Deriv Review 2025

Awards

- Best Trading App 2025 - DayTrading.com

- Most Trusted Broker 2024 - Ultimate Fintech Global Awards

- Best Trading Experience LATAM 2024 - Ultimate Fintech Global Awards

- Best LATAM Region Broker 2024 - Ultimate Fintech Global Awards

- Best Customer Service 2024 - Global Forex Awards

Pros

- Account funding is a breeze with a very low minimum deposit of $5 and a huge selection of payment options, plus Tether was added to the cashier in 2023.

- Deriv stands out with its innovative products, from multipliers and derived indices to its addition of accumulator options, providing exclusive short-term trading opportunities.

- Deriv revamped its app in 2025, now sporting a slicker interface alongside improved position management and streamlined contract details for smarter mobile trading, earning it DayTrading.com's 'Best Trading App' award.

Cons

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

- Apart from the MFSA in the EU, Deriv lacks top-tier regulatory credentials, reducing the level of safeguards like access to investor compensation.

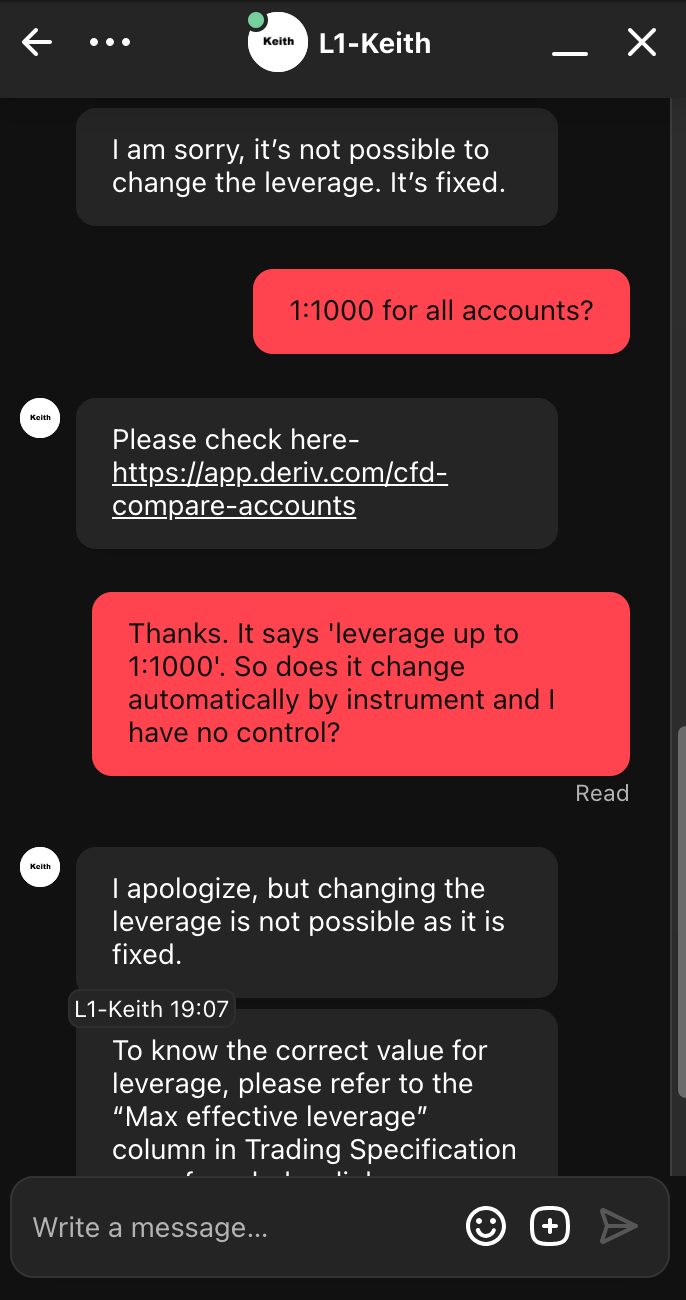

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

Deriv Review

This review of Deriv.com evaluates the day trading experience, drawing on the multiple rounds of personal tests we’ve been conducting since 2017.

Regulation & Trust

3.5 / 5Pros

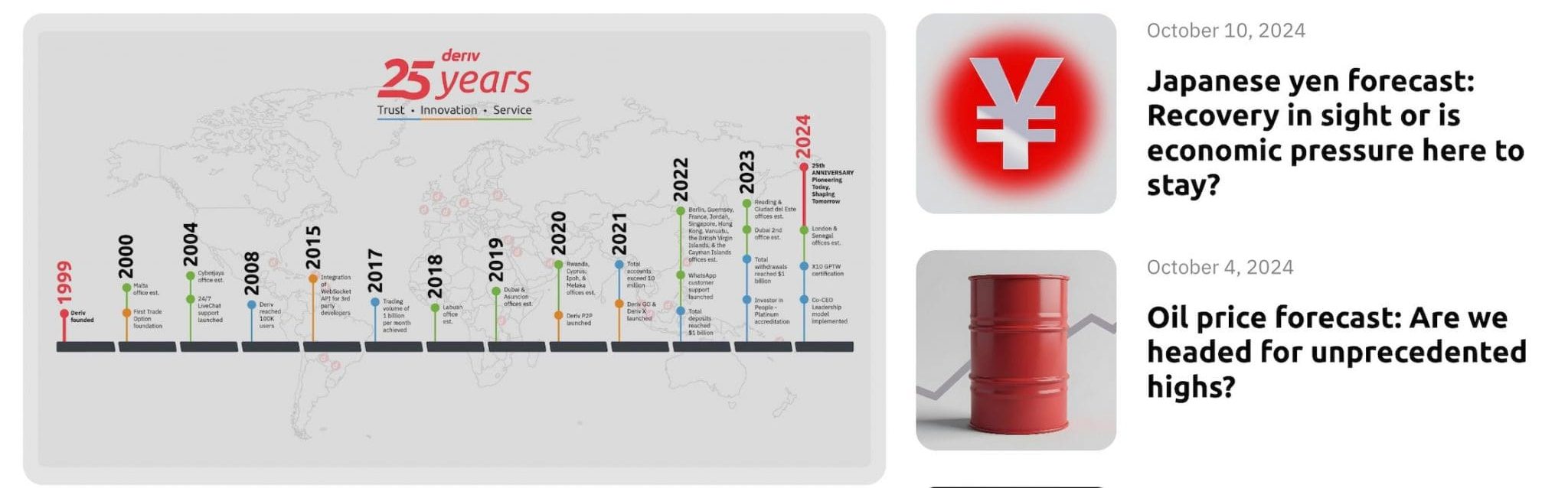

- Longstanding presence since 1999, serving over 2.5 million traders worldwide.

