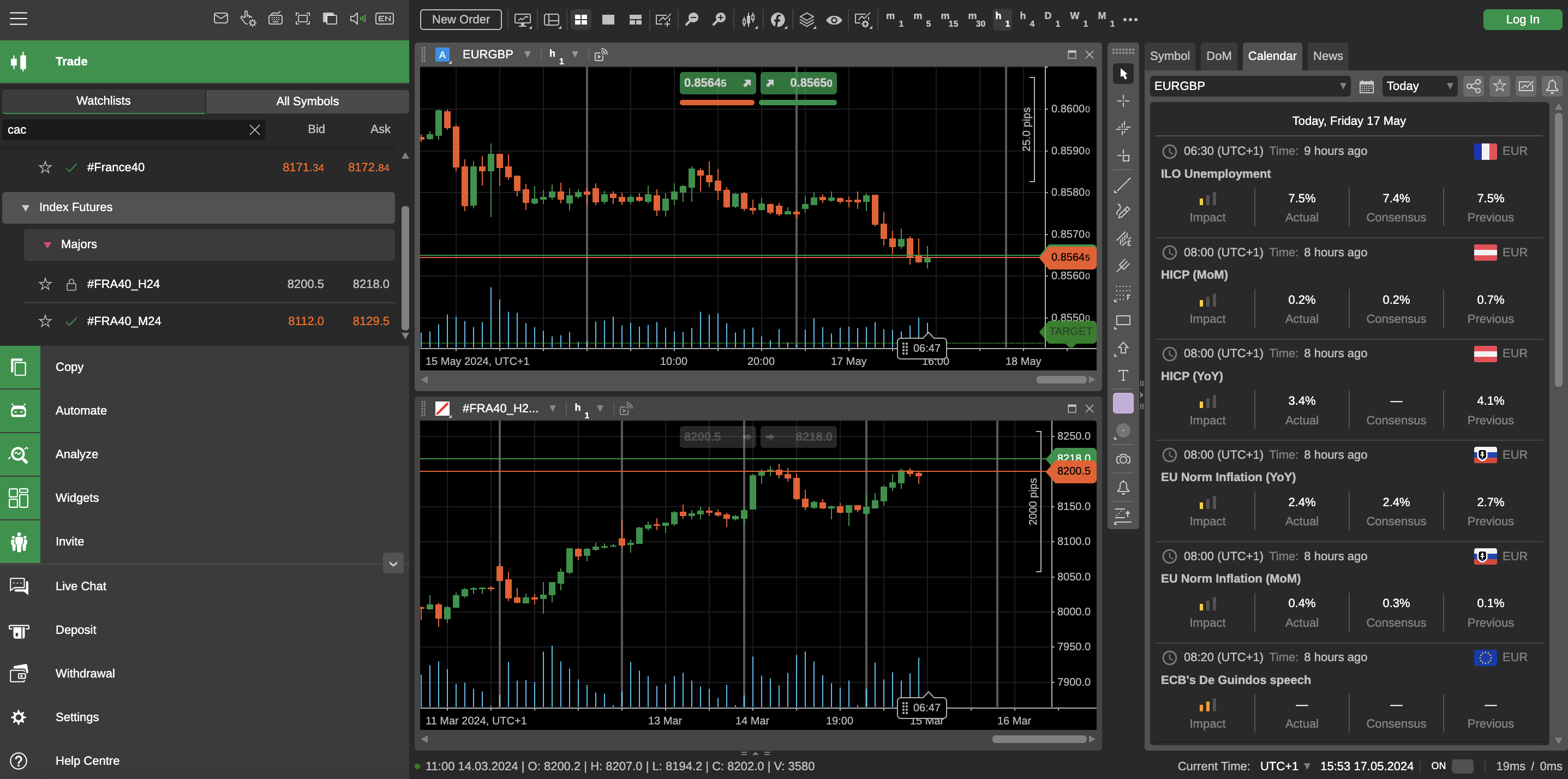

Choose A Broker With Reliable Charting Platforms

Day traders need a powerful and feature-rich environment to conduct technical analysis. Notable tools include indicators, graphical objects and short time intervals on charts.

