Best Brokers With Synthetic Indices 2026

Brokers with synthetic indices provide unique trading opportunities on products that emulate realistic market movements. Unlike a traditional index, a synthetic index often has no correlation to underlying assets and is not impacted by real events.

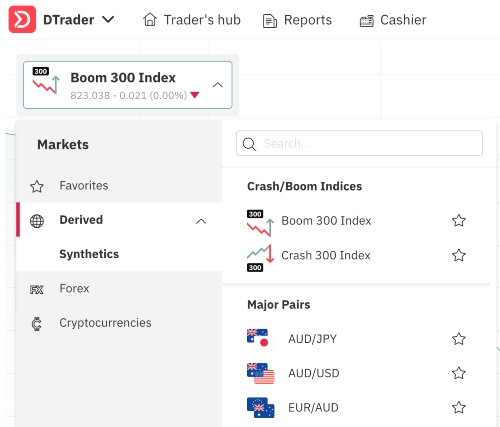

The leader in synthetic indices is undisputedly Deriv, with multiple proprietary indices that can’t be found elsewhere. However, they don’t accept traders from a long list of countries, including the US, Canada, UK and several others. Our list of top brokers with synthetic indices below will only show those that accept your location.

Best Synthetic Index Brokers 2026

We tested multiple brokers and found that these 6 platforms offer the best synthetic index trading products:

-

1

Focus Markets

Focus Markets -

2

XM

XM -

3

AvaTrade

AvaTrade -

4

Exness

Exness -

5

IC Markets

IC Markets -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Why Are These Brokers The Best For Synthetic Indices?

Here’s a quick rundown of why we think these are the top brokers for trading synthetic indices:

- Focus Markets is the best broker for synthetic index trading in 2026 - Focus Markets offers synthetic indices via its MT5 platform, providing 24/7 access to algorithmically generated markets that simulate real-world price movements. These indices are unaffected by real-world news or market volatility, allowing traders to engage in continuous trading. What we like is that the platform supports various synthetic indices, catering to different trading strategies and preferences.

- XM - During our tests, XM offered synthetic indices like Volatility 75 (VIX75) via MT5, providing 24/7 trading. Spreads started at 0.08 with competitive costs. Execution was fast, with 99% of trades under one second.

- AvaTrade - AvaTrade offers synthetic indices from our tests, notably the Volatility 75 Index (VIX 75), through its MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These indices are algorithmically generated, providing 24/7 trading opportunities. Spreads for the synthetic index range from 0.15% to 0.21%, with trading costs at industry standard levels.

- Exness - In our latest tests, Exness offered synthetic indices like Volatility 75 (VIX75) via MT4 and MT5, available 24/7. Spreads started from 0.5 pips with fast execution. Regulated by FSCA, Exness also provided advanced charting tools, diverse account types, and competitive trading conditions for volatility-based strategies.

- IC Markets - During our tests, IC Markets offered synthetic indices like Volatility 75 and Volatility 100 via MT5 and cTrader, available 24/7. Spreads started from 0.5 pips with low trading costs. Execution was fast, averaging under 50 ms. Regulated by ASIC, CySEC, and FSA, IC Markets provided a secure environment for algorithmically generated markets.

- Pepperstone - During our tests, Pepperstone offered synthetic indices like Volatility 75 (VIX75) via MT5 and cTrader, providing 24/7 trading. Spreads started at 0.0 pips with fast execution under 30 ms. Regulated by ASIC, FCA, CySEC, and DFSA, Pepperstone also offered Razor and Standard accounts, advanced charting, and an Active Trader program with rebates and reduced costs.

Best Brokers With Synthetic Indices 2026 Comparison

| Broker | Minimum Deposit | Minimum Trade | Platforms | Regulator |

|---|---|---|---|---|

| Focus Markets | $100 | 0.01 Lots | MT5 | ASIC, SVGFSA |

| XM | $5 | 0.01 Lots | MT4, MT5, TradingCentral | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| AvaTrade | $100 | 0.01 Lots | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Exness | Varies based on the payment system | 0.01 Lots | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| IC Markets | $200 | 0.01 Lots | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | ASIC, CySEC, CMA, FSA |

| Pepperstone | $0 | 0.01 Lots | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

How Safe Are The Best Synthetic Index Brokers?

