Best Day Trading Brokers For Beginners 2026

The best day trading brokers for beginners offer excellent educational resources, a demo account so you can practice trading, an easy-to-use platform and a low minimum deposit. We’ve identified and evaluated the top day trading platforms that tick these boxes for new traders.

5 Best Day Trading Brokers For Beginners In 2026

Our exhaustive tests show that these are the 5 top day trading platforms for beginners:

- IG: Best-in-class education. Unlimited demo account. No minimum deposit.

- Pepperstone: Accessible commission-free account. 24/7 support. Great copy trading tools.

- XTB: xStation platform for new day traders. Award-winning support and huge range of markets.

- eToro: First-rate social trading network. Beginner-friendly app. Low minimum deposit.

- InstaForex: Dedicated toolkit for beginners. Demo trading contests. Sign-up takes <15 minutes.

Comparison of Top 5 Brokers For Beginner Traders

| IG | Pepperstone | XTB | eToro | InstaForex | |

|---|---|---|---|---|---|

| Minimum Deposit | $0 | $0 | $0 | $50 | $1 |

| Demo Account Balance | $10k | $50k | $100k | $100k | $50k |

| Education Rating | 5/5 | 4.3/5 | 4.2/5 | 4.5/5 | 4.1/5 |

| Platform Rating | 4.8/5 | 4.2/5 | 4.2/5 | 4.1/5 | 4.1/5 |

| Support Rating | 4.5/5 | 4.8/5 | 4.2/5 | 3.5/5 | 3.7/5 |

1. IG

Why We Chose It

IG continues to lead the pack with its first-rate educational resources that cover all the essentials for aspiring day traders. The $0 minimum deposit, unlimited demo account and intuitive web platform also solidify its position as a superior broker for new day traders.

Pros

- The IG Academy, available on the website or through the stand-alone app, is the ideal entry point for new day traders, offering 18 interactive courses, complete with progress-tracking quizzes that make for an enjoyable learning experience.

- The demo account offers $10,000 to practice day trading strategies, but the real strength is that there is no time limit, making it a valuable resource for aspiring traders.

- IG’s web platform excels for its intuitive design with an uncluttered interface and the option to save multiple workspaces tailored to your trading preferences. It remains one of the most user-friendly day trading platforms we’ve evaluated using real money.

Cons

- You need to be prepared to invest time in setting up IG’s web platform as the default view is basic, especially compared to third-party software like MetaTrader 4.

- Although the IG Community helps connect traders so you can share ideas and market insights, the broker lacks a copy trading service like eToro, which would allow beginners to replicate the trades of experienced day traders.

- While IG’s customer support team are almost always available and helpful when we’ve needed them, they aren’t available 24/7 and the automated chatbot can be painful to use sometimes.

