US Dollar Liquidity: What You Need to Know

US dollar liquidity refers to the amount of dollars available in the commercial banking system. The US Federal Reserve lends dollars to other central banks through swap lines, which the commercial banks in those other countries can use as a funding source.

Many traders believe the US dollar will decline in the coming months. Speculative positioning on the USD is now net short. The most common argument is that the Fed is an easing cycle, which will reduce interest rates, which means holding dollars no longer provides the interest income they once did, which makes holding them less desirable.

From a demand perspective that can make sense. But there’s a supply side to consider as well.

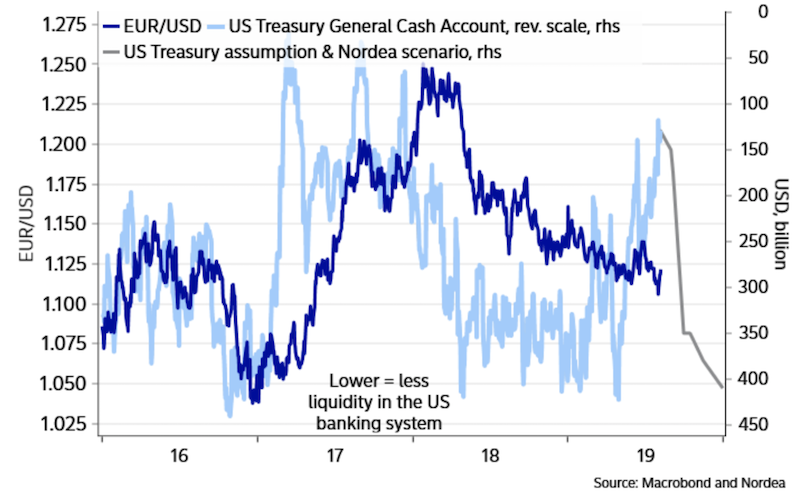

The US government recently suspended its debt ceiling, allowing the US to borrow so it can continue to pay its bills. If the debt ceiling had not been suspended, the US would have had to run down its general cash account (the GCA) at the Federal Reserve. This would have had the effect of pushing liquidity into the commercial banking system and increasing reserves. This is a form of quantitative easing. Quantitative easing is supportive of risk asset markets and negative for the dollar (because there’s an extra supply of them available).

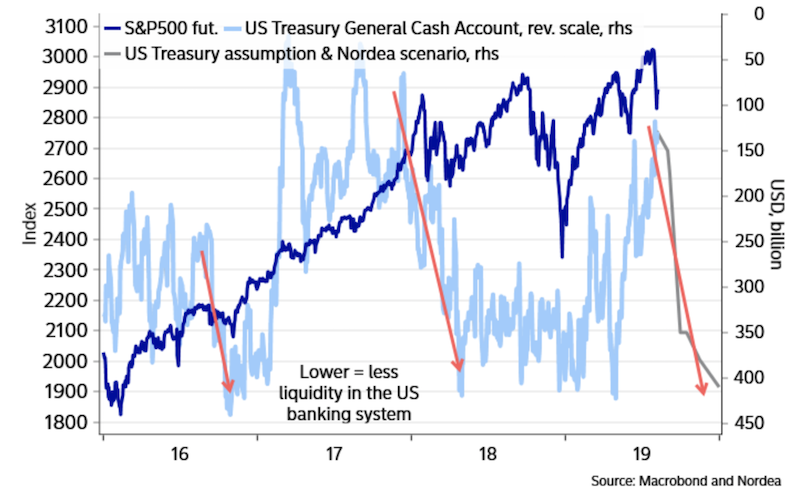

But instead of adding liquidity throughout the rest of the quarter, the US Treasury will remove liquidity from the commercial banking system. The US Treasury is looking to borrow around $430 billion in the current quarter. This is about $275 billion more than what was previously announced, a form of quantitative tightening. This is not supportive of risk asset markets and is positive for the dollar (i.e., a lower supply of them).

The graph below shows the relationship between the EUR/USD currency pair and the Treasury general cash account.

