WazirX Review 2026

WazirX Review

WazirX has grown rapidly over the past few years into one of the biggest cryptocurrency exchanges, providing the world’s second-most populous country access to an ever-expanding industry. This review will discuss the company’s key details, the services on offer, benefits, drawbacks and any other relevant information you will need before you start trading with WazirX.

WazirX Headlines

WazirX is a centralised cryptocurrency exchange based in India that was launched in March 2018. Its owner and CEO, Nischal Shetty, is the founder of the successful social media manager app Crowdfire and has an estimated net worth of around $5 million. Alongside co-founders Sameer Mhatra and Siddharth Menon, Shetty has built WazirX into one of the biggest Indian crypto exchanges, after ZebPay, despite the blanket ban on digital coins by the Indian central bank three weeks after launch.

Demonstrating the success of WazirX, in March 2019 it started accepting international users from countries like the UK and the USA and, in November 2019, it was acquired in a deal by Binance, who shortly afterwards invested $50 million worth of funding for Indian blockchain projects and startups.

In 2020, the crypto ban was lifted, making cryptocurrency trading and WazirX legal in India and allowing the country’s populace to access famous cryptos such as Bitcoin, Ethereum and Dogecoin.

WazirX has created its own native coin, WRX, that is used to provide benefits to the traders on their platform. There is a total supply of WRX 1 billion and 15% of it was offered for free to early WazirX traders in an airdrop to incentivise users to sign up leading up to the token release date of February 7th, 2020, when it was unlocked and tradable. There is currently a four-year transaction fee discount plan whereby users that complete transactions using WRX receive a 50% discount in year one, a 25% discount in year two, a 12.5% discount in year three and a 6.25% discount in year four. Currently, the discount is 50%.

Additionally, users that hold some WRX coins are given voting power on token listings and any new platform features. In order to keep demand for the token high, some WRX is burnt every quarter to reduce the supply. The 5th quarterly burn event took place on June 30th, 2021, where WRX 7.3 million was destroyed.

Currently, WRX has a market cap of $462.5 million and its highest price since its launch date was $4.0767. You can see the current valuation and price history chart at CoinMarketCap.com. Further company details can be found on Zauba and YourStory.

