Best Brokers With Market Execution 2026

Brokers with market execution fill orders at the next available market price and without requotes. This is the model used by the majority of ECN/STP brokers to provide clients with a competitive trading environment. In contrast, market makers normally offer instant executions, whereby trades are processed through the firm’s pricing feed. If the requested forex price isn’t available, for example, the broker will requote with the newly available price.

This guide lists the best brokers with market execution accounts in 2026. We also consider the differences between market execution and instant execution, considering price uncertainty and slippage, MT4 access, and more.

Best Brokers With Market Execution

Our experts have tested a range of market execution brokers and these are the top 6 firms in 2026:

This is why we think these brokers are the best in this category in 2026:

- FOREX.com - In our ECN-style testing with FOREX.com’s account, execution averaged 40ms with moderate slippage during fast market moves. Spreads on EUR/USD started near 0.1 pips, plus a $6 commission per lot. Liquidity was deep but slightly fragmented during off-hours. Best suited for experienced traders using limit-order dependent strategies.

- VT Markets - When we evaluated VT Markets’ ECN Raw account, execution speeds averaged 35–40ms with consistently low slippage. Spreads on major pairs like EUR/USD often hit 0.0 pips, paired with a $6 round-turn commission. Liquidity was reliable across sessions, making it a solid option for day trading and automated trading systems.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

- PU Prime - PU Prime is a forex and CFD broker offering direct market access on forex, commodities, stocks, bonds, indices, and ETFs. With four account types (Cent, Standard, Prime, ECN) and multiple platforms, from MetaTrader to its own PU Prime app, it’s built for active traders at every level.

- FXGT - Established in 2019, FXGT is an offshore broker providing CFD trading on 185+ instruments. Through MT4, MT5 and FXGT Trader (added in 2024), alongside a choice of five accounts (Mini, Standard+, ECN Zero, PRO and Optimus), FXGT caters to a broad spectrum of short-term traders.

- Errante - Errante is a Cyprus-based and regulated forex and CFD broker with leveraged trading on multiple assets, tiered accounts including a zero-spread option, and copy trading support. The broker offers leveraged trading up to 1:30 under its CySEC-regulated branch and 1:500 from an offshore branch, and supports the MetaTrader 4 and MetaTrader 5 platforms. Errante's asset list is relatively limited but it does offer fast execution and low latency, and it is a trustworthy brand.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

VT Markets

"VT Markets is a great choice for regular traders who are looking for very tight spreads and powerful charting software. The broker's share CFD offering is particularly strong, with hundreds of commission-free assets spanning multiple global markets."

Tobias Robinson, Reviewer

VT Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Commodities, Stocks, Indices |

| Regulator | ASIC, FSCA, FSC |

| Platforms | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral |

| Minimum Deposit | 50 - 500 USD |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Spreads are competitive based on tests, coming in at 0.2 pips for EUR/USD in the ECN account, aligning with top brands like Pepperstone

- Traders can access a range of analysis tools supplied by reputable providers, including Trading Central’s Market Buzz AI tool and a customizable economic calendar

- There’s a strong range of payment methods, including bank wire, credit cards and e-wallets, plus 5 base currencies to choose from

Cons

- Unlike similar brands like Fusion Markets, VT Markets does not offer crypto trading

- The broker’s bonus schemes have stringent terms and conditions, including restrictions on minimum deposits and payment methods used

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Multiple accounts to suit different strategies and experience levels

- Trustworthy and regulated by CySEC

- 170+ trading instruments

Cons

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

PU Prime

"PU Prime is a great fit for experienced, high-volume traders with its ECN account offering tight spreads from 0.0 pips and low commissions from $1/side. The addition of an easy-to-use copy trading app, alongside the stacked Trading Academy with progression levels, also makes PU Prime a strong option for aspiring traders. "

Tobias Robinson, Reviewer

PU Prime Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Metals, Crypto, Bonds, ETFs |

| Regulator | ASIC, FSCA, CMA, FSA, FSC |

| Platforms | PU Prime App, PU Web Trader, PU Social, MT4, MT5, AutoChartist |

| Minimum Deposit | $20 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD |

Pros

- PU Prime has upped its game over the years, including launching its PU Social app in 2022, securing ASIC authorization for its Australian entity in 2025, and adding over 200 trading instruments, bringing the total to 1,000+.

- The platform lineup is strong, with the PU Prime Web Trader and app especially smooth to use with a modern design, easy-to-configure order tickets and responsive charts for fast entries and exits.

- Prime and ECN pricing can be very competitive for active traders, and in our tests spreads tightened notably in liquid sessions to hit ~0.0 pips.

Cons

- The ECN account’s $10,000 minimum deposit puts the best pricing out of reach for some active retail traders who may end up paying more for spreads and commissions on Prime, Standard or Cent accounts.

- The in-house market updates are useful for a quick read, but they’re generally high-level and don’t go deep enough for serious strategy building or advanced analysis.

- Getting through to customer support can be fiddly and slow to reach a human – in our latest checks we had to navigate multiple chatbot menus and questions then enter contact details before getting to an agent.

