xStation

xStation is the proprietary trading platform offered by online broker XTB as an alternative to MetaTrader 4. The xStation 5 platform has a range of features and supports many different asset classes. This review will cover all angles of both versions of XTB’s platform: xStation 5 and the xStation mobile application.

Company Details

XTB Online Trading has been going since 2009 and is one of the largest stock-exchange-listed CFD brokers in the world. The firm has offices in 11 countries, including the UK and Germany, and has secured high-profile brand ambassadors such as Hollywood actor Mads Mikkelsen and football manager José Mourinho.

The firm accepts clients from many countries throughout the world, including most of Europe and Latam (Latin America) but with notable exceptions Belgium, the US and Australia among others. xStation is the award-winning trading platform offered by the broker and is available on the web or as a mobile or desktop app.

Platform Breakdown: Features & Usability

One major selling point of the xStation platform is its functionality and usability. The interface layout will be immediately navigable for anyone familiar with similar trading platforms, while beginners can get to grips with the major features in just a few minutes.

There are over 10,000 instruments available on xStation, including forex, indices, commodities like gold, stock CFDs and ETF CFDs. Traders outside the UK may also be able to trade cryptocurrency CFDs. It may seem like a daunting task to sift through these but, by making this list fully customisable by instrument and asset class, the “Market Watch” feature allows users to navigate instruments with ease.

Different asset classes are also divided into practical sub-categories. For example, FX pairs are broken up into major forex pairs, minors and EM (emerging market) pairs and stocks can be separated by country.

XTB allows traders to use leverage when trading on xStation. Margin levels are displayed in the bottom right corner of the screen.

Charting & Indicators

There are 29 drawing tools and 37 technical indicators available in total. xStation allows you to easily customise the appearance of charts to suit your needs best. By right-clicking on the chart and selecting “Personalise Chart View”, you will bring up a new window on which you can fully customise the charts to your preferences.

The platform allows you to set up multiple workspaces. This makes sorting and grouping your chosen instruments easier. To open a new workspace, click on “Workspace” in the top left-hand corner of the chart and select “Add New”. You then have the option to name this workspace – “US Stocks”, for example. You can open an unlimited number of workspaces and add up to 16 charts to each. If you have more than one monitor you can detach these charts and view them on different screens. Charts can be viewed in full-screen mode or you can view multiple charts in grid mode. You can change or close any of these charts by clicking on the tab below them.

The charts have a countdown timer that shows how long is remaining on each candlestick, which is a practical addition, and economic news releases can be seen on the bottom axis of the chart, keeping traders up to date with the latest developments. Seasoned traders will welcome the abundance of charting tools. Furthermore, newcomers should have no issues getting to grips with charting on xStation, as it is an extremely intuitive process.

Order Types

xStation has three main order types, with the possibility of adding “take profit” and/or “stop-loss” orders. Traders can also add a trailing stop loss before or after executing the trade.

- Market: A trade is executed at the prevailing market rate. The simplest order type.

- Limit: Depending on whether it is a buy or sell order, a limit order is executed at a predetermined point above or below the prevailing market rate. A trader can also select the expiration time of this order.

- Stop: A stop order is also a pending order which will be executed above or below the prevailing rate depending on the position. Traders can also select the expiration time of stop orders.

