Best Day Trading Platforms and Brokers in China 2026

China’s highly volatile Shanghai and Shenzhen stock markets, frequent government interventions leading to sharp market movements, and rapid economic growth making it the world’s second-largest economy with a GDP of $17.7 trillion, create an attractive environment for short-term traders.

We’ve identified the best day trading platforms in China following hands-on tests. Many of these platforms cater to Chinese day traders, offering local markets like currency pairs containing the Chinese yuan (CNH) and stocks listed on the Shanghai Stock Exchange (SSE), as well as convenient payment methods, such as Hangzhou-based Alipay.

Note, the China Securities Regulatory Commission (CSRC) has tightened restrictions surrounding online trading in recent years. This is to keep a handle on capital outlfows and stabilize the yuan. We recommend checking Beijing’s latest rules to make sure you only trade with authorized brokers.

Top 6 Platforms For Day Trading In China

Following our first-hand evaluations, these 6 trading platforms stand out as the best for Chinese day traders:

This is why we think these brokers are the best in this category in 2026:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- InstaTrade - InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

Best Day Trading Platforms and Brokers in China 2026 Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|

| IC Markets | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:1000 (FSA Only) | ASIC, CySEC, CMA, FSA |

| RoboForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 | IFSC |

| XM | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| InstaTrade | $1 | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures | InstaTrade Gear, MT4 | 1:1000 | BVI FSC |

| Trade Nation | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | TN Trader, MT4 | 1:500 (entity dependent) | FCA, ASIC, FSCA, SCB, FSA |

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 (FSA Only) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

Cons

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- There is a low minimum deposit for beginners

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

- The trading firm offers tight spreads and a transparent pricing schedule

Cons

- Fewer legal protections with offshore entity

Methodology

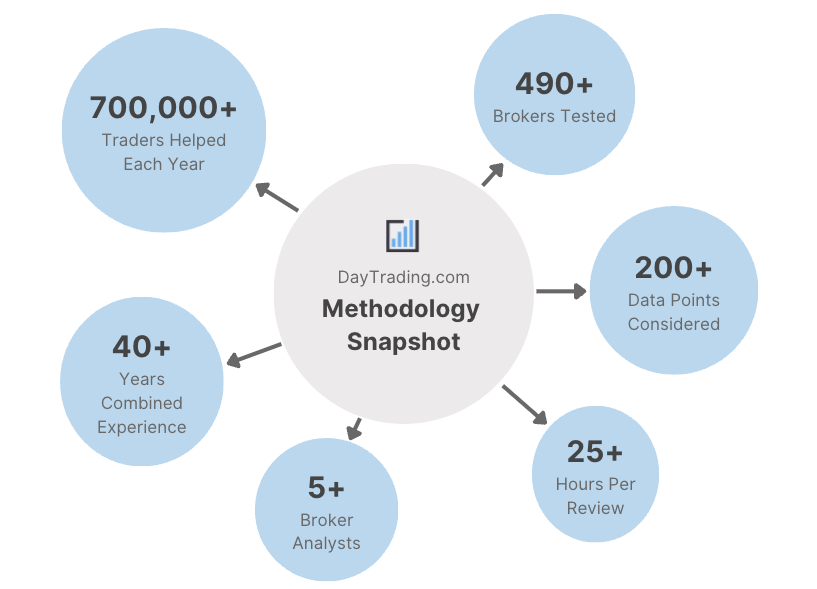

To uncover the best day trading brokers in China, we searched our database of 139 online platforms and narrowed it down to all those that accept Chinese traders.

We then ranked them by their overall score, leveraging 100+ data points and findings from our in-depth assessments.

- We ensured each broker accepts Chinese day traders.

- We only recommended trusted and regulated brokers.

- We prioritized brokers with a wide range of markets.

- We favored brokers with competitive day trading fees.

- We checked for a range of charting tools for technical analysis.

- We assessed each broker’s leverage and margin requirements.

- We investigated each broker’s execution speed and quality.

- We made sure each broker offers convenient account funding

How To Choose A Day Trading Broker In China

Our years in the industry have shown that there are several important factors to consider when choosing a broker:

Choose A Trustworthy Broker

A trusted brokerage will be regulated by a credible authority and provide a secure environment to help protect you from trading scams.

Unfortunately, trading scams are prevalent in China, with the infamous ‘Pig Butchering’ operation sweeping through Asia in recent years. As reported by CNN, this is a “type of confidence fraud in which victims are lured by scammers often impersonating young women on the internet. The scammers then spend weeks building a relationship with their victim, introducing them to cryptocurrency and encouraging them to invest on a fake platform.”