FXGT

"FXGT, especially with its Optimus account, targets day traders seeking extremely high leverage of up to 1:5000, offering the potential for amplified profits and losses, though at the cost of robust regulatory protections."

Christian Harris, Reviewer

FXGT Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FSCA, FSA |

| Platforms | FXGT Trader, FXGT App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:5000 |

| Account Currencies | USD, EUR, JPY |

Pros

- FXGT stands out after introducing access to over 30 popular cryptocurrencies such as Bitcoin, Ethereum, etc. This is advantageous for traders interested in diversifying into digital assets and provides an additional market to explore beyond traditional forex and stocks.

- FXGT supports multiple platforms, including MT4, MT5, and its proprietary FXGT Trader, added in 2024, catering to different trading styles, such as MetaTrader's automated trading with Expert Advisors (EAs).

- Five account types are available to suit different trading needs, including accounts for beginner and advanced traders, plus the Optimus account, which was built for day traders and now offers the highest leverage we've seen up to 1:5000 (amplifying profit and loss).

Cons

- While FXGT offers some research, such as its market analysis section and an economic calendar, they are not as extensive as those provided by brokers like IG. Traders looking for detailed analysis, in-depth reports, or third-party research will find FXGT's resources woeful.

- FXGT is regulated by regional authorities like the Seychelles FSA and South Africa’s FSCA, but still does not hold licenses from ‘green tier’ regulators such as the UK’s FCA or Australia’s ASIC. This means that traders may not benefit from the higher investor protections, stringent oversight, and dispute resolution mechanisms.

- FXGT offers a subpar selection of around 185 assets, which is limited compared to category-leading brokers like Saxo with its 72,000+ instruments. In particular, FXGT does not provide access to a wide range of stocks from international markets.

Errante

"We recommend Errante for users seeking multi-asset trading on the MT4 and MT5 platforms. The copy trading platform and straightforward sign-up process will also suit newer traders."

William Berg, Reviewer

Errante Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Indices, Forex, Metals, Energies, Cryptos |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR |

Pros

- Open an account in four easy steps

- Supports cTrader, MT4 and MT5 platforms

- Copy trading available

Cons

- Small selection of shares

- Advanced educational content is expensive to unlock

- MT4 not available to EU traders

What Is Market Execution?

A market order is an immediate order to buy or sell at the current price in the market. The price is determined by trading volumes and available prices at that exact moment. This means that although slippage can occur if the market moves against you, there can also be price improvements if the market moves in your favor.

Many trading platforms use market execution to process orders. However, market-driven prices are associated with two kinds of brokers in particular:

Both of these brokerages take market prices from multiple liquidity providers, and tend to provide lower spreads than the average retail trading provider. These brokers also tend to place fewer restrictions on trading strategies than market-maker brokers, for example. This makes brokers with market execution a good option for investors interested in scalping or automated trading.

Market Execution Vs Instant Execution

Trade execution is the means by which brokers process orders, while they act as an intermediary between the trader and the liquidity provider in the market. When an order is being executed, it is not always as simple as processing it at the price the trader intended – the forex market can change quickly, for example. This is why brokers have two primary ways of executing orders: market execution and instant execution.

Since market execution depends only on the available market price, traders only have to place their order and state their desired volume. The trade will be executed at the best price, as close as possible to that price. In short, the trade will definitely happen, but the price might change during the process. If the price is higher or lower than expected, it’s known as “slippage”

In contrast, instant execution brokers will execute an order at the specific price requested by the trader. Therefore, when an investor places an order they must state both the trade volume and the price. If this price is not achievable, then the broker will issue a requote which the trader can either accept or reject.

There are several benefits to using brokers with market execution over instant execution accounts. Firstly, market execution brokers offer more dynamic and fluid prices, giving traders confidence that their orders will be executed at the best available market price. Most brokers with market execution charge a small commission alongside a floating spread. This means traders can experience substantial slippage in volatile markets, either in their favor or not in line with their plan.

Instant execution accounts also tend to be slower. It can often take up to three seconds to confirm orders. And in volatile forex markets, for example, this can mean traders receive multiple requotes. In addition, instant execution brokers tend to offer wider, fixed spreads accounts, which can mean higher fees for traders.

Market Execution Vs Pending Orders

Pending orders are another way in which brokers can execute trades. A pending order essentially allows you to buy and sell securities at a future price.

There are several kinds of pending orders: buy limits, buy stops, sell limits, sell stops, and take profits. All types set different thresholds and limits for buying and selling assets in the future.

The key difference with pending orders is that they are set up in advance, and become market orders when they are executed.

Advantages Of Brokers With Market Execution

- Transparency – Brokers with market execution models are more likely to be transparent. Due to the nature of requotes, instant execution leaves more space for the broker to quote in their favor.

- No Delays or Requotes – Market execution means that the order is going to go through regardless of the market price. Although slippage can occur, your order is never going to be rejected. This means you won’t be offered a requote, and there will be no delay.

- Positive Slippage – Slippage is often cited as one of the biggest disadvantages of using brokers with market execution because it can give the trader a worse price than anticipated. However, this can also go in your favor – the price when the order is executed could be better than the price when you requested the trade.