Mobile App

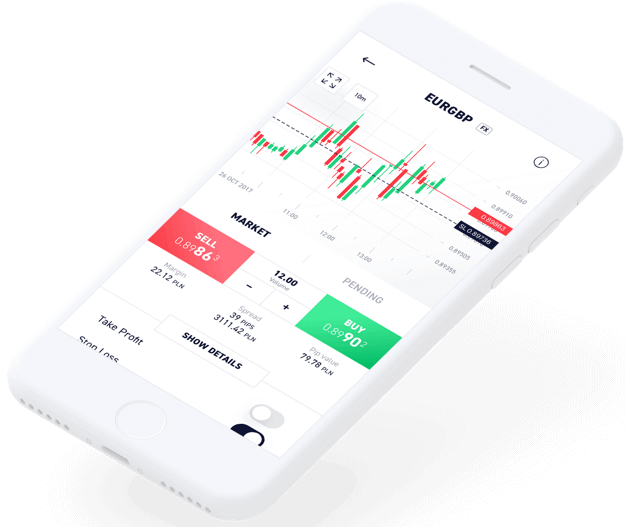

The xStation mobile app includes almost all the same functions as the web platform. Some notable omissions include the ability to set price alerts, a watchlist that syncs to the web platform and more than 20 indicators available on the web and desktop platforms.

Aside from this, the app is streamlined and extremely well-designed. Important features such as streaming news, pre-defined watch lists, an economic calendar, top movers and client sentiment data are all retained. There are also several education videos integrated into the mobile app that can be accessed at any time. Charting is also a smooth process on the app, with drawings and trend lines saved automatically and a responsive zoom function.

Demo Account

You can open a free xStation demo account loaded with $100,000 of virtual funds. You can use this account for up to four weeks to practise trading risk-free and get to know the platform. The demo account also gives you access to the “Premium” level of education courses.

How To Place A Trade On xStation

There are three ways to make a trade on xStation:

- Market Watch – Use the market watch window to find a market you would like to open a position on. Click on that market’s name and an order window will appear. Here you can choose the volume of the transaction and whether to apply a stop loss or take profit order level. The order window will also display the spread in both pips and monetary value, commission, pip value and daily swap points. Once you have selected your volume, select the direction you wish to trade. If you want to buy or go long, hit the green button. If you wish to sell or go short, hit the red button. After you do this, your order will be placed.

- The Charting Deal Ticket – You can also make a trade from the chart window. Once you have finished analysing a market and wish to make a trade, you will find the same red and green buttons on the top left-hand corner of your screen. You will be able to adjust the volume of your trade from this window.

- Three-Click Charts Trading – You can make a trade directly on the chart using xStation’s three-click trade functionality. At the top of the chart of the market you want to trade, click on the ‘Place pending order on Chart’ icon. This will activate three-click functionality. Next, click where you wish to trade, use the second click to indicate where you want to place your stop loss and the third click where your profit target is. You will be presented with a new order ticket based on what you have clicked. Click buy or sell to complete the order.

Education & Analysis Features

Portfolio Breakdown

xStation provides clients with a portfolio breakdown to help you keep track of all your trades. The statistics are broken down into overall profit/loss, specific instruments, percentage accuracy (all/buy only/sell only), average trade duration, average/maximum consecutive winning/losing trades and average/maximum profit/loss on winning/losing trades. Advanced users may prefer a platform that provides a more detailed breakdown but this should be sufficient information for any beginner or intermediate trader.

News

The xStation news section provides traders with up-to-date information on important global news. You can search the news by category or keyword by using the filter section on the top left-hand corner of the screen. The news section contains succinct, relevant and well-written news reports.

Economic Calendar

The xStation economic calendar is very easy to get to grips with and can give you the edge when trading stocks and other foreign markets. It is a good idea to be aware of periods of high liquidity and the calendar will give you announcements for each country, time and currency. as well as forecasts, previous numbers and actual posted numbers.

Market Sentiment

The market sentiment section is a helpful feature that displays the overall open position status for all XTB clients. This is displayed in clear, understandable graphics and can help you gauge how other traders are thinking.

Top Movers

The top movers feature gives you the chance to see which instruments have had the biggest percentage moves in the last week or month. This is a useful way to spot potential trades by looking at increasing volatility.

Stocks Scanner

This allows you to keep track of your chosen stocks and filter what you see by market cap, EPS, P/E values, dividends, ROE and BETA. The xStation heatmap is essentially the same thing as the stocks scanner, only in a different, chromatic graphical form.

Investment Basket

A unique tool of the xStation platform is the “investment basket”. This allows traders to group various instruments thematically. You can then open a position on all instruments simultaneously with just one click. Baskets can contain both long and short positions, making them useful for certain advanced trading strategies.

