How Would a US Dollar Devaluation Affect Assets?

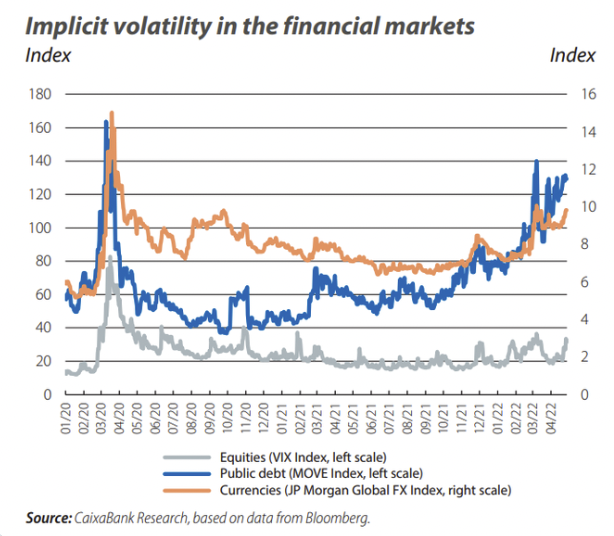

A US dollar devaluation would have an impact on movements in other asset classes. Currency volatility picked up with more inflation risk in 2022.

Post-2008, we’ve mostly been in a low interest rate world.

However, when interest rates become so low to the point where they can’t be lowered any more, and relative interest rates between countries can’t be changed, currency volatility must necessarily pick up.

The inability to lower interest rates is true in all developed markets and is largely the most important factor in markets today.

Japan’s rates are at zero or negative along almost the entire curve. The same is true in Germany, Switzerland, France, and other developed European markets. The US has been there since March 2020.

In other words, when interest rates become tapped out as a way of getting more money and credit into the economy, currencies will undergo pressure to depreciate. Otherwise these moves will translate into economic volatility, which is less desirable.

For example, Greece was pegged to the euro during its debt crisis in 2012. Accordingly, it wasn’t able to pursue an independent monetary policy. So it had to take the devaluation internally through lower output and incomes.

If it had been on the drachma, which was officially phased out in 2002 (and had been pegged to the euro during the transition period starting in June 2000), it could have better handled its debt issues by lowering the interest rates, extending out the maturities, and devaluing its currency.

Due to the US’s balance of payments deficits (i.e., current account deficit, fiscal deficit) and bloated net external debt to GDP ratio (about 45 percent), the dollar will need to depreciate over time.

A weaker currency helps create debt relief – foreign borrowers get paid back in money that’s less valuable – and helps make exported goods more competitive internationally. A cheaper currency (lower relative exchange rates) is effectively the same as giving a discount to foreign buyers while it keeps domestic workers’ wages constant.

It’s basically a devaluation to the rest of the world.

In the US, currency policy is within the purview of the Treasury Department. During the Trump administration, the US didn’t explicitly state a desire over where it wanted the currency to go, through Trump railed against a stronger dollar multiple times, and has even considered direct intervention.

However, the Treasury likely lacks the resources to exert much of an effect on the greenback and has not acted on intervening.

But more generally, when the rates and fixed-income channel for conducting monetary policy are exhausted – i.e., rates are zero or negative and yields further out along the curve are zero or negative – then “currency wars” are likely to become more prominent. There is increased pressure on governments to depreciate their currencies.

Pegged exchange rate systems are at increased pressure of folding or being altered when they are inconsistent with the underlying macroeconomic fundamentals.

There is increased currency risk for traders, who currently perceive currency risk to be around all-time lows.

Moreover, since exchange rate depreciations provide no real net value-add globally, exchange rate shifts will not bring about the global easing that will help improve living standards on a global level. (Though it can help, on net, on a country-specific level if they can reduce exchange rates in relative terms, notably with respect to key trading partners.)

When exchange rates move, that benefits one country at the expense of another. There are also distributional effects.

