How Would a Yuan Devaluation Impact Assets?

In a previous article, we covered how a US dollar devaluation would impact various asset classes.

Here, we’re going to discuss how a devaluation in the yuan (also known as the renminbi, CNY, or RMB) would influence asset prices.

Since currency movements are always in relation to each other, we’ll discuss a yuan devaluation as it relates to the US dollar.

Key Takeaways – How Would a Yuan Devaluation Impact Assets?

- Yuan (RMB/CNY) moves are driven to a large extent by US-China trade policy and tariff expectations, especially when those policies change.

- US tariffs up on China, all else equal = USD up, CNY down

- A rough rule: tariffs are often offset by proportional CNY depreciation versus USD.

- Yuan devaluation generally pressures global equities, especially firms exposed to China.

- USD appreciation is generally a headwind for stocks because it tightens global financial conditions by a) raising the real burden of USD-denominated debt, b) increasing commodity costs, and c) reducing foreign earnings when translated back into dollars.

- EM export currencies often weaken alongside CNY to preserve competitiveness. It’s especially a pressure in export-oriented countries.

- Industrial commodities typically fall. Gold tends to benefit as a risk-off hedge.

How much would the yuan devalue against the USD due to trade related concerns?

First, we should note that as long as the trade conflict between the US and China persists, it will be the predominant source of volatility for the currency.

The basic math to determine the extent of the move is to take the expected tariff rates multiplied by the amount of goods subject to them, then divide that figure by the number of goods imported into the US from China each year.

For example, these are hypothetical numbers simply to illustrate:

– 15 percent tariffs on $300 billion worth of goods is $45 billion, multiplying the two numbers together.

– The US imports about $560 billion worth of goods from China each year.

– $45 billion divided by $560 billion is 8.0 percent.

– That accords with an 8.0 percent decline in the CNY against the USD to offset the economic impacts of the tariffs.

Let’s go through how a yuan devaluation would likely impact each asset class.

Equities

A yuan devaluation against the US dollar would largely lead to a drop in global equities as a whole.

Most foreign debt is denominated in dollars, so a dollar appreciation in relative terms makes that harder to service.

Moreover, many commodities are also priced in US dollars and most countries import commodities from a smaller number of exporters. A more expensive USD would increase commodity costs.

In terms of the distributional effects, it depends. For companies that generate a large portion of their sales from China, these firms would likely underperform. For companies that have more of their revenue exposed to the US, these companies would likely outperform in a yuan devaluation scenario.

Credit

A yuan devaluation against the USD would be negative for USD credit, but it depends on the extent of the depreciation.

An excessive depreciation in the yuan would incentivize other export-oriented nations to devalue their currencies as well to keep their goods competitively priced in the global market.

The USD’s strength would raise the costs of global debt servicing and commodities globally, causing growth headwinds in most emerging markets. This would incentivize capital to flow into safe havens, including US Treasuries.

A yuan devaluation could also increase the demand for safe havens like yen. (A stronger yen would, however, incrementally reduce demand for USD credit from Japanese investors, in particular.)

For portfolios that are heavily based on generating yield from carry trades, the JPY is a common funding currency given its low yield (it’s cheap to borrow in). For those who don’t hedge their short JPY positions, a stronger yen would cause FX losses and an unwinding of JPY shorts.

FX

We’ll cover this in two parts, both CNY alone and emerging markets FX excluding China.

CNY

When the US escalates the trade conflict, or there are rumors or threats of such, the USD appreciates versus the CNY.

The market takes into account the probabilities of the future events occurring and bakes this into the expectations.

Nonetheless, the CNY is managed by the PBOC (China’s central bank), so it will resist movements in the currency beyond a certain band. The PBOC fixes the rate daily and doesn’t allow movement of more than one percent above or below the fix.

When the conflict attenuates, the USD depreciates against the CNY. An example of the math behind the process was mentioned toward the beginning of this article and others that discussed the global tail risk associated with a yuan devaluation.