- Well-regulated for EU clients with negative balance protection.

- Multi-jurisdictional regulatory approach is suited for global accessibility.

Cons

- Lacks regulation from top-tier authorities like FCA or ASIC.

- Traders have limited coverage under investor protection schemes.

- Offshore regulation may offer global traders limited recourse in disputes.

Deriv.com earns a reasonable trust score. On the one hand, it’s got over two decades of industry clout, picked up multiple awards in 2025 alone, while it launched Deriv Prime in 2023, strengthening its institutional liquidity offering.

But on the other, the broker has only secured authorization from one ‘green tier’ body (MFSA) in DayTrading.com’s Regulation & Trust Rating, limiting the level of investor safeguards for retail traders outside of the European Union.

When you consider these factors alongside the fact it’s not listed on a public stock exchange, Deriv can’t rival the most regulated brokers, such as IG and XTB.

You can open an account with one of these six entities, depending on your location and preferred instruments:

- Deriv Investments (Europe) Ltd is licensed by the Malta Financial Services Authority (MFSA). ‘Green tier’.

- Deriv (FX) Ltd is licensed by the Labuan Financial Services Authority (LFSA). ‘Orange tier’.

- Deriv (BVI) Ltd is licensed by the British Virgin Islands Financial Services Commission (BVIFSC). ‘Red tier’.

- Deriv (V) Ltd is licensed by the Vanuatu Financial Services Commission (VFSC). ‘Red tier’.

- Deriv (Mauritius) Ltd is licensed by the Financial Services Commission, Mauritius (FSC). ‘Red tier’.

- Deriv (SVG) LLC is an unregulated entity incorporated in St. Vincent and the Grenadines (SVGFSA). ‘Red tier’.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA | FINMA, JFSA, FCMC | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4 / 5Pros

- Terrific choice of account types suits both novice and experienced traders.

- Wide range of deposit options with Tether added to Deriv Cashier in 2023.

- Smooth account opening with social logins taking <24 hours.

Cons

- The vast number of accounts may confuse many new clients.

- Deposit and withdrawal options vary by region.

- Leverage is fixed for all accounts.

Live Accounts

Deriv provides various account types depending on whether you want to trade options or CFDs:

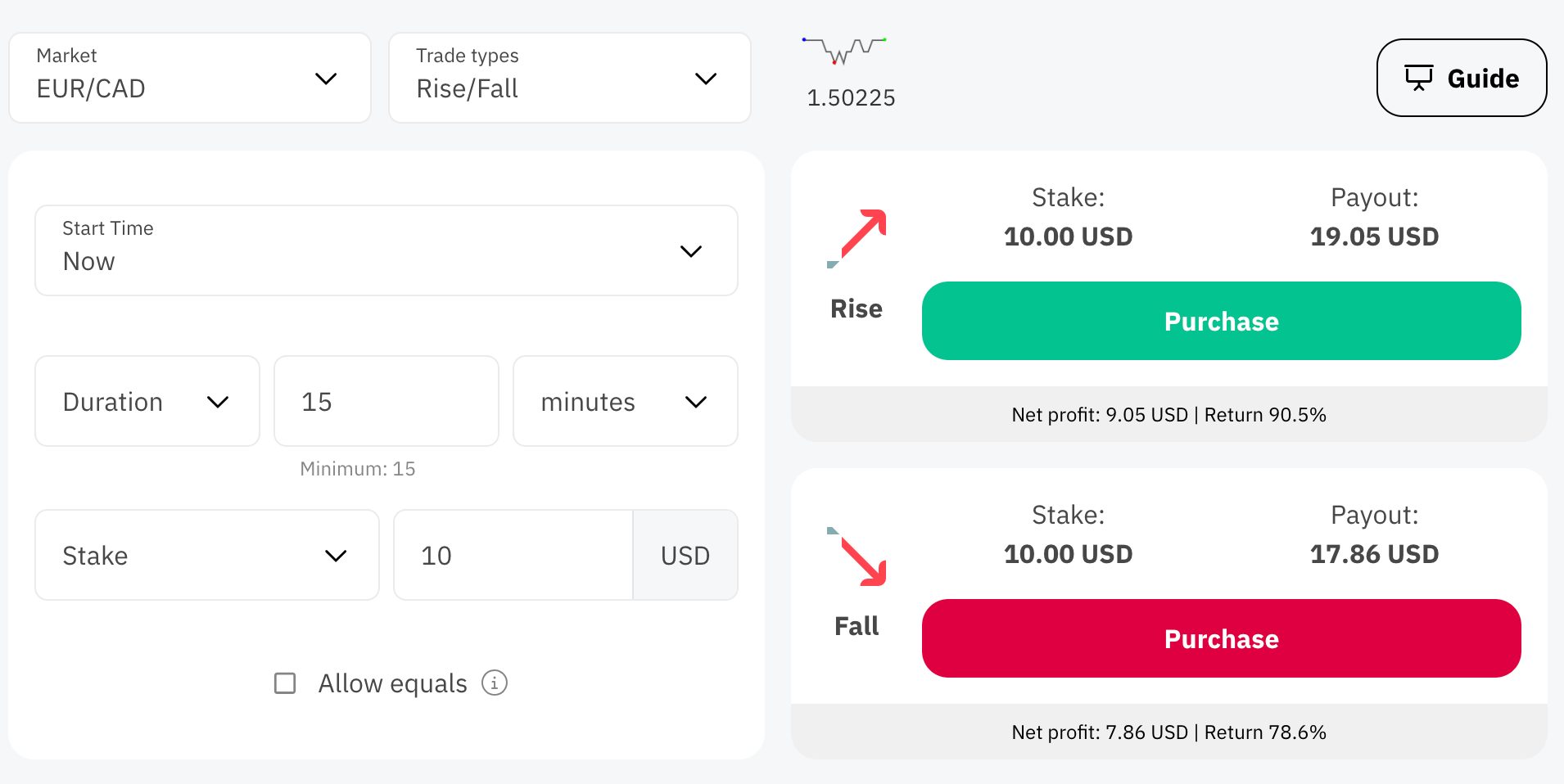

- Deriv Trader: Suitable for trading options and multipliers. With a simple interface, you can access various assets, including forex, commodities, and indices. There’s a minimum stake of $0.50 and potential payouts of over 200%.

