How to (Tactfully) Bet Against the Consensus

The difficult thing about doing well in the markets is that it’s not whether results turn out “good” or “bad” for a particular asset or asset class but how things turn out relative to what’s already discounted in the price. The range of information that it unknown is going to be far greater than whatever it is that you are aware of relative to what’s already priced in. To do well, you need to bet against the consensus and be right, but you need to bet against the consensus in a tactful way.

Picking what’s likely to be good and what’s likely to be bad isn’t the hard part. For example, in Premier League football, you can predict with pretty strong certainty that Manchester City is likely to finish ahead of Aston Villa in the table.

However, that’s already a consensus viewpoint priced into betting markets. The respective odds of those two clubs winning the EPL are already well reflected into the price of those bets.

It’s not a straightforward decision whether it’s smarter to bet on Manchester City at -185 (i.e., bet $185 to win $100) or Aston Villa at +100000 (i.e., bet $100 to win $100,000). Manchester City is already viewed as 1,850x more likely to win the EPL than Aston Villa.

One might think that betting on Manchester City is the easy answer because it’s simply so much more probable and therefore far more likely that you’ll make money.

But if you’re right – and that’s not a guarantee – you make only $54 off a $100 bet, only a little more than half your initial bet. On the other hand, if you take the flyer on Aston Villa, that $100 will turn into $100,000 or 1,000x your initial bet.

The point being:

The expected value of each bet – namely, the reward multiplied by the probability of being right minus the penalty multiplied by the probability of being wrong – is approximately the same between each. Accordingly, this makes them roughly equally good or equally bad bets.

The way you make money is by having a unique insight where you deem the market odds are too high or low relative to what’s priced in, and being correct when expressing this opinion. Moreover, the act of betting itself can or will change the odds, as odds are simply the dollar-weighted average opinion of all market participants.

Once you understand the concept of expected value, you will know that it’s not always the best idea to bet on something simply because it’s the most probable.

Betting on one or the other is equally good or bad because of the reward relative to the risk (assuming you can cover the loss). Getting the relative probabilities right over time and managing risk properly is how you do well in various games – whether its sports betting, poker, the financial markets, among other “betting competitions” that need to be strategized off the basis of probabilistic outcomes.

The concept of expected value was covered in more detail in this article.

Concept applied to financial markets

In the financial markets, it’s also important to understand what everybody else thinks. How do you do this? There are futures and options markets that will outright tell you. Some broker-dealers, such as Interactive Brokers, have such features integrated into their platforms.

These instruments provide insight into what the mean-weighted average opinion on price will be (futures). Moreover, they will tell you what the relative probabilities are of the security or asset closing above or below certain prices by a certain point in the future (options).

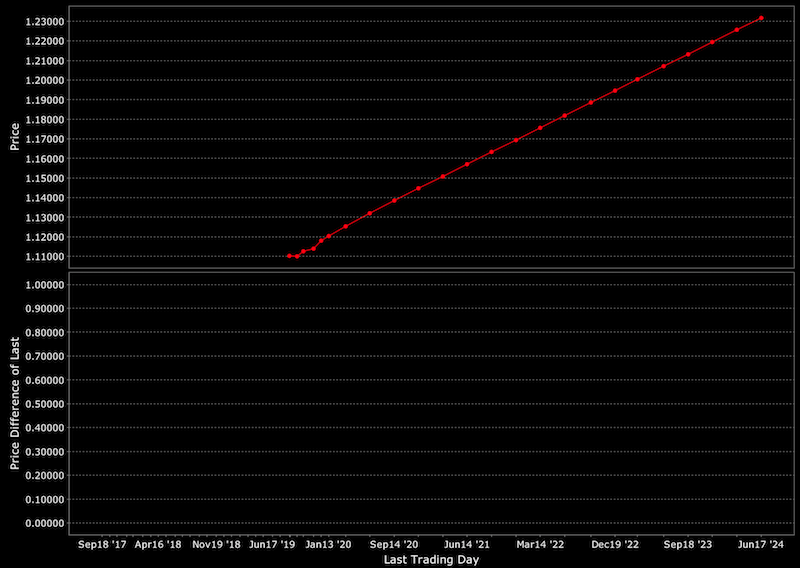

Below is an example of a futures curve of the EUR/USD currency pair, showing the euro priced to appreciate against the US dollar in the years going forward.

