Brokers With Low Leverage

Brokers with low leverage enable traders to manage risk when trading derivatives. Higher leverage means greater risk. This guide explains how trading with low leverage works and examines common leverage ratios and models. Read on for a list of the benefits and drawbacks of trading using lower leverage accounts. We have also ranked and compared the best companies and brokers with low leverage in 2026.

Brokers With Low Leverage

-

1

Interactive Brokers

Interactive Brokers -

2

Kraken

Kraken -

3

Coinbase

Coinbase -

4

Trade Nation

Trade Nation -

5

Exness

Exness -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Kraken - Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

- Coinbase - Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators. In May 2025, Coinbase also became the first crypto company to join the S&P 500, a milestone that enhances its credibility.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Kraken

"Kraken will suit traders looking for a diverse list of cryptos including Bitcoin and a good security track record."

William Berg, Reviewer

Kraken Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Cryptos |

| Regulator | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Platforms | AlgoTrader, Quantower |

| Minimum Deposit | $10 |

| Minimum Trade | Variable |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF |

Pros

- Mobile investing

- 3D secure required

- Low exchange fees on Kraken Pro

Cons

- Low leverage on spot trading

- Does not support many newer altcoins

- Slow verification process on Pro account

Coinbase

"Coinbase is ideal for beginners looking for an intuitive platform to buy and sell a wide variety of cryptocurrencies, with robust security and regulatory compliance. However, its fees are higher compared to competitors in our tests, and it’s not as tailored for short-term traders."

Christian Harris, Reviewer

Coinbase Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Crypto |

| Regulator | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | $2 |

| Account Currencies | USD, EUR |

Pros

- There are platforms for all levels: beginners can use the simple Coinbase app, while Advanced Trade provides lower fees and pro-level tools.

- Coinbase Advanced has added TradingView integration, a feature rarely offered by crypto exchanges, allowing users to trade spot and futures markets directly from real-time charts with powerful technical analysis tools.

- As a Nasdaq-listed company, Coinbase follows strict financial regulations, with licensing across the US, UK, and Europe. Security includes FDIC insurance for USD balances (up to $250,000) and two-factor authentication (2FA).

Cons

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Multiple account currencies are accepted for global traders

- There is a low minimum deposit for beginners

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

Cons

- Fewer legal protections with offshore entity

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

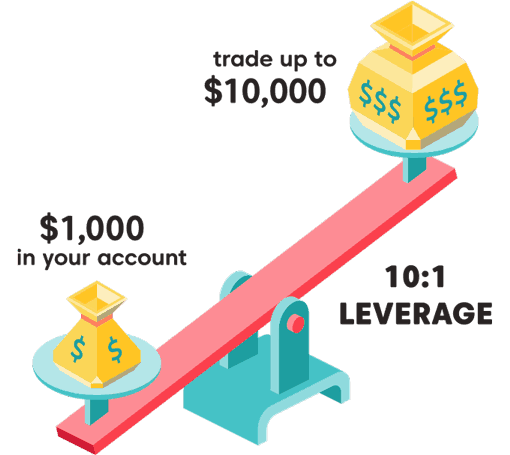

How Does Leverage Work?

In basic terms, leverage trading works in a similar way to borrowing. Your broker lends you money to open larger position sizes, and in turn, you can make a greater profit.

Leverage is often shown as a ratio which represents the balance of the loan capital (from the broker) to the value of the full equity (the amount the trader invests).

For example, a broker offering 1:5 leverage means for every $10 invested, you can borrow up to $50. This gives traders the chance to multiply the results of a trade.

Importantly however, trading on leverage can magnify losses. So in highly volatile markets, such as cryptos, you can use lower leverage to protect yourself from losing money quickly. This is also why brokers with low leverage are popular with traders starting out.

Examples

Let’s say a trader starts with a $100 deposit, and their broker offers a 1:10 leveraged ratio on commodities. This means that they can trade in positions up to ten times the value of their available balance, so a maximum of $1000.

They invest $1000 in crude oil and the value of crude oil rises by 10%, so the trader earns $100 in profit ($1000 * 1.1 = $1100). However, if they had purchased $100 worth of crude oil without leverage on the same trade, their profit would be $10 ($100 * 1.1 = $110).

Alternatively, say a trader has a $100 deposit and their broker offers higher leverage at 1:100. They invest $10,000 ($1000 * 100) in Apple stocks but the value of the stock plummets by 10% so the trader loses $1000 ($10,000 * 0.9 = $9,000), 10 times their initial deposit.

So, while leveraged trades can magnify your profits, brokers with low leverage can help avoid larger losses.

Note, the examples above do not take into account any fees you may have to pay to trade on margin.

What Is Considered Low Leverage?