Synthetic indices are unique instruments, so regulation, fund security, and platform reliability are essential. Here’s how our top brokers safeguard your trading experience:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Focus Markets | ✘ | ✔ | ✔ | |

| XM | ✘ | ✔ | ✔ | |

| AvaTrade | ✘ | ✔ | ✔ | |

| Exness | ✘ | ✔ | ✔ | |

| IC Markets | ✘ | ✔ | ✔ | |

| Pepperstone | ✘ | ✔ | ✔ |

Are The Best Synthetic Index Brokers Good For Beginners?

New to synthetic indices? We reviewed education tools, demo accounts, and user-friendly platforms to see which brokers are best for beginner traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Focus Markets | ✔ | $100 | 0.01 Lots | ||

| XM | ✔ | $5 | 0.01 Lots | ||

| AvaTrade | ✔ | $100 | 0.01 Lots | ||

| Exness | ✔ | Varies based on the payment system | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots |

Are The Top Synthetic Index Brokers Good For Experienced Traders?

Experienced traders need consistent pricing, reliable execution, and leverage flexibility. Here’s where our leading brokers excelled for advanced synthetic index trading:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Focus Markets | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| XM | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:1000 | ✔ | ✘ |

| AvaTrade | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✔ | 1:30 (Retail) 1:400 (Pro) | ✔ | ✘ |

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✔ | ✘ | ✘ | 1:30 (ASIC & CySEC), 1:1000 (FSA) | ✔ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ |

Compare Detailed Ratings Of Top Synthetic Index Brokers

See how the top brokers for synthetic indices performed across critical categories in our tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Focus Markets | |||||||||

| XM | |||||||||

| AvaTrade | |||||||||

| Exness | |||||||||

| IC Markets | |||||||||

| Pepperstone |

How Popular Are The Top Synthetic Index Brokers?

Synthetic indices are gaining traction with traders worldwide. We looked at which brokers are attracting the most users

| Broker | Popularity |

|---|---|

| XM | |

| Pepperstone | |

| Exness | |

| AvaTrade | |

| IC Markets |

Why Trade Synthetic Indices With Focus Markets?

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

Cons

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

Why Trade Synthetic Indices With XM?

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Why Trade Synthetic Indices With AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

Why Trade Synthetic Indices With Exness?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

Why Trade Synthetic Indices With IC Markets?

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

Why Trade Synthetic Indices With Pepperstone?

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

How DayTrading.com Chose The Top Brokers That Allow Trading On Synthetic Indices

To rank the best brokers for synthetic indices, our team of experienced traders found and then evaluated platforms that offer simulated trading instruments.

Each broker’s synthetic index setup was tried, with our traders recording key factors like execution, pricing, platform stability, and user experience. We then combined hard data with our hands-on testing insights to create a ranking of the top synthetic index brokers.

What Is A Synthetic Index?

Synthetic index is a term used to describe an index that is not comprised of underlying assets, such as stocks, instead using random number generators to provide a value.

Synthetic indices typically take two forms:

- Asset-based, tracking the value of a specific market or element of a market, or

- Simulated, based on computer-generated data entirely separate from any actual markets but designed to imitate real-life price movements.

Understanding these different products can be confusing due to the interchangeability of the synthetic index label. This can also make it difficult for traders to discover which brokers offer synthetic indices trading.

Le’s break down both types of synthetic indices, listing their differences, respective merits and supporting brokers.

Simulated Synthetic Indices

Most commonly offered by forex brokers and binary options brokers from our tests, simulated synthetic indices use complex algorithms designed to mirror realistic price movements. In contrast to asset-based products, simulated synthetic indices are markets with no correlation to any underlying asset.

