A Guide To Day Trading The Non-Farm Payrolls (NFP) Report

The non-farm payrolls (NFP) report is one of the most important indicators of the strength of the US economy. It can have a significant influence on the direction of financial markets, and in particular movements in the foreign exchange market, providing opportunities for short-term traders.

Quick Introduction

- The NFP report is released by the Bureau of Labor Statistics (BLS) on the first Friday of every month, showcasing the monthly change in employment numbers across various US sectors.

- Its release is a significant event for the forex market, particularly affecting pairs that include the US dollar, such as GBP/USD, EUR/USD and AUD/USD.

- The NFP’s publication can lead to heightened market volatility, presenting day traders with the potential to capitalize on rapid price movements.

- To day trade the NFP report you need a reliable broker, an effective strategy and a sensible approach to risk management.

Best Brokers For Trading The NFP Report

These are our three highest-rated brokers that facilitate NFP trading strategies:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

FOREX.com

FOREX.com

Understanding Non-Farm Payrolls

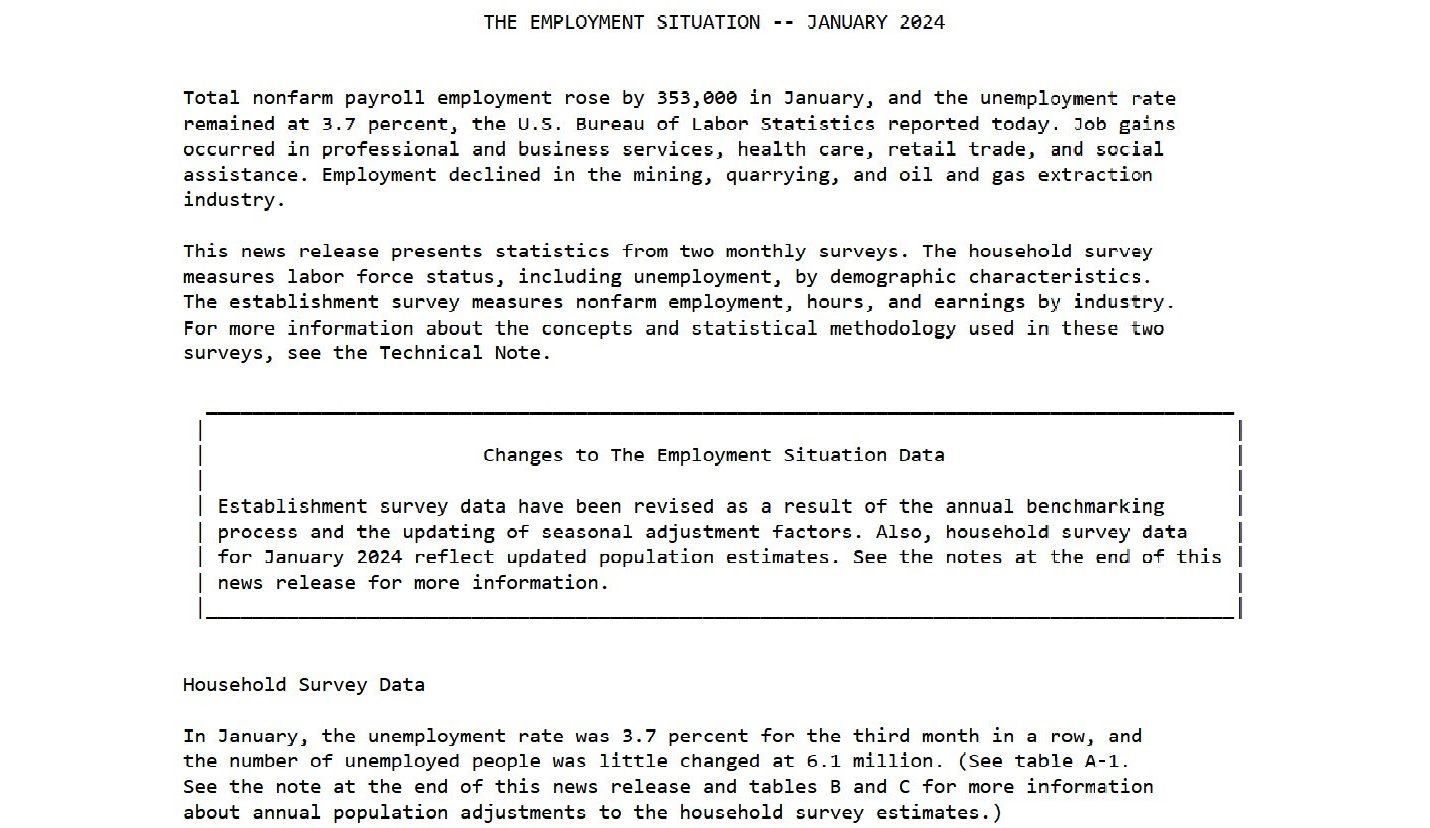

The NFP report is one of the most closely watched economic indicators in the US. It quantifies the number of people who are employed in the world’s largest economy, except farm workers, government employees, private household staffers, and employees of nonprofit organizations.

Approximately 80% of the total US workforce is covered in the NFP report. As a result, it is considered an important indicator of where the US economy may be heading.