If you are a net borrower, a weaker currency is typically helpful, as you pay back in depreciated currency. If you are a net creditor, a weaker currency is a disadvantage, as the asset you held (somebody else’s debt) is now worth not as much in terms of the purchasing power it conveys.

A currency devaluation is also the most discreet way to bring about a needed easing. People don’t notice it, or even like the effects, such as their assets going up. So, it’s also the most politically palatable.

General impacts of a weaker currency

A weaker currency is essentially a hidden tax on those holding assets in that currency and a benefit to those holding liabilities in that currency.

To summarize:

i) Devalues the debt denominated in the depreciating currency. This disadvantages the foreign holder of that debt.

ii) For those holding the currency, it diminishes their buying power in the rest of the world. For example, dollar weakness reduces Americans’ buying power relative to that of foreigners.

iii) Helps support the prices of assets denominated in that currency. This gives the illusion of increasing wealth.

iv) Increases a country’s inflation rate.

v) Helps stimulate domestic activity.

In the case of the US, the size of dollar reserve holdings (in dollar-denominated debt) and the USD’s role as the dominant world currency are more befitting of a previous era, as the US’s role in the global economy has shrunk and will continue to and many Asian economies catch up.

The USD’s role in the global payments system is too high relative to what one would want to hold to be balanced. Reserve currency status always declines with a lag relative to the empire’s influence because it requires the creation of a new system.

So, rebalancings of dollar holdings (i.e., closer to the US’s role in the global economy) should be expected over time – just as what happened after the decline of the Dutch Empire and British Empire.

This is especially true as US dollar bonds are not attractive and tensions with dollar creditors will continue to be there and are likely to aggravate in various ways. This will diminish their willingness to hold USD assets and shift into other currencies, currency hedges (e.g, gold), and things that they’ll need (e.g., oil, commodities, and commodity producers).

Let’s go through a rundown of how a US dollar devaluation would impact various asset classes.

Equities

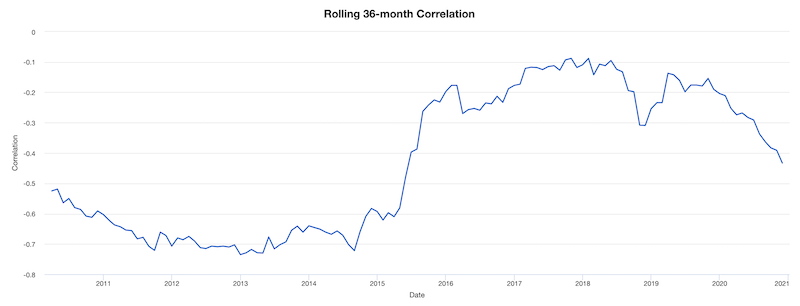

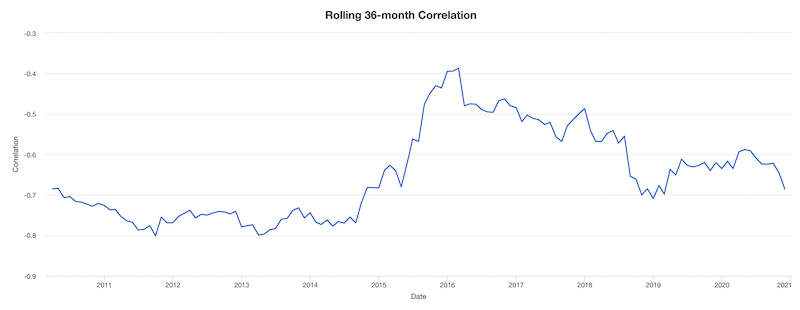

Equities generally negatively correlate with the USD. Over the past 13 years or so, the S&P 500 and the dollar index have held a negative correlation (minus-0.47), and sometimes deeply negative correlation, due to the way the printing of money is bad for the value of the dollar but good for spending.

However, correlations are not stable over time and it’s more important to understand the cause-effect relationships.

A few as it pertains to the dollar / US equities relationship.

i) A lower exchange rate relative to US trade partners helps firms that rely on selling their goods abroad. Because most of the largest US companies sell goods and services internationally, a lower dollar is generally beneficial to earnings.

