Bond Duration

Bond duration is a measure of how long it will take to reach a bond’s mid point in cash-flow terms. For example, if a bond’s duration is 3.6 years, that specifies that one will receive one’s original investment back in that length of time through its coupon payments (assuming no default).

Top Bonds Brokers

This differs from maturity, which is the length of time a bond investment lasts. For zero-coupon bonds, where principal and interest is paid at expiry, duration is equal to maturity. For coupon bonds, duration is less than maturity.

Bonds with higher duration are subject to greater interest-rate risk. Bond prices and interest rates share an inverse relationship. When interest rates rise, bond prices fall.

There is, however, a high level of gray area to this rule. For shorter duration bonds with high levels of credit risk, interest rates will not impact the value of these securities to the same degree as longer duration bonds with low levels of credit risk. In the case of the latter, interest rates play a much more substantive role in pricing these bonds. US Treasuries, considered to be among the safest bonds globally, are priced almost purely off interest rates accordingly.

A general, but far from exact, rule stipulates that for every 1% rise in interest rates – i.e., a 1% parallel shift in the yield curve – bonds will decrease in price by 1% for every one year in duration. This may not apply to a bond with a high level of credit risk, but will be close for a “risk free” security, such as a US Treasury bond or German bund.

Therefore, for a 10-year US Treasury bond, a 1% parallel shift in the yield curve would expect to decrease its price by about 10%. If you plan to hold to maturity, then the rate you bought it at would be locked in.

Factors Impacting Bond Duration

As mentioned, the longer the maturity of a bond, the longer its duration, holding all else equal.

This should make intuitive sense; given duration is the amount of time it takes to reach a breakeven point on your investment, the longer the duration, the longer it should take to earn back your capital. (Investors are normally compensated by this through a higher yield to maturity. Notable exceptions include an inverted yield curve, where shorter duration bonds have higher yields than longer duration bonds.)

The coupon rate also influences the duration. If we have two identical bonds in maturity and value, but one pays out higher coupons, it will have a lower duration. In other words, the higher the coupon payment, the sooner you will be reach your breakeven point. Likewise, the lower the coupon payment, the longer it will take to get back to breakeven, and therefore the longer the duration.

Bond Duration and Volatility

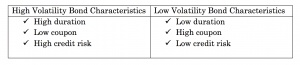

High duration is associated with higher volatility. This should also be intuitive, as the longer it takes one to reach the breakeven point on the investment, the greater the chance of something going awry with the investment.

For example, a bond with a duration of two years will have much less volatility than a duration of 25 years. In the US Treasuries market, a 25-year bond duration has about 20x the volatility of a bond with a two-year duration.

Why? First, because of the time value of money (“a dollar today is worth more than a dollar tomorrow”). And there is also the chance of credit negative events occurring in the extra 20+ years that could jeopardize the financial health of the investment.

Bond Duration and Its Yield to Maturity

Bonds with higher yields to maturity (YTM) tend to have higher durations. This is due to greater amounts of the two main risks: 1) higher duration and/or 2) higher credit risk (generally in the form of a lower credit rating)

As mentioned, if a higher yield to maturity is due to higher duration risk, then this bond will be more subject to interest rate risk. If one believes that interest rates will decrease, taking on more duration risk can make sense. If one believes that interest rates will increase, taking on less duration risk would be a better move.

If a higher yield to maturity is due to higher credit risk, on the other hand, then its interest rate risk will have less influence in the bond’s overall pricing. For those who want higher-yielding bonds in rising rate environments, using short-term high-yield bonds could fulfill that purpose. But one has to consider the risk trade-off of swapping out one form of risk for another – interest rate risk versus credit risk.

Overall, a bond’s duration is positively correlated to its yield to maturity. Bonds will nonetheless trade more heavily on whatever risk factor is most pertinent to its valuation.

Bonds with long durations but high credit risks can gain value in a rising rate environment if improvements to its financial health outweigh the rise in rates. High durations and higher credit risk will be associated with higher volatility more generally.

Bond Duration: Points to Keep In Mind

As a day trader, one needs to ideally remain aware of what part of the business cycle one is in, as this has important implications for how to trade bond duration.

As of early 2018, the US is entering into the later stage of the business cycle accompanied by higher rates. The EU will begin entering this stage sometime in late 2018 and early 2019. This means that interest rates will be increasing and higher duration bonds are thus likely to underperform.

However, it also depends on the shape of the yield curve. When central banks begin tightening monetary policy, this usually flattens the yield curve given they have direct control over the front end. The rest of the yield curve is set by the market (with special exceptions, such as the Bank of Japan pegging its 10-year yield to 0.00%-0.10%). If long-term inflation expectations are anchored, this can actually mean that shorter duration bonds can underperform longer duration bonds.

This means that as the central bank undergoes a tightening cycle, it could be beneficial to trade interest rate risk for credit risk, if one believes in the continuing strength of an economy. This limits the damage rising rates could have on one’s bond trades.

During an easing cycle, where the central bank decreases interest rates, making the trade off of credit risk for interest rate risk could be a good strategy.