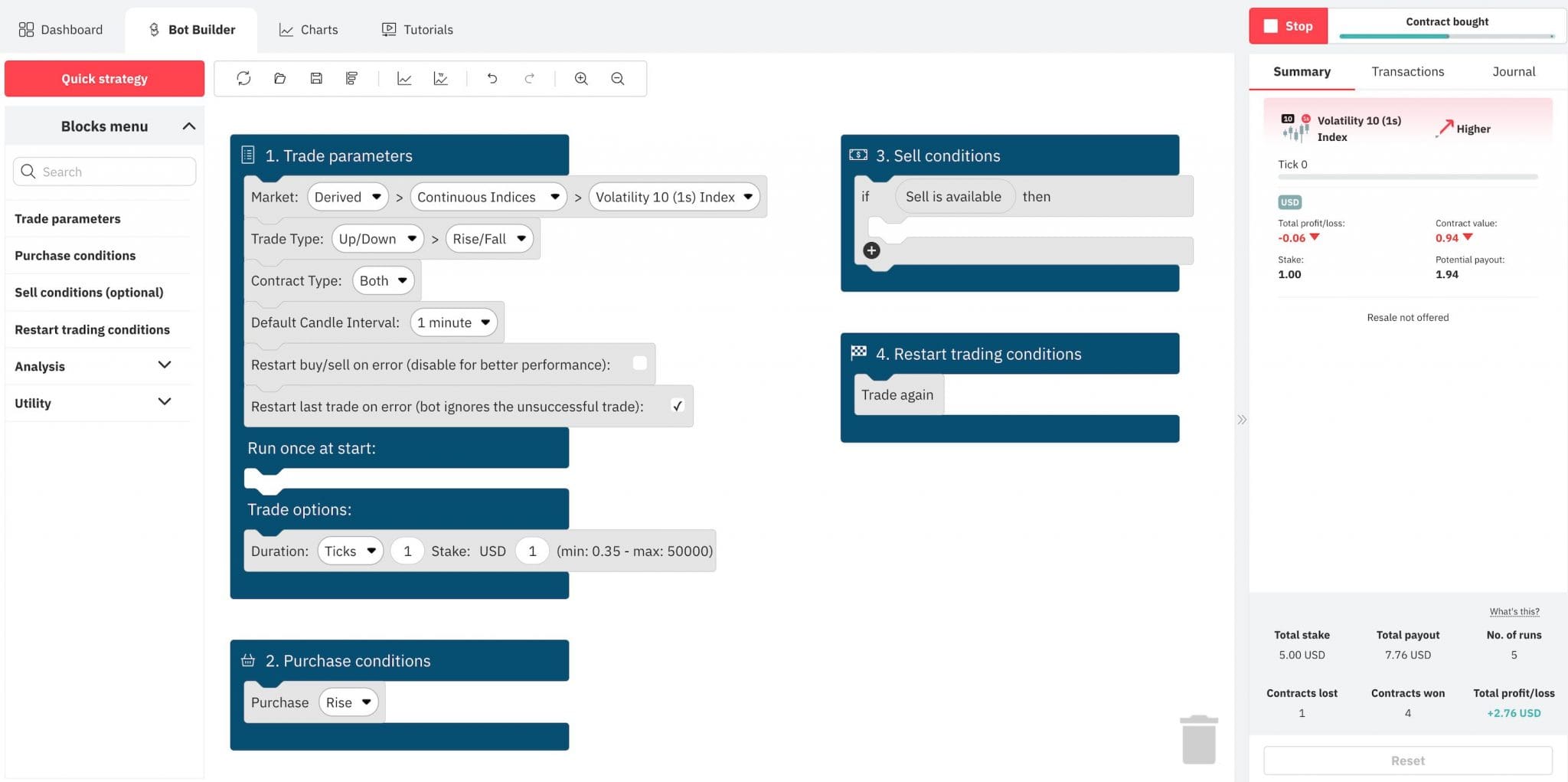

- Deriv Bot: Allows you to create and deploy trading bots for automated trading strategies. It is designed for traders who prefer algorithmic trading and want to automate their trading processes without needing extensive coding knowledge.

- SmartTrader: A legacy options trading platform with similar features to Deriv Trader.

- Deriv Go: A mobile app (iOS and Android) for trading multipliers and accumulators, released in 2021 to reflect the growing trend towards on-the-go trading.

- Deriv MT5: MetaTrader 5 traders have a choice of five account types. ‘Standard’ is the most popular and includes all instruments, fixed leverage, and spreads from 0.1 pips. ‘Financial’ reduces the number of instruments and increases spreads from 0.2 pips. ‘Swap-Free’ doesn’t charge overnight fees but increases swaps from 0.3 pips. ‘Zero Spread’ reduces spreads to 0 pips on many instruments but removes stocks and ETFs.

