Markets Lead the Economy

Financial markets lead the economy and the coronavirus market action is another illustration of this phenomenon.

In some parts of the world, the rate of new coronavirus infections is past its peak. While aggregate numbers will continue to increase (recovered patients are not subtracted out), many leaders are thinking ahead on how to go about re-opening their economies. Much of this falls on local governments.

What businesses will be viable to open back up, and what types of individuals will be encouraged to continue their pre-virus schedules and which groups will be instructed to remain hunkered down?

For market participants, it’s important to think about the virus dynamics beyond the peak and how this will inform economic re-openings.

The IMF, which has a “global lender of last resort” mandate, has its own challenges as it attempts to preserve global economic and financial stability, as virtually every country has had its incomes and balance sheets battered, some worse than others.

IMF managing director Kristalina Georgieva recently wrote her thoughts about the need to think ahead, come to reasonable educated estimates of the type of lending support that might be required country by country, and be prepared for what will come to ensure it executes on its mandates to the full extent of its ability:

To quote a great Canadian, Wayne Gretzky: ‘Skate to where the puck is going, not where it has been.’ We need to think hard about where this crisis is headed and how we can be ready to help our member countries, being mindful of both risks and opportunities. Just as we responded strongly in the initial phase of the crisis to avoid lasting scars for the global economy, we will be relentless in our efforts to avoid a painful, protracted recession. I am particularly concerned about emerging markets and developing countries

As we argued in a different article, any reopening is likely to be cautious and fitful and market volatility will remain higher than normal. While we are not epidemiologists, we know that these types of pandemics typically come in waves.

For any sustainable reopening, the following components will need to be in place:

1. Sufficient testing capacity supported through public health infrastructure

2. Serology testing to determine who’s immune to the virus

3. Surge capacity within the healthcare system

4. Contact tracing to identify problematic areas where the virus is being spread

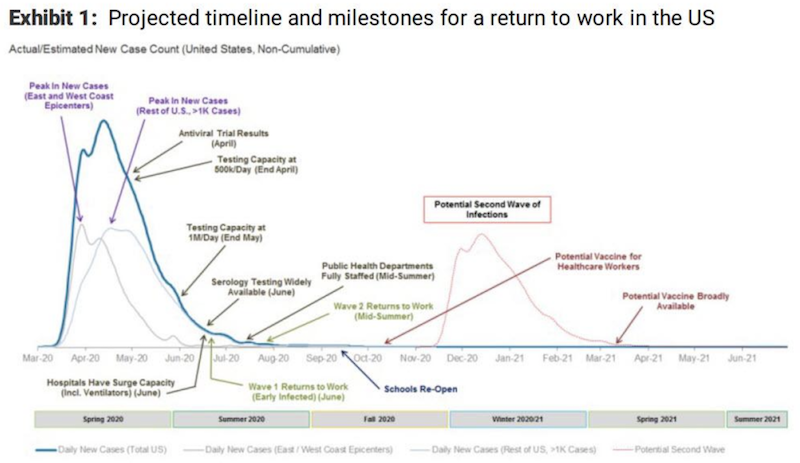

Morgan Stanley offered a potential timeline for a re-opening and when certain developments might become available, such as testing capacity at above one million people per day and serology testing.

(Source: Morgan Stanley Research)

The diagram illustrates that the re-opening process is likely to follow a series of steps. The return to normality in terms of work schedules, school schedules, sporting and entertainment events, and so on, will be slow.

Seeing pre-downturn levels of output in the US, developed markets, and globally likely won’t be realized until the end of 2021.

Markets lead the economy

As it pertains to markets, they always lead the real economy. The market bottom was likely in March, with the economic bottom likely to be in April, perhaps May, or roughly similar activity between the two months.

When the cracks first emerge in the economy, the market flare-up is usually the worst right away. They go from discounting a better economy to discounting a worse economy. This typically happens because traders become accustomed to extrapolating what they’ve gotten used to. That diversion relative to what’s discounted in is a huge shock, leading to the bursts of volatility that characterize these major economic downturns.

During the Great Depression, the biggest shocks to the market didn’t come during the economic or market bottom in 1932-33. They came during the very onset in October 1929. That was the same month investors believed the economy was the best shape it was ever in. But eventually the debt-fueled growth of the 1920s couldn’t go on as the payments came due and not enough income was available to service it. A lot of assets went on sale and there was a deep shortage of buyers.

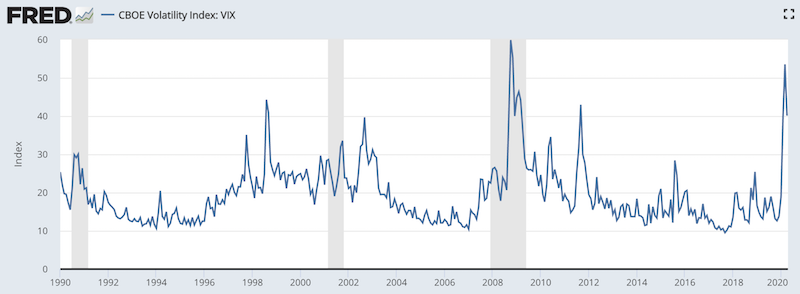

Looking at the VIX data, which goes back to January 1990, the worst of the volatility from the financial crisis came in October 2008 when credit markets froze up. The markets bottomed in March 2009 and the economy bottomed later, around June 2009, before expanding again.

