Best Brokers With Guaranteed Stop Loss 2026

Brokers with guaranteed stop loss features should be on the list of potential platforms for investors looking for limited risk trading. This built-in risk management function is a great way to negate the possibility of excessive losses when speculating on complex instruments.

This guide to brokers with guaranteed stop loss functionality explains how it works, its benefits and how it holds up against other risk management techniques. We have also listed the best brokers with guaranteed stop loss orders in 2026.

Best Brokers With Guaranteed Stop Loss

-

1

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

2

XTB69-83% of accounts lose money when trading CFDs with this provider.

XTB69-83% of accounts lose money when trading CFDs with this provider. -

3

Plus50079% of retail CFD accounts lose money.

Plus50079% of retail CFD accounts lose money. -

4

Markets.com

Markets.com -

5

City Index

City Index -

6

CMC Markets68% of retail CFD accounts lose money.

CMC Markets68% of retail CFD accounts lose money.

Here is a summary of why we recommend these brokers in January 2026:

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring day traders.

- Plus500 - Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

- Markets.com - Established in 2008, Markets.com is a long-standing, multi-regulated broker with oversight from the CySEC and FSCA. It offers unique features to track hedge fund moves and insider trades, while providing stock signals to alert traders to market opportunities. Its choice of accounts (Classic to Professional) caters to all levels of active trader. 72.3% of retail accounts lose money.

- City Index - Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Account Currencies | USD, EUR, GBP |

Pros

- First-class 24/5 customer support is available, including a friendly live chat with response times of under two minutes during testing.

- Opening an XTB account is a hassle-free, entirely online process that takes just a few minutes, making the entry into day trading smooth for new traders.

- XTB offers fast withdrawals with payment within 3 business days, depending on the method and amount.

Cons

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

- Plus500 provides a specialized WebTrader platform designed explicitly for CFD trading, offering a clean and uncluttered interface

- In 2025 Plus500 added new share CFDs in emerging sectors like quantum computing and AI, offering opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

Cons

- The absence of social trading means users can’t follow and replicate the trades of experienced traders

- Plus500’s lack of support for MetaTrader or cTrader charting tools might be a deal breaker for advanced day traders looking for familiarity

- Compared to some competitors, especially IG, Plus500’s research and analysis tools are limited

Markets.com

"Markets.com is best suited to retail investors who trade frequently but don’t want to calculate commissions, thanks to its spread-only pricing (EUR/USD around 1.3 pips). It especially appeals to short-term traders who value fast execution, flexible asset choice spanning 2,200+ instruments and proprietary tools like hedge fund confidence indices and insider trade alerts."

Christian Harris, Reviewer

Markets.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds |

| Regulator | CySEC, FSCA, SVGFSA |

| Platforms | Web Platform, MT4, MT5, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK, CHF, PLN, CZK |

Pros

- Within the 2,200+ CFDs, Markets.com offers thematic baskets like the Warren Buffett Blend and Cannabis Blend, which behaved like ready-made mini-ETFs during testing, saving the work of balancing weights manually.

- Markets.com provides commission-free trading on most assets with spreads starting from around 0.6 pips on major forex pairs, making it cost-effective for casual traders.

- Switching between the proprietary web platform (great for alerts and quick analysis) and MT5 (strong for algorithmic EAs) was smooth in our tests; positions synced across desktop, web, and mobile without gaps or re-quotes.

Cons

- During sign-up, we hit unclear account type explanations and got stuck in an email verification loop that locked us out for an hour - way less streamlined than other brokers we’ve tested.

- The proprietary web platform felt a bit basic once we pushed into advanced charting with fewer drawing/indicator options than full TradingView or MetaTrader.

- Inactivity charges kick in after just 3 months, while variable spreads are wider than top ECN brokers during testing, which may deter day traders and high-frequency traders.

City Index

"City Index is a great match for active traders, with ultra-fast execution speeds averaging 20ms, a highly customizable web platform featuring 90+ technical indicators, and some of the best education we’ve seen."

