Best Brokers Without KYC In 2026

When you’ve been trading for years like me, you get used to the endless requests for documents. Passport scans, utility bills, selfies with today’s newspaper – the list goes on. That’s KYC (Know Your Customer) in action, and for regulated brokers, it’s standard practice.

But not every trader wants to go through that process. Some of us just want to get an account live in minutes, test a strategy, and see how execution feels without waiting two or three days for an ID check. That’s where no-KYC brokers come in. These are platforms that either skip verification completely or let you deposit and trade before you’ve handed over any personal documents.

Explore our pick of the best brokers for no KYC trading – selected following our rigorous evaluation process.

Trading with a no-KYC broker carries higher risks. These platforms often operate without strong regulatory oversight, and while they allow faster, more anonymous access, this comes with reduced investor protections.

Top 2 No-KYC Brokers For Trading

Based on our hands-on tests, these brokers stand out if you want to trade without mandatory KYC checks:

Why Are These Brokers The Best For No-KYC Trading?

Here’s why we rate these platforms as the top providers for trading without full identity verification:

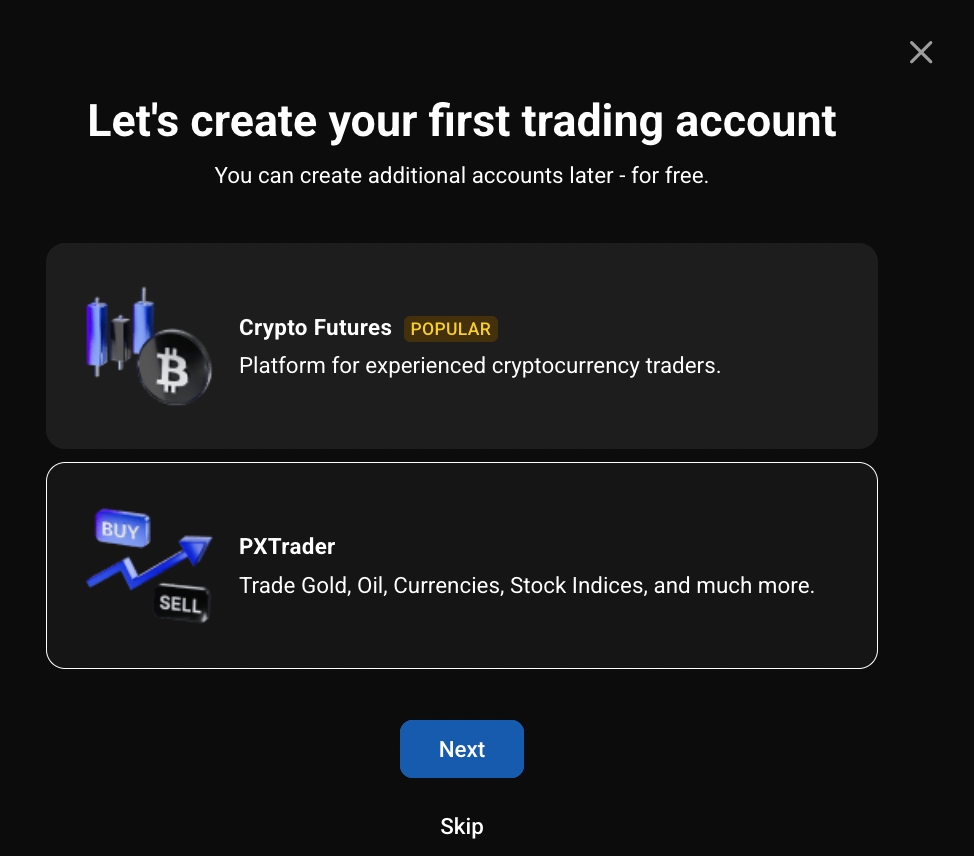

- PrimeXBT is the best no-KYC broker in 2026 - PrimeXBT is as close as you’ll get to a full no-KYC broker. We signed up with just an email, deposited Bitcoin, and were trading within minutes - it was a breeze. Withdrawals under the daily limit (around $20,000) processed smoothly with no ID checks. For active traders wanting a no-KYC broker, PrimeXBT is hard to beat.

