Best Brokers For Trading Hydrogen Stocks and ETFs 2026

Hydrogen has shifted from being an energy buzzword to a genuine growth story. With governments worldwide throwing serious weight behind the clean energy transition, hydrogen is moving closer to the center of conversation amongst active traders.

When we first started testing hydrogen-linked brokers, one thing jumped out: volatility. These stocks can move fast. That’s partly because many of the companies are still in growth phases, and partly because investor interest spikes whenever fresh news about subsidies or infrastructure investments hits the wires.

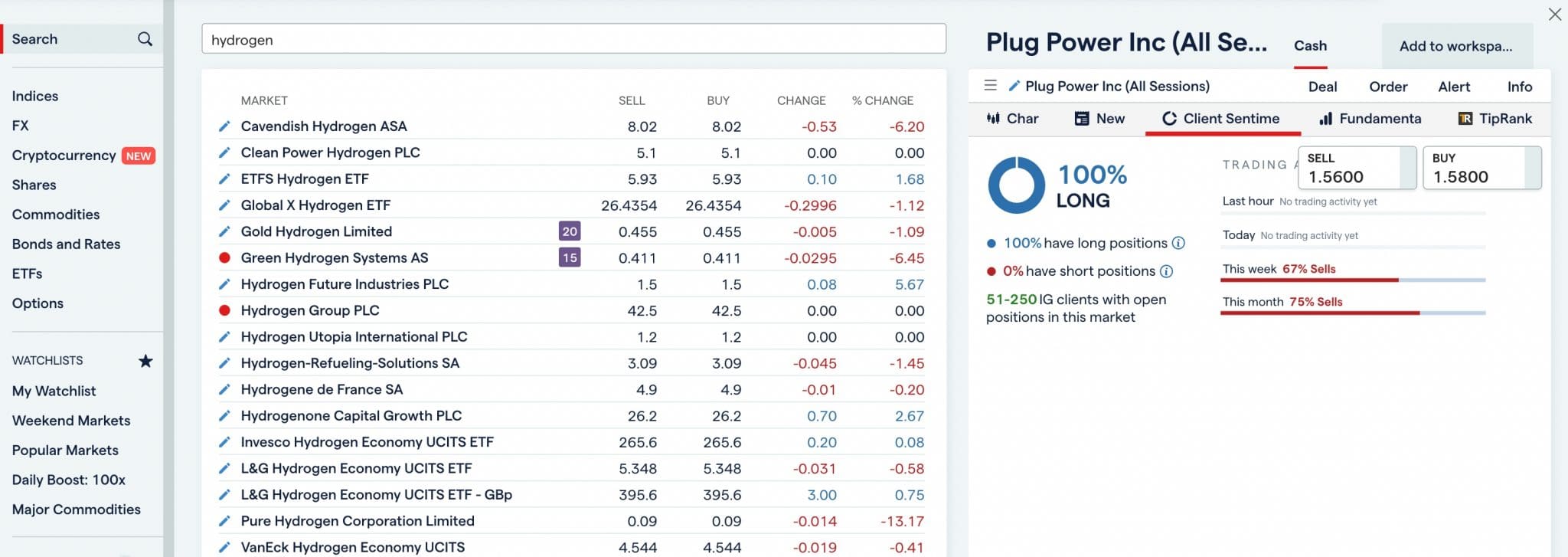

For us traders, that makes hydrogen stocks and ETFs a compelling space. Still, finding a platform with the right access, tools and pricing is key. Fortunately, we’ve run tests to identify the best brokers for trading hydrogen.

Top 2 Brokers For Trading Hydrogen Stocks and ETFs

Following our hands-on tests, these brokers stand out if you want to trade hydrogen stocks, clean energy firms, and hydrogen-focused ETFs:

Why Are These Brokers The Best For Hydrogen Trading?

Here's a rundown of why we rate these platforms as the top providers for trading the hydrogen economy:

- Interactive Brokers is the best broker for hydrogen stocks and ETFs in 2026 - Interactive Brokers delivered the strongest hydrogen coverage of any platform we tested, from international large caps like Linde to smaller speculative plays in Europe and Asia, plus full ETF access across HYDR, HTWO, and HDRO. Costs are low, with consistently tight spreads and multi-currency accounts that make cross-border hydrogen investing painless. The complexity of the platform means it’s best suited for serious traders, but for global reach in hydrogen, Interactive Brokers is a terrific option.