US small cap stocks tend to do more of their business domestically and have less foreign sales exposure. Accordingly, they generally don’t benefit as much from a weaker dollar to the same extent as multinational corporations do.

ii) USD strength can be a sign of broader strength of the US economy. This can also support the outperformance of US equities relative to foreign-facing companies.

iii) A US intervention to weaken the USD could cause an increase in geopolitical risk and market volatility. Markets typically react to volatility by pricing equities lower due to a higher risk premium.

Impact on Chinese and emerging market equities

A weaker US dollar relative to other currencies would bring about a global easing. Emerging market equities would be expected to benefit as a whole.

Most foreign external debt (some 60-65 percent) is priced in USD. A cheaper dollar would make this debt easier to pay back. Many commodities are also priced in USD, like oil (‘petrodollars’). These would become cheaper to many commodity importers.

Most of the world imports commodities come from a smaller number of exporters. So, in terms of the distributional effects, this would be net positive for most countries purely from a commodities pricing standpoint.

This would also place less pressure on Chinese capital outflows, which would also be a plus for Chinese equities.

However, at the same time, it depends on the nature of the depreciation. If the fall in the USD causes growth headwinds to other countries because their currencies become too strong, this could ultimately become a more important driver of the returns of EM equities.

While the USD is somewhat overvalued relative to long-run expectations – evidenced by its high net external debt and bloated fiscal and current account deficits – the size of the depreciation has to be balanced in a way that’s not too large or small to give the desired effect.

Over time we can see that EM equities have had a noticeable negative correlation with the dollar, primarily through the channel of cheaper USD debt and cheaper commodity imports.

Emerging market credit

EM credit has typically traded inversely with the US dollar. Namely, its price has increased during periods of USD depreciation.

Some of it is “chicken and egg” in nature. When the world is in a synchronized global upswing, there is less demand for the safety and liquidity of safe haven currencies, such as the USD, JPY, CHF, and/or gold.

More gets pushed into riskier emerging market financial assets where higher returns are likely to be had and less into the traditional safe markets.

So, while there is some causation involved in a weaker dollar and stronger EM assets, some of the relationship is a matter of basic flows and the reality that all assets compete with each other.

Developed market FX

A US dollar devaluation is likely to be met with corresponding devaluations by other countries mired in their own low-growth, low-inflation environments.

In developed markets, the US has more monetary policy room than other countries to boost the economy. The Fed has no room at the front end of the curve and about 50-100bps in the middle and back end.

In Japan and most of developed Europe, they are at the point at which they’re more or less tapped out on the rates and fixed-income channels to stimulate their economies.

Given the zero-sum nature of FX devaluations, a US depreciation likely wouldn’t simply slide by other countries to avoid a tightening in their own financial conditions.

So, USD intervention would very likely be met by intervention by the BOJ, ECB, and Swiss National Bank at a minimum, all of whom don’t want stronger currencies.

This is part of the reason why FX volatility is priced so low. Countries are expected to react in-kind to keep exchange rates relatively stable to avoid disadvantaging themselves internationally.

Interest Rates

US Rates

A currency depreciation is inflationary holding all else equal. Your currency doesn’t go as far, so the relative prices for imports increases.

And if imports are more expensive, then the demand for local goods will be higher and could lead to greater scarcity, increasing their prices.

If inflation increases, then you would normally think that bond yields would increase because bond yields are simply a function of:

- the real risk-free rate,

- credit premium (i.e., to reflect credit risk), and

- inflation and inflation expectations

However, currency depreciations are often motivated by disinflationary or deflationary forces, such as having too much debt, which puts more capital into debt servicing and away from consumption and investment.

So, when currency devaluations happen, you often don’t see bond yields increase (i.e., bond prices fall). That comes later, because since you’re counteracting deflation, not much in the way of inflation is produced.

In the US during the Great Depression, they added money into the system (because there was too much debt and not enough money to service it). This devalued the dollar because of an increased supply.

