US Stocks vs. EU Stocks

The US stock market saw a V-shaped recovery from the Covid-19 losses. This is not unusual.

The financial economy is different from the real economy. If central banks pull their levers to get adequate liquidity back into the system, you’ll see financial assets get purchased. The financial economy leads the real economy. Generally, it’s easier to create and transact in financial assets than it is to create and transact in real goods and services.

Nevertheless, each region in the world is different in how they’ve been impacted and their response. Naturally this leads to different outcomes in their capital markets.

In this article, we’ll primarily look at the European market.

US vs. Europe

The stock market had a great run in Q2’2020, recovering its losses from March.

But the S&P 500 is not the best performing primary equity index in the developed world. That goes to the German DAX index, which was up about 23 percent.

Most of the rest of Europe performed well, but lags the US year-to-date.

The recovery in European risk assets gets little focus in the US, where commentators and sell-side analysts are primarily focused on domestic asset markets.

But what’s happened in Europe and the ways their asset markets have reacted is encouraging despite having some uniquely European risks.

Europe was hit early by the Covid-19 pandemic. Belgium, France, Italy, and Spain encountered some of the world’s highest mortality rates.

As a result, due to the expected shutdowns and drops in productivity and incomes, market participants moved out of the stock and bond markets in these countries. Economies across the region contracted due to both voluntary and mandated changes in behavior.

Whenever there is any kind of economic shock or higher-than-normal financial risk, investors will tend to worry about the sustainability of highly indebted countries like Italy. They also become more concerned about the risk/reward of putting capital in the assets of those countries when a crisis impacts those countries directly. This led investors and forecasters to be highly pessimistic in February and March.

Italian debt dropped swiftly (compared to an opposite reaction to safe haven like US Treasuries, as the world’s top reserve currency).

BTP Futures (Long-Term Italian Bond Futures)

(Source: Interactive Brokers internal interface)

ZB Futures (Long-Term US Treasury Bond Futures)

(Source: Interactive Brokers internal interface)

Since then, many European countries have been able to contain the spread of the virus. And the areas that were hit worst are now steadily reopening and getting economic activity back. Cases, hospitalizations, and deaths have come down.

If successful and enduring, this will in turn justify the gains in asset prices from an earnings perspective. Some outbreaks have spurred regional restrictions, but nation-wide lockdowns may no longer be necessary. Entertainment activities like sports have come back, but without crowds.

Europe has been known globally for its rich history and culture, but also, to varying extents depending on where you go, a sclerotic political environment and bureaucratic inertia. Institutions have been slow to react in past economic and financial crises.

But this time has largely been different. The monetary and country-level fiscal response has been swift. (We can also say this for the United States and its monetary and fiscal reaction, which was slow to recognize and react to the 2008 financial crisis, and didn’t get a floor under asset markets some 17 months after the top of the stock market and six months after the collapse of Lehman Brothers.)

The countries that have been less historically reserved about spending have used the crisis to spend, and politicians have used the crisis as part of their power plays. France gave monetary grants to small- and medium-sized businesses, increased loan guarantees and other direct liquidity support to certain industries, as well as grown healthcare expenditures.

The case of Germany

Germany is the European Union’s largest economy at around 29 percent of the overall economic activity of the area.

Germany, traditionally disciplined in its spending due to a variety of historical and cultural factors (the pain of multiple 20th century hyperinflations being a part of it), has also opened up its fiscal spending to support its population and euro area more broadly.

This has included a cut in consumption taxes and support for individuals/families and businesses. It’s been roughly 5x its package in response to the 2008 financial crisis.

Does Germany’s budgetary strictness hold back the EU growth and asset markets?

Germany has been criticized by other EU members, economists, public policymakers, and investors over the years for its strict budgetary behaviors.

Being the largest economy in the world’s second-largest overall economy (behind the US), it has control over the region’s primary reserve asset (the German bund).

Strict budgetary discipline has prevented more issuance of the bund. This, in some respects, has helped hold back the euro’s status as a reserve currency relative to the US dollar. It lags far behind the USD, which is 62 percent of international debt, 62 percent of foreign exchange reserves, and 57 percent of global import invoicing.

Debt helps create demand for a currency. Going back to the Dutch guilder, British pound, and US dollar, other countries holding their debt helped create global demand for the currency. Widespread demand for debt/currency lowers borrowing costs, which can lead to higher living standards.

In the EU, the creation of the euro (EUR) helped to establish a currency union with a combined output close to that of the US. Traditionally, the economy with the highest national income enjoys status as the world’s top reserve currency. This goes hand in hand with other things like the world’s most dominant military, technological sophistication, global influence, among other matters.