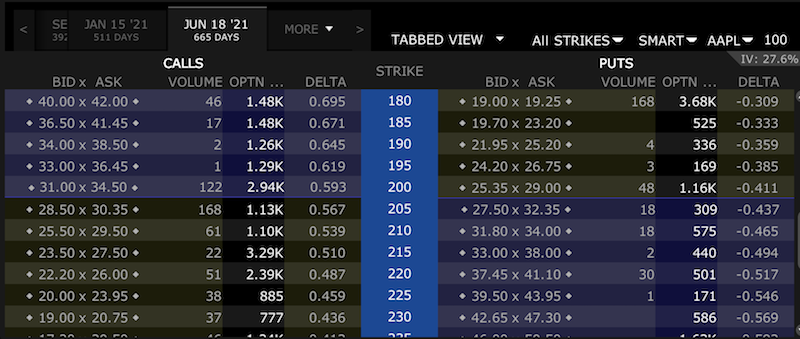

Options chains can back out relative probabilities of where price will be by when.

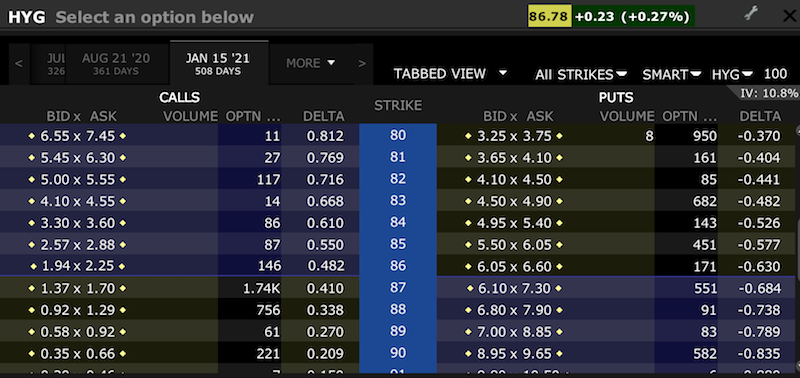

Note that certain assets will appear to be skewed in one particular direction or another, but this can simply reflect the presence of a dividend. High-yield bonds (below represented by the ETF HYG) are one example.

The puts are much more expensive because they effectively integrate the dividend. If you short the security outright, you will need to pay the dividend. This cost is built into the put options, or the underlying derivative contract that models shorting the security.

When everybody else thinks the same thing – e.g., futures curve slanted in a steep direction or the cost of call options being high or low relative to puts – that shows what can be broadly labeled the “consensus”.

When there is concern about the global economy, US Treasuries, gold, and other safe haven assets such as yen, the Swiss franc, and German bunds have high demand. The prices of the calls end up being more expensive than the puts when looking at, for example, strike prices equidistant from the prevailing spot prices.

How to bet against the consensus?

To do well in the markets you need to be an independent thinker. You need to be aware of herding behavior and avoid that. Traders will tend to extrapolate the past and overemphasize asset classes that have done well in the very recent past.

Once there’s a strong consensus in a certain trade, this causes forward curves to adjust, options to get more expensive or less expensive on a certain side (or both or neither side depending on relative volatility), and prices to rise.

Sometimes when everybody crowds on the same side of the boat it can flip and lead to reactions in the opposite direction. It’s prudent to be on the lookout for opportunities to take the other side of the consensus in a cheap way. You might even take a position that’s not your core belief or against what you think is most likely to happen. Having cheap hedges and cheap gamma is not a bad thing.

(Note: Gamma is the rate of change of an option’s delta, which is the rate of change of an option’s price relative to the underlying. To simplify things, when one is “long gamma”, they own options. When they are “short gamma”, they are short options. Only in rare cases is this not true, such as in certain securities that are tied to mortgage refinancing activity.

But broadly speaking, long gamma refers to the idea that a trader is long options, or has limited downside but high or theoretically unlimited upside. Short gamma refers to the notion that a trader is short options, or has limited upside but high or theoretically unlimited downside.)

Gold and US Treasuries gamma was cheap to very cheap for most of 2019. But once the market picked up on the idea that the US-China trade and broader geopolitical tensions would be longer lasting and more serious than most anticipated and that slowing global growth would cause central banks to become more dovish, the risk/reward doesn’t look as attractive.

Now everyone is broadly in consensus that having safe haven exposure is a good thing. The last few months were one of those rare opportunities where cheap gamma and a consequent big move led to large gains that don’t happen very often.

Now the gamma skew on the long bonds is very high on the calls associated with gold and US Treasuries.

Example

UB refers to the ultra-long bond, the futures equivalent of about a 26-year Treasury.