WazirX Services

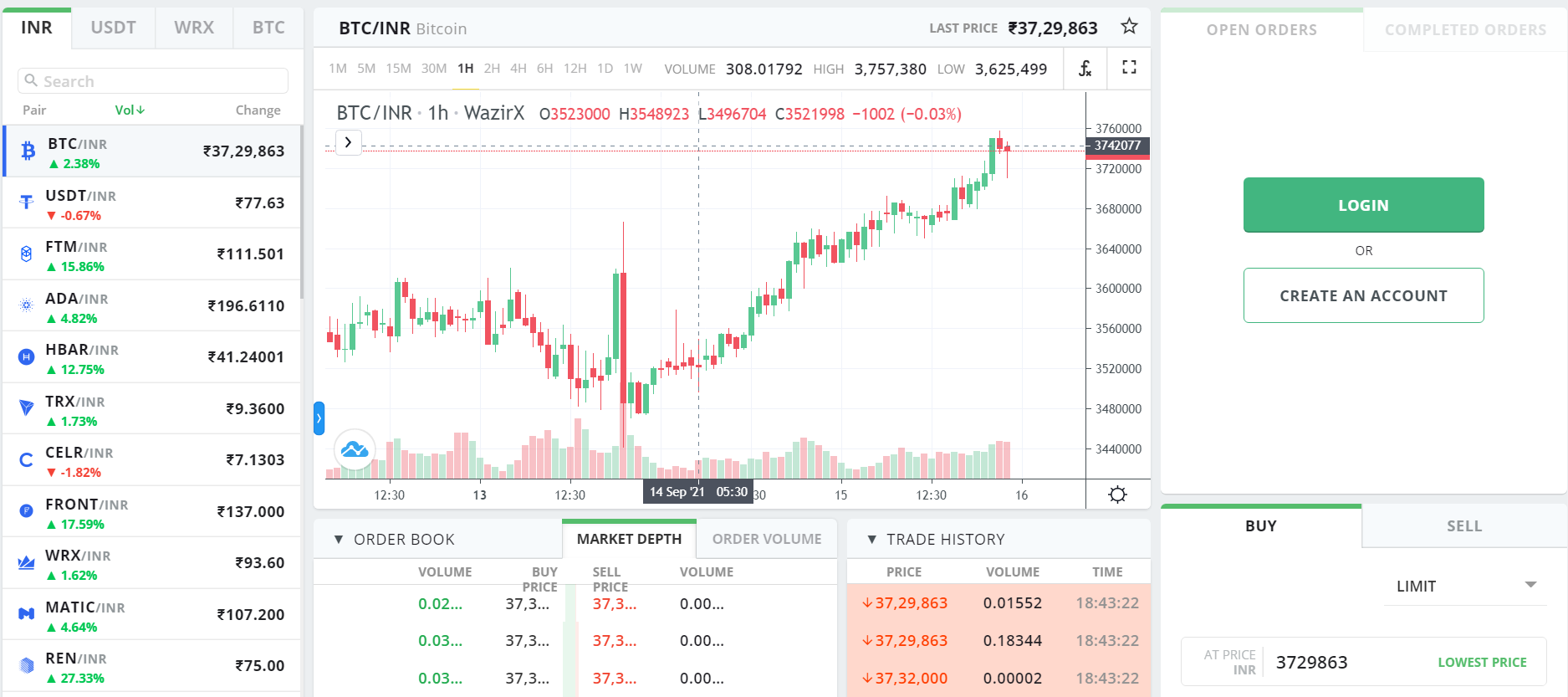

Exchange

The WazirX exchange is where users can complete spot trading for a range of cryptocurrencies like XLM, XRP, ZIL, PUNDIX and TRX, all paired with Indian rupees (INR), USDT, Bitcoin (BTC) or WRX.

To make a trade on WazirX, you have the choice of placing a limit order, which is executed immediately, or a stop-limit order, which is only executed when the value of the pair reaches the determined amount.

For example, if you wish to purchase WRX with INR, you can input the number of coins you want and the exchange will calculate the cost from the most recent coin price. Once the order is placed, you must wait for a seller to respond to fill the other end of the order. When the seller accepts the order and you have paid the INR, the WRX will appear in your crypto wallet.

In 2021, WazirX launched its ‘Quick Buy’ feature, where users simply need to log into the app, select the crypto they wish to purchase, preview and then place the order.

P2P

WazirX provides a peer-to-peer (P2P) trading platform on which users can gain access to the world of cryptocurrencies via the purchase of the stablecoin USDT. It was the world’s first P2P auto-matching engine. While users cannot purchase cryptocurrencies directly using fiat currencies (unless using INR), they can purchase USDT, which can then be used on the exchange to acquire crypto.

USDT is a stablecoin that is pegged to the US dollar and so its price is less volatile than other cryptocurrencies. Currently, the eight fiat currencies you can use to purchase USDT on the WazirX P2P are INR, IDR (Indonesian rupee), RUB (Russian rouble), UAH (Ukrainian hryvnia), NGN (Nigerian naira), SAR (Saudi riyal), EUR (Euro) and TRY (Turkish lira).

The buying and selling fees on the P2P are 0%, making it an attractive option for new users that wish to dip their toes into crypto trading. Purchasing orders are limited to a minimum of USDT 14.5 and a maximum of USDT 2,000. The minimum selling order is also USDT 14.5 but WazirX do not disclose a maximum.

WazirX lets users specify preferred buyers and sellers so they are matched together for future trades. This is done using the XID and preferred matching system whereby each user is allocated a unique ID (XID) that is added when an order is placed.

In order to trade P2P, users must have completed and verified the know-your-customer (KYC) process due to the trading of fiat currencies.

Smart Token Fund

The Smart Token Fund (STF) feature is a great way for traders who do not have the time or expertise to earn a passive income. WazirX has created a marketplace for investors to connect with skilled traders whereby traders create their own smart token with information like their trading strategy, asset allocation for each token and their performance. If a new trader wishes to follow the contract owner’s strategy, they purchase their smart token and essentially pass their portfolio over to them. When traders make a profit using the investor’s funds, they take a 25% commission from the profits and the value of their smart token increases. The highest value smart tokens at the time of writing are XOOM, XMINT and XOLO.