From our years in the industry, it’s rare to find a broker that doesn’t offer either MetaTrader 4 or MetaTrader 5. However, their outdated designs are increasingly being outshined by more modern solutions like cTrader and TradingView.

I’ve found demo accounts, offered by the vast majority of our recommended brokers, are an excellent way to familiarize yourself with the platform’s features and test short-term trading strategies before registering for a live account.

- FxPro excels in this category, offering MT4, MT5, cTrader and a proprietary solution, which collectively delivers dozens of technical tools and integrated features. I particularly appreciate cTrader’s intuitive workspace, which allows me to view EUR/GBP and FRA40 charts alongside an economic calendar with an impact filter – great for staying abreast of market developments in France and further afield.

Choose A Broker With Reliable Order Execution

Fast and dependable order executions are vital for day trading, where any delays in filling orders on volatile French securities like Europlasma, for instance, can result in higher costs, eroding profit margins.

Leading brokers usually ensure that orders are filled at the best possible price while keeping delays to a minimum, preferably executing trades in less than 100 milliseconds.

- Moneta Markets is a very fast broker with order execution speeds of 15 milliseconds and connections to deep liquidity pools – creating an optimal environment for serious day traders. It also offers access to local and regional markets, from the France 40 to the Euronext index.

Choose A Broker With Clear Leverage Requirements

Leverage often plays an important role in day trading strategies – allowing you to increase the value of positions (and therefore any profits) while only putting down a small deposit (known as margin).

Let’s say I want to day trade the CAC 40 Index with leverage of 1:5. This means that if I put down €500, my trade will be magnified 5x, giving me buying power equivalent to €2,500.

However, leverage can also greatly magnify losses, so employing strict risk management and fully understanding your broker’s margin requirements is key.

- Eightcap offers sensible leverage up to 1:30, including on currency pairs like the EUR/USD and EUR/GBP. You can also easily adjust your leverage levels by contacting the broker – useful for beginners looking to lower their risk exposure.

Choose A Broker With An Affordable Minimum Deposit

After evaluating countless day trading platforms, we’ve found most brokers let you get started with up to 250 USD, approximately 230 EUR. That said, some brokers are geared towards beginners and budget traders with no minimum.

Depositing and withdrawing funds using popular payment methods in France can also help you minimize transaction costs and potentially enjoy faster processing times. Aside from card payments, digital wallets like PayPal and Apple Pay are leading funding options in France, according to research by Pay.com.

- eToro’s minimum deposit is an accessible $100, which can be deposited into a EUR-based account using convenient payment methods like PayPal. eToro also offers a fantastic roster of tradable assets that may be of interest to day traders in France, notably 128 French securities like Air France and BNP Paribas.

FAQ

Who Regulates Day Trading Platforms In France?

The Autorité des Marchés Financiers (AMF) regulates financial services providers in France, such as day trading platforms.

However, other European-regulated brokers can also onboard French day traders through the EU’s passporting scheme. Among the most prominent and respected financial authorities in Europe are the BaFin (Germany) and CySEC (Cyprus). It’s important to adhere to French tax rules if you do go down this route.

Which Is The Best Broker That Accepts Day Traders From France?

See our list of the top day trading platforms in France to find the broker that best ticks your boxes.

For example, XM is a terrific pick if you want low fees on a range of French markets. It also offers some of the highest-quality and easiest-to-digest education and research tools that I’ve seen – perfect for newer traders.

Recommended Reading

Article Sources

- Autorité des Marchés Financiers (AMF)

- Euronext Paris

- French Regulators Flag 14 Illegal Forex Platforms - Finance Magnates

- LVMH - Euronext Paris

- Europlasma - Euronext Paris

- Banque de France

- 6 Top Payment Methods In France - Pay.com

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com