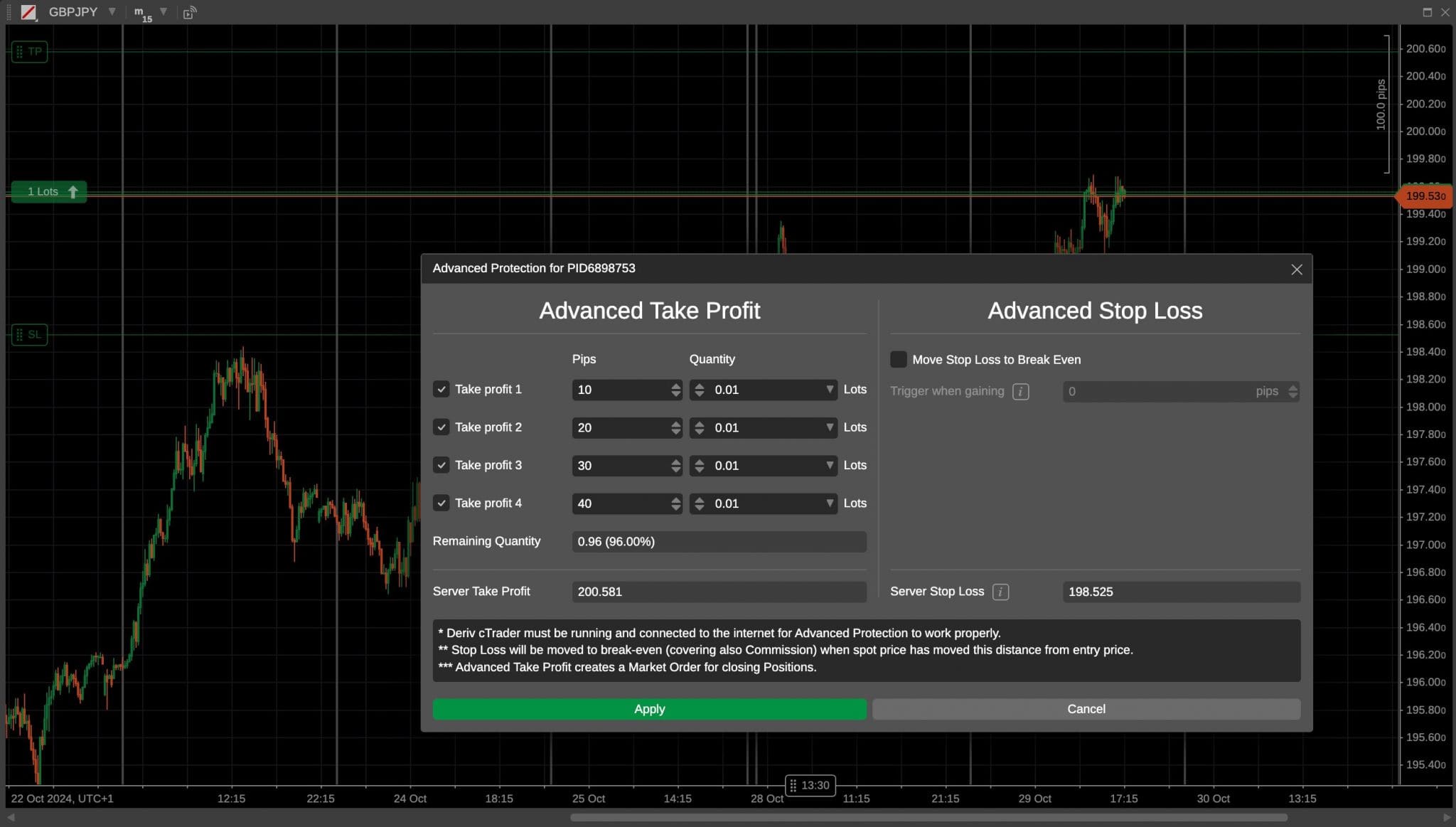

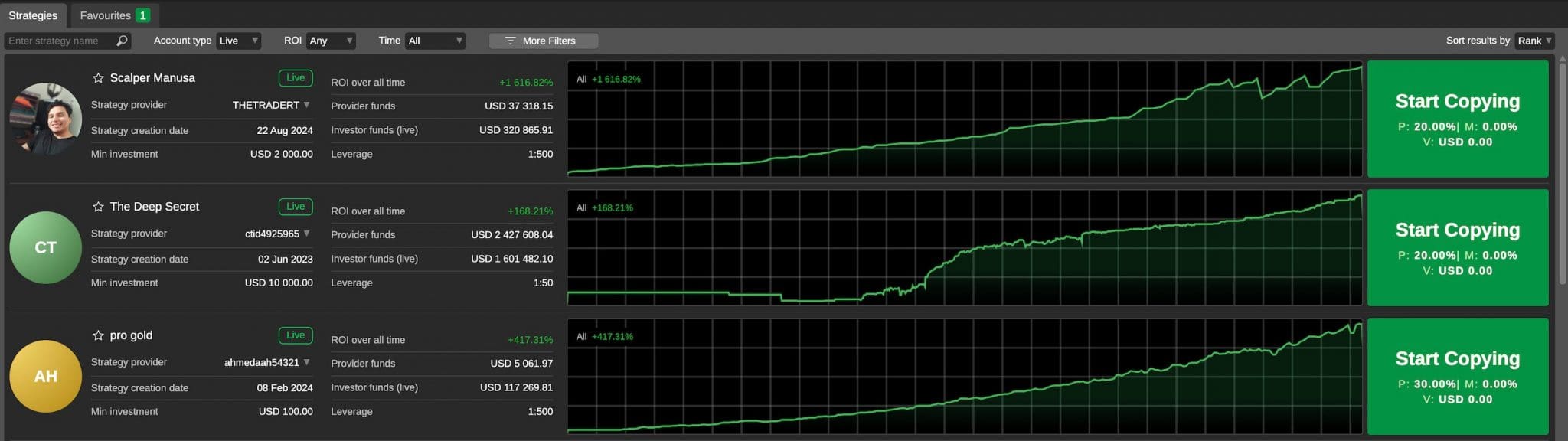

- Deriv cTrader: An account specifically for trading CFDs using the cTrader platform. All instruments are available, leverage is fixed, and spreads start from 0.5 pips. cTrader Copy is also supported for automatically copying the trades of other traders.

- Deriv X: An account specifically for trading CFDs with TradingView integration added in 2023. All instruments are available, leverage is fixed, and spreads start from 0.5 pips.