A “no trade war” situation would put the USD/CNY rate toward the lower-6 range. A full-blown trade war, wherein the US would theoretically place tariffs on all goods, could put the exchange rate up toward 8 depending on the tariff rates applied.

EM FX ex-China

A yuan devaluation also incentivizes devaluations in currencies belonging to export-centric countries. Nobody wants to lose out on trade competitiveness.

Countries with a high beta to the CNY include TWD, SGD, MYR, and KRW. Some EM Asia currencies have shown less sensitivity to the CNY, which include THB, INR, and PHP.

Commodities

Since the CNY is controlled by the PBOC, a drop in the currency would be most likely due to domestic economic weakness. This would be a negative for commodities that serve as feed-ins for industrial purposes, such as base metals (e.g., copper, zinc, aluminum, nickel) and oil.

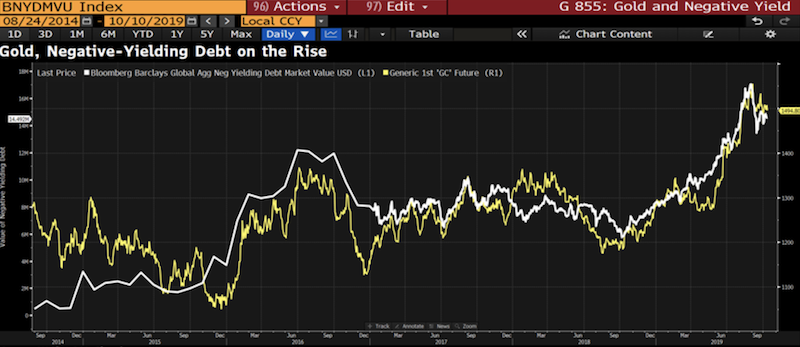

It is positive for gold, as gold is a “risk off” hedge that tends to increase as global interest rates decrease. The correlation between gold prices and negative yielding debt is one illustration of the relationship.

Trade frictions lower nominal growth expectations, and interest rates must necessarily follow these expectations up or down. (Said another way, the rates households, companies, and governments pay on the capital they borrow has to be in line with the rates they’re generating from it.)

China is a not a resource-rich country, so therefore it is a net importer of various commodities. A yuan devaluation reduces China’s purchasing power globally. Commodities like platinum and copper would be especially sensitive, as China relies heavily on external sources for these metals.

However, a weaker CNY could also mean easier lending standards in China. A weaker currency is typically stimulative to risk assets like stocks and riskier forms of credit. Rising asset prices help households and businesses become more creditworthy, as collateral is worth more.

Moreover, a weaker CNY could also go hand-in-hand with more fiscal stimulus from the central government. Nothing happens in a vacuum, so second- and third-order effects are important to anticipate as well.

What’s the difference between the yuan and renminbi? Is one term used more than another?

The difference between renminbi and yuan is mostly a matter of terminology and not substance. Just as we refer to the GBP as both the sterling and pound in the United Kingdom, there’s no functional difference.

(It is different than dollars/bucks and pounds/quid, as that’s slang rather than any kind of formal terminology.)

Renminbi (RMB) is the official name of China’s currency. The term renminbi means “the people’s currency” in Mandarin.

RMB refers to the entire monetary system issued by China’s central bank – i.e., all denominations and forms such as banknotes, coins, and digital representations. Renminbi is the correct and preferred term in formal, legal, regulatory, and international financial contexts

Yuan is the basic unit of account within the renminbi system. Functionally, it has the same role that “dollar” does within the US monetary system.

Prices inside China are quoted in yuan, and everyday transactions are described using yuan rather than renminbi.

For example, a coffee costs “20 yuan,” not “20 renminbi.”

So, in practice, yuan is used more often in daily speech and pricing, while renminbi is used more often in official documents, banking, economics, and international discussions.

Outside China, especially in finance and policy analysis, RMB is common shorthand.

In short, renminbi is the currency’s formal name while yuan is its primary unit.