Best Brokers With Low Spreads 2026

If you’re a day trader, every fraction of a pip counts. That’s why brokers with low spreads can be a game-changer, helping you pocket more of what you earn and keeping you competitive in fast-moving markets.

Let’s dig into our lowest spread brokers, tested and rated by industry experts and active traders.

Best Low Spread Brokers

We've been recording and analyzing spreads for 7+ years, and these 6 brokers offer the tightest spreads:

Here is a summary of why we recommend these brokers in March 2026:

- FOREX.com - In our ECN-style testing with FOREX.com’s account, execution averaged 40ms with moderate slippage during fast market moves. Spreads on EUR/USD started near 0.1 pips, plus a $6 commission per lot. Liquidity was deep but slightly fragmented during off-hours. Best suited for experienced traders using limit-order dependent strategies.

- VT Markets - When we evaluated VT Markets’ ECN Raw account, execution speeds averaged 35–40ms with consistently low slippage. Spreads on major pairs like EUR/USD often hit 0.0 pips, paired with a $6 round-turn commission. Liquidity was reliable across sessions, making it a solid option for day trading and automated trading systems.

- Tickmill - Tickmill is a global broker authorized by trusted regulators including the CySEC and the FCA. Hundreds of thousands of traders have opened an account with the firm with more than 530 million trades executed. Advanced trading tools, educational content and low fees make this broker stand out from competitors.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

- PU Prime - PU Prime is a forex and CFD broker offering direct market access on forex, commodities, stocks, bonds, indices, and ETFs. With four account types (Cent, Standard, Prime, ECN) and multiple platforms, from MetaTrader to its own PU Prime app, it’s built for active traders at every level.

- FXGT - Established in 2019, FXGT is an offshore broker providing CFD trading on 185+ instruments. Through MT4, MT5 and FXGT Trader (added in 2024), alongside a choice of five accounts (Mini, Standard+, ECN Zero, PRO and Optimus), FXGT caters to a broad spectrum of short-term traders.

Fee Comparison At Low Spread Brokers

| Broker | EUR/USD Spread | FTSE Spread | Oil Spread | Stock Spread | Crypto Spread |

|---|---|---|---|---|---|

| FOREX.com | 1.2 | 1.0 | 2.5 | 0.14 | BTC 1.4%, ETH 2% |

| VT Markets | 0.4 pips | From 40 | From 16 | Variable | - |

| Tickmill | 0.1 | 0.9 | 0.04 | N/A | Variable |

| JustMarkets | 0 - 1.0 | 1 - 2.5 | 2.0 | Variable | Floating from zero (Raw ECN) |

| PU Prime | 0.2 pips (ECN) | 23 (ECN) | 2.2 (ECN) | 4.2 (Amazon) | 27.5 (BTC) |

| FXGT | 2.2 | 110 | 1.1 | 31.9 (Apple Inc) | Variable |

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

VT Markets

"VT Markets is a great choice for regular traders who are looking for very tight spreads and powerful charting software. The broker's share CFD offering is particularly strong, with hundreds of commission-free assets spanning multiple global markets."

Tobias Robinson, Reviewer

VT Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Commodities, Stocks, Indices |

| Regulator | ASIC, FSCA, FSC |

| Platforms | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral |

| Minimum Deposit | 50 - 500 USD |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- A proprietary copy trading service, VTrade, is available on two platforms, with access to 100+ providers

- Market-leading MetaTrader 4 and MetaTrader 5 charting platforms are offered, with advanced technical capabilities and access to Expert Advisors (EAs)

- Spreads are competitive based on tests, coming in at 0.2 pips for EUR/USD in the ECN account, aligning with top brands like Pepperstone

Cons

- The broker’s bonus schemes have stringent terms and conditions, including restrictions on minimum deposits and payment methods used

- Unlike similar brands like Fusion Markets, VT Markets does not offer crypto trading

Tickmill

"Tickmill is a stellar choice for day traders, especially if you opt for the Raw account which delivers near-zero pip spreads and impressively fast order execution during testing. "

Christian Harris, Reviewer

Tickmill Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds |

| Regulator | FCA, CySEC, FSA, DFSA, FSCA |

| Platforms | Tickmill Webtrader, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, ZAR |

Pros

- When using the Raw Spread account, you’ll notice how tight the spreads are - sometimes even zero pips - paired with a transparent per-trade commission. This setup helps keep your overall trading costs low, which is a significant advantage when you’re making frequent trades and want to avoid hidden fees that cut into your profits.