- XTB - XTB proved itself a cost-effective choice for hydrogen traders. The platform provides access to U.S. hydrogen names like Plug Power and Bloom Energy, with HYDR among the ETFs available. Where it excelled was pricing - spreads and costs stayed low throughout testing, making it highly attractive for serious traders. Research tools and European depth lag behind other providers in this list, but if your focus is budget-friendly trading of U.S. hydrogen stocks, XTB is a standout.

How Trusted Are The Best Hydrogen Brokers?

Hydrogen investors need secure accounts. Here’s how our top brokers ensure compliant access to global hydrogen equities and ETFs:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| XTB | ✔ | ✔ | ✔ |

Are The Best Hydrogen Brokers Good For Beginners?

New to hydrogen ETFs, fuel cell firms, and clean energy stocks? We assessed education, demo accounts, and support to find how our top choices help beginners:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| XTB | ✔ | $0 | 0.01 Lots |

Are The Top Hydrogen Brokers Good For Experienced Traders?

Seasoned traders need access to hydrogen sector ETFs, global clean energy equities, advanced order types, and fast execution. Here’s where our top firms excelled:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| XTB | - | ✘ | ✘ | ✔ | 1:30 (EU) 1:500 (Global) | ✔ | ✘ |

Compare Detailed Ratings Of Top Hydrogen Brokers

See how the leading hydrogen trading platforms performed in each main testing area:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| XTB |

Compare Trading Fees

Costs matter for hydrogen investing, especially for active traders. Compare trading fees across our top brokers:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| XTB | ✘ | €10 per 365 days |

How Popular Are The Top Hydrogen Trading Platforms?

Hydrogen investing is gaining traction as part of the global clean energy transition. We looked at user numbers to see which brokers attract the most traders:

| Broker | Popularity |

|---|---|

| Interactive Brokers | |

| XTB |

Why Use Interactive Brokers To Trade Hydrogen?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Use XTB To Trade Hydrogen?

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Account Currencies | USD, EUR, GBP |

Pros

- XTB has boosted its interest rate on uninvested balances and added zero-fee ISAs (On ETFs and real shares, or 0.2% with transactions over €100k) for UK clients with a huge range of markets available.

- With a vast range of instruments across CFDs on shares, Indices, ETFs, Raw Materials, Forex, Crypto, Real shares, Real ETFs, share dealing and more recently Investment Plans, XTB caters to both short-term traders and longer-term investors.

- XTB offers fast withdrawals with payment within 3 business days, depending on the method and amount.

Cons

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

- XTB does not offer a raw spread account, which is becoming increasingly common among competitors like Pepperstone, and may disappoint day traders looking for the tightest spreads.

How DayTrading.com Chose The Top Brokers That Offer Hydrogen Stocks and ETFs

Hydrogen is still an emerging sector; therefore, broker choice makes a bigger difference than with mainstream equities. We put each platform through hands-on testing rather than relying on advertised features. Our goal was to see how each broker handles real trading of hydrogen stocks and ETFs.

Here’s what we looked for when testing brokers:

- Market Coverage: Some platforms only give you access to the big U.S. names, while others cover the entire supply chain across Europe, Asia, and the U.S. We wanted brokers that offered more than just Linde and Air Products. Access to growth stocks like Nel ASA or Ballard Power Systems, was a key scoring factor.

- ETF Access: Hydrogen ETFs are increasingly popular for diversification. We tested access to major ETFs, including the Global X Hydrogen ETF (HYDR), Defiance Next Gen H2 ETF (HDRO), and L&G Hydrogen Economy UCITS ETF (HTWO). Brokers that offered both U.S. and European ETFs scored higher.

- Execution Speed: We placed multiple market and limit orders on both large-cap names like Linde and smaller, volatile plays such as Plug Power and Nel ASA. We measured how quickly orders were filled and tracked any slippage during periods of high market activity.

- Costs and Fees: We recorded spreads, commissions, and overnight financing charges across a variety of trades. This helped us see which brokers are truly cost-efficient when trading hydrogen stocks and ETFs rather than just relying on their published fee tables.