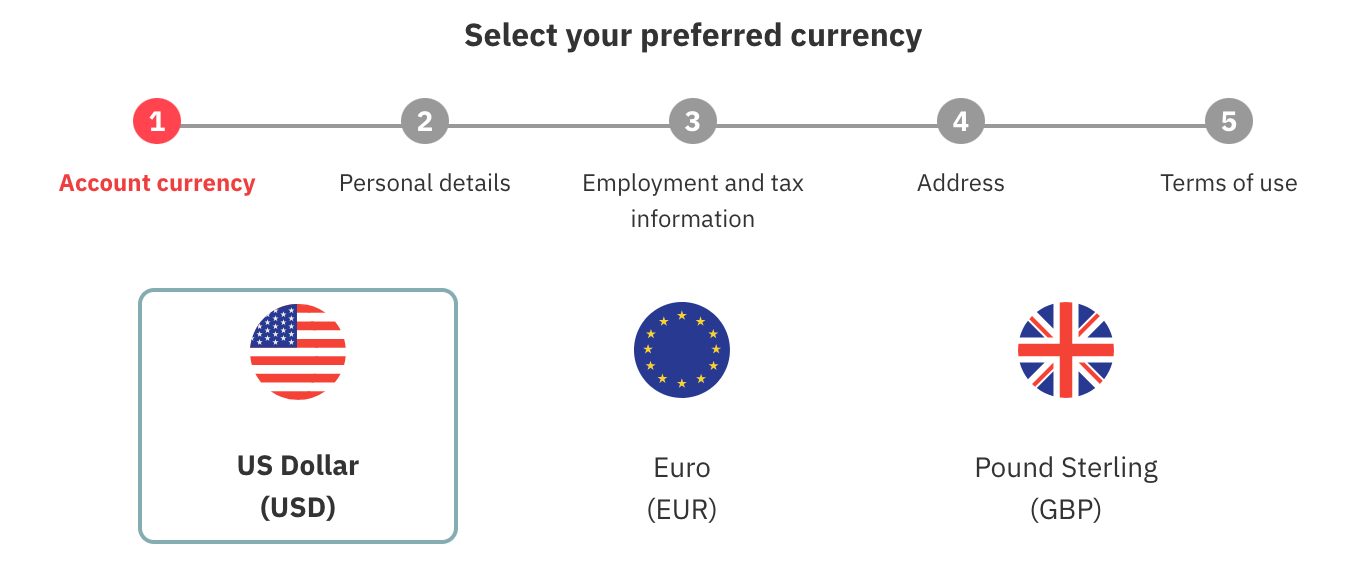

To open a live account, I first registered using my email address and a password. My email address had to be verified before I could proceed. I appreciated the convenience of social login options (Google, Facebook, or Apple).

Email verification was required to proceed, but phone number verification was not mandatory. I then uploaded the necessary Proof of Identity (POI) and Proof of Residence (POR) documents to complete verification.

The approval process was efficient, taking less than 24 hours. There’s support for two-factor authentication (2FA), but I had to activate it manually.

I could select an account type that aligned with my trading preferences but was left incredulous by being unable to alter leverage, which is fixed between 1:30 and 1:1000 depending on your region and the instrument you are trading.

Demo Accounts

Unlike many brokers that restrict demo accounts to specific platforms or account types, Deriv.com provides demo accounts for all its platforms, allowing you to experiment with various trading tools and assets without financial risk.

Creating a demo account is straightforward. Upon account creation, you’ll be provided with a $10,000 virtual balance. This balance can be modified to suit your practice needs, whether you prefer a smaller or larger starting amount.

Deposits & Withdrawals

Deriv offers many deposit and withdrawal options for different trader preferences and regions. For deposits, you can fund your GBP, USD, or EUR base accounts using major credit and debit cards, such as Visa/Mastercard/Maestro/Diners Club, which provide an instant and convenient option.

E-wallets like Perfect Money, Skrill, and Neteller are also available, allowing quick transactions. Additionally, direct bank transfers can be used, although they may take longer to process compared to other methods.

In certain jurisdictions, Deriv accepts deposits in cryptocurrencies like Bitcoin (BTC) and Tether (USDT), catering to the growing demand for digital currency transactions.

Regarding withdrawals, Deriv lets you transfer funds back using the same methods used for deposits, maintaining convenience. E-wallets again provide a faster withdrawal option, often processed within minutes. You can also withdraw funds via direct bank transfer, which may take several days to complete.

Like many brokers, Deriv typically does not charge deposit fees, but withdrawal fees may apply based on the chosen method and regional regulations.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Airtel, Airtm, AstroPay, Banxa, Bitcoin Payments, Boleto, Credit Card, Diners Club, FasaPay, JCB Card, JetonCash, M-Pesa, Maestro, Mastercard, Neteller, Paysafecard, Paytrust, Perfect Money, PIX Payment, Przelewy24, Skrill, Sticpay, Trustly, Visa, Volet, WebMoney, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | Bitcoin Payments, Credit Card, Ethereum Payments, Mastercard, Neteller, Perfect Money, Skrill, Visa |

| Minimum Deposit | $5 | $100 | $250 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

4.8 / 5Pros

- The industry leader in synthetic indices allowing 24/7 trading outside traditional market hours.

- Multipliers offer leveraged trading with capped risk, providing an alternative to CFDs.

- Accumulator options added in 2024, providing a flexible way to trade within specific price ranges.

Cons

- Derived indices are proprietary, so they lack the transparency of real-world market assets.

- The range of stocks and commodities is limited compared to category leaders like Blackbull.

- Options are binary, which may not suit traders looking for traditional options.

Deriv offers a relatively small but growing array of 100+ instruments across global markets.

The platform provides access to CFDs on 40+ forex pairs (e.g., EUR/USD and GBP/USD), 10+ major stock indices (e.g., Dow Jones and DAX), 60+ US and EU stocks (e.g., Tesla and BMW), 10+ commodities (e.g., WTI Oil, Gold and Silver), 40+ cryptocurrencies (e.g. Bitcoin and Ethereum), 30+ US ETFs (e.g. DIA and GLD), and its signature synthetic indices.

While many brokers offer a similar selection of CFDs, Deriv stands out with its custom derived indices and its Multi Step Indices iteration and Tactical Indices added in 2024. These indices are powered by a secure random number generator and mimic real market volatility without being influenced by actual market events.

Unlike standard indices, synthetic indices are available 24/7, making them suitable for traders who want continuous trading opportunities outside traditional market hours.

Deriv also caters to more advanced trading strategies by offering options and multipliers. Options allow you to profit from predicting asset price movements without owning the asset, a common feature among brokers like Interactive Brokers.

There are also accumulator options, particularly suitable for short-term traders who aim to profit within specific price ranges on volatility indices. This feature is not widely available across other trading platforms.

Additionally, Deriv’s multipliers function similarly to margin trading by leveraging your positions, increasing both profit potential and risk. However, unlike traditional leverage, Deriv’s multipliers cap potential losses to the amount initially invested, providing a risk-limiting advantage over typical leveraged CFD trading on platforms like Plus500.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:1000 | 1:200 | 1:500 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.3 / 5Pros

- Tighter forex spreads since 2021 reduction.

- No deposit fees helps keep non-trading costs down.

- Swap-free trading on specific instruments (MT5 only).

Cons

- $25 inactivity fee kicks in after 12 months.

- Spreads are uncompetitive for less liquid instruments.

- Floating spreads can widen a lot during trading sessions based on tests.

Deriv’s fee structure is reasonably competitive, particularly for a broker offering diverse trading instruments and platforms.

One of the main attractions of Deriv is its low minimum deposit requirement of just $5, allowing you to start with a smaller capital outlay than some brokers like IC Markets which requires $200.

Deriv typically has average spreads, especially on major forex pairs. However, it’s worth noting that the floating spreads may widen for less liquid instruments or during volatile market conditions.

