Yuan Depreciation a Tail Risk to Markets

The Trump administration recently upped the ante on tariffs with China, putting another 10% rate on $300 billion worth of goods. A general trading principle is that whenever one country imposes tariffs on another country with a floating exchange rate, that’s an adverse shock that will cause that country’s currency to fall. Whenever a new round of tariffs is announced on China, this causes the yuan (also known as the renminbi, CNY, or RMB) to fall relative to the USD. The yuan depreciation in June and July 2018 was in response to the $250 billion in tariffs levied by the US. The recent move pushed the yuan even lower.

The general math on the tariff related currency adjustment is the following:

– 10% tariffs on $300 billion worth of goods is $30 billion (multiplying the two together) in terms of the change in national accounting

– The US imports approximately $500 billion from China each year

– Dividing the two quantities, $500 billion / $30 billion, that comes to a currency adjustment of about 6%

When the tariffs were announced, the USD/CNY currency pair was trading at 6.88. A 6% adjustment would put that rate at around 7.29. The RMB is a managed currency, so it’s expected that the People’s Bank of China (known as the PBOC, their central bank) and the state banks who work in managing the economy will step in.

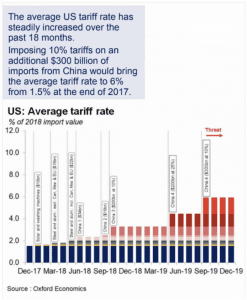

The effective tariff rate in the US is now 6%, up from 1.5% at the end of 2017.

Generally, countries have lower overall tariff rates as they develop, as they’re no longer inclined to protect domestic industry as they become competitive with the world.

Backstory Regarding China’s Economy

At the broadest level, China is going through four main things:

1. Economic restructuring

China is restructuring its economy away from the indebted industrial sectors that characterize its interior provinces and toward service- and tech-based sectors mostly situated on the country’s coastline.

As economies develop, the economic model tends to shift away from exports (of goods, services, and/or resources) and toward consumption. Over 60% of economic activity in developed markets tends to come in the form of consumption, which is the end and objective of all production in capitalist economies.

2. Restructuring its debt

As its economy heads toward its equilibrium growth rate (some 2% to 3% based on long-run sustainability in productivity and labor force growth), much of its debt will need to be refinanced.

When nominal interest rates on debt are higher than the nominal growth rates in the economy, that is unsustainable. The debt will compound faster than goods and services will be produced and sold for. That means it will need to refinance much of its debt, particularly in the corporate sector, and gradually ease monetary and fiscal policy to accommodate the slowdown.

3. Restructure its financial and capital markets

To attract foreign investment, its financial and capital markets will need to be more liquid and transparent.

This includes the PBOC regularly putting liquidity into its markets to ensure they’re properly functional. China’s higher growth rates relative to G-7 economies make its expected returns higher, but liquidity risks are much higher.

Moreover, more of their equities markets are owned by retail investors relative to the US, which makes the price action more momentum-like than what you see in the US.

Financial reporting also needs an overhaul, as discussed further in this article.

4. Manage its capital account

China needs to stem capital outflows to promote stability in the yuan. This will help to bring along its status as a global reserve currency, and help push capital toward productive domestic consumption and investment outlets rather than seeing it go offshore.

For a currency to have value it needs to be a reliable store-hold of wealth and widespread medium of exchange. The USD is the world’s top reserve currency because of its relative stability in value and its widespread use in foreign transactions. A volatile currency is less likely to be held by other central banks as reserves because they will have less clarity and faith in its value and ability to store wealth.

How much yuan depreciation can China’s economy handle?

It’s a difficult question to answer. In terms of the distributional effects, a yuan depreciation would help certain sectors of the economy, such as manufacturing and exporters. At the same time it would hurt others, such as the consumer because their currency wouldn’t go as far and imports would become effectively more expensive.

Because China is reorienting its economy toward internal consumption and trying to establish the yuan as a reserve currency, it favors seeing stability in the yuan. Under an export model, some decade-plus ago, they favored a weaker currency.

Keeping the yuan stable would help keep the financial account healthy by encouraging bonds inflows and discouraging residents from moving funds offshore.

China manages the yuan against what’s called the CFETS basket, which is a weighted mix of other currencies – i.e., USD, EUR, JPY, KRW, among many others.

