Best Day Trading Platforms and Brokers in the US 2026

The best day trading platforms in the US cater to active short-term traders, offering trading on key markets like the Nasdaq and EUR/USD. The top brokers are also regulated by the CFTC, NFA or FINRA, provide accounts in US Dollars for convenient deposits, and offer reliable execution.

Explore the best day trading platforms in the US, chosen after hands-on testing and in-depth analysis. All recommended brokers welcome US day traders and have our experts’ confidence.

Top 6 Platforms For Day Trading In The US

After exhaustively evaluating 140 online brokers, these 6 platforms continue to stand out as the best for day traders in the United States:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

5

FOREX.com

FOREX.com -

6

Crypto.com

Crypto.com

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Crypto.com - Crypto.com is one of the biggest names in cryptocurrency trading, developed with the aim to expedite the world's transition to DeFi technologies. The crypto exchange offers token lending, pre-paid cards, NFTs and more. The firm was established in Germany in 2016 and its quality is proven by its 150 million users.

Best Day Trading Platforms and Brokers in the US 2026 Comparison

| Broker | US Regulated | USD Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| NinjaTrader | ✔ | ✔ | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| Plus500US | ✔ | ✔ | $100 | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | Variable |

| OANDA US | ✔ | ✔ | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist | 1:50 |

| FOREX.com | ✔ | ✔ | $100 | Forex, Stock CFDs, Futures, Futures Options | WebTrader, Mobile, MT4, MT5, TradingView | 1:50 |

| Crypto.com | ✔ | ✔ | Varies by payment method | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) | Own | - |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- Although support response times were fast during tests, there is no telephone assistance

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- Beginners can get started easily with $0 minimum initial deposit

- Day traders can enjoy fast and reliable order execution

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

Crypto.com

"Crypto.com is a snug fit for aspiring crypto traders who want to buy, sell and trade over 400 digital tokens. Its strike options and prediction markets spanning financial, economic, election, sport, and cultural events via its CFTC-regulated entity also make it a secure option for US traders interested in binary-style contracts on an intuitive app."

Christian Harris, Reviewer

Crypto.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) |

| Regulator | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU |

| Platforms | Own |

| Minimum Deposit | Varies by payment method |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, PLN, CZK, AED, SAR, HUF, BRL, KES |

Pros

- Crypto.com has expanded beyond crypto in some regions, offering over 5000 stocks and ETFs for traders looking to build diverse portfolios and opportunities in different sectors.

- Crypto.com uses a cold wallet solution that integrates multi-signature technology and geographic distribution to enhance security. This approach ensures robust protection of user assets with highly secure offline storage.

- The Crypto.com Exchange platform offers sophisticated bots, including Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. These tools allow traders to automate strategies, including leveraged perpetual trades, minimizing manual effort and slippage.

Cons

- Customer support primarily relies on chatbots and email, with limited reliable phone support from our testing. This can lead to delays in resolving urgent issues, such as account access or transaction problems, which can be frustrating for crypto day traders who need quick assistance.

- Withdrawal fees apply to crypto transfers and fiat withdrawals, and these can be significant for active traders making smaller transfers. The minimum withdrawal limits are also relatively high, which restricts flexibility for managing smaller portfolios or quick liquidity needs.

- The app's high bid-ask spreads on many coins can be costly for traders placing market orders. Wide spreads mean the price you pay when buying is noticeably higher than the price you receive when selling, cutting into profits, especially on lower-volume trades.

Choosing A Day Trading Platform In The US

There are several key factors to consider when deciding which platform to use for day trading:

