Alternatives To Robinhood

This article was first published on January 30, 2021

Consumer faith in the Robinhood platform was dashed at the end of January 2021, as the company suspended trading in cryptos and GameStop shares. Follow the events that led to the broker losing favour with day traders and see our recommended alternatives to Robinhood.

Other Brokers

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

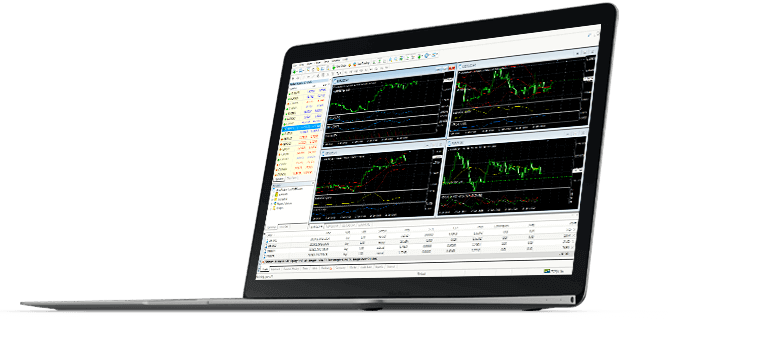

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- Average fees may cut into the profit margins of day traders

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

Cons

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

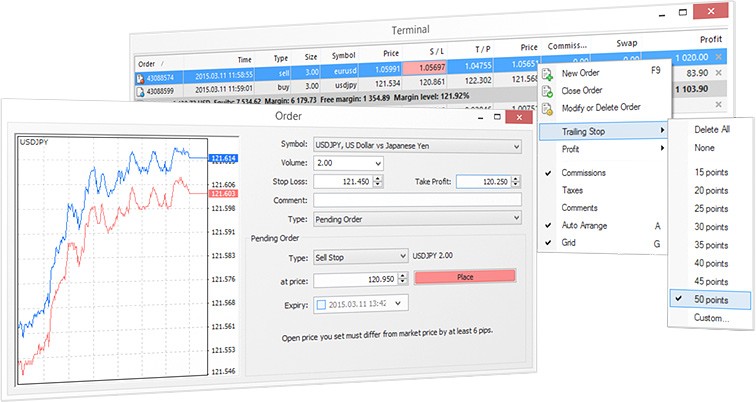

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Although support response times were fast during tests, there is no telephone assistance

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- The broker offers a transparent pricing structure with no hidden charges

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

WallStreetBets & GameStop

Buoyed by insider knowledge that Wall Street hedge funds had millions in short positions on the high street gaming retailer, Redditors jumped to purchase shares in the firm, causing a surge in the value of stocks.

In reaction, Robinhood suspended trade on GameStop shares to comply with ‘financial requirements’ the platform’s CEO Vlad Tenev confirmed.

Whilst heavily restricted, trade has now resumed after the firm raised $1 billion in emergency investment. But the damage to consumer confidence still remains.

Angry investors posted a barrage of 1-star reviews for the app on the Google Play Store. These have recently been deleted by Google, returning Robinhood’s average star rating to four.

Crypto Trading Suspended

In the wake of the volatility, other markets have also seen disruption.

Gold prices declined 0.2% and UK short positions in Cineworld and Pearson were also impacted. However, it was cryptos that saw volatility in particular.

The price of dogecoin, a relatively unknown crypto, soared by 800% after it gained traction on social media.

The spike in price and market activity led to Robinhood suspending instant cryptocurrency deposits on Friday, citing ‘extraordinary market conditions’.

For the second time in one week, the broker acted as a barrier between its customers and the financial markets. It was perhaps unsurprising then that loyal day traders were once again up in arms.

Alternatives To Robinhood

Retail day trader interest has quickly turned to alternatives to Robinhood. Competitor brokerages that offer stock trading and options are seeing a pique in new accounts.

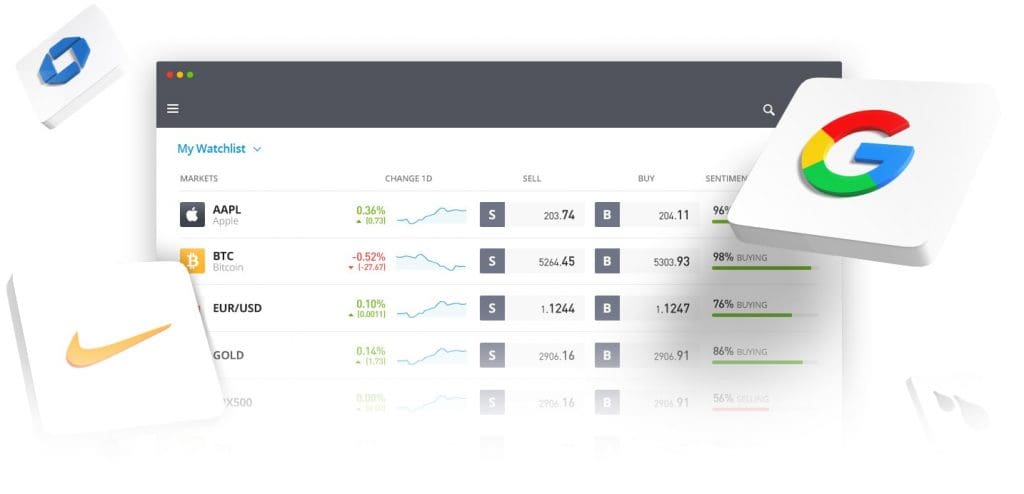

eToro

Top alternatives to Robinhood include eToro, a social trading platform that offers trading in stocks, cryptocurrencies and CFDs. Clients can utilise social feeds to discuss strategies and copy positions. 50+ currencies, nearly 1,000 stocks and a portfolio of indices are also available.

In addition, the broker provides its own powerful trading platform with extensive customisation and a user-friendly dashboard.

Forex.com

Forex.com is one of the top rated online brokers offering access to over 180 global markets. Leveraged trading is available on forex, stocks, commodities and cryptos.

The broker also offers multiple live account options, competitive floating spreads and a choice of flexible deposit and withdrawal options.

Add in daily market updates and approval from a long list of respected regulators and it’s unsurprising Forex.com is a popular alternative to Robinhood.

Pepperstone

For those with an interest in forex trading, Pepperstone offers trading on six major currency pairs, as well as numerous minors, crosses and exotics.

CFDs are available on major instruments such as indices, commodities and shares. Australian-based Pepperstone also provides the leading MT4 and MT5 platforms, alongside a competitive £200 minimum deposit requirement to meet the needs of novice traders.

Final Word

The GameStop and crypto disruption has proven the volatility of financial markets and the risks involved. The reaction of Robinhood has also shown that not all brokers will respond how customers would expect. As a result, many traders will look for alternatives to Robinhood.

Fortunately, there are many top brokers available in today’s market.