That’s why day trading with a regulated broker is crucial if you want peace of mind and security. The China Securities Regulatory Commission (CSRC) oversees domestic financial markets.

Some overseas brokers also accept Chinese traders, though it’s important to check for any legal restrictions before signing up.

If you do opt for this route, it’s advisable to select a broker authorized by a ‘green tier’ regulator, such as the UK’s FCA. We also recommend picking a broker with a long, clean track record.

- AvaTrade maintains a top spot in our trust ratings, with licenses from multiple green tier authorities including Australia’s ASIC and Japan’s FSA. It’s also upheld an excellent track record since 2006 and safeguards client accounts with negative balance protection and its own AvaProtect feature.

Choose A Broker With Diverse Market Coverage

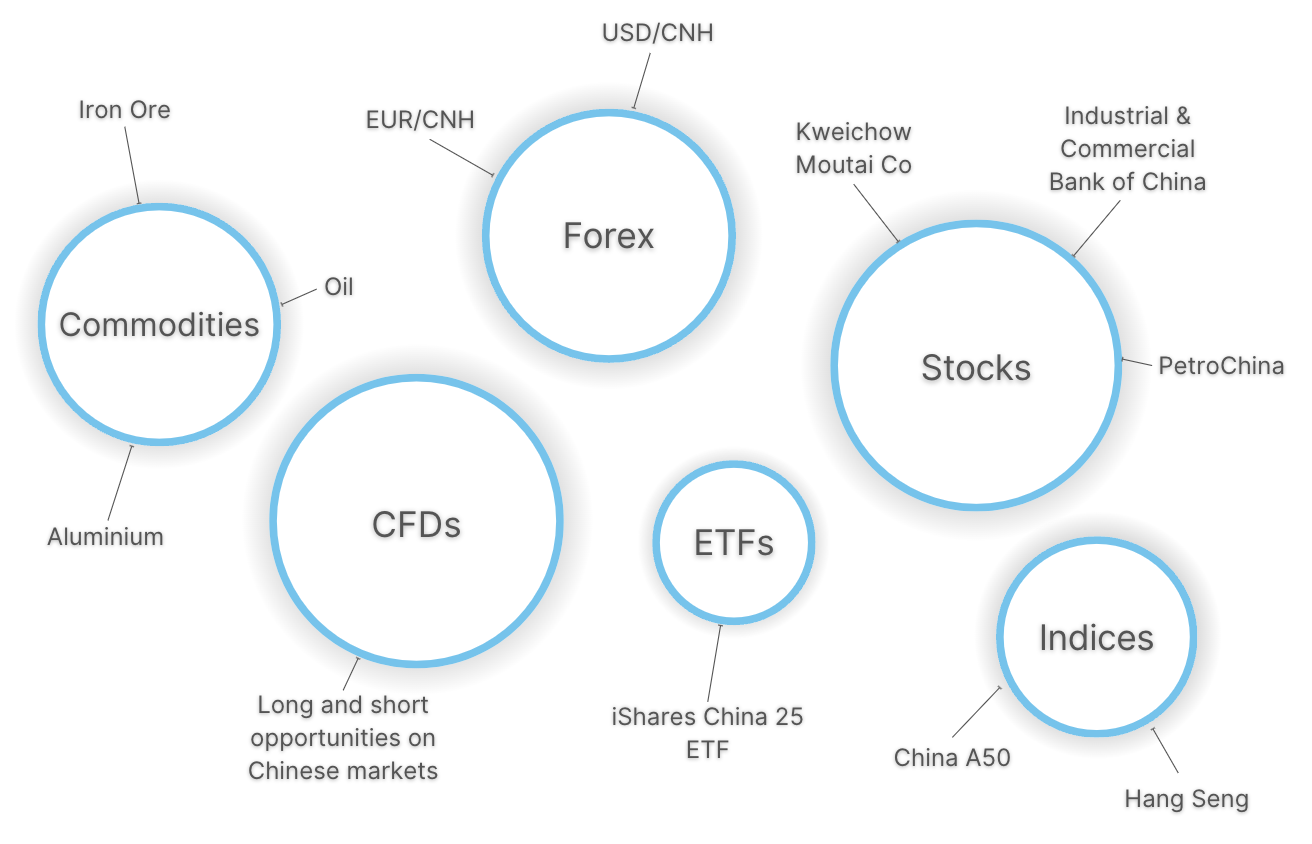

Day traders may be interested in a range of asset classes, typically traded via short-term products like contracts for difference (CFDs).