- LHFX - LHFX is a user-friendly, crypto-funded broker that doesn’t ask for ID at all. We opened an account, funded it with Bitcoin, and were trading on MT4 within the hour. Withdrawals also went through without verification. For a pure no-KYC experience, albeit with limited regulatory oversight, LHFX delivers.

How Safe Are No-KYC Brokers?

No-KYC brokers come with unique risks. We looked at account security and fund segregation to see how safe these brokers are for active traders:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| PrimeXBT | ✘ | ✔ | ✔ | |

| LHFX | ✘ | ✔ | ✘ |

Are The Top No-KYC Brokers Good For Beginners?

If you’re new to online trading, we assessed how these brokers support beginners without requiring KYC, including demo accounts and education:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| PrimeXBT | ✔ | $0 | 0.01 Lots | ||

| LHFX | ✔ | $10 | 0.01 Lots |

Are The Top No-KYC Brokers Good For Experienced Traders?

Advanced traders need fast execution, global access, and flexible order types. Here’s where the leading no-KYC brokers excelled in our tests for experienced traders:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✘ | ✘ | ✘ | 1:1000 | ✔ | ✘ |

| LHFX | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

Compare Detailed Ratings Of Top No-KYC Brokers

See how the leading no-KYC trading platforms performed in each main testing area:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| PrimeXBT | |||||||||

| LHFX |

Compare Trading Fees

Fees are equally important when using no-KYC brokers. Compare costs across our top picks:

How Popular Are The Top No-KYC Trading Platforms?

With no-KYC trading increasingly in demand, we measured user numbers at our top providers:

| Broker | Popularity |

|---|---|

| PrimeXBT |

Why Use PrimeXBT To Trade Without KYC?

"PrimeXBT is perfect for aspiring traders looking for crypto derivatives alongside traditional markets like forex and indices, all tradable on an intuitive, web-based platform. The copy trading solution is also ideal for hands-off traders with 5-star ratings and performance graphs to help you find the right trader."

William Berg, Reviewer

PrimeXBT Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Cryptos, Forex, Indices, Commodities, Futures |

| Platforms | Own |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

Pros

- Ultra-fast execution speeds, averaging 7.12ms, make PrimeXBT an excellent option for day traders looking to secure the best prices in volatile markets.

- 24/7 customer support, available via live chat, proved excellent during testing, while the extensive help centre is perfect for self-help.

- PrimeXBT has added fresh opportunities with new tokens for exchanging and funding, including 1Inch, Aave, and Injective.

Cons

- The lack of integration with established platforms like MT4 will be limiting for traders familiar with the world’s most popular forex trading software.

- Despite improvements, the selection of around 100+ instruments still seriously trails competitors, notably OKX with its 400+ assets.

- While common in the crypto industry, PrimeXBT lacks authorization from a trusted regulator, seriously elevating the risk for retail traders.

Why Use LHFX To Trade Without KYC?

"LHFX is a top choice for short-term crypto traders seeking an MT4 broker with ECN execution. After expanding its range of digital tokens in 2024 and enhancing the payment solutions, it now enables Bitcoin deposits and withdrawals in just 30 minutes - putting it among the fastest for providing access to funds."

Christian Harris, Reviewer

LHFX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities |

| Regulator | FSCA, FSC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP |

Pros

- In December 2025 LHFX integrated MT5 on desktop, web and mobile, providing advanced charting and trading tools, including 38+ indicators, 21 timeframes, and algo trading capabilities.

- LHFX provides round-the-clock customer service via live chat, email, a callback service, and social media platforms like Facebook, X, and Instagram, with fast if not fairly basic responses from agents during testing.