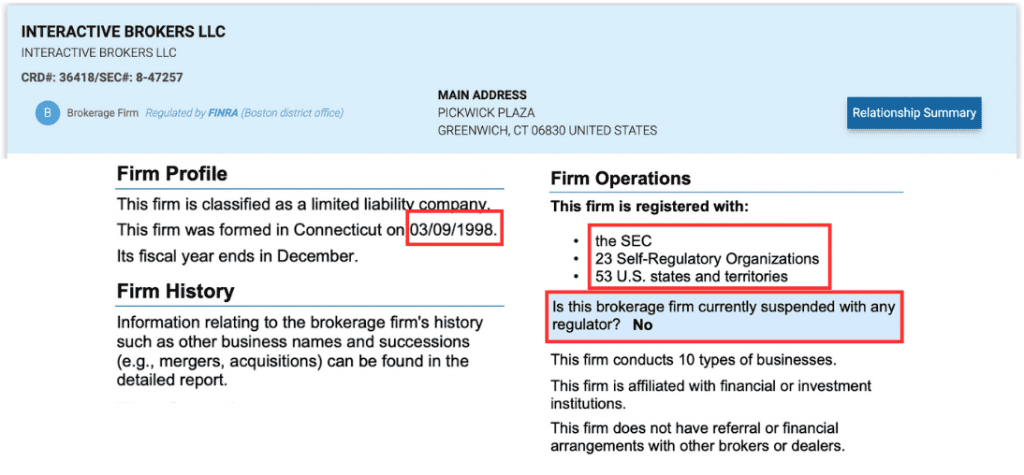

Choose A Trusted Broker

We only recommend US day trading brokers we’ve personally tested after weighing their regulatory credentials with their industry standing.

Several ‘Green-Tier’ regulators oversee day trading activities in the US:

- Securities and Exchange Commission (SEC): Responsible for regulating the securities industry, notably stocks and options exchanges.

- Commodity Futures Trading Commission (CFTC): Responsible for regulating derivatives and commodities trading.

- National Futures Association (NFA): Responsible for regulating derivatives trading, working alongside the CFTC as a self-regulatory organization.

- Financial Industry Regulatory Authority (FINRA): Responsible for overseeing brokerage firms, working under the SEC as a non-governmental organization. Its Pattern Day Trader (PDT) rule mandates traders with 4+ day trades in 5 days to keep a minimum of $25,000 in their accounts, and it limits day traders to borrowing up to 50% of the purchase price of securities. That said, US regulators have introduced plans to scrap the $25K minimum for pattern day traders. This move could open day trading up to smaller investors and spell good news for US brokers.

Regulators also enforce strict rules to help combat trading scams, which have targeted US traders in recent years. In 2022 for example, Finance Magnets reported that two American nationals, Patrick Gallagher and Michael Dion, used a fake investment firm, Global Forex Management, to swindle $30 million in investor deposits.

I recommend checking any broker you plan on day trading with is regulated in the US. You can do this by using FINRA’s BrokerCheck, which provides details on a company’s history and any disputes.

- IG scooped our vote as the most trusted broker. It’s authorized by 13 regulators including the CFTC in the US, boasts a 50+ year industry, and our experts have traded at IG with real money and reported a reliable day trading environment with no withdrawal issues.

