Considerations of Whether to Join or Leave a Currency Bloc

Countries must decide whether to manage their currency policy in a way that’s best for their country, whether that means keeping a fixed exchange rate, a free float, or possibly by joining a currency bloc if they have that option available to them (effectively a peg in itself).

For reasons that were covered more in depth in a previous article, a “currency war” could be the next big global macro event that’s largely not well priced into financial markets.

While gold, which would be the big beneficiary of a move that would see real exchange rates decline globally, is up 15 percent year-to-date, it would move quite a bit higher if central governments eventually begin shifting toward the exchange rate channel to ease policy. In terms of the major four economies, Japan is closer to this stage than Europe (based on the extent to which their interest rates are lower in relative terms), and Europe is closer than the US, which is closer than China.

Easier monetary policy also naturally brings down exchange rates given it causes currencies to yield less going forward. Therefore, there is less demand to hold lower-yielding currencies and assets denominated in these currencies.

Interest rates throughout the developed world are negative, zero, or close to zero. When interest rate policy is maxed out and buying assets closes longer dated spreads to zero (i.e., quantitative easing), then tertiary forms of policy must be pursued. This will include such measures like debt monetization and/or currency depreciations.

But the idea of using currency depreciations to stimulate domestic demand (i.e., exports become cheaper, external debt effectively becomes cheaper) becomes a thorny topic when that currency is managed.

For example, most of the European Union is on the euro, a common currency system. (The exceptions are Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, Sweden, and the United Kingdom.)

That means each country on the euro currency has limited ability to pursue an independent monetary policy. Accordingly, that means many countries will be linked together that largely have no business being linked due to very different economic situations.

Consider Germany and Greece in 2012. Greece was pegged to the euro and doesn’t have autonomy over its monetary policy. If it had stayed on the drachma it would have simply devalued its currency and spread its debt problems externally by paying back in depreciated currency. But being monetarily linked to everyone else in the EU, it didn’t have control over its situation and had to take the effects internally, with GDP decreasing some 40 percent. It will likely be 25 years before Greece gets back to its pre-2012 output economically (i.e., by the late 2030s).

This type of pegged structure makes Europe the most vulnerable of developed market economies. Individual countries lack the tools to combat their problems. Pegged currency systems become strained when they become divorced from the economic fundamentals and exchange rate breakups become more likely.

Broadly, there are five economic tests that determine whether having a common currency between countries is a good idea.

1. Economic structures and business cycles must be compatible with other members of the currency bloc

For example, Norway’s business cycle depends heavily on oil because it’s an oil-rich country. Switzerland, on the other hand, is not and necessarily has a different economy. Tying these two countries together on a common currency wouldn’t make a lot of sense based on this test alone.

Both countries have their own currencies and neither are part of the European Union. Both also have their own independent monetary policies accordingly.

2. Adoption of the common currency must be positive for individuals and firms investing in the country

Adopting a common currency requires an abdication of a country’s own interest rate policy.

Hypothetically, if the UK were to adopt the euro and come off the pound, investors would need to adjust to a new euro-based system and take into account what that might entail. The UK would no longer have control over its own interest rate policy and would need to adopt what’s called the “euro convergence criteria” which would place limitations on UK fiscal policy.

Constraints on UK fiscal spending could result in insufficient capacity to stimulate their economy and general loss of flexibility.

3. Would entering a currency bloc allow one sufficient flexibility to deal with both local and aggregate economic problems?

When a country has a lot of debt that it needs to sell to the rest of the world to finance current account and/or fiscal deficits – and this approaches levels with dubious sustainability (i.e., 40 percent or more of annual economic output) – they will naturally want a currency devaluation.

This creates debt relief because the liabilities they’re selling (other people’s assets), get paid back with depreciated money. If they are pegged to another currency, they have limitations in how they can go about this.