- Tickmill’s multiple licenses with authorities like the FCA and CySEC aren’t just paperwork - they translate to real-world benefits. Your money is kept separate in secure accounts, and the broker offers negative balance protection. In practice, this means you won’t be on the hook for more than you deposit, providing peace of mind when markets get volatile.

- Based on our actual trading experience, Tickmill consistently processes orders quickly - averaging ~59 milliseconds - with very few instances of slippage or requotes. For a day trader, that means you can trust your entry and exit prices without worrying about delays that might cost you money in fast markets.

Cons

- If you’re used to cTrader’s modern layout and sophisticated order types, you’ll miss that here. Tickmill sticks with MetaTrader 4 and 5, as well as TradingView and its own proprietary platform, so there’s no cTrader option. This might slow down traders who rely on cTrader’s workflow or specific tools, such as cTrader Copy.

- Tickmill’s demo accounts don’t support all platforms (like its proprietary one), which can make practicing your strategies less seamless. That’s a hassle if you want to thoroughly test your skills before going live, especially with newer Tickmill tools.

- Tickmill primarily focuses on forex pairs, select stock CFDs, indices, and a few commodities. If you like switching between many different asset classes, like crypto or a broader range of stocks, you’ll find the choices limited compared to brokers with thousands of instruments.

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Low minimum deposit

- Multiple accounts to suit different strategies and experience levels

- Welcome bonus for new traders

Cons

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

PU Prime

"PU Prime is a great fit for experienced, high-volume traders with its ECN account offering tight spreads from 0.0 pips and low commissions from $1/side. The addition of an easy-to-use copy trading app, alongside the stacked Trading Academy with progression levels, also makes PU Prime a strong option for aspiring traders. "

Tobias Robinson, Reviewer

PU Prime Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Metals, Crypto, Bonds, ETFs |

| Regulator | ASIC, FSCA, CMA, FSA, FSC |

| Platforms | PU Prime App, PU Web Trader, PU Social, MT4, MT5, AutoChartist |

| Minimum Deposit | $20 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD |

Pros

- Prime and ECN pricing can be very competitive for active traders, and in our tests spreads tightened notably in liquid sessions to hit ~0.0 pips.

- The platform lineup is strong, with the PU Prime Web Trader and app especially smooth to use with a modern design, easy-to-configure order tickets and responsive charts for fast entries and exits.

- There’s a great suite of tools for short-term traders, from practical margin and position sizing calculators to economic calendars and strong technical insights via Autochartist.

Cons

- The in-house market updates are useful for a quick read, but they’re generally high-level and don’t go deep enough for serious strategy building or advanced analysis.

- Getting through to customer support can be fiddly and slow to reach a human – in our latest checks we had to navigate multiple chatbot menus and questions then enter contact details before getting to an agent.

- The ECN account’s $10,000 minimum deposit puts the best pricing out of reach for some active retail traders who may end up paying more for spreads and commissions on Prime, Standard or Cent accounts.

FXGT

"FXGT, especially with its Optimus account, targets day traders seeking extremely high leverage of up to 1:5000, offering the potential for amplified profits and losses, though at the cost of robust regulatory protections."

Christian Harris, Reviewer

FXGT Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FSCA, FSA |

| Platforms | FXGT Trader, FXGT App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:5000 |

| Account Currencies | USD, EUR, JPY |

Pros

- FXGT stands out after introducing access to over 30 popular cryptocurrencies such as Bitcoin, Ethereum, etc. This is advantageous for traders interested in diversifying into digital assets and provides an additional market to explore beyond traditional forex and stocks.

- Five account types are available to suit different trading needs, including accounts for beginner and advanced traders, plus the Optimus account, which was built for day traders and now offers the highest leverage we've seen up to 1:5000 (amplifying profit and loss).

- FXGT supports multiple platforms, including MT4, MT5, and its proprietary FXGT Trader, added in 2024, catering to different trading styles, such as MetaTrader's automated trading with Expert Advisors (EAs).

Cons

- FXGT offers a subpar selection of around 185 assets, which is limited compared to category-leading brokers like Saxo with its 72,000+ instruments. In particular, FXGT does not provide access to a wide range of stocks from international markets.

- While FXGT offers some research, such as its market analysis section and an economic calendar, they are not as extensive as those provided by brokers like IG. Traders looking for detailed analysis, in-depth reports, or third-party research will find FXGT's resources woeful.