For Chinese traders, exotic currency pairs involving the Chinese yuan renminbi (CNY or CNH in the offshore market) such as the USD/CNH, exhibit significant volatility that can make them attractive to short-term trading strategies.

You may also be interested in Chinese shares listed on the Shanghai Stock Exchange (SSE), such as Kweichow Moutai Co and PetroChina.

Additionally, as the world’s number one exporter of goods, China offers opportunities to speculate on prominent commodities, such as oil, iron ore and aluminium.

- Pepperstone offers a superb range of regional markets for Chinese day traders, including the USD/CNH currency pair, shares listed on the Hong Kong Stock Exchange (HKEX), and a range of local indices and ETFs, notably the Hang Seng China 50 Index and the iShares China 25 ETF.

Choose A Broker With Excellent Pricing

Low brokerage fees are important if you’re actively trading, as transaction costs can accumulate quickly.

That’s why we assess spreads and commissions on popular assets, the most common day trading fees. We also consider non-trading fees such as deposit and withdrawal charges, plus conversion costs if transferring Chinese yuan.

- Moneta Markets continues to deliver some of the best pricing in the industry, with ultra-low spreads from 0.3 on USD/CNH and 0.6 on the China 50 Index. For no additional fee, you also get access to an intuitive economic calendar where you can filter economic events in China.

Choose A Broker With Reliable Charting Platforms

Short-term traders require a stable charting environment to build strategies and execute trades.

Crucially, the best charting platforms are user-friendly, easy to navigate and deliver a wide range of technical tools.

Popular options include MetaTrader 4 and MetaTrader 5, which have pioneered online trading software since 2005. However, more contemporary options like cTrader and TradingView stand out for their sleeker designs, with limited compromises in terms of quality and features.