The STF is a simple venture as it is easy to learn how to use and traders cannot withdraw any funds to steal from their investors, instead only making trades on their behalf and only turning a profit if they are successful.

NFT Marketplace

The trading of non-fungible tokens (NFTs) has grown rapidly over the past few years and, according to NonFungible.com, the first quarter of 2021 alone saw over $2 billion worth of NFT sales. To capitalise on this boom, WazirX has launched its NFT marketplace, which is currently in the beta stage of development. Here, artists have the opportunity to upload and mint their own artwork for users to buy and sell using WRX.

The process to purchase an NFT is relatively simple. You must first connect a digital wallet from either Binance, Coinbase Metamask to the platform (transfer between Binance and WazirX is fee free). Clicking on the NFT you wish to purchase shows you its price in both WRX and USD, proof of authenticity, trading history with the NFT launch date, the creator’s name and a brief description. Then you click ‘buy’ and confirm the transaction on your wallet. Once the transaction has finished processing you will receive a notification confirming you now own the NFT and your purchase can be seen on the NFT’s history.

Fees

The WazirX exchange platform charges 0.2% for both makers and takers for all BTC, INR and USDT pairs, which is below the industry average of 0.25%. WRX pairs are exempt from paying any maker or taker fee (except WRX/BTC, which charges 0.2%).

There are no direct INR deposit or withdrawal fees. However, a charge is applied for withdrawing crypto in the form of INR, dependent on the specific tokens. For example, the price for Bitcoin is BTC 0.0006, 1inch is 1INCH 3.82 and Matic Network is MATIC 12.4. Some cryptos have no withdrawal fees, such as Verge (XVG), Shiba Inu (SHIB) and Quant (QNT).

There are no WazirX hidden charges, which means there are no joining fees, yearly fees or account opening charges.

There are no NFT listing fees, though there is a gas fee of $1 for each transaction. This is low because the marketplace is based on the Binance Smart Chain, which is a faster and inexpensive alternative to Ethereum, which many other marketplaces are based on.

Payment Methods

To deposits funds into your WazirX account, you may use UPI or a wire transfer. Both are simple processes as you only need to link your bank account or UPI ID to deposit. Users are limited to only depositing funds in INR, so you will need to consider the conversion rate between your fiat currency and INR.

The minimum deposit limit is INR 100, and the minimum withdrawal limit is INR 1,000.