Christian Harris, Reviewer

City Index Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting |

| Regulator | FCA, ASIC, CySEC, MAS |

| Platforms | Web Trader, MT4, TradingView, TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:50 (Accredited Investor), 1:200 (Sophisticated Investor), 1:300 (Wholesale Investor), 1:400 (Professional Trader). Varies with jurisdiction. |

| Account Currencies | USD, EUR, GBP, AUD, PLN, CZK |

Pros

- City Index provides versatile trading platforms for all skill levels. The intuitive Web Trader platform is ideal for beginners, while support for MetaTrader 4 (MT4) and TradingView adds robust analysis and automation features, ensuring a flexible experience for traders of all levels.

- City Index has made strides to enhance the trading experience, notably through its Performance Analytics in 2024 for insights into trades and discipline, plus an upgraded mobile app featuring in-built market research and news at a swipe.

- City Index boasts 13,500+ markets spanning forex, indices, shares, commodities, bonds, ETFs, and interest rates, with the platform's inclusion of niche markets like interest rates offering unique trading avenues not always found elsewhere.

Cons

- While many brokers like eToro have expanded their crypto offerings, City Index only provides crypto CFDs, and the limited range may not satisfy traders looking for a broader selection of altcoins.

- Unlike brokers such as AvaTrade and BlackBull, City Index does not provide passive investment opportunities like social copy trading, or real stock or ETF ownership, making it less appealing for hands-off trading.

- City Index lacks an Islamic account with swap-free trading conditions, making the broker less appealing to Muslim traders compared to providers like Eightcap and Pepperstone.

CMC Markets

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

Christian Harris, Reviewer

CMC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Regulator | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Platforms | Web, MT4, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN |

Pros

- CMC offers excellent pricing, including tight spreads and low trading fees for all but stock CFDs. The Alpha and Price+ schemes also offer perks for active traders with up to 40% discounts on spreads.

- CMC Markets has added an AI News feature, using AI to surface and summarise market stories rather than place trades for you, hinting at where broker research tools are heading.

- The brokerage continues to stand out with its wide range of value-add resources, including pattern recognition scanners, webinars, tutorials, news feeds, and research from respected sources like Morningstar.

Cons

- Despite improvements, the web platform still requires enhancements to make it as intuitive to trade on as software from rivals like IG.

- An inactivity fee of $10 per month is applied after 12 months of inactivity, which may deter casual investors.

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

What Is A Guaranteed Stop Loss?

A guaranteed stop loss (GSL) is a risk management tool designed to protect clients against large losses. Complex speculation like CFD trading can be highly risky, so traders need effective management systems to minimize their costs and keep their net profits high. Two common issues with retail CFD and derivatives trading are gapping and slippage, each of which can quickly cause losses much larger than expected.

Gapping refers to when the price of an asset suddenly moves from one price to another in a highly volatile market. This typically occurs in the wake of major world events and economic news. Slippage, on the other hand, is the difference between the expected execution price and the actual execution price. When the market is volatile, both positive and negative slippage can occur.

A regular stop loss order would limit your losses to a certain level if the markets move against you. However, in the event of significant gapping, your broker may not be able to close your position at the desired price. This would result in a greater loss than calculated when the order was placed. But brokers with guaranteed stop loss orders (GSLOs) will absorb this price difference, returning the expected loss to their clients.

Example

Below is an example to demonstrate how brokers with guaranteed stop loss orders work:

Suppose an investor buys 1,000 shares of BP for £10, a position size of £10,000. They then place a guaranteed stop loss 5% below the entry stock price.

Suddenly, the market gaps and experiences a quick bearish jump, the new stock price becoming £8.25. When this happens, investors without a stop loss may rush to sell, likely seeing a further price drop, thus a more significant loss. Those with regular stop loss orders would see their positions closed at £8.25. However, using brokers with guaranteed stop loss orders would have resulted in a closing point of £9.50.