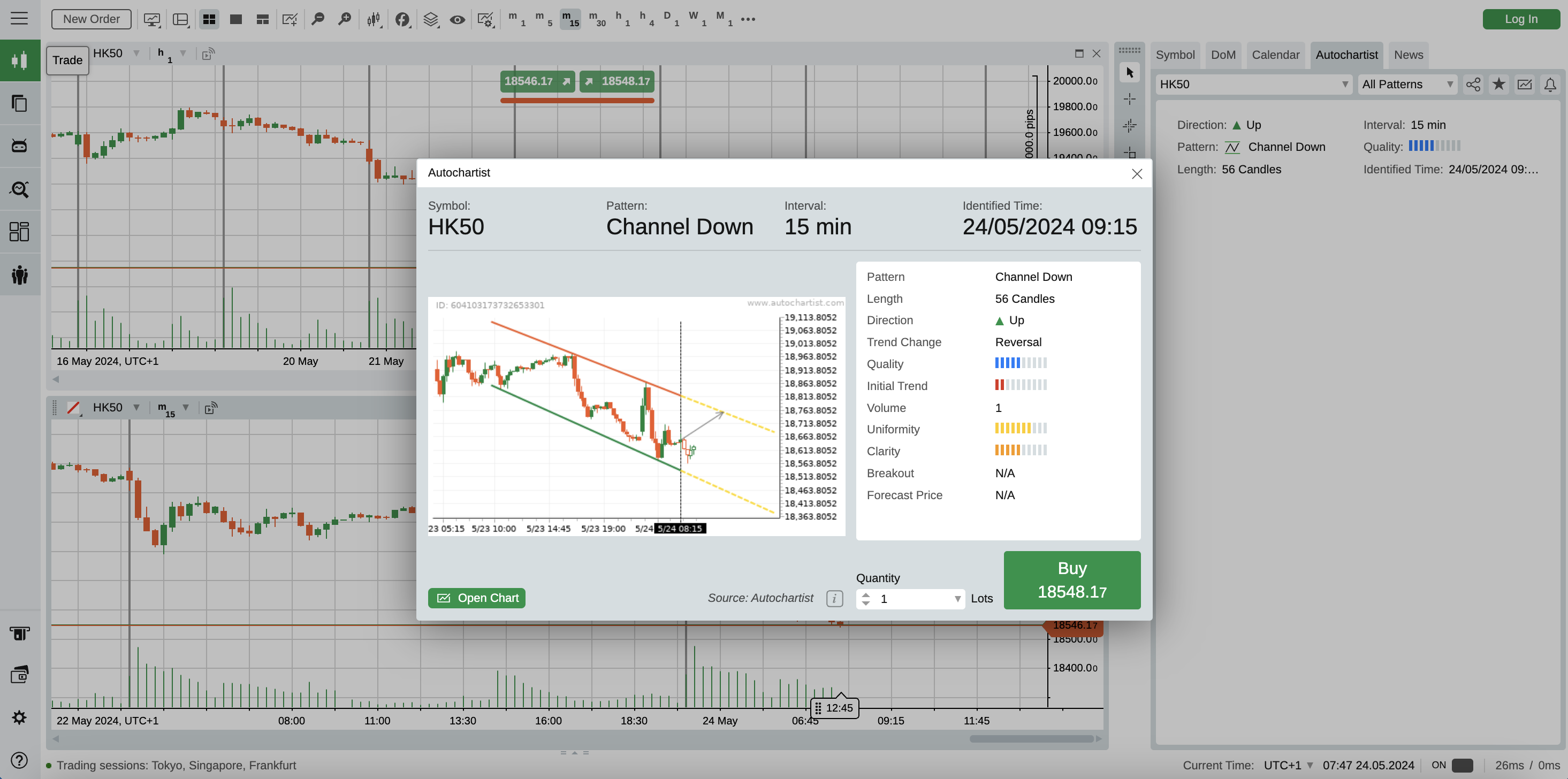

I particularly love that you can view chart patterns from Autochartist directly in the cTrader workspace alongside your chosen asset. For example, I was able to seamlessly analyze potential opportunities in the HK50 Index, as can be seen below.

- IC Markets offers a superb selection of platforms to suit all experience levels and strategies, including MT4, cTrader and TradingView. You can also access superior tools, including IC Insights, which I’ve used to view market research on NASDAQ-listed Chinese stocks, such as China Xiangtai Food Co.

Choose A Broker With Clear Leverage Requirements

Leverage is a key component of many day trading strategies, allowing you to magnify your gains while only putting down a small deposit (margin).

Let’s say I want to speculate on PetroChina shares with leverage of 1:5, this means that my gains from a 500 CNH deposit would multiply x5, to 2,500 CNH.

That said, leverage can also contribute to significant losses, so understand your broker’s margin requirements upfront and take a proactive approach to risk management.

- XM offers leverage up to 1:1000 for highly experienced investors, although leverage on USD/CNH is capped at 1:50. Margin requirements are clearly articulated upfront, for example, the China 50 Index requires a minimum margin of 0.4%. I also recommend using the broker’s handy margin calculator to work out what you need for each trade.

Choose A Broker With Fast Execution

Successful day trading requires reliable order execution, ensuring that positions are filled quickly and at the desired price.

We examine brokers’ execution data where possible, including speeds (ideally meeting our <100-millisecond benchmark).

We also take into account latency and slippage rates – the measures of time delay and price difference per order executed, respectively.

- FOREX.com consistently delivers ultra-fast execution speeds averaging 50 milliseconds, with 100% of trades successfully executed at the requested price or better on the MT4 platform. This makes it an excellent option if you want to day trade fast-moving markets such as USD/CNH, AUD/CNH, EUR/NCH, and CNH/JPY (all available at FOREX.com).

Choose A Broker With Convenient Account Funding

You can usually open a day trading account with less than 250 USD (approximately 1,810 CNY), though some brokers let you sign up with no minimum.

Having access to convenient local payment methods can also help keep transaction costs and processing times down.

According to research by Adyen, 92% of Chinese consumers use Alipay and WeChat Pay as their primary funding methods, while Union Pay is a prominent card solution. These are offered by various day trading platforms, as firms look to attract Chinese traders.

- RoboForex is a great option for budget traders with its $10 minimum deposit. It also offers a vast selection of payment methods, including leading payment solutions in China, WeChat Pay and Alipay.

FAQ

Who Regulates Day Trading Platforms In China?

The China Securities Regulatory Commission (CSRC) regulates the financial markets in China, including participants like online trading platforms.

We recommend checking the latest rules and regulations from the Chinese government before choosing a broker, as there may be restrictions on using international platforms in certain instances.

Which Is The Best Broker That Accepts Day Traders In China?

See our list of the best day trading platforms in China to find a suitable option for your needs.

For example, Pepperstone offers a great range of Chinese markets, from CNH currency pairs to Chinese ETFs, while RoboForex is a top pick for those looking for hassle-free account funding using Chinese payment solutions like Alipay.

Recommended Reading

Article Sources

- National Financial Regulatory Administration (NFRA)

- Shanghai Stock Exchange (SSE)

- Chinese Trading Scam - CNN

- China Economy - OEC

- Hong Kong Stock Exchange (HKEX)

- People's Bank of China

- Payment Methods In China - Adyen

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com