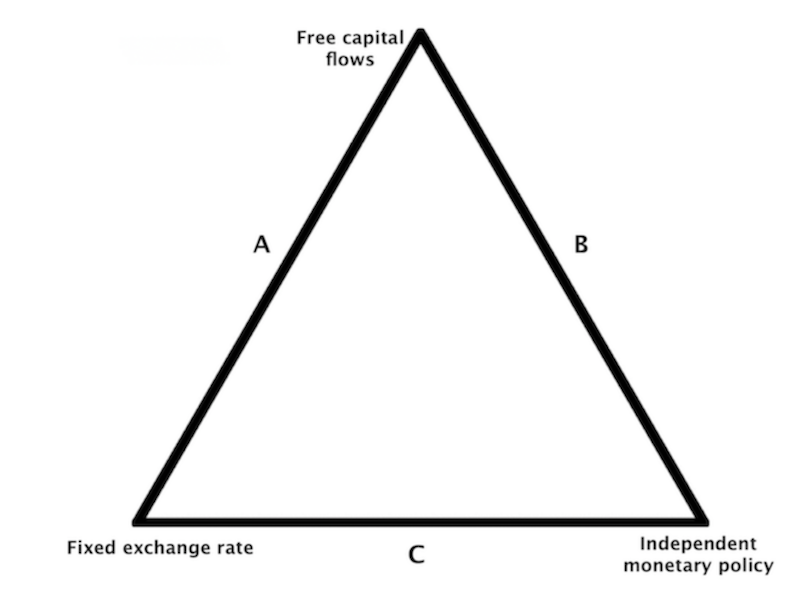

The classic trade-offs that come with foreign exchange management are commonly referred to as a “trilemma” or sometimes an “impossible trinity”.

This is graphically conceptualized below:

If a country is joining a currency bloc, they will need to be on either Side A or Side C given they’re essentially adopting a fixed exchange rate, which A and C have in common.

If on Side A, this means that they’ll have free capital flows. This comes at the trade-off of forgoing an independent monetary policy. In other words, their monetary policy will necessarily be linked with the rest of the currency bloc. So, latitude in the management of interest rates and money and credit creation is limited.

If on Side C, then it can run an independent monetary policy so long as it can sufficiently tie up its capital account. This means controlling the inflow and outflow of capital in the country. Naturally, conversions of assets from one currency into another will move the exchange rate.

The Bretton Woods system that ran from 1944 to 1971 was based a “Side C” type of format, where currencies were managed relative to each other and capital flows were small enough to the point where each country could broadly pursue an independent monetary policy.

4. Would its most important industries remain in a competitive position internationally?

For example, if a country is heavily export-based, would a currency switch imperil the ability for these industries (e.g., manufacturing, farming) to compete effectively? If converting to a “stronger” currency wherein its effective exchange rate would increase, this would make its goods and services more expensive internationally and therefore less competitive.

Likewise, if a country is heavily consumption based, which is normal for all large developed economies, having a stronger currency can actually be an advantage because the currency goes further internationally (i.e., can buy more imports).

5. Would becoming part of a currency bloc promote higher growth and economic stability?

Ultimately, capable people would need to go in and do the calculations to determine whether adopting a different currency would benefit the country through higher growth, more and better jobs, and greater economic stability.

Will the country have sufficient monetary policy and fiscal policy flexibility? Will adopting a common currency allow it to borrow more cheaply? Does pegging itself to the exchange rate benefit its particular circumstances, whether that’s as an export-based economy, consumption-based economy, and so on?

While the idea of a country like the UK converting to the euro has been discussed and analyzed many times in the past, satisfying all the conditions above-mentioned is difficult.

The Brexit situation would also be vastly more complex if the UK’s debt had been denominated in EUR instead of GBP. In turn, if a country like Italy were to ever leave the EU, though Italy is only about 75 percent of the size of the United Kingdom’s, the Italian debt situation and re-conversion to the lira would be complex because they would effectively have to default on their debt.