Generally, low leverage is considered to be below 1:30. However, leverage can vary depending on the markets you’re investing in.

The most trusted brokers that offer lower leverage are regulated by the FCA (UK), ASIC (Australia) and CySEC (Europe). These financial watchdogs typically limit leverage rates based on the market in question. Common leverage ratios include:

- 1:30 – Major forex pairs, for example, EUR/USD and GBP/USD

- 1:20 – Gold, minor forex pairs, major stock market indices, for example, NYSE and FTSE 100

- 1:10 – Commodities and minor indices, for example, energies like oil

- 1:5 – Stocks and shares, for example, Amazon, Microsoft, and Tesla

- 1:2 – Cryptocurrency assets, for example, Bitcoin, Ethereum and Litecoin

Pros Of Brokers With Low Leverage

- Gains With Reduced Risk – Using smaller leverage can benefit traders by slightly increasing their position size, and thus increasing their potential profits. With low leverage, the risk is minimized but bigger profits are still achievable.

- Lower Charges – Because leverage means that you borrow money, the broker can charge you fees for holding positions overnight or completing transactions. However, the cost structure with lower leverage means that you borrow less, and therefore you pay less in fees.

- Fewer Losses – As leverage boosts capital, it will also magnify any gains and losses. Choosing a broker with a lower rate of leverage will help to mitigate your losses, as you are exposed to less risk overall.

- Beginner-Friendly – Using brokers with low leverage is a more risk-conscious strategy, which makes it ideal for beginners who are still becoming familiar with a given market.

Cons Of Brokers With Low Leverage

- Limited Profits – When using a broker with lower leverage, your profit potential is limited by the rate of leverage they offer. There is no opportunity to make higher-risk trades that offer potentially larger returns.

- Restricts Your Portfolio – Signing up to a broker with low leverage means you may have fewer opportunities to diversify your portfolio. A trader using high leverage is more likely to have the capital to invest in multiple assets like REITs, CFDs, bonds, or cryptos.

How To Choose Brokers With Low Leverage

The key factors to consider when selecting a trading account with lower leverage include:

- Fees – Research the broker’s overall fee structure. Look for leverage transaction costs and any fees charged for keeping positions overnight.

- Available Assets – Ensure that your desired asset is available, whether that’s forex, equities, commodities or cryptocurrencies.

- Minimum Leverage – Check the level of minimum leverage offered on your chosen asset. Alternatively, we have compiled a list of the top brokers with low leverage.

- Negative Balance Protection – This is a useful feature offered by most regulated brokers. It protects your account from going negative even if the markets change rapidly. This is especially beneficial for new traders.

- Demo Account – Demo accounts enable you to practice trading with low leverage, and to establish if you are happy with the trading software offered by the brokerage. Free practice accounts are often the sign of a trusted broker.

- Supported Countries – Ensure that you’re allowed to use the broker in question. Whether you’re from the US, Canada or elsewhere, different brokers will only accept traders from certain jurisdictions.

Final Word On Brokers With Low Leverage

Brokers with low leverage offer clients the opportunity to benefit from trading on margin without the risks that higher leverage can bring.

It’s important to remember, however, that any form of leveraged trading can result in unpredictable losses. Beginners should open demo accounts to practise trading on margin, and ensure that they select the most trusted broker to protect their capital.

Nevertheless, low leverage is ideal for cautious investors looking to steadily build profits. See our list of the best brokers with low leverage trading to get started.

FAQs

Is Low Leverage Better For Beginners?

Whether you’re trading crypto, forex, stocks or bonds, for beginners a lower leverage ratio is good. This helps to reduce losses, which are more expected with newcomers who may make mistakes. Fortunately, most EU, UK and Australian-regulated trading brokers cap leverage for retail traders to 1:30.

Who Are The Top Regulated Brokers With Low Leverage?

Many of the best brokers offer low leverage options, and choosing a platform will depend on your individual needs. Some of the top low leveraged trading firms include XM, AvaTrade, eToro, Pepperstone and IG.

What Does Low Leverage Vs Low Margin Mean?

Leverage and margin both involve borrowing funds to trade. A leveraged position means a trader has taken on debt, while the margin is the actual money/ratio i.e loan taken to invest in financial markets. Both terms are often used interchangeably.

What Countries Allow Low Leveraged Trading?

Leveraged trading is regulated and legal in numerous countries across the globe. For example:

- US – National Futures Association (NFA)

- Australia – Australian Securities and Investments Commission (ASIC)

- UK and Europe – Financial Conduct Authority (FCA), the European Securities and Markets Authority (ESMA), Cyprus Securities & Exchange Commission (CySEC)

- Singapore – Monetary Authority of Singapore (MAS)

Note, in 2021 India banned the retail trading of many leveraged products.