- FXGT is regulated by regional authorities like the Seychelles FSA and South Africa’s FSCA, but still does not hold licenses from ‘green tier’ regulators such as the UK’s FCA or Australia’s ASIC. This means that traders may not benefit from the higher investor protections, stringent oversight, and dispute resolution mechanisms.

Methodology

To rank the brokers with the best spreads, we

- Evaluated spreads on forex, stocks, indices, crypto, and commodities for 139 brokers as of March 2026;

- Combined these with the overall ratings we assigned brokers because you need more than just low spreads;

- Ranked these providers to reveal the brokers with the lowest spreads AND the best trading experience.

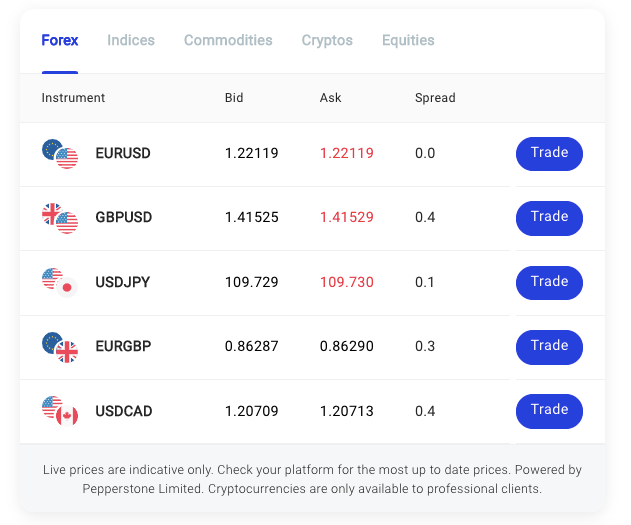

What Is A Spread?

A spread is the difference between the bid (selling) price and the ask (buying) price of a financial instrument – essentially, the cost your broker charges for executing a trade. Think of it as a toll booth on your trading highway.

Let’s break it down with an example:

Imagine you’re trading EUR/USD (the Euro against the US Dollar), and your broker quotes:

- Bid price (Sell): 1.1000

- Ask price (Buy): 1.1002

The spread here is 2 pips (1.1002 – 1.1000 = 0.0002).

Here’s how it works in action:

- You decide to buy one standard lot (100,000 units) of EUR/USD at the ask price of 1.1002.

- As soon as your trade is executed, if you were to sell it immediately, you’d sell at the bid price of 1.1000.

- That means you’d start with a -2 pip loss, which is the spread.

To break even on this trade, the price must move in your favor by at least 2 pips. If the price goes beyond that, you’re in profit.

For those with a short-term trading strategy, like day trading or scalping, this cost directly impacts your bottom line.Low spreads mean you can hit profitability faster, especially when making multiple trades a day.

What Influences Spreads?

Not all spreads are created equal, and understanding what makes them widen or shrink can give you an edge in choosing the right broker.

Here are the key factors that come into play:

Broker Markups

Your broker has to make money. That’s where markups come in. Some brokers like IC Markets offer raw spreads (essentially the market spread) and charge a commission, while others roll their fees into wider spreads.

Example: A raw spread on EUR/USD might be 0.2 pips, but a broker could add 1 pip as their markup, making your spread 1.2 pips.

Market Volatility

Spreads tend to widen in fast-moving markets. This is because prices are jumping around, and brokers increase spreads to manage their risk.

Example: During a significant news release like Non-Farm Payrolls, spreads can skyrocket as liquidity providers struggle to quote stable prices.

Asset Liquidity

High-liquidity assets like EUR/USD or major indices like the S&P 500 generally have lower spreads because there’s a lot of buying and selling.

On the other hand, exotic currency pairs or niche stocks often have wider spreads due to lower trading activity.

Example: EUR/USD might have a spread as low as 0.1 pip, while USD/TRY could have a spread of 10+ pips.

Time Of Day

Markets aren’t equally active 24/7. Spreads are usually tight during peak trading hours (like the London-New York overlap) and wider during quieter periods, like the Asian session for non-Asian markets.

Type Of Broker

- Market Maker: These brokers set their own spreads and can widen them based on market conditions or internal policies.

- ECN broker/STP broker: These brokers pass on market spreads directly, which can be tighter but may charge a commission.

Knowing these factors can help you spot when and why spreads change – and, more importantly, which brokers and trading times are better for minimizing your costs.

What To Look For In A Low-Spread Broker

Low spreads are great, but they’re not the only thing that matters when choosing a broker. A flashy claim of “spreads as low as 0.0 pips” might sound tempting, but there’s more to the story.