2. Pepperstone

Why We Chose It

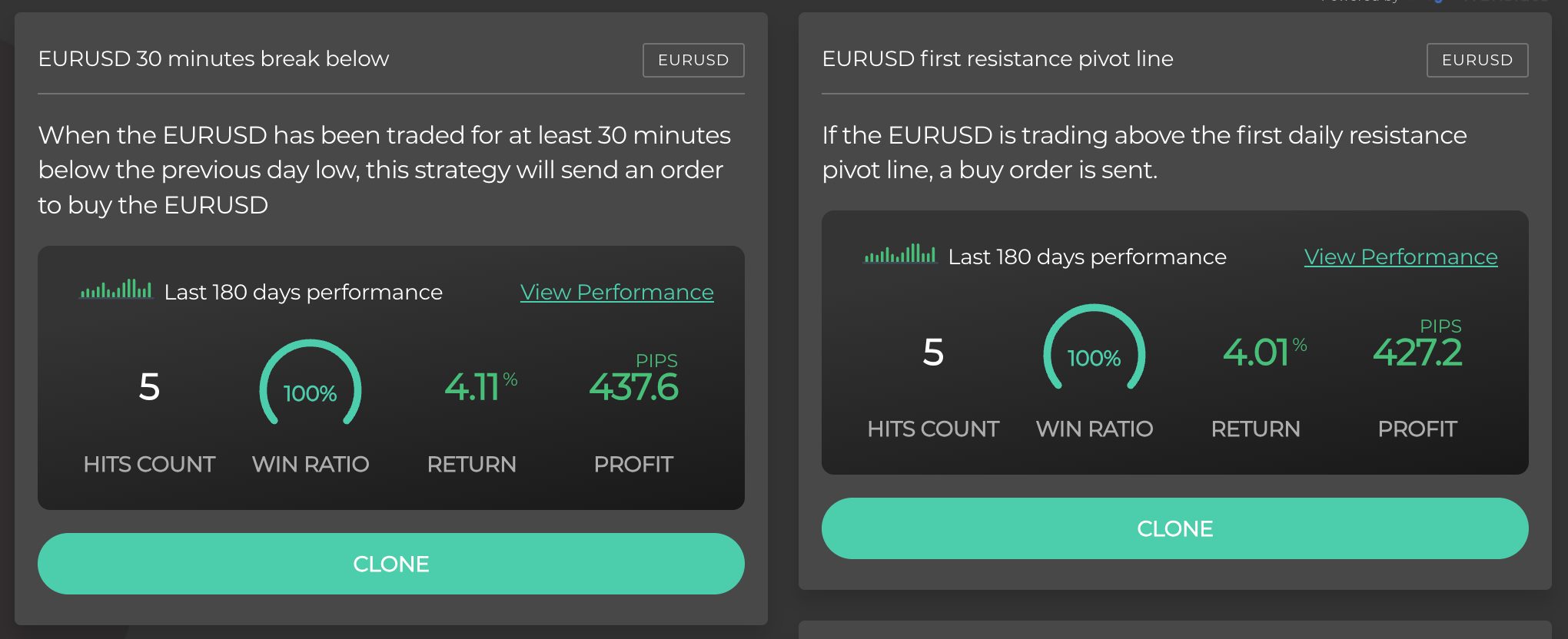

Pepperstone secured a close second place in our list of the best day trading brokers for beginners thanks to its accessible account requirements, top-rate support, and suite of copy trading tools. It also shines for its access to Capitalise.ai, a platform designed to help aspiring traders build automated trading solutions with zero coding knowledge.

Pros

- Both the Standard and Razor accounts are accessible with no minimum deposit, although the Standard account is our pick for beginners owing to the commission-free model that keeps pricing simple.

- Year after year Pepperstone demonstrates it offers reliable and helpful support, with response times of under 5 minutes during tests and knowledgeable staff who can assist with new account queries.

- Pepperstone beats IG when it comes to copy trading tools, providing three solutions (Myfxbook, DupliTrade and MetaTrader Signals) that can help beginners learn from seasoned day traders.

- For day traders interested in algo trading, access to Capitalise.ai is a key strength, allowing beginners to build automated trading systems with plain English commands and zero coding.

Cons

- Despite resources aimed specifically at day traders, including a guide on forex day trading strategies, the educational materials are very text-heavy and less engaging than the resources in the IG Academy.

- Pepperstone offers access to some of the best third-party day trading platforms, including MT4, MT5 and cTrader, however these have a steep learning curve for beginners and there is no in-house web trader designed with new traders in mind.

- The demo account offers $50,000 to learn how to day trade, but it expires after just 30 days, while IG’s paper trading account doesn’t expire.

3. XTB

Why We Chose It

XTB made our top list because its xStation software provides a great entry point for new day traders, while micro-lot trading and fractional shares lower the entry barrier. XTB is also one of the few day trading brokers to pay interest on uninvested cash in certain regions, which is an attractive bonus for beginners still navigating the financial markets.

Pros

- The xStation platform offers easy access directly through browsers and has clearly been built with new day traders in mind, featuring a clean interface with the key charts, timeframes and technical indicators you need for short-term trading strategies.

- Over 10000 instruments are available, providing opportunities across major asset classes, regions and sectors, but the key selling point for beginners is fractional shares that allow you to buy expensive stocks like Tesla with a small outlay. Free for ETF and real shares and 0.2% fee for transactions above EUR 100000

- XTB offers 24/5 support via a range of convenient channels including live chat, email and phone, while the account manager assigned when you register provides dependable assistance with new account queries.

Cons

- XTB trails category leaders like IG with its threadbare research tools consisting of basic news, calendars and market sentiment data, which don’t do enough to help beginners discover day trading opportunities.

- While the xStation platform offers a great launch pad for new day traders, it doesn’t provide access to additional, sophisticated charting software like MT4, which intermediate traders may wish to progress to.

- XTB charges a €10 inactivity fee which won’t deter active day traders but beginners who lose interest could get caught out by the penalty after 12 months.

4. eToro

Why We Chose It

Our experts have traded at eToro for many years and it continues to deliver the full package for beginners. Its social investing network is the best in the market, while it’s obvious the app has been designed for new traders, also featuring excellent charting tools.