- Platform Usability: Ease of use matters, especially for volatile sectors like hydrogen. We evaluated charting, alerts, watchlists, and research tools, as well as the onboarding process and account setup speed.

- Real-World Trading Scenarios: We simulated different trading strategies, including short-term trades in volatile single stocks. This allowed us to test each broker’s performance in scenarios day traders are most likely to encounter.

How to Trade Hydrogen

There are two main ways to trade hydrogen:

1. Single Stock Purchases

Buying individual hydrogen stocks gives you direct exposure to the companies driving the sector. This works well if you want to focus on a few names and ride their growth (or short them if the hype fades). But the trade-off is volatility – hydrogen pure plays like Plug Power can swing double digits in a single session.

Hydrogen is a mix of giants and disruptors. On one side, you’ve got established chemical companies that have been producing hydrogen for decades. On the other hand, smaller, high-volatility innovators are trying to carve out their place in the clean energy boom.

Here are the key names we’d keep on our radar:

| Company | Ticker | What They Do | Why Traders Watch |

|---|---|---|---|

| Plug Power | PLUG | Builds hydrogen fuel cells and infrastructure. | One of the most liquid hydrogen plays, but also volatile with regular earnings shocks. |

| Ballard Power Systems | BLDP | Specializes in fuel cell tech for buses, trucks, and shipping | A pure-play hydrogen stock with global projects, often sensitive to policy news |

| Bloom Energy | BE | Produces solid oxide fuel cells for clean electricity | Gains traction on partnerships and adoption in industrial markets |

| Nel ASA | NEL.OL | Norwegian hydrogen equipment and electrolyzer producer | Heavily tied to European hydrogen projects and subsidies |

| Linde | LIN | Global industrial gas giant with large hydrogen division | Stable, blue-chip exposure to hydrogen and green projects |

| Air Products & Chemicals | APD | U.S. giant investing heavily in hydrogen production and distribution | Reliable stock with both dividend stability and hydrogen upside |

During my tests, I noticed brokers vary widely in the stocks they offer. Larger caps like Linde and Air Products are accessible almost everywhere, while names like Nel ASA often require a broker with wide European market coverage.That’s why and when platform and broker choice becomes crucial, depending on how deep into the hydrogen supply chain you want to trade.

2. Exchange-Traded Funds (ETFs)

Hydrogen ETFs are the smarter route if you prefer diversification. Instead of betting on one or two companies, you spread exposure across dozens of players in hydrogen production, fuel cells, and infrastructure.

The most popular funds we saw across platforms in testing include:

- Global X Hydrogen ETF (HYDR) – U.S.-listed fund tracking hydrogen production and supply chain players.

- Defiance Next Gen H2 ETF (HDRO) – Diversified exposure to global hydrogen innovators.

- L&G Hydrogen Economy UCITS ETF (HTWO) – A European option covering hydrogen and fuel cell firms.

- VanEck Hydrogen Economy ETF (HDRO.EU) – Another EU-based product with broad sector exposure.

Hydrogen is volatile, no doubt, but that’s what makes it worth watching for many of us traders.The key is having the right broker setup – one that gives access to both single stocks and ETFs, with tight spreads and reliable execution.

Pros and Cons of Trading Hydrogen

Pros

- High Growth Potential: Hydrogen is at the forefront of the clean energy transition, with both established companies and innovative startups.

- Diversification via ETFs: ETFs like HYDR and HTWO let you spread your risk across multiple hydrogen plays in one trade.

- Volatility Creates Opportunities: Price swings in smaller hydrogen names can offer short-term trading potential.

- Global Exposure: Traders can access U.S., European, and some Asian hydrogen stocks through the right brokers.

Cons

- High Volatility: Smaller hydrogen stocks can swing sharply on policy news, earnings, or project announcements.

- Limited Liquidity on Some Names: Some ETFs and smaller stocks trade with lower volume, which can affect fills and pricing.

- Complex Sector: Understanding hydrogen production, fuel cells, and infrastructure is necessary to make informed trades.

- Broker Access Varies: Not every platform offers all hydrogen stocks and ETFs, so careful broker selection is essential.