Doing some maths, the investor has saved the difference between its guaranteed exit value and the market price the asset dropped to. This comes out to £9.50 – £8.25 = £1.25 per share or £1,250 in total.

Guaranteed Stop Loss Vs Other Risk Management Systems

Guaranteed stop loss orders are useful but they are not the only risk management tool available. Our trading experts have found that using a combination of different approaches is often best.

Take Profit Orders

A take profit order is a limit order whereby the trader specifies the profit at which they want to close a position. If the price reaches the limit, the broker will automatically close the trade. This protects investors against a sharp, unexpected downturn before they have time to close their profitable trade. This can improve net profitability and helps traders remain objective, preventing emotions like fear or greed from driving decisions.

Hedging

Hedging is another means of managing risk. It works by offsetting investment losses through positions that oppose the primary one. This acts as a kind of insurance, so you do not see such a negative impact if the market does not go your way.

While hedging does not protect against all losses, the impact of major downturns is reduced. A hedge position creates an effective risk management tool but also reduces potential profits.

There is also an added cost, known as the premium, to protect your assets in this way.

Trailing Stop Orders

For risk-effective management, find a broker that gives both trailing and guaranteed stops and pair them. Trailing stops describe an order type whereby the stop loss price is not fixed to one amount but as a percentage below the market price. This means that, if the asset value increases, the trailing stop also rises. Once the value starts dropping, the trailing stop remains fixed and the investor is always protected by the same difference. This ensures traders can lock in profits when prices rise without closing the position.

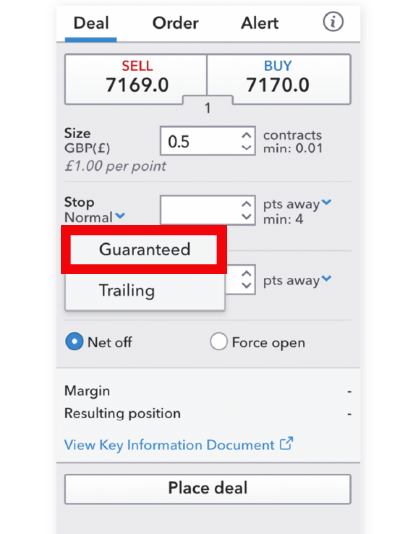

How To Use A Guaranteed Stop Loss

See the following top tips for using brokers with guaranteed stop loss orders when investing and trading:

- Ensure the broker only charges a premium for implemented guaranteed stops

- Consider whether these are necessary as active monitoring can reduce their benefits

- Remain aware of what charges are implemented on each order and check that the cost is worthwhile

- Check the minimum distance that brokers with guaranteed stop loss orders support and whether this negates any significant benefit of the order type

- Some brokers with guaranteed stop loss orders allow them to be modified after the fact, which could be taken advantage of to act like a trailing stop order

Benefits Of Brokers With Guaranteed Stop Loss

Prevents Major Losses

The major benefit of using guaranteed stop loss orders is that they prevent you from losing excessive amounts of money in your trades. In highly volatile markets, brokers with guaranteed stop loss orders protect investors from gapping events, ensuring that the expected risk is the maximum taken on.

When you set a guaranteed stop loss, you agree to what you are comfortable losing; there is no way to lose more than this.

Hands-Off Trading

Guaranteed stop loss trading is perfect for those who cannot monitor their positions all the time. When a stop loss is set, there is no need to watch market fluctuations closely because your trade will exit automatically.

If you do not want trading to be a full-time job, then setting a guaranteed stop loss could be a sensible option.

Objectivity

Implementing a guaranteed stop loss allows you to be more objective with your trades. When monitoring stocks yourself, you may be motivated by emotions and the hope that the market will change. This kind of mentality can lead to further, more significant losses. With investments that are exited automatically, no emotional drivers enter into the equation.