Pros

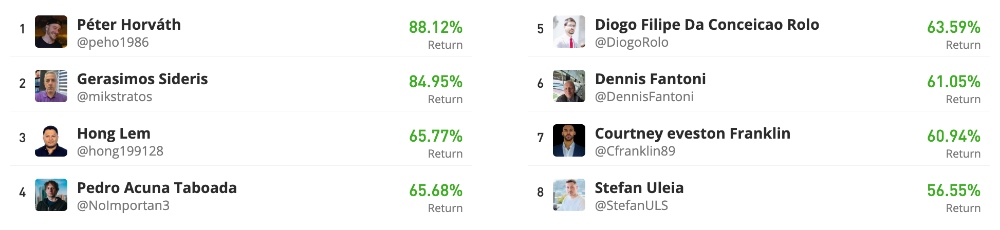

- eToro has the best social trading app we’ve used, featuring an active community chat where you can learn from seasoned traders and have the opportunity to copy up to 100 traders based on their performance and risk appetite, complete with transparent fees.

- The proprietary web and mobile platform is extremely intuitive and easy to use. It also offers invaluable resources to support new day traders, notably portfolio analysis and interactive charts.

- The Learning Academy presents a huge selection of videos, articles, and webinars, offering beginners particularly valuable categorized content that delves into trading instruments and considerations before you start trading.

Cons

- Beginners lack access to guaranteed stop loss orders, a feature that would significantly aid in risk management, and which is available at IG.

- The $5 withdrawal fee will frustrate beginners and those with less capital, especially when it can be avoided if you day trade at any other broker in our top list.

- Good customer support is key for new day traders, but despite 24/5 assistance, we’ve found the lack of a direct phone line or email support frustrating while using eToro, particularly compared to Pepperstone which excels here.

5. InstaForex

Why We Chose It

InstaForex stood out in our comprehensive analysis of beginner-friendly day trading brokers thanks its vast educational resources and demo contests which are great for practicing trading strategies. It also offers a smooth sign-up process and 24/7 support which makes getting started an enjoyable experience for new traders.

Pros

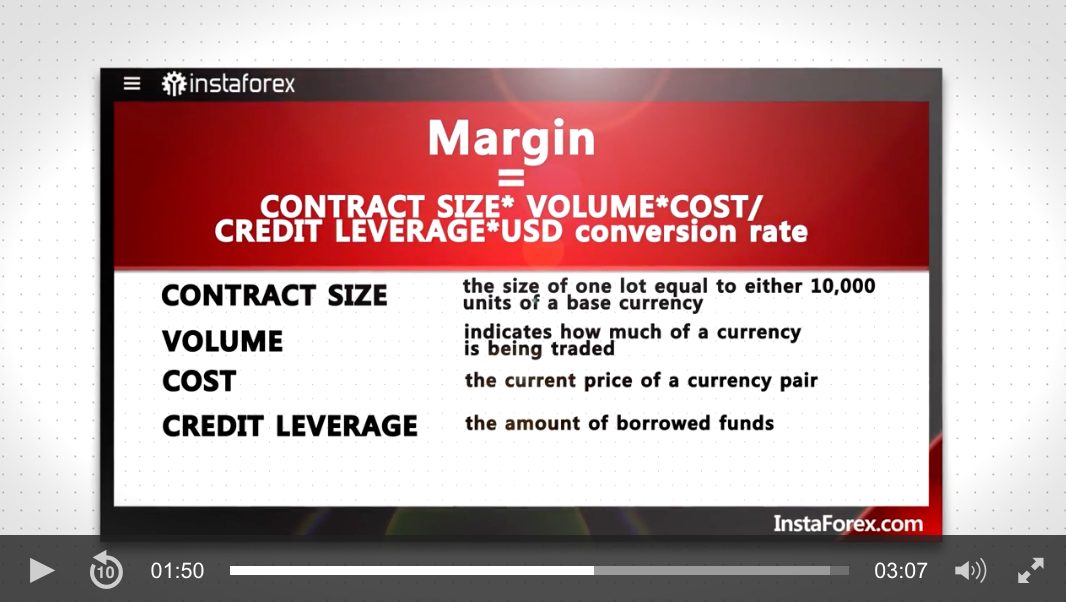

- InstaForex offers the complete package for beginners with video tutorials, online courses, webinars, tips, glossaries and technical summaries clearly explained for new traders, with a particular focus on currencies.