Generally speaking, rising NFP payrolls indicate that the economy is growing, while a decline is suggestive of economic contraction. As a result, it can used as a guide to how the Federal Reserve might alter interest rates.

Monetary policy is a significant influence on asset prices, so NFP numbers can cause market volatility to pick up considerably.

How Can The NFP Report Affect Financial Markets?

Profitable NFP trading is possible across multiple asset classes including stocks, bonds, commodities and forex.

When the report comes in better than forecast, market confidence typically improves, and riskier assets can rise in value. The opposite usually occurs when the NFP data falls below estimates.

The impact of NFP numbers can be especially significant in the currency market. While it can impact the movement of many different currencies, it is particularly influential on the direction of major forex pairings involving the US dollar. These include:

- EUR/USD – the euro and US dollar

- USD/JPY – the US dollar and Japanese yen

- GBP/USD – the British pound and US dollar

- USD/CHF – the US dollar and Swiss franc

- AUD/USD – the Australian dollar and US dollar

- USD/CAD – the US dollar and Canadian dollar

Robust NFP data is usually positive for the North American currency. This is because a stronger job market can fuel speculation of rising inflation, and by extension the possibility of Federal Reserve interest rate hikes further down the line.

As well as this, better-than-expected data boosts market confidence in the US economy, which in turn can also improve demand for the buck.

NFP reports concentrate on the change in employment numbers for the previous month. However, they also often include revisions for prior months, changes which can also impact financial markets.