Here’s what you should be looking for:

Transparent Average Spreads

Ignore the marketing hype about minimum spreads. Those ultra-low numbers often apply under perfect conditions that rarely happen.

Instead, focus on brokers like Pepperstone that provide their average spreads across key trading hours and assets.

Reliable Execution

Low spreads mean nothing if you can’t enter or exit trades at the prices you see. A good broker should offer fast and reliable trade execution, especially during high-volatility periods when the market is moving quickly.

Why it matters: Slippage (getting a worse price than expected) can cancel out the benefits of low spreads.

BlackBull impresses with speeds of less than 75 milliseconds.

Powerful Platforms And Tools

A low-spread broker should also equip you with the tools to trade effectively.

Look for platforms like MetaTrader 4, MetaTrader 5, or TradingView available at providers like FOREX.com with features like:

- Advanced charting and analysis tools.

- Automated trading support.

- Risk management tools like stop-loss and take-profit orders.

Market Data And Insights

A broker that provides real-time market data, economic calendars, and regular insights can help you make smarter trading decisions.

It’s a massive plus if these come free of charge, which you can find at firms like Fusion Markets.

No Hidden Costs

A broker with low spreads might offset them with other fees like:

- Commissions on trades (especially with raw spread accounts).

- High withdrawal fees or inactivity charges.

- Wide spreads during off-peak hours.

Strong Regulation

Choose a broker like Vantage which is regulated by reputable authorities, including the FCA and ASIC. Low spreads are only worth it if your funds are secure and the broker operates transparently.

DayTrading.com’s Regulation & Trust Rating can help here. We’ve classified a growing list of over 65 regulators depending on their reliability and safeguards, from ‘green tier’ bodies like the UK’s Financial Conduct Authority (FCA) through to ‘red tier’ bodies like the Vanuatu Financial Services Commission (VFSC).

Liquidity And Asset Variety

The more liquid the broker’s offering, the tighter the spreads you’ll see. Make sure they offer a good range of assets, especially the ones you trade most, whether that’s major currency pairs, indices, or commodities.

By focusing on these factors, you’ll enjoy low trading costs and a smooth and reliable trading experience. Remember, a low-spread broker is about the complete package, not just a single number.

What Type Of Broker Offers The Best Spreads?

Raw spreads are the tightest possible spreads – straight from the interbank market, with no markup.

Electronic Communication Network (ECN) brokers like IC Markets and Pepperstone typically provide access to these raw spreads by directly connecting you to liquidity providers.

While raw spreads often come with a commission fee per trade, they can still be cost-effective for active traders like us. Here’s why:

Ultra-Low Spreads

ECN brokers provide raw spreads as low as 0.0 pips on major pairs like GBP/USD or EUR/USD. This significantly lowers your trading costs, especially for high-frequency traders who make multiple trades daily.

Imagine:

- You trade GBP/USD with an ECN provider offering a raw spread of 0.1 pip.

- The commission is $7 per round trip (buy and sell) on a standard lot.

- The total cost is $7 + the 0.1 pip spread, much lower than a broker with a fixed spread of say 2 pips.

Direct Market Access

ECN firms connect you directly to the market, meaning you’re trading against other participants (banks, hedge funds, etc) rather than the broker.

This eliminates potential conflicts of interest, as the broker doesn’t profit from your losses.

Better Execution Speed

ECN brokers generally offer faster trade execution, which is crucial for day traders who rely on quick entries and exits.

Fewer requotes during volatile conditions means more reliable trading.

Transparency

You see actual market prices without hidden markups, giving you confidence that you’re getting a fair deal.

However, there are things to keep in mind:

- Commissions Add Up: While spreads are minimal, commission fees per trade can add up for smaller-volume traders. Ensure your strategy can cover these costs.

- Volatility Risks: Raw spreads can widen during high-volatility events. Even with an ECN account, be prepared for occasional spread spikes.

- Minimum Deposit Requirements: ECN accounts often have higher minimum deposits than standard accounts.

Bottom Line

Choosing the right broker with low spreads can make a big difference in your trading profitability, especially for active traders like day traders.

However, look beyond flashy “minimum spread” claims and focus on brokers offering transparent average spreads.

For high-frequency traders, ECN brokers with raw spreads may be worth considering. Lower costs and direct market access can outweigh commission fees.

Ultimately, the best broker for you isn’t just about spreads – it’s about the whole package: reliable execution, helpful trading tools, and a trustworthy, regulated platform.

Find the right low-spread trading platform for your needs.