Gold went up because gold typically tracks the quantity of currency and reserves in the system globally relative to the amount of gold above a certain purity. Long-term bond yields continued to fall because investors still wanted safety and liquidity and could get this through Treasury bonds.

In other words, just because the dollar loses its value doesn’t mean that the bonds will necessarily decline.

Even though the typical reaction to a currency depreciation is for bonds to sell off at first – i.e., stimulative to economy and inherently inflationary, so more inflows into risk assets and away from defensive assets – in a scenario where currency devaluations are used to counteract deflation and the depreciation doesn’t get them very far in negating it, bonds often continue to increase in price.

European Rates

Major European bond markets are already more tapped out than US bond markets. We’ve seen some European yields get down to minus-100bps, but there’s a limit to how negative yields can get.

At some point, creditors will want to get out of safe assets and into riskier ones if they’re simply losing money.

A US dollar devaluation would make US exports cheaper in relative terms and euro zone exports more expensive. This could dampen euro area growth expectations and cause some level of inflows into safe European bonds.

US Dollar Devaluation: General Discussion

Traders view the rise and fall of all assets through the lens of a currency, typically their own because it’s the one they transact in or make their incomes in. Everything you see is printed in currency and that’s fundamentally how you gauge your results.

We’re now in an environment where currency depreciations are becoming more of a long-term trend due to high debts relative to incomes and the need to create relief from that burden. It will also get worse over time as obligations increasingly come due related to debt and debt-like liabilities.

In these periods, policymakers want a weaker currency because it helps negate deflation, reflates asset prices, and help debtors relative to creditors so they can more easily meet their obligations.

Better assets or weaker currency?

In these cases, we sometimes make the mistake of thinking that assets went up because of an inherent improvement of their fundamentals and not because the value of the currency is going down.

We’re seeing this more and more in developed markets.

A lot of new money and credit had been and is being created to deal with a big drop in incomes and spending and will continue to be a problem because these countries spend more than they produce. This has been a trend for a long time.

We’re in such an environment where:

a) Central banks (in the developed world – US, developed Europe, Japan) are out of stimulant in the traditional ways they can boost financial markets and the economy when they’re weak.

b) There is a very large amount of debt and debt-like liabilities – e.g., related to pensions, healthcare, insurance, and other unfunded liabilities – that are many multiples of annual GDP and will increasingly be coming due. They won’t be able to be funded with assets and the income they produce.

So, we’re now in a world where:

i) Real (i.e., inflation-adjusted) interest rates are so low that investors holding this debt will not be inclined to hold it.

They will look for other stores of wealth they think will provide both better returns and more reliably hold their value better.

ii) The need for money to fund debt and other liabilities will create a gradual squeeze over time.

Because these liabilities won’t pay for themselves in terms of higher net productivity, there will be an increasing amount of monetization.

It’s not politically acceptable to not make due on retirement or healthcare obligations. So they’ll create money and essentially debase the currency to make everyone whole.

There will have to be some combination of large deficits that will be monetized, currency depreciations (the main channel), and tax increases.

There are also the elements of austerity (less spending or spending cuts). But austerity is more of an emerging market course of action because they lack reserve currencies.

In developing economies, they don’t have the global demand for their currencies, which means if they overspend and have to issue debt, the lack of demand raises interest rates.

If they want to monetize debt, they debase their currency more easily because there isn’t enough demand for the debt, which can lead to inflation and balance of payments issues where attracting foreign capital is more difficult.

In bad cases where policymakers fail to close the gap between external spending, external income, and debt service requirements, they can end up with hyperinflation.

Tax increases also typically have a very limited effect on curing big debt problems. There’s a limitation to how much taxes can be increased before getting on the backside of their curves and losing revenue.

Tax hikes are often levied on the wealthy because those who have the most tend to fall into a small percentage of the population.

But they typically want to be defensive and move their assets and/or themselves out of the jurisdictions or the types of assets or transactions subject to these new or higher taxes.