Choose A Broker With Wide Market Coverage

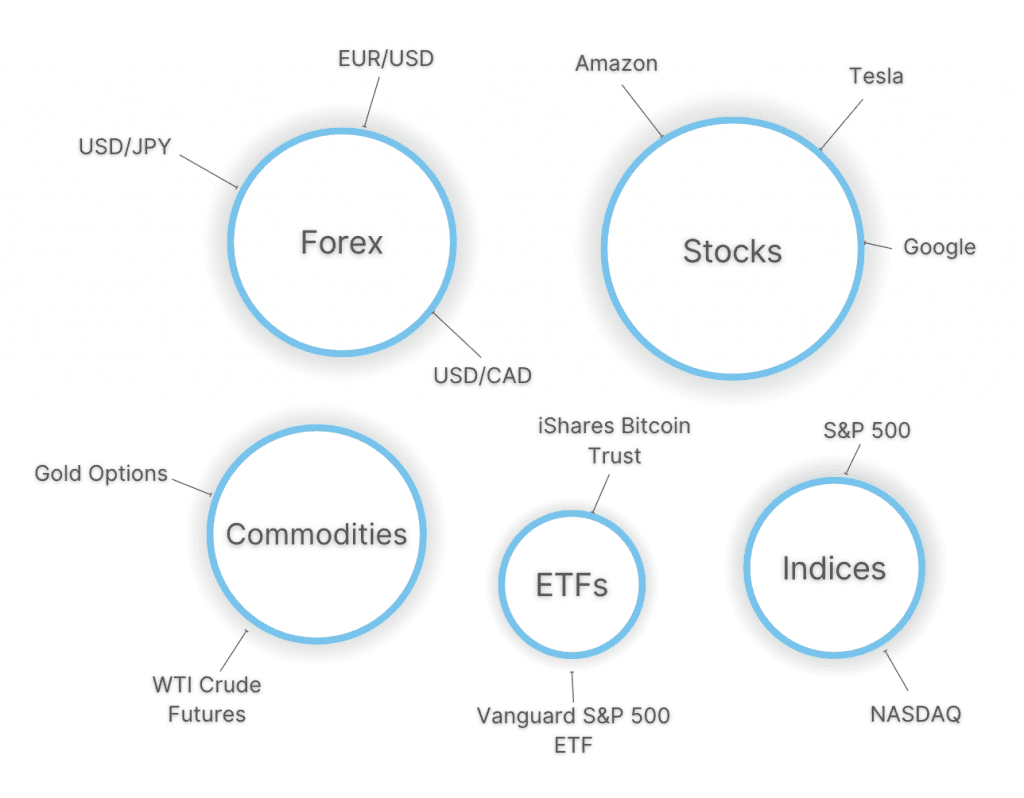

The best platforms provide access to a wide range of financial markets, catering to diverse day trading strategies.

We’ve used the platforms of every broker we’ve recommended and countless more, to make sure they offer trading on popular markets in the US, as well as opportunities in global financial markets.

American traders can speculate on forex with many currency pairs containing a US Dollar component, as well as stocks listed on key stock exchanges like the New York Stock Exchange and Nasdaq.

Additionally, many top platforms offer short-term trading on popular commodities like oil and natural gas through futures and options.

In January 2024, the SEC also approved the launch of new spot Bitcoin ETFs for US traders, including the iShares Bitcoin Trust, enabling investors to speculate on current prices without having to buy BTC.

Unlike many countries, CFD day trading is not permitted in the US. These popular short-term trading vehicles are over-the-counter products that are restricted under US securities laws.

- Interactive Brokers has spent years adding to its suite of instruments, now offering a fantastic selection of products for active traders spanning 15 markets, 24 countries and 27 currencies, including stocks, ETFs, futures, futures options, fixed income, mutual funds, cryptocurrencies, indices and warrants.

Choose A Broker With Low Fees

We only recommend brokers with competitive pricing for active day traders, for whom a large volume of trades can lead to mounting fees.

To identify low-cost day trading brokers in the US, we evaluate fees on popular assets, for example, USD currency pairs like the EUR/USD and GBP/USD, and major indices.