An NFP Trade In Action

Doing My Homework

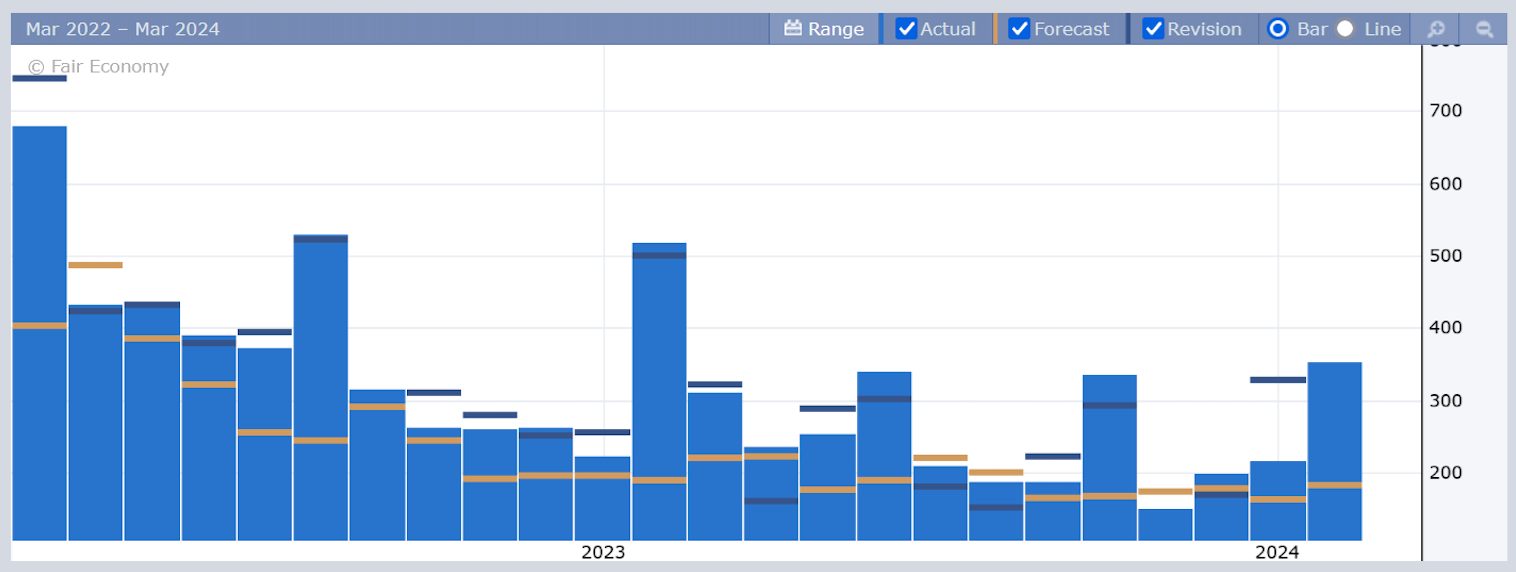

The NFP report is released on the first Friday of the month, at 8.30am Eastern Time (ET). Analysts will have lined up to predict what the headline number will be (i.e. the total number of people in employment) before the release. A consensus of these forecasts will then be drawn up and published by various media outlets for economists and traders to consider.

There are several things I will need to look at as a trader before the NFP numbers come out:

- Previous NFP reports and other key employment releases from the US (such as the weekly jobless numbers and the ADP employment report).

- Other key economic releases from the States, like GDP numbers and purchasing managers index (PMI) reports.

- Recent commentary and monetary policy decisions from the Federal Reserve and other central banks.

- Broader market sentiment concerning the US and global economies.

This information will not only help me formulate a better idea of whether analyst forecasts are ‘on the money.’ They may also indicate how volatile financial markets may become in the aftermath of the NFP release.

Making The Trade

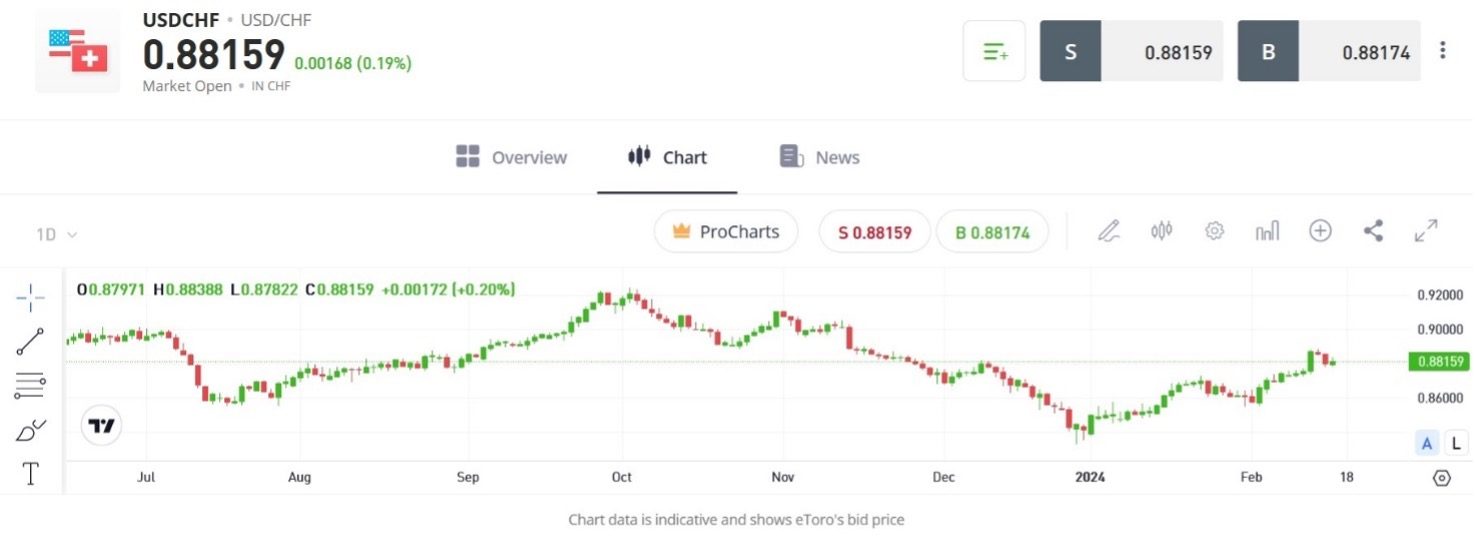

As I say, the forex market can be especially choppy following the release of this employment report. This potentially gives me the best chance of making a profit, so I decide to trade the USD/CHF pairing on the day of the report.