So, it impacts incentives and capital flows in an adverse way if policymakers aren’t careful in how they engineer these policies. If pushed too far, it will reduce productivity and lower overall tax-take.

This set of trade-offs is likely to cause increased social and political conflicts between the “capitalists” and the “socialists”. More generally, you see tensions between those on competing ends of the political and ideological spectrum.

Low cash and bond yields weaken the currency

Over this time, those who hold debt are very likely to receive very low to negative nominal returns and also negative real returns.

The currency that these debts are held in is likely to weaken because of the increasing monetizations and lesser overall desire to hold it when the yields on the cash and debt are low.

Essentially, cash and debt will almost be like a wealth tax.

Some of that debt will also still have some level of credit risk and volatility to it based on its duration. These are additional risks to holding it.

As of the end of 2020, there is about $15 trillion worth of sovereign debt with negative interest rates attached to. Over eighty percent has a nominal yield of one percent or less.

When there is near-zero, zero, or negative nominal return, and likely even more negative real return, investors start searching for alternative stores of wealth.

This is why the amount of negative yielding debt tends to positively correlate with the price of gold. It’s an alternative safe haven. Moreover, it’s simply expressing that the value of money went down in gold terms and gold went up in money terms.

Negative interest debt is not useful for producing income. The exception is when they are funded by liabilities that have even more negative interest rates where an investor can make a profit of this spread.

For example, if a trader funds a EUR cash asset yielding minus-50bps with a CHF debt asset yielding minus-100bps, the trader would earn a positive-50bp yield.

They could also be used to speculate on the future path of interest rates. For instance, Austria has a 100-year bond. It generally yields about zero.

If the yield of the 100-year bond went down by half a percent, the price increase is approximately the duration of the bond (about 100 years) multiplied by the yield change. So you have 100 multiplied by 0.5, or 50 percent.

You also have enormous downside if interest rates were to climb.

These terrible-yielding investments may be passable stores of wealth to hold principal.

But they’re not likely to be safe because they offer poor real returns and have some level of volatility depending on their duration (and credit risk, depending on who it’s issued by).

Asset strength illusion

When the prices of assets go up in this type of environment, it’s not because of stronger growth or greater productivity, but because the value of money has gone down.

The current period is analogous in many ways to the 1929-1945 period.

We went from a big bust to running out of traditional monetary policy room, to having large wealth gaps, to seeing the rise of other global powers to challenge an existing power, trade and capital frictions, to currency devaluations, and eventually a new world order. The US became the clear global superpower and the USD became the world’s reserve currency under the Bretton Woods agreement.

When President Franklin Roosevelt came to power in 1933, he ran on a platform that raised taxes and spent a lot to get the economy going again. This created larger deficits.

But all the spending and new money and credit lifted stocks and bonds. If you create the liquidity in excess of what’s being destroyed from a bust, it goes into assets. Their prices went up, but not in relation to something like gold, a type of contra-currency.

Their value went up in money terms, and the value of money went down in terms of the value of those assets.

When you print money and create debt, that makes cash less attractive to own.

This affects bonds as well. Bonds are a promise to deliver currency over time. If you’re paid back in depreciated money and the interest on it is nothing (or worse than nothing in real or nominal terms), then those become less attractive.

Implications for pensions

Most pensions are scrambling for returns to meet their future obligations. Unfortunately, this often means skewing their portfolios in riskier assets rather than engineering the portfolio in a balanced way.

They are essentially betting on a certain economic environment being good (quality growth) that may not come to pass.

When cash and bond investments yield about nothing, there won’t be enough income to fund the liabilities.

These assets can store or preserve wealth to a limited extent, but have limited use beyond that.

To finance expenditures (without government assistance), holders of these assets will need to sell off principal. This diminishes the value of their remaining asset pool.

This means they will need either:

i) higher returns on the smaller base of principal (which is not very realistic to achieve), or

ii) the principal will eventually deplete, especially with a lower asset base progressively producing less income.

In the end, insufficient pension returns are another source of pain that will gradually come to the surface and encourage more policy easing through new liquidity creation and currency devaluation.