Simulated synthetic index brokers often provide traders with several options for their preferred trading vehicle and simulated market conditions. In addition, these markets can normally be traded 24/7.

However, some active traders are understandably wary of these products due to the opacity of these over-the-counter products. Some traders believe that for these products to be viable, the algorithms must be broker-favored, and therefore abstain from these artificial markets.

Asset-Based Synthetic Indices

Asset-based synthetic indices track the value of specific market sectors or market values. Popular examples of asset-based synthetic indices are the S&P 500 Volatility Index (VIX) and the US Dollar Index (USDX).

With synthetic indices based on spot assets, such as currency indices or market sector instruments, many of these products are hedged with real assets by the firm that provides the index.

A combination of swaps, futures, options and spot assets can also be used to back more sophisticated synthetic indices, though some of these products may not be fully hedged due to their complexity.

This measure attempts to secure the values of synthetic indices, though collapses have happened in the past – more on this later.

Simulated Vs Asset-Based Synthetic Indices

To help you decide which type of synthetic index is best for your goals and trading style, we have compared simulated and asset-based indices across several key categories:

Trading Vehicles

Simulated

With simulated synthetic indices brokers, trading instruments are more limited, often via binary options or CFDs. There are fewer forex brokers with simulated synthetic indices, with products mainly offered by binary brokers.

While these products are different in terms of leverage, fees and payouts, strategies are more limited than with asset-based synthetic indices.

Binary options, which are unregulated in certain jurisdictions, are typically traded in the short term with an all-or-nothing strategy.

Asset-Based

With asset-based synthetic indices, traders can use a variety of trading vehicles. Synthetic index brokers may offer contracts for difference (CFDs), exchange-traded funds (ETFs), futures, and options.

This gives traders more choice, opening up possibilities in terms of strategies and timeframes. The variety of vehicles available to trade asset-based synthetic indices also offers traders both high and low leverage options.

Payouts & Risk

Simulated

Simulated synthetic indices are typically traded through binary options or CFDs, and their payouts and capital risks vary depending on the vehicle used.

Binary options offer fixed payouts for a winning trade, with the best brokers for synthetic indices offering payouts of over 95% for a correct prediction. Traders cannot lose more than they invest in a position.

While CFDs offer leveraged profit potential, they also carry significant risks, including the possibility of losing more than the initial investment.

When trading at synthetic indices brokers using CFDs, ensure that your chosen brokerage offers features like stop losses and negative balance protection.

Asset-Based

Due to the wide range of vehicles available when trading asset-based synthetic indices, investors can choose a trading strategy suited to their personal risk/reward tolerance.

Products range from the highly leveraged CFD market down to the more stable ETF setup.

Safety & Security

Simulated

Brokers with simulated synthetic indices are not typically regulated by top-tier financial authorities such as the Securities and Exchange Commission (SEC) in the US or Financial Conduct Authority (FCA) in the UK.

Synthetic index binary options and forex brokers may not store client finds in tier-one banks or provide access to investor compensation schemes.

In addition, the opacity of simulated trading algorithms may not sit well with some traders. We’ve seen limited evidence to suggest that synthetic index brokers skew their algorithms to disadvantage investors, but with no real market to base prices on, the opportunity to manipulate simulated prices is arguably there.

Asset-Based

Asset-based synthetic indices are typically traded through regulated exchanges and brokers, which offer a higher level of security and transparency.

For example, the best brokers with synthetic indices brokers are often regulated by the FCA, SEC, or trusted bodies from other regions. This regulatory oversight provides traders with some level of protection against fraud, market manipulation, and other forms of misconduct.

However, this does not mean that asset-based synthetic index investments are safe. On 5 February 2018, VIX futures rose from their opening level of 16 into the low 30s by the afternoon. This caused two synthetic indices that offered an inverse VIX tracker to fall by over 95% each, wiping out the funds of traders.