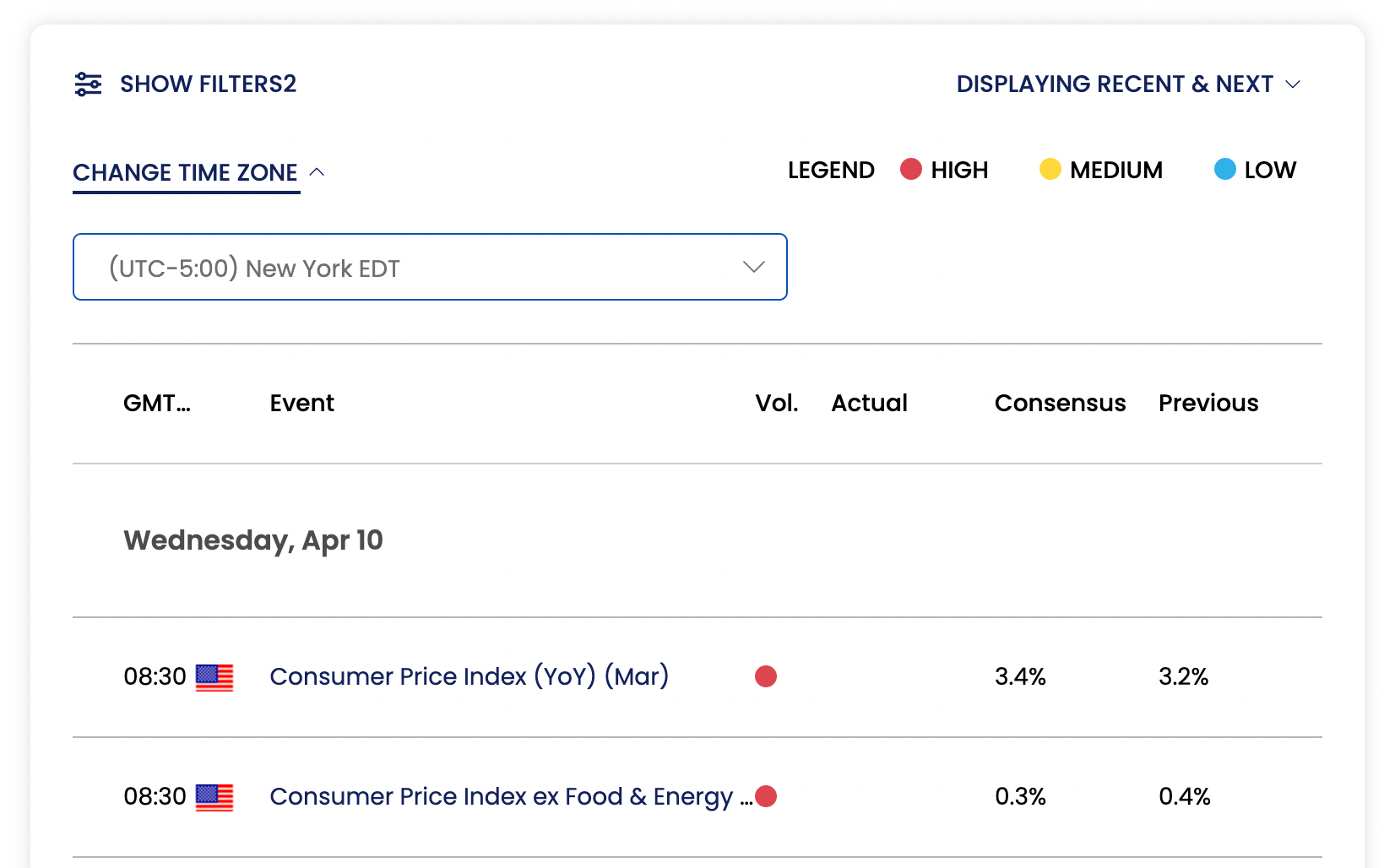

We then balance the trading fees with the quality of the overall day trading environment. For example, it may be worth paying more for tools that provide insights into events that could impact US financial markets such as interest rate decisions from the Federal Reserve Board and yields on bills auctioned by the Department of Treasury.

- FOREX.com offers a cost-effective RAW account for serious day traders, with spreads from 0.0 and a $7 commission per $100K on forex and zero commissions on stocks, options and mutual funds. Its Active Trader program can further cut costs by 15%. The platform also provides excellent tools, including a user-friendly financial calendar that you can filter by the US, event type, and volatility, helping to identify short-term trading opportunities.

Choose A Broker With Terrific Charting Tools

The top US brokers stand out by providing intuitive platforms with excellent charting tools that are often employed by short-term traders.

Our experts have spent hundreds of hours testing dozens of charting platforms and day trading apps, balancing ease of use with the range of charting styles, timeframes, indicators and algo trading features.

MetaTrader 4 and MetaTrader 5 remain the most popular third-party day trading platforms, especially among seasoned traders. However, they face increasing competition from the likes of TradingView, which sports a more intuitive interface in our view, lending it to beginners.

Since many US brokerages are focused on securities, specialized terminals are also often available, notably Charles Schwab’s thinkorswim.

Alternatively, brokers like Plus500 have invested heavily in building their own software in recent years, though it still lacks the customization capabilities and account analytics available on leading third-party solutions, despite a slick design that we really enjoy.

- IG’s almost unmatched selection of platforms and apps cater to all types of day traders and strategies. Alongside the broker’s proprietary platform and MT4, active traders can use the advanced ProRealTime, which delivers over 100 technical indicators for short-term analysis.

Choose A Broker With Reliable Order Execution

Efficient order execution is crucial, especially for day traders speculating on volatile US stocks like Beneficient (NASDAQ: BENF) and Etao International Co., Ltd (NASDAQ: ETAO), where minor price discrepancies can affect profits.

Let’s say I plan to buy 500 shares of ETAO at $5.00, targeting a quick profit by selling at $5.10. However, slow execution resulted in a buy price of $5.05, and I ended up selling at $5.10.Instead of the $50 profit I anticipated, I only made $25 in profit.

That’s why we analyze order execution policies and data where available, with our experts deeming <100 milliseconds ‘fast’ for day traders. This will help ensure low latency – the least possible downtime between order placement and fulfilment.