The euro has not been successful at replacing the US dollar as the top reserve currency or overall monetary system as a reserve asset or global payment option. There’s been some positive income effect, but GDP per capita in Europe’s top economies still lag some ~20 percent behind those in the US. This approximate 20 percent gap is typical historically. (Japan’s GDP per capita was within 10 percent of the US’s just before the popping of its bubble in 1989.)

A material challenge of the euro is that by putting multiple different countries on the same system, it essentially acts like a pegged currency system. The EU doesn’t have a common fiscal policy. This makes monetary policy the primary lever for fighting an economic downturn.

Most countries within the EU are on the euro. This means they are broadly linked together in a monetary sense and not free to set their own interest rates or policies in light of their own individual conditions.

This has led to the currency being too weak in stronger-performing countries like Germany. This has led to the creation of fiscal and balance of payments surpluses in the country. Yet the euro has remained too strong in the periphery countries, like Italy.

For example, this type of pegged structure left Greece with limited policy arsenal to fight its 2012 debt crisis. Rather than decreasing interest rates and depreciating their currency to spread the devaluation externally – i.e., this makes exports cheaper and debt easier to service – the country had to take their debt problems internally through a large downturn in economic output.

It will take Greece until nearly mid-century to recover its former level of economic activity.

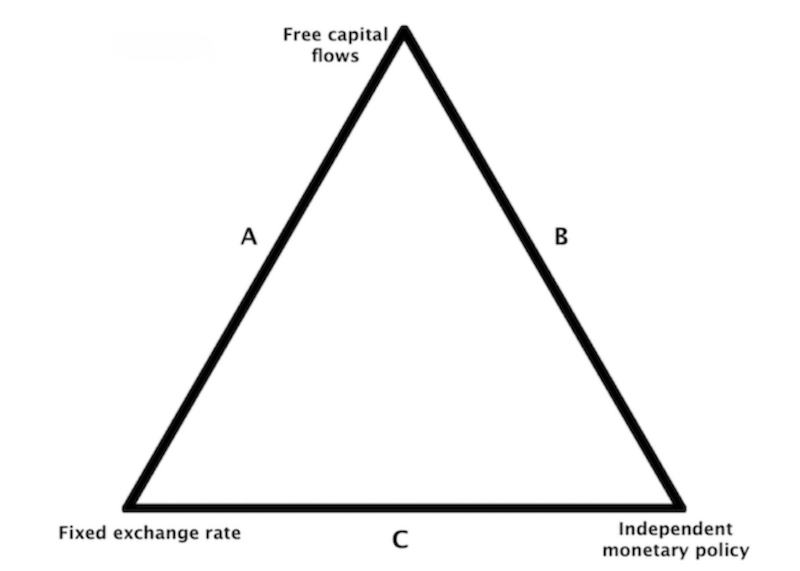

If we think of things in terms of a trilemma among fixed exchange rates, free capital flows, and independent monetary policies, the euro would be on Side A of the triangle.

In other words, the euro area combines several different countries together as one general area and most share the same currency. It is essentially a peg that permits the free flow of capital.

Going this route, countries must necessarily forgo having an independent monetary policy. One of the primary concerns of the euro area is the stress put on countries when they run into debt problems and cannot devalue their currency in the normal ways that countries that have an independent policy.

This is what made the Greece situation bad and is the backbone of the concerns regarding Italy and why its debt market reacted the way it did.

This is a risk that is uniquely European.

The US is on Side B. It has an independent monetary policy. It doesn’t regulate cross-border flows, which means it has a free-floating currency regime. It is also the world’s top reserve currency, which means this privilege conveys the capacity to basically “print money” to the extent it needs to.

There is always the risk of overdoing this and is a long-run issue that provides secular tailwinds to other asset classes. But in the short-run it’s been great for asset prices. And when a currency does devalue, it reduces debt burden, which on its own is good for risk assets.

To give a taste of all sides of the triangle, China is an example of Side C.

It has a pegged exchange rate that it manages relative to the CFETS basket. China manages the renminbi, also known as the yuan, through its central bank and state banks within a daily band.

Due to China’s high levels of debt, China needs an independent monetary policy. By doing so, it can manage these debts in the usual ways by altering the interest rates and maturities (and what entities own the debt) when it needs to. It can also devalue the yuan to “export” the effects. (Creditors get paid back in depreciated currency and can come with secondary effects such as being able to export more and improve its balance of payments.)

China is also broadly a top-down, centrally-directed economy. It is still much different from the old communism, as much of the economy is market-based but with state support (similar to what’s increasingly happening in other parts of the developed world, as the government supports the economy). It wants stability in its exchange rate, so it desires a pegged exchange rate regime supported by the watchful eye of its central policymakers (PBOC and state banks).

Stability in the currency also makes it more valuable as a store of wealth. People are more likely to hold cash, or equity or credit assets in a currency when its value holds well over time.