– Current UB price = 195’00

– UB Dec ’19 220 Call = 38/64

– UB Dec ’19 170 Put = 3/64

The strikes are equidistant from each other relative to the current price.

In other words, you pay approximately 13x more for the ~13% out-of-the-money (OTM) calls than ~13% OTM puts. And that divergence steepens in a non-linear way the further you get OTM.

You see the same thing, but to a lesser extent, on ZB, or the equivalent of a 17-year Treasury.

For 10% OTM on Dec ’19 GC (gold) you pay 4x-5x as much for the calls as you do the puts.

Another example

– Dec ‘19 gold is priced at $1538.

– Dec ’19 GC 1700 Call = $1,060 per unit

– Dec ’19 GC 1450 Put = $1,060 per unit

The call is 10%-11% OTM while the put is 5%-6% OTM. Yet they are the same price.

Part of this is consensus driven with the higher demand for safe haven assets. Part of it is a natural structural effect of the gold market. Gold is a structurally contango market – upward sloping futures curve – as a durable commodity that requires costs to store it. Therefore, traders typically demand a higher price in the future relative to the present.

Takeaway from these examples

In other words, even if it’s something you don’t necessarily believe in, sometimes the crowding becomes so great on one side that it can make sense to do the opposite in terms of risk versus reward.

Moreover, it’s important not to underestimate the value of hedges. This is particularly true when they can be obtained in a cost-effective way. Most traders have portfolios that are skewed so heavily in a certain way – i.e., typically being leveraged to be uniformly long equities – that they have a substantial amount of risk toward a particular environment playing out in the world. (Namely, in the case of being long equities, that growth will be above expectation within the context of a favorable interest rate environment.)

Hedges are not only valuable for protection, but it can effectively buy collateral and allow the trader to take more risk in the places that have positive expected returns. Some view hedges as having only negative expected value and are hence a “waste of money”. This isn’t always true, as they help protect capital, lower the volatility of the portfolio, and free up capital so you can take risk elsewhere in positive expected value opportunities.

If you are wrong on some of your positions – and it’s inevitable that you will be – having cheap hedges in place can more than pay for themselves, and even more than compensate for being wrong in your core position. Sometimes when there’s a major move in a market – e.g., the recent up move in US Treasuries, bunds, and gold – the OTM puts can get so cheap that whenever there’s a minor move back down these options will see their values get bid up by several multiples.

For example, in the UB Dec ’19 170 put example above, the option is priced at 3/64 (equivalent to about $47) because reaching that level is a very low probability outcome. (UB was last at 170 three months ago.) However, any move back in the other direction is likely to increase the value of those puts and can potentially pay off the initial outlay you spent on the hedge. That gives the option of liquidating some to take profit while keeping some as a hedge against your core positions.

The most important thing

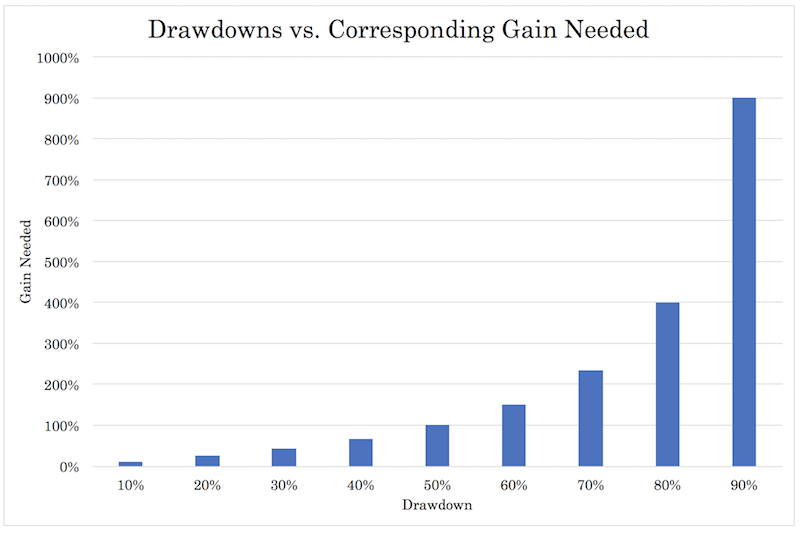

The most important thing to understand is that traders should strive to have balance in their portfolios. If you drawdown 50%, you need a 100% gain in order to catch back up. And that increases in a steepening, non-linear way.

The more you drawdown, the harder it is to climb back out of the hole. At various points, it’s almost impossible to recover from a drawdown and would essentially require a recapitalization, or basically starting over again. Drawdowns of any material size absolutely need to be avoided at all costs.