(Source: St. Louis Fed, Chicago Board of Exchange)

Equities volatility also has a high correlation with things like credit spreads. When a big event comes along that changes investors’ expectations from discounting higher growth to much lower growth, volatility picks up. A wave of assets is for sale and there’s not enough buyers and prices go down by quite a bit. Equities are in the same bucket as corporate credit in terms of which environment they perform best. They both tend to benefit when growth is positive, particularly when it’s above expectation, and when there is ample liquidity in the financial system from stimulative monetary policy (and/or fiscal policy, though central banks typically have the biggest financial levels over an economy).

Even before bad economic data comes in, investors (i.e., the mean dollar-weighted expectation) anticipate things ahead of time because the markets are a discounting process. The financial economy leads the real economy. The same dynamic is playing out.

This also means certain relationships may seem counterintuitive to those who believe markets should roughly mirror the economy.

For example, credit spreads tend to improve ahead of the peak in default rates. In other words, even as the credit situation gets worse economically (e.g., more defaults, more restructurings), the market itself typically starts to improve before the bottom economically.

Stocks markets are the present value of companies’ future cash flows from now until several decades forward (i.e., until the discounting process so far out makes the additional summed amounts negligible).

This is why equity volatility is likely to keep falling from here. We have not yet hit an economic bottom, though we’ve likely seen the overall financial bottom.

The upshot to this is that the markets don’t “need to be saved” by a fast economic re-opening. Nor is it necessarily true that if such doesn’t materialize (i.e., said re-openings), then we’ll supposedly go back below the lows.

While investors will see that Q2’2020 will likely be the worst quarter for economic activity in their lifetimes, as long as Q3 figures to be better and the path beyond that continues to improve, markets should be more forgiving.

The coronavirus is no longer a novel event to discount in that radically flips investors’ expectations as it did in the latter part of February and well into March.

At the same time, this is in part predicated on the idea that April and May will be a low for US, developed market, and global economic activity. Investors expect it to be bad for the moment, but they also need to see an improvement.

Many emerging markets will run into issues with their debt servicing that could see their economies take a decade or more to regain their former output. This is especially true for debtor countries that have borrowed material amounts of money in a foreign currency.

That means having the four abovementioned components in place to have a sustainable course of re-opening and ensuring that the worst is over by Q2. If not, this would undermine the current positive bias investors currently have toward the markets.

The trade-off between controlling the pandemic and benefiting the markets is not terribly acute

In sum, we don’t believe there’s an acute trade-off between opening the economy and the health of the markets because of the discounting process that is part of pricing determinations.

Expectations are low for now, with gradual improvements priced in beyond that. A complete recovery in the US is priced to come in the latter half of 2021. This is reasonable and enough time to get testing capacity way up and vaccine in place and available to the broader public.

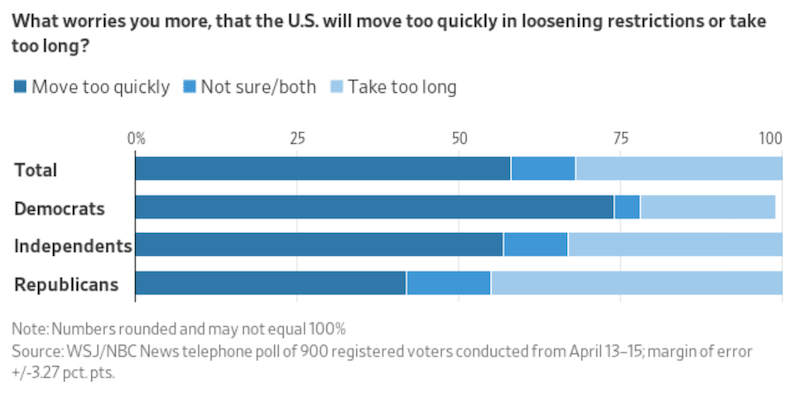

The New York Federal Reserve looked at the impact of the 1918 flu and found that cities that implemented stricter quarantining measures ultimately observed higher levels of industrial output. Unfortunately, the “lockdown vs. reopen” question has been turned into another topic for partisan division between the left and the right.

Based on a survey of registered US voters, nearly three-quarters of Democrats have their top concern as loosening restrictions too fast. This is true for slightly more than 40 percent of Republicans, where nearly 50 percent believe taking too long to loosen restrictions is their main worry. Independents are naturally somewhere in the middle at just over 50 percent.

The New York Fed’s general message, based on their study, is that fighting the pandemic and doing what’s best for the economy (and financial markets) don’t have to be mutually exclusive and can be the same thing. If the economy is to re-open, it has to be done in a sustainable way. Moreover, adaptations necessarily come out of every crisis. In 1918, despite the biological damage that was done and the economic costs incurred because of the pandemic, the Dow Jones rose 10 percent that year.

Final Thoughts

Today’s challenges are serious but surmountable and new innovations will develop out of this crisis. What’s best to fight the pandemic and help the economy and markets can be the same or at least overlap heavily. The sustainability of the recovery will ultimately be dependent on ensuring testing capacity is in place, setting up serology testing to help determine those immune to the virus, having adequate surge capacity present within the hospital system, and developing contact tracing.