For China to accomplish its dual objectives of an independent monetary policy and fixed currency regime, it must take control over its capital account and regulate its cross-border financial flows.

The Bretton Woods monetary system in place from 1944 to 1971 was another example of Side C.

Other national currencies were pegged to the US dollar, which was linked to gold.

Other countries were nonetheless allowed to set their own interest rates. Namely, they were allowed to pursue their own autonomous monetary policies.

To get this system to work, the capital flows would need to be either a) restricted, or b) small enough such that they don’t make enough difference so the system would be sustainable.

The capital flows between countries were small enough for many years for the period after World War II, which allowed the Bretton Woods system to hold up until the claims on gold became much larger the gold stock available to redeem those claims. Accordingly, the US broke the link after 27 years when it was no longer consistent with the fundamentals and was increasingly untenable to defend.

The US free floated its currency, moving from Side C to Side B. The ability to create more money and credit uninhibited led to a “reflation” and boosted stocks and gold.

Read more: Considerations of Whether to Join or Leave a Currency Bloc

The ECB’s liquidity spigot

After initial reluctance to support the debt of the periphery countries, the ECB launched its own alphabet soup of programs to “save the system”.

It added a €750 billion asset purchase program known as the PEPP on top of its existing quantitative easing program.

New special pandemic long-term refinancing operations were announced in the form of PELTROS. Essentially, the existing TLTROS plus some additional incentives made them attractive for banks. The demand has been good and helped to narrow bond spreads and lower lending rates.

Defining the overall stimulus effect among different central bank programs will be difficult, but the ECB may eventually be the largest relative to the size of the amount of economic activity its supporting.

Moreover, the layoffs the US saw through its loss in activity didn’t occur in the volume in European economies. This may set up the euro area to close its output gap and see a faster return to potential growth.

Why does Europe still lag the US in YTD returns?

It’s not due to Robinhooders irrationally buying stocks with their $1,200 checks from the government.

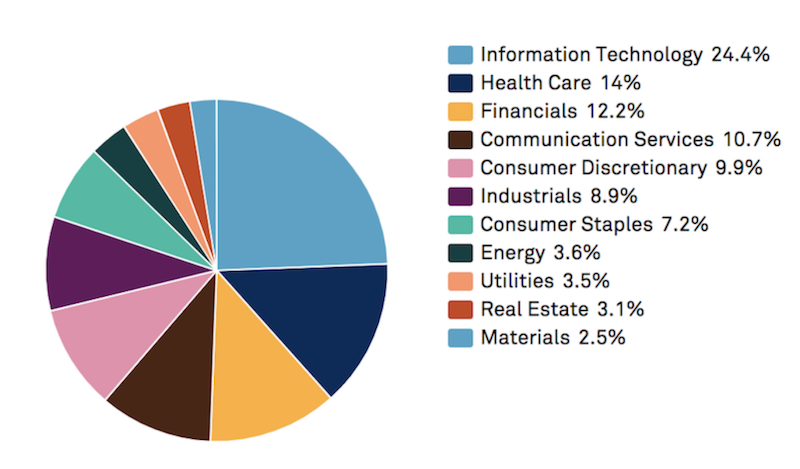

The composition of European markets are different from US markets.

Notably, the S&P 500 benchmark has a higher proportion of technology stocks (about one-quarter of the index) than the European indices (typically around five percent).

S&P Sector Allocation

(Source: S&P Global. Please note that these allocations are not static and will change over time.)

The German DAX and Dutch AEX have a higher proportion of tech stocks among European indices and have been the best performers YTD.

Politics also plays some role. Any crisis will test unity and the social fabric of a region. We’ve seen that in the US.

We’ve seen it historically, like in the 1930s when trying economic conditions and low stimulative capacity (i.e., interest rates at zero) led to social upheaval.

Europe has issues with unity between countries and among countries. Support for the European Union is divided, and populism has been a popular political theme for many years.

Many in Italy, even those who believe the pros of the European Union outweigh the cons, believe that Germany and the broader EU and its institutions didn’t do enough to help early on in the crisis.

The EU and Fiscal Integration Going Forward

The topic of fiscal integration is an ongoing debate. Some argue that the EU should have a common fiscal budget for emergency times like the pandemic.

Nonetheless, the more well-off countries are unwilling to commit to a form of fiscal integration that would essentially become a perpetual subsidy or tax to pay for lower-performing members of the EU.

Some compromise proposals included using the European Stability Mechanism (ESM), which was created during the sovereign crisis.

Countries like Italy and Spain did not like the ESM as it required future fiscal constraints (and strict monitoring of their fiscal decisions) as a precondition for support.

This debate will go on for a while. The German government may be more open to a fiscal union that it has been in the past. Any proposal that allows for one-time transfers is likely to see more success than proposals that lock in perpetual transfers.