- OANDA continues to stand out with excellent execution speeds as low as 12 milliseconds on popular markets like EUR/USD. US clients can also request regular trade execution reports, as per the NFA’s transparency requirements.

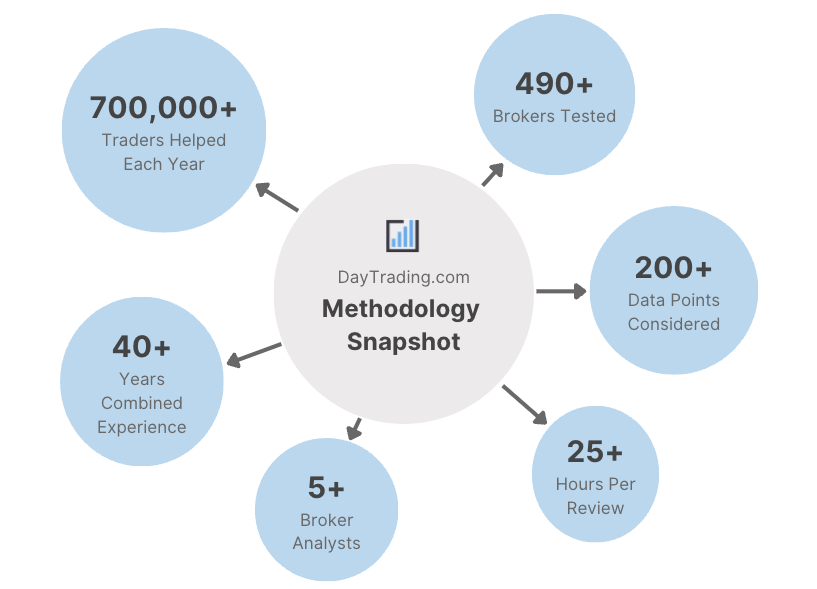

Methodology

To find the best day trading platforms in the US, we took our vast database of brokers and filtered them on those accepting investors from the United States. We then ranked them on their overall rating which draws on over 200 data points and criteria, notably:

- Whether they are trusted and regulated by the SEC, CFTC, FINRA or another reputable agency.

- Whether they offer short-term trading on a range of markets, such as US equities and currencies.

- Whether they offer low day trading fees, focusing on key markets like EUR/USD and US stocks.

- Whether they deliver intuitive charting platforms and day trading apps following tests.

- Whether they offer fast and reliable order execution for active trading strategies.

I do not recommend day trading for inexperienced investors. Regardless of the broker you choose, there is a high risk you could incur substantial losses in a short period. Consult with a financial advisor if you are unsure whether day trading aligns with your goals.

FAQ

Which Is The Best Day Trading Platform In The US?

Use our list of the top day trading brokers in the US to find a suitable platform for your requirements.

All our recommended brokers have been tested by our industry experts, though the choice of day trading platform is ultimately a personal decision.

Who Regulates Day Trading Brokers And Platforms In The US?

Several regulators oversee day trading platforms and activities in the US, including the SEC, CFTC, NFA and FINRA. These authorities often coordinate efforts to combat scams, penalize misconduct, and provide investor protection for day traders.

That said, day trading is inherently risky with many active investors losing money. You can also lose more than your deposit as negative balance protection is not provided as standard in the US, despite it being a requirement in other heavily regulated jurisdictions, notably the UK and Australia.

How Much Money Do I Need To Start Day Trading In The US?

Based on our database of 140 day trading brokers, US investors will often need between $0 and $250 to open an account.

That said, some day trading platforms stand out with no minimum, catering to budget investors. The highest-rated are Interactive Brokers and OANDA.

Most US day trading platforms support deposits in debit card, wire transfer and ACH transfer.

Recommended Reading

Article Sources

- Securities and Exchange Commission (SEC)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Financial Industry Regulatory Authority (FINRA)

- Pattern Day Trading Rule - FINRA

- BrokerCheck - FINRA

- Nasdaq Stock Exchange

- Beneficient (NASDAQ: BENF)

- Etao International Co., Ltd (NASDAQ: ETAO)

- New York Stock Exchange

- SIPC Investor Protection

- US Trading Scam - Finance Magnates

- Federal Reserve Board

- Department of Treasury

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com