The USD Remains Strong (But For How Long?)

Despite the US Federal Reserve’s large-scale “printing” of money to combat the economic fallout from the virus, the USD is remaining fairly strong. Though still 20 percent lower than its 2002 high (then the highest since the 1985 Plaza Accord), the USD remains near its highest point in nearly twenty years.

(Source: Trading View)

The coronavirus crisis and the resulting drops in income resulted in widespread needs for USD liquidity globally, which has created a dollar short squeeze.

The Fed has taken actions to ensure everyone that needs US dollars has access to them, which has helped calm financial markets.

But after the coronavirus effects pass over and economies and markets are in permanent recovery, it’s expected that the USD will weaken against most other major currencies.

How will the USD weaken?

Eventually, the US dollar will weaken through either one of two ways:

a) the dollar will depreciate when either enough money has been created by the Fed to meet demand for it, and/or

b) debt restructurings and bankruptcies will reduce the need for US dollars because the debt’s been defaulted on, reducing the need for money to cover it.

The two main sources of USD liquidity internationally

There are two main sources of US dollar liquidity for international market participants.

i) First is the Federal Reserve, through such measures like swap lines. It has done everything possible to provide US dollars to the international markets that need them.

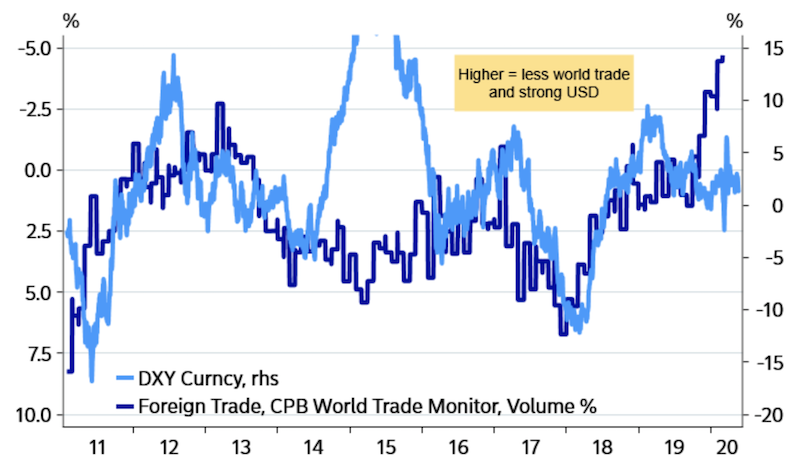

ii) Second is global trade, of which about 60 percent is conducted in US dollars. Global trade activity remains very low. Many countries have closed borders and regulated some forms of international shipments to control the spread of the virus. This means fewer US dollars are circulating around the global financial system and they’re not getting to where they need to go.

A rebound in global trade will be a key component to getting USD liquidity to where it needs to. This will reduce the shortage and likely cause the USD to weaken materially against developed market European currencies in particular.

An exception could be the British pound (GBP). The GBP is sensitive to financial and banking activities, and has work to do in forging a future trade agreement with the EU. Similar to the Brexit headline risk the pound suffered from 2016 to early-2020, it will face trade agreement deadline risk going forward.

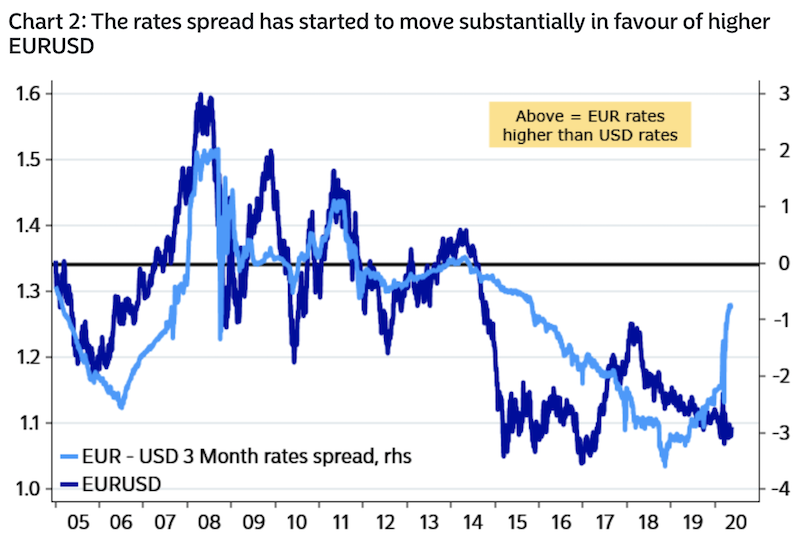

(Source: Nordea and Macrobond)

(Source: Nordea and Macrobond)

Interest rate factors in FX trading

In currency trading, if the real (i.e., inflation-adjusted) interest rate of one currency increases relative to another currency, it will appreciate, holding all else equal. Investors seek out higher returns, holding risk constant.

The interest rate spreads between USD and EUR have moved considerably in favor of the EUR since the coronavirus situation began. This is due to the fact that the Federal Reserve was the only one of the main G3 central banks (along with the ECB and Bank of Japan) that had the capacity to cut short-term interest rates.

With the Fed cutting its benchmark short-term lending rate from around 150bps, this has put the USD rate on par with that of other central banks.

Additionally, USD hedging costs are much lower than they have been in recent years, which is likely to spur interest in selling US dollars as hedging costs pick up.