- Opening an account with LHFX is super easy, taking just minutes and only requiring a $10 deposit, making it accessible for traders with limited capital.

Cons

- LHFX lacks essential research tools like an economic calendar, trading calculators, and currency converters, while we encountered error messages accessing its market analysis.

- LHFX operates with Bitcoin-based deposit and withdrawal systems, meaning that deposits made in USD, EUR, or GBP are automatically converted to Bitcoin. This lack of direct fiat banking options can be a hassle for traders who prefer the simplicity of traditional solutions.

- LHFX only supports MT4 with no add-ons available at firms like Admirals. And with no alternative software like cTrader, TradingView or a proprietary app, the limited selection could prove restrictive for many traders.

How DayTrading.com Chose The Best Brokers For Trading Without KYC Checks

With no-KYC platforms, real testing is essential because the gap between what’s promised and what actually happens can be wide.

Here’s what we did:

- Registration speed: We opened fresh accounts and timed how long it takes to go from sign-up to placing a live trade, noting any surprise ID requests.

- Funding tests: Deposits were made via crypto (most no-KYC brokers lean that way) to measure how quickly balances appear and whether brokers delay confirmations.

- Execution & slippage: We ran live trades, tracking order fills, slippage, and spreads against regulated benchmarks.

- Withdrawal checks: We requested payouts, including small amounts, to confirm whether withdrawals are smooth, delayed, or blocked by hidden KYC demands.

- Ongoing reliability: Accounts were left active to see how conditions change over time, especially as balances and trade volumes grow.

By running through this checklist, we could separate brokers that genuinely deliver on no-KYC trading from those using it as marketing bait. Providers were then ranked by overall ratings, balancing accessibility, reliability, and cost.

What Does “No-KYC” Really Mean?

When we talk about “no-KYC brokers”, it doesn’t always mean zero checks, ever. In reality, there are a few different levels of “light-touch” verification, and it’s worth knowing the difference before you start trading.

Here’s how it usually works:

- True no-KYC: You can open an account, deposit, trade, and withdraw without ever uploading ID. These are rare, but they exist (often offshore, crypto-only platforms).

- Partial no-KYC: You’re allowed to sign up and trade straight away, sometimes even deposit and withdraw small amounts, but you’ll eventually be asked for documents once you hit certain limits.

- Crypto-only no-KYC: Some trading platforms give you a lot more freedom if you stick to crypto deposits and withdrawals. Add fiat into the mix, and suddenly, KYC is mandatory.

When I actually tested a load of these brokers myself, I found big differences in how no-KYC plays out. On one, I was trading within two minutes using only an email login. On another, I could deposit Bitcoin without question, but the moment I tried to move money back out, an ID request popped up.So, when you see “trade without KYC” in a broker’s marketing, be dubious. It often means fast onboarding with minimal upfront checks, rather than total anonymity forever. And that distinction matters if you’re planning to scale up an account or rely on it as a core trading venue.

Pros And Cons Of Using A Broker With Zero KYC Checks

Pros

- Speed: When you’re trading short-term setups, timing is everything. With a no-KYC broker, you can register, deposit, and be live in the market in minutes. In one of our tests, I literally went from email sign-up to placing a trade in under three minutes. Try doing that with a fully regulated broker.

- Privacy and security: Not every trader is comfortable uploading passports and bank statements to an offshore server. I’ve spoken to plenty of traders who’ve had issues with identity theft or account freezes after submitting KYC, and they’d rather avoid the hassle altogether. With a no-KYC setup, there’s less personal data at risk.

- Fewer restrictions: Some KYC-heavy brokers put limits on leverage, withdrawals, or even which assets you can access until your documents clear. With no-KYC brokers, those barriers tend to vanish – you’re free to move money around without the red tape.