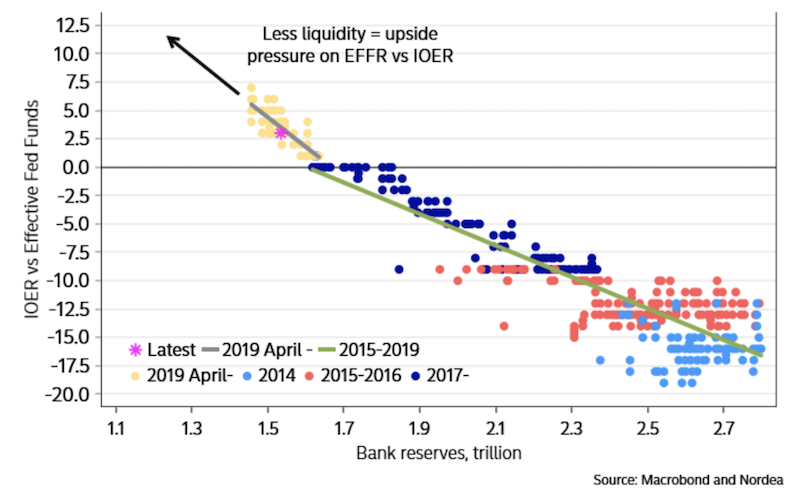

The rebuilding of the GCA has effects on other asset markets. Namely, this means more tightening in the repo market – the cost of short-term borrowing goes up. The effective federal funds rate (EFFR) is likely to increase slightly. The Libor-OIS spread is also likely to increase.

In the chart below, we can see how lower bank reserves increases pressure on short-term interest rates like the fed funds rate. This inherently has to do with dollar scarcity.

It is negative for risk sentiment – e.g., credit, equities, and emerging market currencies who depend on external financing for their current account deficits. Some of this risk is mitigated by the fact that US interest rates – particularly real (inflation-adjusted) rates – are declining to limit the effect of the risks from tighter US dollar liquidity.

When the Treasury replenished the GCA in late 2016 and early 2018, we saw volatility in stocks.

Lower dollar availability could also worsen risk appetite if non-US financial institutions struggle to satisfy their regulatory-mandated need for US cash and bond assets. In this event, banks would need to deleverage, or sell assets in exchange for US dollars.

The combination of fewer bank reserves and larger borrowing by the US federal government to cover its growing fiscal deficit has led some to bet on a widening Libor-OIS spread or a higher EFFR. This increases the likelihood that the Fed will make small tweaks to the IOER rate going forward. The Fed could also move to restart asset purchases or implement the standing repo facility that’s been discussed internally to increase US dollar liquidity.

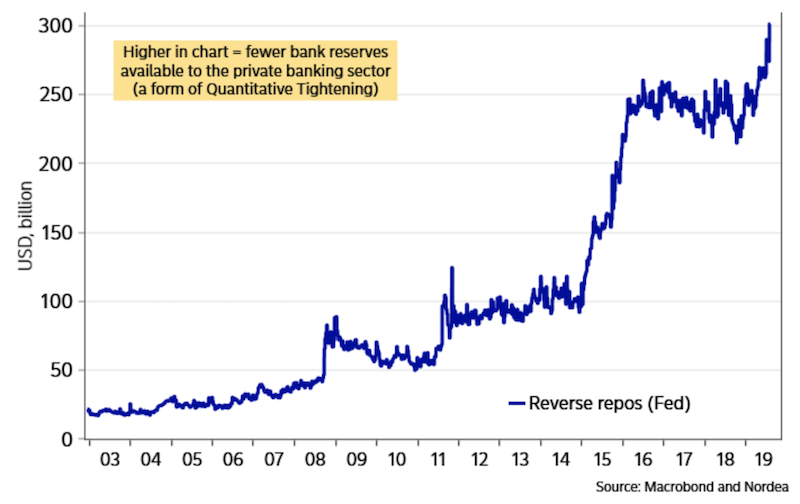

Moreover, foreign central banks and other official accounts can use a reverse repo program with the Federal Reserve. When the reverse repo program is utilized, the amount of bank reserves available to financial institutions shrinks. Since October 2018, this reverse repo pool has grown from $215 billion to more than $300 billion. The has reduced USD liquidity by about $85 billion, another form of quantitative tightening.

The growth in this reverse repo pool may also reflect the US yield curve’s flattening as foreign official accounts reduce exposure to US Treasury bonds in favor of the repo pool. This pays right around the fed funds rate and is very liquid. Accordingly, when the yield curve flattens, this reduces demand for US Treasuries, given they no longer pay as well relative to cash. So, this increases demand for the foreign repo pool, reducing US dollar liquidity in the process.

Takeaway

Despite declining rates in the US and longer-term structural issues – e.g., current account deficit, fiscal deficit, large non-debt liabilities (pensions, healthcare) that are 11x GDP (depending on the discount rate used) – the ongoing shrinkage in US dollar liquidity is likely to keep the USD stronger for longer.