There is also a small selection of educational videos and tutorials available on the xStation platform, as well as a YouTube channel with guides, updates, tips and tricks. You can view your trade history by clicking on the “History” tab. All data can be exported as an excel/CSV file for ease of tax reporting.

How To Download xStation

The xStation platform is available on the web without the need to install any software, or as a mobile or desktop app. To download the desktop client, you will need to open a demo or live account on the XTB website. Note that some traders will be eligible for a welcome bonus. Once you log in to your account, you can download xStation for your PC, both for Windows and Mac. You can find the mobile app by searching “xStation” on the Google Play Store for Android (APK) devices or the App Store for Apple (iOS) devices. You will be able to trade on the go, even from your Apple Watch.

XTB XStation Vs MetaTrader 4

MetaTrader 4 (MT4) is a well-known trading platform offered by many brokers. Here is a list of the main differences and similarities between xStation and MetaTrader 4:

- Spreads are wider on MT4. If you are trading with XTB, you will find that xStation offers tighter spreads.

- xStation does not allow automated trading but MT4 supports the use of expert advisors (EA) to automate your trades.

- XTB does not offer its own ready-made back-testing applications (back-testing evaluates how a particular strategy would have fared using historical data). MT4 users can create their own.

- There is an official API for xStation 5, where users can open trades and retrieve real-time data using JSON. Note that, although Python APIs for xStation exist, they are not official.

- MT4 users have access to 24 analytical tools and up to 30 inbuilt technical indicators and chart types, including lines, bars and candlesticks. All tradable assets can be displayed over nine timeframes. xStation 5 clients can make use of 29 drawing tools and 37 technical indicators.

- MT4 users cannot trade cryptocurrencies CFDs, including Bitcoin. xStation clients have access to XTB’s full range of products. Note that UK users will not be able to trade crypto CFDs.

- Users can execute withdrawals directly from the xStation platform.

Advantages

- Full range of products – including crypto CFDs

- Extensive range of technical features

- Three-click trade functionality

- Functional and streamlined

- Investment baskets

- Customisable

- Tight spreads

- API support

Drawbacks

- No automated trading

- No backtesting applications

- Limited portfolio breakdown details

Final Word

Overall, the xStation platform has an extensive range of features that should satisfy the needs of most traders, retail or professional. Its sleek and user-friendly design means that it gives stiff competition to industry favourites like MetaTrader 4.

It also has a range of useful and creative additional features, such as its chart-based three-click trading functionality and the ability to create investment baskets.

However, the platform is lacking in its back-testing and automation capabilities. Ultimately, unless you are using algorithm-heavy strategies, this platform comes highly recommended.

FAQs

Is xStation A Good Trading Platform?

xStation is XTB’s proprietary trading platform. It is popular due to its functionality and usability. The platform has 29 drawing tools and 37 technical indicators. When trading with XTB, xStation has access to tighter spreads and more instruments than the MT4 platform.

What Is The Difference Between xStation & MetaTrader 4 (MT4)?

XTB offers two trading platforms for its clients: xStation and MT4. xStation, its proprietary software, comes with an extensive range of features and has a highly intuitive and user-friendly interface. However, its competitor, MT4, is better suited for algorithmic or EA traders as it allows for back-testing and automation.

Where Can I Download xStation?

xStation 5 is available on the web or as a desktop or mobile. To download the app, you will need to create an account on the XTB website. The mobile app can be found on the Google Play Store or the Apple App Store.

How Do I Place A Trade On xStation?

There are three ways to place a trade on xStation: Market Watch, Charting Deal Ticket and Three-Click Charts Trading. All three trading methods are intuitive and fully customisable. Read our guide above to find out more about placing a trade on xStation.

Can I Open A Demo Account For The xStation 5 Platform?

Yes, you can open a free xStation demo account and use it to get to know the platform. It will be active for four weeks and is automatically loaded with $100,000 of virtual funds.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69-83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money