- Quick strategy testing: One of the underrated perks: you can spin up small test accounts instantly. I often do this myself when I want to try a new setup without committing real capital or waiting on compliance checks.

Cons

- Withdrawals can get tricky: The biggest risk is simple: you may not get your money out. We’ve tested brokers that let us deposit instantly with no checks, but the second we tried withdrawing, they froze the account and demanded documents. If you can’t (or won’t) provide them, your funds are stuck.

- No regulatory safety net: Most no-KYC brokers operate offshore and outside of major regulators like the US Securities & Exchange Commission (SEC) or UK Financial Conduct Authority (FCA). That means if the broker collapses, or simply refuses to pay, you don’t have an ombudsman or compensation scheme to fall back on. It’s your word against theirs.

- Higher scam risk: Because no-KYC accounts are easier to open, they also attract shady operators. We’ve seen cases where traders deposited into a no-KYC platform, only to find spreads widened massively after a few trades or the broker disappeared overnight.

- Security and compliance issues: Some traders go no-KYC because they want privacy – which is fair. But remember, anonymity cuts both ways. A broker that isn’t asking for your ID is also less accountable to regulators. If they’re not keeping proper AML checks, you may be trading in an environment where illicit flows are involved, and that carries its own risks.

- Limits kick in eventually: Even on so-called no-KYC brokers, you’ll often hit withdrawal or deposit limits. Once you cross that threshold, they’ll demand documents. If you can’t provide them, you’re capped – or worse, locked out.

Should I Use A Broker That Doesn’t Have KYC Checks?

From our own testing, it’s clear that no-KYC brokers aren’t a one-size-fits-all solution. They work brilliantly in some situations, but they can be a terrible fit in others.

They can be a good fit for:

- Strategy testers and system builders: If you just want to spin up an account quickly to trial a new approach, no-KYC saves days of waiting. I do this myself when I want to stress-test a setup without committing much capital.

- Privacy-focused traders: Some traders simply don’t want to upload IDs to offshore servers, and no-KYC brokers give them a way to stay active without that exposure.

- Short-term, smaller accounts: If you’re running small positions and turning over quickly, the risks of account freezes or broker issues are easier to stomach.

They can be a poor fit for:

- Anyone trading with serious money: Parking large balances at an unregulated, no-KYC broker is a recipe for sleepless nights. If something goes wrong, you’ve got no recourse.

- Long-term investors: These brokers are designed for speed and flexibility, not safety or trust. If you’re looking to build a multi-year portfolio, you’re better off with a regulated, KYC-heavy broker.

- Traders who hate uncertainty: The reality is that withdrawal policies can shift overnight. If you don’t want that risk hanging over you, steer clear.

When I use no KYC trading platforms, it’s usually with a clear purpose: get in fast, test something, pull the funds back out. That’s the mindset they suit best. If you’re thinking of making one your main broker, think twice – the trade-offs are too steep.

Alternatives to Consider

Not every trader who wants speed and privacy needs to go fully offshore. There are regulated brokers that have streamlined onboarding and “light KYC” processes, which hit a nice middle ground.

For example, some European and Australian brokers let you open an account and start trading with just basic details, then only ask for full ID when you reach a certain withdrawal threshold. We’ve opened accounts, deposited, and been live in under an hour with nothing more than an email and proof of address uploaded later.

Another option is to look at brokers that support instant deposits. Even if they require ID eventually, the ability to fund and trade immediately makes them almost as convenient as a no-KYC platform, but with the security of a regulated environment.

It’s also worth mentioning that a few brokers now use automated verification systems that clear your documents in minutes rather than days. We’ve tried these ourselves and found the delay was small enough that we didn’t lose trade opportunities. It’s not pure anonymity, but it’s safer than going to an unregulated offshore shop.

So, if you’re attracted to the speed of no-KYC brokers but worried about safety, “light KYC” regulated options can give you the best of both worlds: fast access without sacrificing trust.