Drawbacks Of Brokers With Guaranteed Stop Loss

Minimum Stop Distance

Brokers set a minimum stop distance with guaranteed stop losses. This is the minimum distance the stop loss can be from the current market price. This minimum changes according to expected volatility and gets wider the more volatile the market gets. If this minimum is too large, it can result in a guaranteed stop loss order that is not particularly protective.

Premiums

Brokers often charge a premium for investors to use a guaranteed stop loss, which is triggered when the stop loss is met. It tends to be small but varies between brokers, so choose one with a lower premium. You can also close a position before the stop loss is triggered to avoid paying the premium at all.

Short Term Fluctuations

Setting your guaranteed stop loss close to the current price minimizes losses and is a safe way to trade. However, it also means that short-term fluctuations in stock prices, for example, can trigger it and exit your trade unnecessarily. The key is to set your stop at an amount that allows some fluctuation while still minimizing your risk.

How To Compare Brokers With Guaranteed Stop Loss

Choosing brokers with guaranteed stop loss orders is a useful way to limit risk, though it is not the only comparison factor. We have produced a summary guide below on some of the other features that may influence your decision. Alternatively, check out our list of the best brokers with guaranteed stop loss functionality.

- Fees: Beyond a direct comparison of the premiums for the titular order type, several trading fees can impact your net profits. Additional charges may be levied on deposits and withdrawals, currency conversions, spreads, commissions, inactivity and accounts.

- Assets: Not all brokers with guaranteed stop loss orders will offer every financial instrument, so check that your desired markets are covered by a firm’s services. You do not want to open an account, deposit your money and then find out that the crypto options you want to speculate on are not available.

- Regulation: Regulatory bodies like the FCA, SEC and ASIC operate independently to ensure the financial markets remain fair and investors are not scammed. Brokers with guaranteed stop loss orders regulated by such agencies will ensure that client funds are held separately from their own, they do not mislead customers and they operate transparent pricing and business models.

- Customer Service: Customer support can make a huge difference in your overall trading experience and sometimes even your profits. If any technical issues are preventing you from placing or closing positions, you may end up losing money. Check that your potential brokers with guaranteed stop loss orders have customer support teams that speak your language and are readily accessible by your preferred contact method.

- Payment Methods: It is important to ensure that you can deposit and withdraw money from your brokerage account via a convenient method. For example, you do not want to have to open an account with an offshore e-wallet just to take out your money, you may just want a direct wire transfer to your bank account.

Bottom Line

Brokers with guaranteed stop loss orders offer their clients an opportunity to set in stone the risk taken on by any position. These order types can also reduce substantial losses caused by large fluctuations in the market or emotion-based trading decisions. We have found that the optimal way to use brokers with guaranteed stop loss orders is to set them at a limit that minimizes loss but does not risk early exit due to small, short-term volatility. Our experts also recommend using a range of risk management approaches in combination to best maximize net profits.

See our list of the top brokers with guaranteed stop loss functionality to get started.

FAQs

What Are Brokers With Guaranteed Stop Loss?

Guaranteed stop losses protect your open positions by making sure that they are exited if the market falls below a preset point. This means that, regardless of any significant volatility and gapping, you would not face an unexpected loss.

What Is A Guaranteed Stop Premium?

If your guaranteed stop is triggered by the market falling past the point that you set your stop at, then the broker will charge you a fee known as a premium for using the service.

Are Brokers With Guaranteed Stop Loss Orders Good?

Guaranteed stop losses are useful in volatile market conditions as prices can rise and fall very quickly, sometimes faster than platforms can follow. When a guaranteed stop loss is in place, you will never lose more than anticipated when the position was opened.

Should Beginners Use Brokers With Guaranteed Stop Loss Orders?

When used correctly, guaranteed stop losses are a great way for beginners to make trades without taking excessive risks. At any level of investing, they are effective in minimizing losses.

Do I Have To Pay Brokers With Guaranteed Stop Loss?

You will only pay for the guaranteed stop loss if it is triggered by the market falling to or below that point. If you exit the trade before that happens or the market does not fall, you will not pay to use the guaranteed stop loss.