It’s controlled within a range, also known as the CFETS band. When it hits the lower edge of the band, they intervene by selling reserves to buy CNY to keep it within. Their general behavior is to intervene, through the PBOC and state banks, whether it appreciates or depreciates by limiting the move.

What should China do with its currency?

They have a few options:

1. Defend the band

2. Adjust the band, to accommodate some depreciation and help erode the economic effects of the tariffs. This is China’s best option and preferable to selling US Treasuries, as the Fed has the ability to counteract any disruption to the Treasuries market by adjusting rates or through its own bond portfolio.

In countries where funding gaps cannot be ameliorated through devaluation they must do an “internal devaluation” or take the effects economically through a drop in national income. This is very painful economically, leading to high unemployment rates and a drop in GDP per capita. This generally occurs when debts are heavily denominated in a foreign currency or because they’re under a pegged currency regime (either to another currency or to something like gold).

What made the Greece situation so bad in 2012 was the fact that not only did they have a bad debt problem, but being part of the European Monetary Union, they were tied to the euro. Therefore, they couldn’t manage the debt situation in all the normal ways if they had monetary independence. Had they been on the drachma, they could have depreciated their currency and eased the debt burden through the rates and currency channels.

3. Free-float the yuan and let it go toward its fundamental value.

Option 1 is the easiest, but comes at the disadvantage of needing to absorb the brunt of the US tariffs economically. Letting the tariffs go through the currency channel minimizes the influence of the tariffs on their economy. It also requires using foreign reserves to buy up the yuan to support its value.

Options 2, letting the yuan depreciate in a managed way, helps partially offset the economic effect, but has a few downsides:

(1) When a currency is depreciating it invites further bets on depreciation, which makes managing the move down hard, so it eats up reserves.

(2) It could force even higher tariffs from the US and potentially other countries as well.

(3) It wouldn’t allow monetary policy autonomy and would still need to follow the Fed’s rate decisions to keep the yuan stable.

Option 3, a free-float, would give the advantage of offsetting the tariffs, untie the PBOC’s actions from the Fed, and save its reserves.

But it would invite further US tariffs. It would cut global growth.

It would hit China’s domestic consumer confidence and thus undermine itself to a degree. It would pull other Asian currencies down with it. Emerging markets with more dollar debt than China would suffer. So would Europe, given their dependence on China as a source of their exports, which would effectively increase in cost. It would dent confidence in China’s ability to manage its economy and reduce foreign inflows.

If I were them, I would lean more toward lowering the edge of the CFETS band as a one-time thing and hope that doesn’t trigger additional pressure. At the same time, additional fiscal and monetary stimulus would be appropriate to reinforce their financial system and broader economic management credibility.

When will the ‘trade war’ be resolved? Can it be resolved?

The current conflict between US and China is, I believe, a very serious long-term geopolitical confrontation that will run on for decades. While traders try to think about the “end game” the reality is that there is no short-term end game outside cosmetic agreements that resolve little to nothing.

The heart of the matter is not about balancing out global trade flows. Beyond a limited agreement – e.g., China buying more soybeans, natural gas and other goods it already buys already – it’s a fantasy that large-scale structural issues that would undermine China’s long-term strategic objectives are going to be accomplished with respect to intellectual property, forced technology transfer, government subsidies, market access, market competition, global spheres of influence, cyberespionage, and related sub-categories.

Either the US will consolidate as the main global superpower, or China will rise in economic and military influence and form a more bi-polar or multi-polar world and produce a pronounced bifurcation in the global economy. For example, both economies could have separate supply chains. There could be competition and disparities over who develops what technologies along with broader technological decoupling in other spheres.

It’s a broader power struggle between a dominant power and ascendant power that’s happened over and over throughout history. The standard way these conflicts develop going back centuries is following the standard template – first it becomes trade, then economic and capital-related, then geopolitical in most other ways. In the past 500 years where “power #2” came up to try to supplant “power #1” there was a shooting war in 12 of the 16 occasions.

China knows that this is about the US looking to ensure its continued global geopolitical and economic dominance. China has no incentive to agree to anything that structurally undermines its long-term strategic objectives; and if they do, they won’t follow through.

Too many traders perceive that it’s simply a Trump-driven matter where everything goes back to normal once a deal is signed or he’s out of office. That isn’t the case.