- Low Spreads – Brokers with market execution accounts usually offer tight and sometimes zero-pip spreads. This is because the price is not fixed so can vary in the broker’s favor, giving them more flexibility to offer better spreads.

- Uncertainty – Using market execution arguably makes more sense when the market is moving against you. Here, selling the position can be more important than the price itself.

Disadvantages Of Brokers With Market Execution

- Trading Commissions – Generally speaking, brokers offering market execution will charge a trading commission which can negatively impact profit margins.

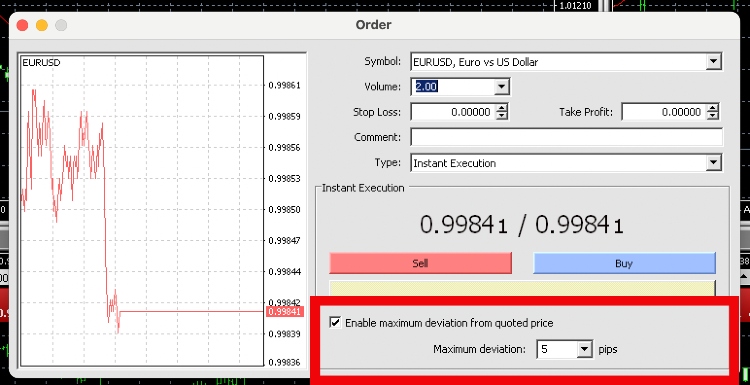

- Negative Slippage – Slippage is the key reason why traders do not choose brokers with market execution. There is no guarantee that you won’t pay a worse price for the order, and this makes market execution somewhat uncertain. There are some instant execution brokers that offer good slippage protection tools to deal with, including on MetaTrader 4 (MT4). This allows the trader to set a maximum deviation from the quoted price. If you do not set this yourself, the platform can also set a default deviation of 10 pips.

- Stop Loss – With market execution accounts, brokers do not normally allow you to set your stop losses and take profits when you open the order. You need to first place the order, and then add these according to the executed price.

How To Tell If Your Broker Uses Market Execution

The first thing to check is the broker’s website, though it could be the case that they do not visibly advertise the execution model they follow.

In the case that it isn’t displayed on the website, you can also check the MT4 order window (if your broker uses MT4). You will first have to register an account and install the platform, but it will show you the execution style used by your broker.

Alternatively, check out our list of the top brokers with market execution accounts.

Best Brokers With Market Execution

FXPro

FXPro offers fast market execution on all account types via the MT4 platform. The brand pride itself on transparency, reporting 79.03% of orders being executed at quote in 2021 while 10.09% were executed with positive slippage.

An account with FXPro also gives traders access to over 250 CFDs on 6 different asset types including forex, shares, spot indices, futures, spot metals and spot energies.

They also boast an impressive execution speed of under 14 milliseconds and records of 199,397 orders in a single day.

XM

XM has one of the highest average execution rates among its competitors at 99.35% of orders executed in less than 1 second. They use real-time market execution, so never issue requotes or reject orders.

XM offers tight spreads of 0.6 pips in their Ultra-Low account, and spreads in other accounts tend to start from 1 pip. Negative balance protection is also provided.

Exness

Exness offers several types of trading accounts, including solutions that follow market execution. The brokerage provides high-quality platforms (MT4 and MT5), plus attractively low spreads beginning at 0.1 pips, making it ideal for scalpers. The firm also has a monthly trading volume of over $2 trillion with more than 250,000 accounts.

Exness is regulated in multiple jurisdictions and holds licenses with the Cyprus Securities & Exchange Commission (CySEC) and the UK Financial Conduct Authority (FCA), among others.

Final Word

This guide has listed the pros and cons of brokers with market execution. We have also shown the merits versus instant execution trading accounts, including no requotes and tighter spreads.

However, ultimately the decision will come down to your trading strategy and personal preference. If you do decide that a market execution account is right for you, then be aware of the potential pitfalls such as negative slippage and higher commissions.

Use our list of the best brokers with market execution to start trading.

FAQs

What Is Market Execution?

Market execution is an execution style used by online brokers to execute orders at the price currently available on the market. Importantly, there are no requotes.

What Is The Difference Between Market And Instant Execution?

Where market execution automatically fulfils a trade at the closest available market price, with instant execution accounts, the trader requests an execution price and the broker tries to fulfil it. If the execution price that is requested isn’t available then the broker can reject the request and offer a requote.

Are Market Orders Executed Immediately?

In most cases, market orders will be executed almost immediately at the best available price on the market. However, the price at which the order is executed is not guaranteed, and can be either better or worse than the price expected by the trader. This difference is known as slippage.

What Is Slippage In Market Execution?

Slippage refers to the price being different to the one expected upon opening the order. Because market orders are executed at the best available price, it means that slippage can either occur negatively or positively.

Does A Requote Occur In Market Execution?

No. Because orders are automatically executed at the best market price, the broker will simply execute the order regardless of slippage, rather than offering a requote. Requotes are offered when instant execution trading models are followed, and the order cannot be executed at the requested price.