After doing my research – which also includes conducting technical analysis on the currency pairing – I conclude that the greenback will rise following the NFP release.

I decide to trade the USD/CHF pair at 0.8816 – selecting a standard lot size of 100,000 units – then sit back and wait for the numbers to be published.

At 8.30am the data comes out. It shows that the number of people in employment last month has sailed above forecasts. This huge divergence prompts waves of volatility on forex markets, and the USD/CHF soars during the aftermath.

By 9.30am the pairing is at 0.8892, so I decide to exit my position and book a profit of $862.07.

Here’s how I manage to generate that profit:

- Lot Size: 100,000

- Exchange Rate Change: 0.8892 – 0.8816 = 0.0076 (or 76 pips)

- Pip Value: (0.0001 / 0.8816) * 100,000 = $11.343

- Trading Profit: $11.343 * 76 pips = $862.07

Note: this is a simplified calculation that does not reflect the impact of bid and offer spreads or other trading fees.

How To Start NFP Trading

It’s pretty simple for traders like me to begin trading the NFP report. Here are the 3 key steps that new day traders should take:

Select A Suitable Asset Class

As shown, the importance of a strong US labour market for the broader economy means NFP releases can have a huge impact on multiple asset classes. The first thing I need to do is to decide which security I wish to deal in.

Equities, commodities, and bonds, for instance, can all experience significant volatility following an NFP report.

The biggest movements usually occur on the forex market, however, as traders hypothesize about the potential impact of employment numbers on interest rate decisions.

Choose A Broker

The next course of action is to choose a broker that allows me to trade my preferred asset class. Fortunately, each of those securities I’ve described are highly popular with retail traders, so I shouldn’t have a problem finding a company through which I can do business.

Other important things I need to consider include the regulatory status of the broker; how user-friendly its trading platform is; the firm’s pricing structure; and whether I can use leverage (or borrowed funds), which is popular with day traders.

I should also consider the quality of the company’s technical analysis tools (using charts effectively is often critical for successful short-term trading).

Open An Account

Once I’ve chosen my broker, I’ll need to provide some personal information and supply identification to open my account.

Then I’ll deposit my funds – usually by making a bank transfer or credit/debit card – and make preparations to execute my first trade following the non-farm payroll release.

Bottom Line

The NFP report is a highlight on the financial calendar for many short-term traders. The volatility it often creates provides an opportunity for them to book considerable profits in quick time. Trading this key economic indicator can be especially lucrative for forex traders who put in place a sound risk management strategy.

See our pick of the best brokers for NFP trading.

FAQ

What Are The Advantages Of NFP Trading?

The choppiness that can develop following NFP releases provides myriad opportunities for traders to make a profit.

As with other major economic statements, the number of trades tends to rise when the employment report comes out. This makes it easier for market participants to open and close positions, while it also makes for tighter bid/ask spreads and therefore lower trading costs.

Many assets like forex can also be traded with leverage. This strategy can create bigger profits by allowing traders to build larger positions, though beware: it can also lead to whopping losses when markets move in the ‘wrong’ direction.

What Are The Drawbacks Of NFP Trading?

The extreme market movements surrounding the release of NFP data can create large losses if day traders fail to put in place proper risk management measures.

Certain asset classes like currencies also require a high level of understanding in terms of both fundamental and technical analysis. This can be time-consuming to achieve and then maintain.

What Time Is The NFP Released?

The NFP is released on the first Friday of each month at 08:30 EST. Significant NFP trading activity often occurs over the several hours following the release.

Article Sources

- What is the Non-Farm Payroll Report? – CME Markets

- Employment Situation Summary – Bureau of Labor Statistics

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com