In contrast, many top-tier brokers offer fixed or even zero spreads but at potentially higher overall trading costs due to commissions. Deriv does not charge commissions on many of its trading accounts, which is appealing if you prefer straightforward pricing.

Another aspect to consider is the currency conversion fees that may apply when funding accounts in a different currency other than the supported base currencies. Deriv charges these fees, which can add up when dealing with multiple currencies.

Other brokers like eToro might offer more favorable terms regarding currency conversions, potentially saving you money.

It’s also worth noting that Deriv charges a $25 dormant account fee every six months after 12 months of inactivity, though this shouldn’t sting active day traders.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 1.4 | 0.1 | 0.1 |

| FTSE Spread | 1.28 | 100 | Floating from 0.2 |

| Oil Spread | 0.02 | 0.1 | Floating from 0.05 |

| Stock Spread | 0.59 (Apple) | 0.1 | NA |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4.5 / 5Pros

- Excellent range of proprietary and third-party trading solutions, including code-free algorithmic trading.

- Desktop clients, web-based alternatives, and mobile apps are supported.

- cTrader Copy supported for hands-off trading.

Cons

- Beginners may find the range of platforms overwhelming.

- Deriv Bot, or DBot, has limited backtesting capabilities to test automated strategies.

- Lacks an integrated VPS service for automated trading.

Deriv provides at least seven platforms tailored to different trading needs, among the widest selections we’ve encountered, with MT5 web trader the latest offering.

Deriv Trader is Deriv’s proprietary, web-based platform. It offers a simple interface for trading multipliers and accumulator options on forex, cryptocurrencies, and 24/7 derived indices.

Deriv Go is the equivalent for mobile devices. The legacy SmartTrader platform is also still available.

Deriv Bot provides a drag-and-drop bot-building tool for traders interested in automation. It allows strategy creation without programming skills, a unique feature that simplifies algorithmic trading for newcomers.

For traditional CFD trading, Deriv supports MT5, a well-established platform for advanced analysis and Expert Advisors (EAs), alongside cTrader for a more intuitive trading environment for advanced traders seeking specialized order types and robust automation.

The welcomed addition of TradingView support provides access to advanced charting tools, community-driven insights, and extensive technical analysis.

MT5, cTrader and TradingView can all be used on a desktop or mobile device via dedicated apps.

There are no exclusive copy trading features, but Deriv supports copy trading through cTrader Copy. It’s great to see this feature supported because many brokers support the cTrader platform but not the copy trading functionality for a hands-off trading experience.

My biggest gripe with cTrader Copy is that many high-risk strategies burn accounts quickly, and cTrader needs to assign risk scores to help advise potential investors of their volatility.

Deriv does not offer a Virtual Private Server (VPS) service, which may be a limitation for traders who rely on continuous, high-speed connections for automated trading strategies, particularly on platforms like MT5.

Many brokers like FOREX.com provide a VPS for free or at a discounted rate for active traders, enhancing the reliability and efficiency of automated systems like EAs.

Without an in-house VPS option, Deriv.com traders interested in automation would need to obtain an external VPS, which requires additional setup and can add extra costs.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | JForex, MT4, MT5 | TradingView |

| Mobile App | iOS & Android | iOS & Android | Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

2.5 / 5Pros

- In-house blog provides general market updates.

- Economic calendars integrated into cTrader and MetaTrader.

- TradingView’s huge user community offers market analysis and trading ideas.

Cons

- Lack of advanced in-house analytical resources.

- No trading calculator to help manage risk.

- No Trading Central or Autochartist analysis.

New traders should be aware of Deriv’s considerable limitations in its research tools.

While the broker provides a blog, there are no advanced research features, such as in-depth fundamental analysis or extensive market reports, to help short-term traders understand broader market conditions.

Additionally, Trading Central or Autochartist do not offer chart analysis and trading signals. Other brokers, including IC Markets and TopFX, offer these third-party tools and can help develop individual analytical skills.

Economic calendars are offered by the cTrader and MetaTrader platforms, which are useful for providing context for important events, but there is no trading calculator to help calculate pips, margin, spread, and commission.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.8 / 5Pros

- Good range of educational materials, including articles and tutorials.

- Structured learning courses for complete beginners.

- Downloadable e-books about basic trading concepts.

Cons

- No webinars for real-time interactive learning with expert insights.

- Depth of educational content may not be sufficient for more advanced traders.

- Quality of tutorials and materials can vary, lacking comprehensive coverage or clarity.

Deriv offers a range of educational materials designed to assist new traders in understanding the markets and developing their trading skills. These resources aim to provide foundational knowledge as well as practical trading strategies.