Economic Management and Dollar Devaluation

Economic management is both a matter of monetary policy and fiscal policy.

However, in countries like the US, economic remedies tend to be a central bank issue. No one will or can tackle the fundamental issues plaguing the fiscal side (the US spending more than it earns and its liabilities are higher than its assets).

One issue policymakers have to think about is the current dynamics with the dollar.

The US officially has a current account deficit of 3.5 percent of GDP, which is really more like 5 to 6 percent. That requires an increasing need for foreign capital to fund the deficit to keep the currency up.

Whether the US can attract that level of inflows will mostly depend on interest rates and asset valuations.

A lot of people are aware of the trade-offs between growth and inflation – if you want inflation down, you sacrifice growth (which is why recessions are almost inevitable at some point); and vice versa.

That trade-off is already hard to manage when you have falling growth and high inflation. But it becomes even more acute when a country’s capital flows are going in the wrong direction, as the US is currently risking with its finances.

As a country’s balance of payments deteriorates they get less growth per unit of inflation.

Arresting this trend requires difficult trade-offs that nobody wants – higher taxes, expenditures cuts, earning more than it spends – and that doesn’t get anyone elected, so the US will continue to decline on a relative basis no matter who’s there.

This is why diversification by country and by currency is important.

Even though the US has been a very good place to invest in the rear-view mirror (and in many respects it still is), lots of countries have been outperforming the US recently.

Many have higher growth rates, reasonable valuations, and their policymakers are a lot less constrained than they are here.

On the fiscal side, they can’t fund those deficits entirely with tax money. Raising them too much or trying to invent new taxes will just exacerbate the capital flow issue. So they’ll print whatever money they need to fund the rest.

This is classically how it goes throughout history.

That means the tax will be paid by those holding cash and fixed-rate credit assets (by devaluing these assets).

In the real world, people experience this through higher inflation and reduced buying power.

Conclusion

At the asset class level, a currency devaluation is good for stocks, good for commodities, and good for gold. It is not good for bonds.

When you print money to relieve financial problems, you have a currency devaluation. These devaluations are always in relative terms.

It may not necessarily devalue relative to other fiat currencies. Many times, these countries share the same financial and economic circumstances and want the same things. So, policymakers watch what other central banks and governments do and react as needed to keep their pricing in line.

Devaluations are likely to occur relative to something like gold. Other assets are supported as well in money terms (e.g., stocks, commodities).

The currency devaluation happens before bonds fall. Not much in the way of inflation is produced, because what’s actually happening is inflation is being negated from the spending contraction through the fall in credit creation.

England did this in 1992 with their currency alignment.

The US has also done this before multiple times. They notably did it during the Great Depression. They created money and devalued the dollar to get a grip on its debt problems.

Debt is a short money position. You cover debt with money. If the debt problems become unbearable and incomes aren’t sufficient, money has to be slipped in to create relief or fix the problem.

Policymakers always prefer currency debasements over a painful drop in incomes. If they have that ability (i.e., through a reserve currency), the trade-off is obvious which one to choose.

During the Great Depression era reflation, gold went up a lot and then bonds eventually fell being unattractive investments with all the money and debt creation. People don’t want to be paid back in depreciated money, especially foreigners. (Domestic investors care more about the real yield; international investors care more about the relative exchange rate and how that changes the value of their holdings in the currency they make their incomes in.)

But then long-term rates continued to decline because people still needed safety and liquidity. Even if a currency is weak, it doesn’t necessarily mean that the bond market is bad in nominal pricing terms.

The US also necessarily had a currency depreciation in 2008.

From the US’s point of view, we want a devaluation. When there is an environment with a lot of deflationary influences, you want your currency to go down to get your pricing at least steady (i.e., an inflation rate up to at least zero).

When you have a lot of foreign debt that’s denominated in your currency, you want to create relief by having your currency depreciate.

Major currency devaluations help produce stock market rallies. Stocks go up in money terms and money’s value goes down in asset terms. One of the best ways to trigger a rally in stocks is to devalue your currency.