- Getting started if you’re new to day trading is straightforward – it took us less than 15 minutes to sign up through the website while verification typically comes through in 24-48 hours.

- InstaForex is one of a select few brokers to regularly runs demo contests, including those that focus on short-term strategies like scalping, providing a risk-free environment for new traders to practice setups.

Cons

- The InstaForex client area and website should be redesigned for clarity and ease of use, making it simpler for new traders to navigate the extensive settings, information, and training resources available.

- The Standard accounts offer spreads of 3-7 pips, appealing to beginners with their commission-free structure, but lag behind cheaper brokers like IG, which has spreads as low as 0.6 pips.

- InstaForex offers very high leverage up to 1:1000 through its global entity, which can be an advantage for skilled day traders, but increases the risk for inexperienced traders unfamiliar with risk management.

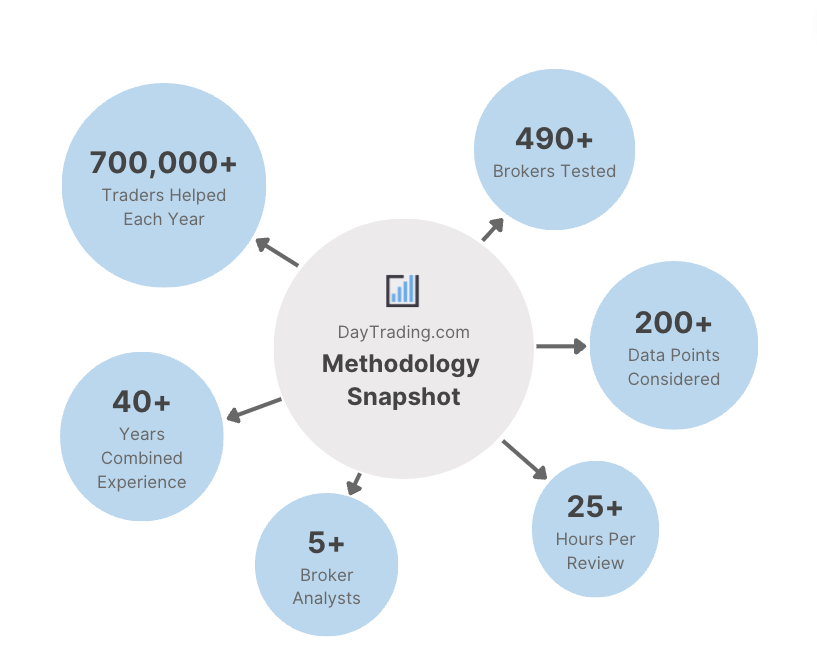

How Did We Choose The Best Day Trading Brokers For Beginners?

To find the top day trading platforms for beginners we looked at our database of 140 brokerages and hand-picked those that met or exceeded these benchmarks:

- We selected brokers with excellent educational materials to help novice day traders advance.

- We chose brokers with free demo accounts for practising short-term trading strategies in a risk-free setting.

- We tested the platform to make sure it’s been designed with beginners in mind, focusing on ease of use, charting tools, and training guides.

- We prioritized day trading brokers with a low or no minimum deposit (<$50) for beginners with limited capital.

- We favored brokers with responsive and reliable customer support, based on hands-on tests, to assist new traders.

- We sought out brokers with unique features that would enhance the experience for new day traders, including social trading tools and special perks.

- We only considered highly trusted day trading brokers, evaluated by our experts who looked at regulation, track record, and industry reputation.

FAQ

Which Are The Best Day Trading Brokers For Beginners?

IG is the best day trading broker for beginners based on our in-depth tests. Runners up in our rankings are Pepperstone, XTB, eToro, and InstaForex.

What Should I Consider When Choosing A Broker If I’m New To Day Trading?

As a new day trader, look for a broker with a low minimum deposit requirement, ideally below $50. This will allow you to start day trading with a smaller investment, reducing your financial risk as you gain experience in live markets.

Choose a day trading broker that offers a comprehensive range of educational resources. This includes videos, webinars, and downloadable guides, catering to different learning styles. A brokerage with a depth of educational content is valuable, as it ensures you can continue learning and developing your day trading skills.

Effective customer support is also crucial, especially for beginners. Look for brokers that offer reliable, responsive, and preferably 24/7 customer support, with services like live chat. This ensures that you can get help quickly whenever you need it.

In addition, an easy-to-navigate yet sophisticated trading platform is essential for a smooth trading experience. Platforms that offer additional tools like copy trading and demo accounts are also advantageous for aspiring traders.