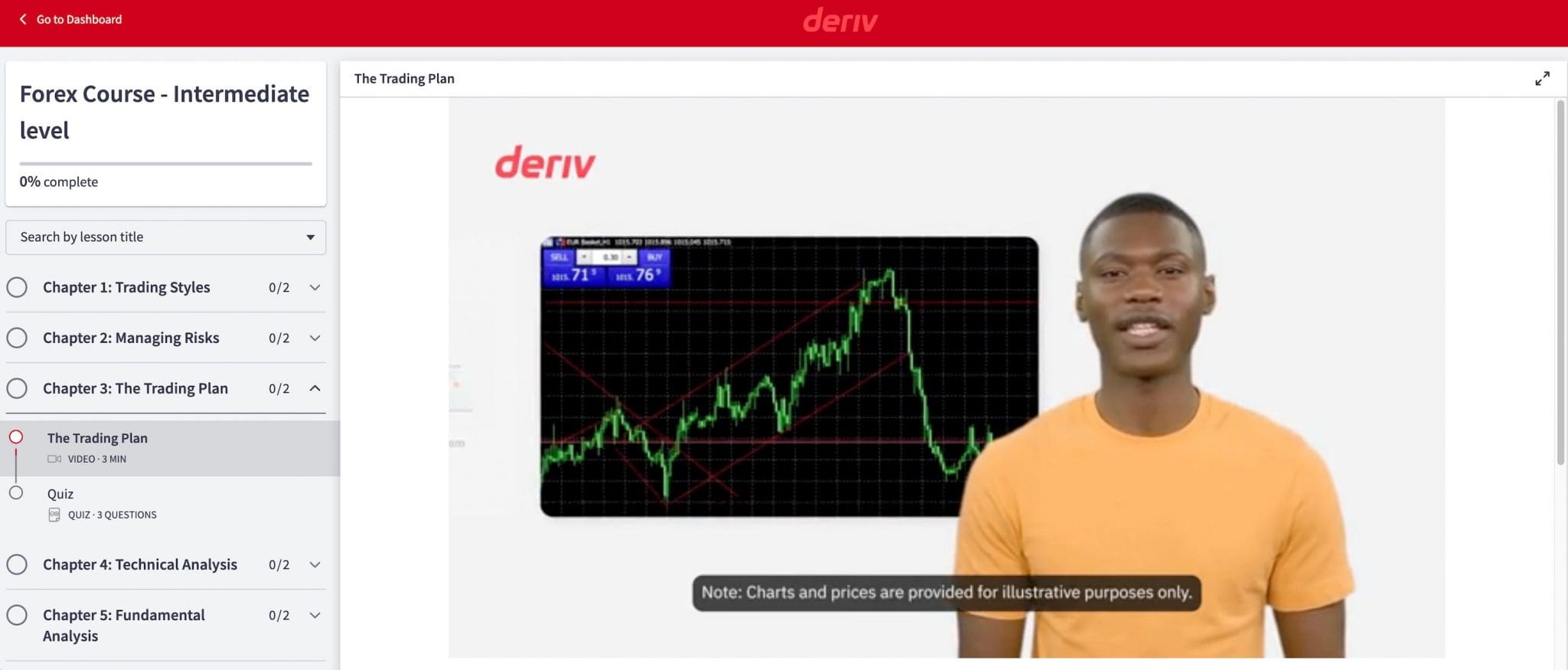

One of the standout features is the Academy, launched in 2021, which provides registered users with written and video tutorials covering various trading topics, from basic concepts to more advanced forex strategies.

Training materials on the MetaTrader platform and downloadable e-books on basic trading concepts are also available.

While the content is relatively basic and lacks the professionalism of IG‘s content, this structured approach allows beginners to learn at their own pace and builds a foundation for trading.

On the downside, the quality and coverage of educational materials can vary, meaning some specific topics may need to be more represented or detailed.

Furthermore, there are no live analysis webinars or Q&A sessions with trading experts to provide an interactive way for clients to gain insights and ask questions directly.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.8 / 5Pros

- Multiple customer support channels, including live chat, WhatsApp, and social media.

- Support is available 24/7, catering to weekend traders.

- FAQ section is extensive and well-organized.

Cons

- Response times for live chat can be slower than expected based on testing.

- No telephone support despite a common option at most brokers.

- Dedicated account manager support is not available.

Whenever I’ve needed assistance with my trading on Deriv.com, the customer support options have been quite helpful and accessible.

I always start by checking the extensive FAQ section, which covers various topics, from account setup to trading strategies. It has been clear and informative, allowing me to resolve some of my questions without contacting support directly.

If I require more personalized help, I can contact the customer support team through live chat or WhatsApp. I appreciate that both options are available directly within my client dashboard, allowing me to get real-time assistance without navigating away from my trading activities.

In my experience, the representatives are responsive and knowledgeable, addressing my concerns efficiently. However, I have had to wait over 10 minutes for a connection on a few occasions.

Unfortunately, Deriv doesn’t offer phone support, which can be helpful for more detailed inquiries.

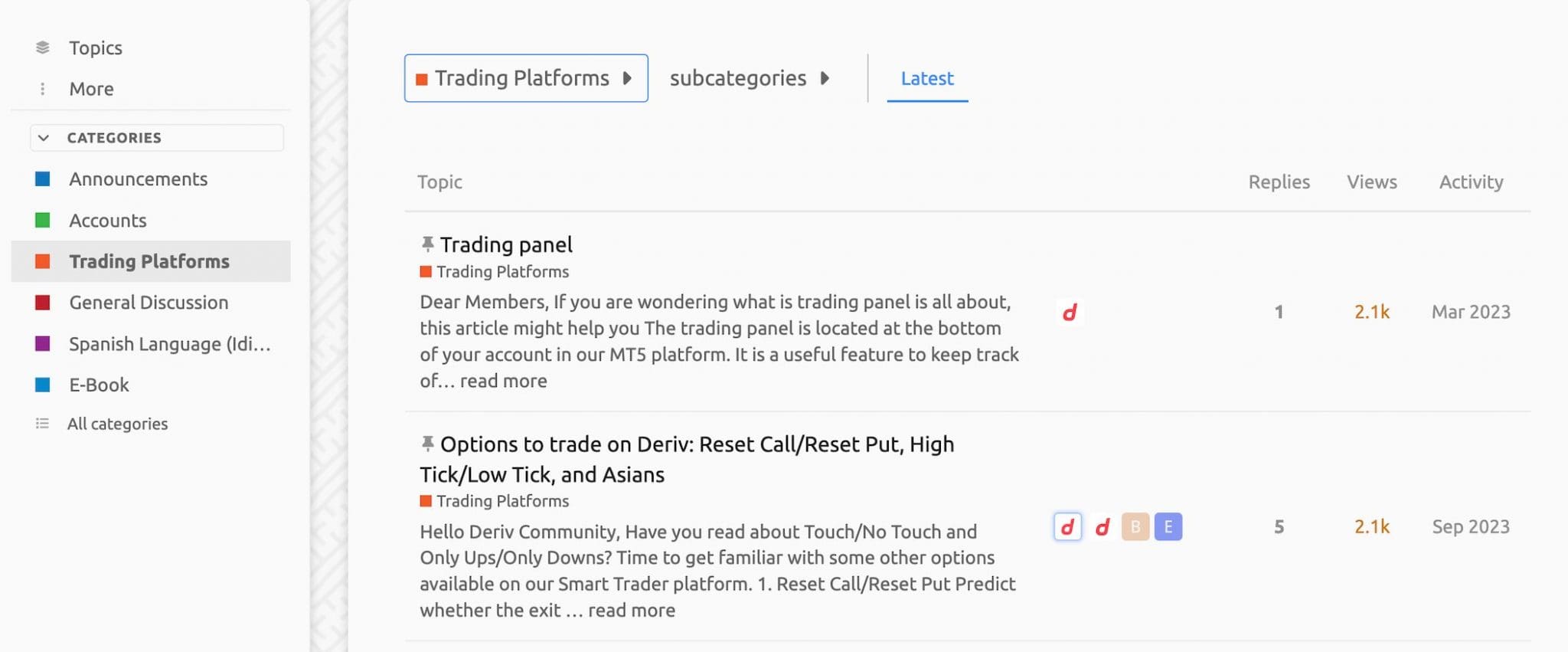

I’ve also noticed that Deriv has a community forum and a presence on social media platforms, where the brokers provide updates and respond to queries. This multi-channel approach makes staying informed and connected with the platform more accessible.