Due to the nature of synthetic indices, such losses are often difficult to reverse.

Trading Hours

Simulated

One of the unique advantages of brokers with synthetic indices is the ability to trade a market with infinite liquidity that operates 24/7.

Other than scheduled maintenance and platform downtimes, the algorithms for simulated synthetic indices run constantly, giving traders around the world an equal chance to trade.

Asset-Based

The operating hours for asset-based synthetic indices usually follow the trading hours of the underlying assets that make up the index.

The longest trading hours can often be found via forex brokers with synthetic indices or futures brokers, with trading available up to 11 hours per day. However, even these extended market instruments do not typically trade on weekends.

Trading Fees

The fees and commissions paid when trading synthetic indices are often dependent on the vehicle and broker rather than the type of index. There are also other types of charges to consider when choosing the best brokers for synthetic indices, which we will get into later on.

Traders can opt for low or zero-commission brokers to trade ETFs and there are no commission fees when speculating with most binary options brokers. The highest fees will come when trading through forex brokers with synthetic indices CFDs, plus futures and options.

Comparing Brokers With Synthetic Indices

Our list of synthetic indices brokers includes several top brands. But to help you find which broker offers the best synthetic indices trading conditions, look for the following qualities:

Vehicles

The first step when choosing a trading platform is to establish the type of synthetic index available.

Binary options and forex brokers can sometimes support both asset-based synthetic indices and simulated synthetic indices.

However, traditional stocks, futures and options brokers typically shy away from the less transparent natures of simulated synthetic indices.

Markets & Customization

The next item to compare is which broker offers the synthetic index markets you favor.

When trading simulated synthetic indices, the best brokers offer a range of different products set up with various algorithms simulating different market conditions.

For asset-based synthetic indices, this can mean finding brokers that support products from a range of financial markets, such as stocks and forex.

Fees & Payouts

Simulated synthetic indices are often traded as binary options or “multipliers”, although some forex brokers allow CFD trading with simulated synthetic indices.

With binary options, there are no trading fees, with profits dictated by payouts. While investors should shop around for the most competitive payouts, ensure that you are not enticed into a suspect broker by high payouts alone.

CFD profits are similar from broker to broker. Spreads and charges such as commissions and swap fees make the difference between trading firms.

With asset-based synthetic indices, payouts will often depend on the trading product, which is largely independent of a specific broker. However, fees and commissions can significantly influence how much profit is made by a successful trader.

Look for low spreads and commissions when trading CFDs, and low or zero commissions for ETF and futures trading. This said, some brokers with synthetic indices can draw investors in with low trading fees and add account or deposit charges, so do your due diligence before signing up.

Regulation & Security

The safety of funds and sensitive personal information is key when trading any product.

To give yourself the best chance at staying safe, favor brokers with regulation from reputable bodies such as the US SEC or UK FCA.

The best brokers for synthetic indices will also offer additional measures, such as two-factor authentication (2FA) and fund insurance schemes.

Trading Platforms

Choosing brokers with synthetic indices that support stable, reliable and user-friendly platforms is a must. Some synthetic indices brokers use proprietary solutions so make use of a demo account to trial these terminals before committing money.

Alternatively, opt for a popular and well-supported platform such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms offer advantages such as customizable indicators and automated trading tools.

Payments

Choose brokers with synthetic indices that offer low-cost, high-speed deposit options. Ideally, these solutions will include choices with some protection, such as PayPal or debit cards. In addition, native support for your local currency will help you avoid conversion fees.

In the CFD and binary options space, there are also some synthetic indices brokers with bonus schemes. But while deposit bonuses can be attractive, ensure you understand any withdrawal terms before opting in.

Bottom Line

When comparing brokers with synthetic indices, there are several considerations to keep in mind. Firstly, traders should favor synthetic index brokers with oversight from reputable regulators. Other considerations include market availability, trading platform support, accepted payment methods and fees.

Get started with our list of the best brokers with synthetic indices.