Even if Germany and France are more open to agreeing, many northern European countries are likely to prefer loans instead of transfer payments. Countries in eastern Europe will have concerns about loan distributions.

Negotiations will play out over months. An agreement will be a boost for European risk assets. The absence of a fiscal integration agreement will drive conflict and many may get to the point where there’s a bigger shift in those who believe that the pros of staying in the European Union don’t outweigh the cons.

Future elections could favor parties that side with Eurosceptic ideology and policy proposals. Legal challenges to ECB programs could pick up.

Investors do not like instability or a wide path of future outcomes. This could push more investors out of European assets even if the economies continue their recovery in the post Covid-19 period.

Realities confronting all developed economies

At the country level, you have the reserve currencies who can print a lot. These are the USD, EUR, and JPY as the main three – as well as GBP, CHF, CAD, AUD, and NZD as the others that are used on a global scale to a lesser extent. China represents a big part of the global credit and monetary system, though has more characteristics of an emerging market than a developed one.

All of these countries don’t borrow much in external FX. This means they don’t have to worry about the inflationary consequences of earning income in domestic currency and paying liabilities in another.

The USD, and to a lesser extent EUR and JPY, have large global demand. So, they can “go to the well” as much as they want relative to an emerging market.

It will have implications for the value of money over the long-run, but they’ll always want to save the system.

But the game is different now relative to what it was from 2009-2019.

It’s not just the lowering and raising of interest rates and looking at the most rate-sensitive parts of the economy and making your decisions a lot on that. It’s now fiscal policy mixed with monetary policy. You have to know where the money and credit is coming from and where’s it going. What companies is it going to, how much is staying in the country and how much is going out, and how to construct a portfolio that benefits from this.

Tech does particularly well in a reflation because their duration is very long – i.e., most of their anticipated cash flows come far out in the future.

If a lot of liquidity is added to the system, the longer-duration stuff will do best in that kind of environment because it’s the most sensitive. That means the NASDAQ (with 50% in tech) will outperform, as will other tech-heavy regional indices (e.g., German DAX, Dutch AEX).

But if the liquidity is pulled back or doesn’t continue to rise relative to expectations, tech and long-duration assets will underperform.

More ‘state capitalism’

The reality is that we have a lot more “state capitalism” now. The US and all of the developed world is now doing more of what China does.

Policymakers primarily decide where the capital goes. The concept of “too big to fail” has broadened. In pure capitalism, if you don’t make it, you go under, and it’s thought of as more of a Darwinian concept.

But throughout history, policymakers have saved certain banks because the loss of jobs and capital would have created too much pain. Now it’s gone way beyond the banks. People need jobs and policymakers need to support the population.

Virtually the whole economy became systemic during the Covid-19 drop because people’s income just fell. In the clear majority of cases it was due to no fault of their own.

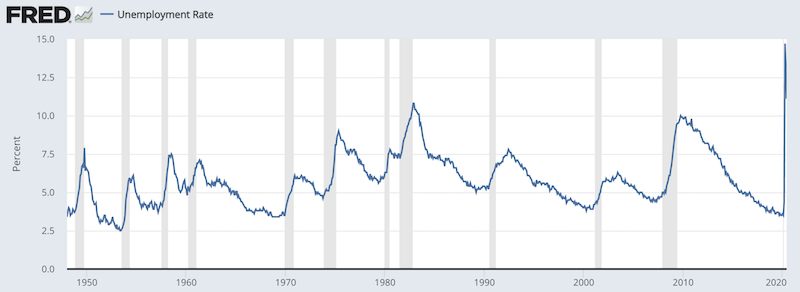

This is opposed to the normal process of how recessions occur due to a rise in interest rates to lower inflation. The rise in interest rates traditionally pulls back credit to curb inflation, which causes the dip in output, followed by a cutback in the labor force as a consequence of there being less work available to do.

That’s why we usually see a lag between when recessions start, their depth, and the unemployment rate spiking after. Often, the unemployment rate peaks just as the economy is starting to grow again. The image below conveys this, with the unemployment rate peaking after the recession (gray shaded regions).

(Source: US Bureau of Labor Statistics)

In this case, the economic shutdowns largely caused income to just fall on its own. We don’t see the same lag with the recession hitting, then the unemployment rate topping early in the expansion, which also tends to be the best time to buy risk assets.

Because of the dynamic of income falling in this recession, policymakers accordingly had to support many different industries. The people need to be able to find a way to get income or produce, and do that process in a way that’s fair or perceived as fair, or else there’s a teardown in the social fabric.

The costs to the government supporting economies are still there.

The debt restructurings and the inevitable currency devaluations (especially relative to gold) that come out of these choices are painful to certain people holding the debt and the currency. But it can serve the greater good if done well.