One potential improvement would be to offer localized direct telephone support or a call-back similar to the service provided by ActivTrades.

| Deriv | Dukascopy | Videforex | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Deriv.com?

Deriv provides a solid range of trading instruments and platforms, making it suitable for beginners and experienced day traders.

However, there are some potential downsides to consider. While Deriv features low fees and multiple deposit and withdrawal options, certain advanced features, like multipliers, come with higher risks that may only be appropriate for some traders.

Furthermore, it’s worth noting that Deriv lacks ‘green tier’ regulation for traders outside of the European Union, which should concern traders who prioritize oversight and robust protection in their trading activities.

Ultimately, if you value innovative trading opportunities through its derived indices, options, accumulators and multipliers, Deriv might be a good fit for you.

Using demo accounts to practice and familiarize yourself with the platform is advisable before committing to real funds.

FAQ

Is Deriv Legit Or A Scam?

Deriv is a well-established trading platform with over two decades of experience, having first launched in 1999.

Its longevity in the market, new offices in London and Rwanda in 2024, plus extensive global user base help speak to its reliability.

Is Deriv A Regulated Broker?

Deriv is a regulated broker and operates under the oversight of several financial authorities across various jurisdictions. However, only the FSA in Malta is considered ‘green tier’ in our Regulation & Trust Rating.

Furthermore, the regulatory status of the entity a client interacts with varies depending on their location and the specific instruments they choose to trade.

Client funds are held in segregated accounts, separate from the firm’s operational funds, and the Malta FSA-regulated entity offers negative balance protection.

Is Deriv Suitable For Beginners?

Deriv can be suitable for beginners due to its user-friendly platforms and low minimum deposit requirements. The platform offers a simplified way to trade binary options and flexible account types that allow beginners to start small.

However, some instruments, like synthetic indices and multipliers, can carry higher risks and may only be ideal for complete novices with experience in risk management.

Does Deriv Offer Low Fees?

Deriv generally offers competitive fees, particularly with its low deposit requirements and spreads on popular assets like forex pairs.

Deriv doesn’t charge commissions either, and swap-free trading keeps costs lower than other brokers for frequent and swing traders.

However, specific instruments and leveraged products, such as synthetic indices and multipliers, may incur higher trading costs due to spread adjustments.

The products offered on the Deriv.com website include binary options, contracts for difference (“CFDs”) and other complex derivatives. Trading binary options may not be suitable for everyone. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, the products offered on the website may not be suitable for all investors because of the risk of losing all of your invested capital. You should never invest money that you cannot afford to lose, and never trade with borrowed money. Before trading in the complex products offered, please be sure to understand the risks involved.

Top 3 Alternatives to Deriv

Compare Deriv with the top 3 similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Videforex – Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Deriv Comparison Table

| Deriv | Dukascopy | Videforex | World Forex | |

|---|---|---|---|---|

| Rating | 4.6 | 3.6 | 3.5 | 4 |

| Markets | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Binary Options, CFDs, Forex, Indices, Commodities, Crypto | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5 | $100 | $250 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $0.01 | 0.01 Lots |

| Regulators | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA | FINMA, JFSA, FCMC | – | SVGFSA |

| Bonus | – | 10% Equity Bonus | 20% to 200% Deposit Bonus | 100% Deposit Bonus |

| Education | No | Yes | No | No |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | JForex, MT4, MT5 | TradingView | MT4, MT5 |

| Leverage | 1:1000 | 1:200 | 1:500 | 1:1000 |

| Payment Methods | 27 | 11 | 8 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Dukascopy Review |

Videforex Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Deriv and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Deriv | Dukascopy | Videforex | World Forex | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Expiry Times | 15 seconds to 365 days | 3 minutes – 1 day | 5 seconds – 1 month | 1 minute – 7 days |

| Ladder Options | Yes | No | No | No |

| Boundary Options | Yes | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | Yes | No | No | No |

| ETFs | Yes | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | Yes | No | No |

Deriv vs Other Brokers

Compare Deriv with any other broker by selecting the other broker below.

The most popular Deriv comparisons:

- Deriv.com vs Binance

- Deriv.com vs IQ Option

- Deriv.com vs Olymp Trade

- Deriv.com vs XM

- Deriv.com vs IC Markets

- Deriv.com vs Axi

- Deriv.com vs Exness

- FXTM vs Deriv.com

- Deriv.com vs Templer FX

- Markets.com vs Deriv.com

- Pepperstone vs Deriv.com

- Deriv.com vs BinaryCent

- Vault Markets vs Deriv.com

- Deriv.com vs Binary.com

- Deriv.com vs FBS

- Deriv.com vs Quotex

Customer Reviews

4.3 / 5This average customer rating is based on 4 Deriv customer reviews submitted by our visitors.

If you have traded with Deriv we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Deriv

Article Sources

- Deriv.com

- Deriv Blog

- Deriv Community

- Deriv Investments (Europe) Ltd - MFSA License

- Deriv (FX) Ltd - LFSA License

- Deriv (BVI) Ltd - BVIFSC License

- Deriv (V) Ltd - VFSC License

- Deriv (Mauritius) Ltd - FSC License

- Deriv (SVG) LLC - SVGFSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I can say that Deriv are a solid broker based on my own experience using them. I’ve never traded CFDs with them (I use another firm for that) but they offer some products I’ve genuinely never seen before, namely multipliers on volatility indexes which is just perfect for my day trading stratyegy – loads of price action and available all day and all night. The charting package is only average though and they do some annoying things, like they changed their financial questions so I have to redo them even though I’ve already been through the sign-up and opened an account. So yeah, not perfect but still pretty good for day trading if you ask me.

I’ve been trading on Deriv for years. They are a properly reliable broker with a super slick platform and high multipliers.

I’ve enjoyed my time at Deriv because the DTrader platform is so reliable. It’s one of the easiest platforms I’ve used and still has dozens of indicators and charting options. I reckon they could do more in terms of research though – there isn’t much of any value in the client area so I have to go elsewhere.

Deriv is one of the best brokers I’ve used. It’s great for trading on the weekends thanks to its synthetic indices and deposits are always fast and hassle-free. Customer support is a bit hit and miss but I can live with that.