Current Account – What It Is & Impact on Markets

A current account in macroeconomics is a country’s net trade in goods and services, plus net earnings from rents, interest, profits, and dividends, and net current transfers such as foreign aid.

It is the sum of the balance of trade (exports minus imports of goods and services), net primary income (earnings on foreign investments minus payments made to foreign investors) and net secondary income (transfer payments between foreign and domestic residents).

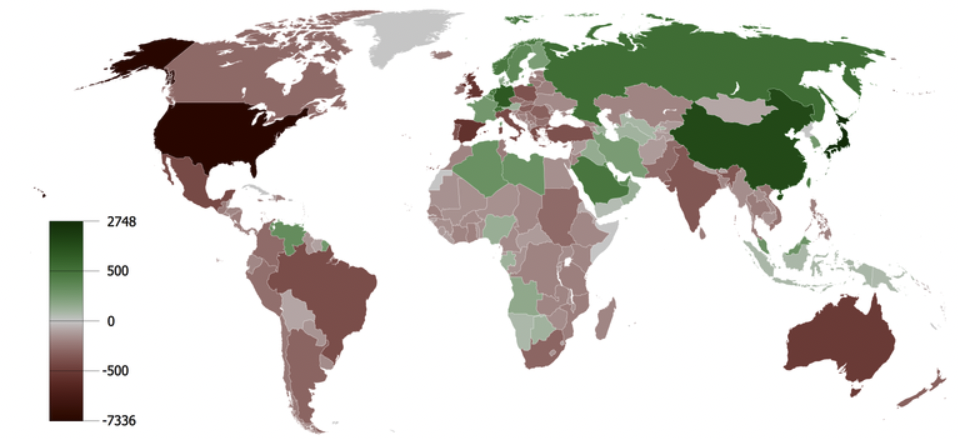

A current account surplus indicates that the value of a country’s net foreign assets (net investments abroad) is positive.

A current account deficit indicates that the value of a country’s net foreign assets is negative.

Current account formula

The current account is calculated using the following equation:

Current account = (exports of goods and services) – (imports of goods and services) + (net income from abroad) + (net current transfers)

Balance of payments

Balance of payments accounts are compiled to track economic transactions between a country and the rest of the world.

These transactions include payments for imports, exports, investment incomes, transfers such as foreign aid, as well as international borrowing and lending.

Balance of payments surplus and deficit

A current account can be either in surplus or in deficit.

A current account surplus is usually associated with positive net exports (net outflows of capital), while a current account deficit is usually associated with negative net exports (net outflows of capital).

A current account surplus increases the value of a country’s net foreign assets, while a current account deficit decreases the value of a country’s net foreign assets.

The current account is one of the three components of a country’s balance of payments, the other two being the capital account and the financial account.

Current account surpluses and deficits can be caused by a variety of factors, including trade imbalances, capital flows, and changes in the level of prices.

A current account surplus indicates that a country is effectively producing more for the rest of the world than it’s taking in, which can allow it to build reserves (or spend fiscally) while a current account deficit indicates that a country is taking in more from the rest of the world than it’s producing.

Balance of payments calculation

The overall balance of payments is equal to:

Balance of payments = balance of the current account + balance of the capital account + balance of the financial account

Current account, balance of payments, and currency trading

The balance of payments and current account is important in currency trading and changes in exchange rates.

A current account surplus means that a country’s currency is in demand and is likely to appreciate relative to other currencies.

A current account deficit means that a country’s currency is in less demand and is likely to depreciate relative to other currencies.

But, of course, it’s more complicated than that.

For example, in the United States, the US runs both a current account deficit and fiscal deficit.

This means there’s need for foreign capital to help plug this gap.

The current account deficit for the United States is traditionally around 3.5 percent of GDP, though that can expand over time to around 6 percent of GDP.

That would suggest a dollar weakening.

But if there’s enough foreign capital to continue to offset that deficit that can keep the dollar higher.

How does it get this foreign capital to fund a current account deficit?

If growth rates are relatively attractive compared to the rest of the world and interest rates (i.e., rate of return on investments) are comparably high on both an absolute and rate of change basis, this makes a country – and therefore its currency – a more attractive place to invest.

If policymakers are less constrained and valuations are more attractive, foreign capital has a better chance of finding its way in and helping plug a current account deficit to keep a currency elevated.

But the higher the current account deficit the greater the vulnerability for a currency.

Current accounts and commodity exporters

Commodity exporters tend to have large current account surpluses, but it depends on the extent and the degree to which they import other things.

Manufacturing hubs or those with weak currencies relative to their economic fundamentals may also see current account surpluses.

In the euro zone, lots of different countries are on the euro currency.

This has led stronger economies in the region, such as Germany, to have a currency that’s too weak relative to its fundamentals, which has contributed to a current account surplus.

It’s also led to a strong currency for countries on the periphery, such as Spain, Italy, and Greece, which has led to weaker growth and higher deficits.

Bond yields and the current account

The current account can also have an impact on bond yields.

For example, if a country’s current account deteriorates and it becomes more reliant on foreign capital to finance its growth, this might lead to higher bond yields as investors will want to be compensated for the increased risk.

This is one of the channels through which current account deficits can lead to higher inflation.

A current account surplus, on the other hand, might lead to lower bond yields as a country becomes less reliant on foreign capital.

Current account vs. financial account

The current account includes transactions in goods, services, and income, while the financial account includes transactions in assets and liabilities.

The current account is sometimes referred to as the real or merchandise account, while the financial account is sometimes referred to as the capital or financial account.

A current account surplus indicates that a country is a net exporter of goods and services, while a current account deficit indicates that a country is a net importer of goods and services.

A financial account surplus indicates that a country is a net lender (creditor) to the rest of the world, while a financial account deficit (debtor) indicates that a country is a net borrower from the rest of the world.

While the current account and financial account are two different things, they are related.

For example, a current account surplus will lead to a financial account surplus if all else is equal.

This is because a current account surplus indicates that a country is earning more than it’s spending, and this excess income will be used to buy assets from other countries, leading to a financial account surplus.

Current account vs. trade balance

The current account is often confused with the trade balance, but they are not the same thing.

The trade balance is a measure of a country’s imports and exports of goods and services, while the current account also includes factors such as income and transfers.

A country can have a current account surplus even if it has a trade deficit (imports of goods and services exceed exports), as long as there is a surplus in other components of the current account such as income or transfers.

Conversely, a country can have a current account deficit even if it has a trade surplus.

Conclusion

The current account is a measure of a country’s net trade in goods, services, and income.

A current account surplus indicates that a country is a net exporter of goods and services, while a current account deficit indicates that a country is a net importer of goods and services.

The current account can be used to assess a country’s competitiveness and to predict future exchange rate movements.

A current account surplus will lead to a financial account surplus if all else is equal, and a current account deficit can lead to higher bond yields as investors demand higher compensation for the increased risk.

The current account should not be confused with the trade balance, which only measures trade in goods and services.

A country can have a current account surplus even if it has a trade deficit, and vice versa. This is because the current account includes more than just trade in goods and services.