Fixed Versus Floating Exchange Rate Systems

Foreign exchange (forex) trading is very popular among day traders because the markets are very liquid and open 24 hours per day five days per week. With the rise of online brokers and a greater number of floating rate currencies, traders have numerous options. However, not all currencies are created equal. Some are under fixed/pegged exchange rate systems while others are under free floating exchange rate systems.

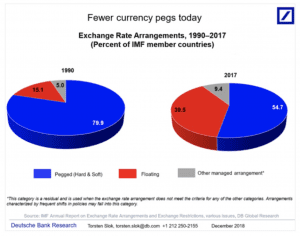

In 1990, approximately 80% of all currencies were pegged (that is, under fixed exchange rate systems). Today, it is close to 50%.

At the same time, it’s important to understand what you’re trading. While developed market currencies are floating – i.e., they largely trade based on supply and demand, with minimal government intervention – many emerging market currencies have fixed exchange rates, meaning government bodies entirely or mostly set their prices.

If you try trading many emerging market currencies – e.g., Chinese renminbi (CNH), Hong Kong dollar (HKD), Indian rupee (INR) – these may be available for trading, but the governments heavily intervene in them. This means if you rely on trends or analysis of economic fundamentals, your strategy may not be effective because the government intercedes in these currencies to steer them in a way that is consistent with their objectives. Currencies with pegged rates tend to go through long periods of stabilization, followed by sharp spikes in either direction.

This is true even on the daily level. For example, the below graph is a daily snapshot of the US dollar / Chinese renminbi (USD/CNY) exchange rate:

Needless to say, this type of price action doesn’t lend itself very well to day trading.

With that said, it’s important to understand the broader picture of what’s going on when it comes to why some currencies are floating and why some are fixed. Ultimately, it can help with your trading to know why things are the way they are. It is especially important when making longer-term bets, though, obviously, most day traders keep themselves to shorter intervals.

Floating vs. Fixed Exchange Rate Systems

From a macroeconomic stance, there is no right answer as to whether a fixed or floating exchange rates is the most appropriate policy. It largely depends on the state of development.

Developing economies often have pegged exchange rates because it helps support internal measures to guide the economy in a certain way. Their currencies and capital markets are undeveloped so they peg their currencies to gold or whatever the prominent reserve currency is, typically the one they want to sell their goods to.

In the very early stages of a country’s development, people value earning money and building savings more than spending it, so governments typically prefer their currencies be undervalued rather than overvalued. This is because they are not yet at a point where they have a need to import large amounts of goods, where a strong currency is beneficial because it can buy more of them. With an undervalued currency, governments can build up reserves/savings by buying the bonds of reserve currency countries.

If this occurs in a country with a culture that broadly works hard, saves a lot, and invests in their means of production, this eventually produces rapid income growth that is matched by rapid productivity growth. Inflation isn’t a problem and they become more competitive relative to other countries.

However, at a certain point, incomes begin to rise faster than productivity and debts begin to rise faster than incomes. These are both unsustainable sets of conditions.

Inflation begins to rise because rising income growth leads to increased spending on items that cannot be correspondingly increased in supply through productivity gains.

Because their exchange rate is pegged to a reserve currency, this means their interest rate is linked to that country, which (almost always) has lower growth and inflation rates. Low interest rates are appropriate for economies with sluggish economic growth and inflation rates, but are too low for the pegging country because it eventually produces excessive price pressures. This leads to money and credit growth and corresponding inflation. These countries will typically maintain the peg through reserve manipulation until the upward bubble/inflationary pressures become too expensive and painful to support.

So they end up with a combination of 1) growing inflation from productivity not growing fast enough to offset income and spending growth, 2) debt growing faster than income, 3) excess investment, and 4) a current account surplus. This mix of conditions will eventually lead to a move toward liberalizing their capital account, free floating the currency, and implementing independent monetary policies more broadly.

Moreover, because of balance of payments surpluses and trade imbalances, this often causes frictions because of the loss of jobs from the developed country and capital outflows. Backlash from other countries often expedites pressure to freely float the currency. This is not just singular from the Trump administration’s stance toward China; it has happened over and over again historically.

Having independent monetary policy is a right that’s earned because their ability to develop to this stage – not all countries will – has given them the credibility to do so.

Independent monetary policies are highly valued because it becomes a very powerful way to balance output and inflation in a way that is consistent with their own unique set of conditions. Accordingly, this is why no developed economy has a pegged exchange rate, though various countries in Europe are linked via the euro in a quasi-peg type of system.

In the end, all pegged systems that are inconsistent with the fundamentals of the currency will eventually fail.

The country with the highest total income typically enjoys the advantage of having the world’s top reserve currency and they derive an income benefit from being in this position. It accounts for a sizable fraction of the gap between the top-earning country and the next highest earning. Since the end of World War II, the real GDP per capita of the UK, Japan, and Germany have stabilized at around 70%-80% of the US’s. The dollar’s influence has been a big part of this.

Conclusion

When trading currencies, it’s very important to understand whether the currency is under a fixed (i.e., pegged) or free floating exchange rate system. Fixed currencies are managed by government agencies and are difficult to trade. They undergo periods of relative stability followed by large, sharp movements. Standard strategies related to trend following, support and resistance, technical analysis, and so on, really are not effective in these cases.

If you’re trading the major currencies – USD, EUR, JPY, GBP, CHF, CAD, AUD, NZD – these are all free floating. While some emerging markets have free floating currencies, most are under some type of management arrangement.