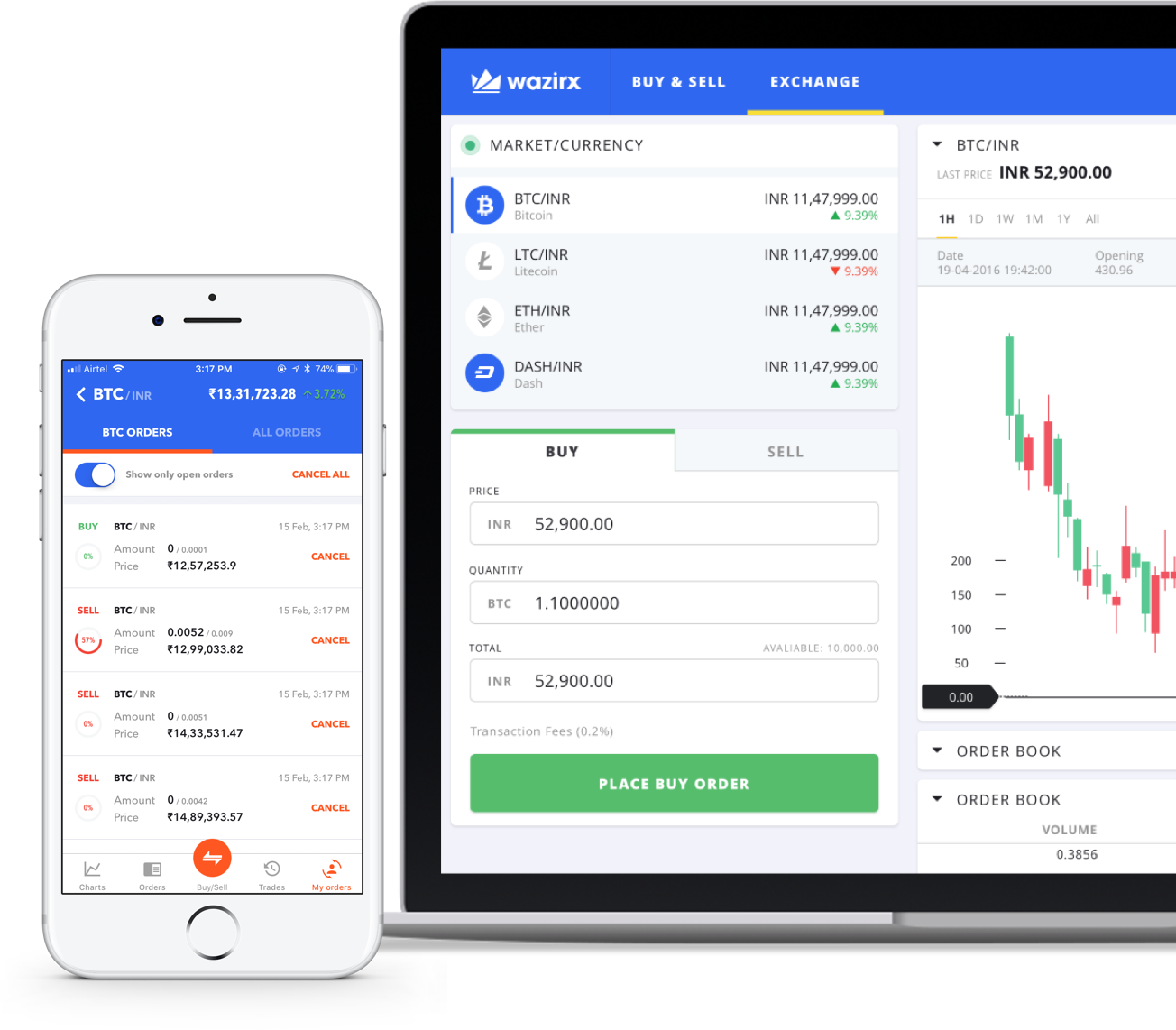

Mobile App

There is a WazirX mobile app available to download on the Apple App Store and the Google PlayStore, where you will see user app reviews and exchange rankings out of five. There are also trading platforms both for Windows and macOS either through their official download stores or as an APK file on third-party websites for both 32bit and 64bit download. The apps can be found by searching for them in stores or by scanning the QR code on the WazirX website.

If you are searching for the WazirX app, ensure you have found the correct one, it is the mobile app created by Zanmai Labs Private Limited with a blue background and white crown logo.

Deals & Promotions

WazirX has a joining and sign-up bonus system with its refer and earn program. Once you have set up an account, you are provided with a code that you can share with friends. If someone uses your referral code to create an account, you will earn 50% of their trading fees as commission. Users could also receive a free INR 200 coupon code via the Airtel Thanks App if they have an Airtel SIM card.

Recently, WazirX hosted a giveaway with events continuing for an entire week and prizes totalling $25,000 worth of IOTX. The broker also hosts quizzes, AMAs and 48-hour trading marathons that all clients can participate in.

Customer Support

There is an extensive support page where users can find helpful tutorials to guide them through the exchange such as how to deposit money, input bank account details and explain graphs. If you wish to keep on top of every update and upcoming event like any new coin listings, you can read the announcements page on the support section of their website.

Alternatively, you can watch videos on the WazirX YouTube channel, follow the broker’s Twitter, where you can see the latest coin news today and token launch dates, follow the WazirX Medium blog or read financial news websites like Yahoo Finance.

If you are having any problems, such as a deposit issue, payment issue or the UPI not working, you can submit a query on the WazirX website via email, use their live chat option or call the dedicated helpline number that is open 24 hours.

WazirX provides each user with a trading report, where they can see trading history, revenue, deposit, withdrawals and profit & loss (p&l).

Security

When you set up an account with WazirX, you have the option to enable two-factor authentication (2FA) using either the Google Authenticator App or SMS/email confirmation. The Google Authenticator App works by displaying a six-digit code passcode that needs to be entered at login to gain entry to your account. This code changes every 30 seconds and so any stolen codes are useless in trying to access your account.

You are also given the option to open your account with or without the know-your-customer (KYC) process. This is a verification system adopted whereby users must submit documents like primary and secondary forms of ID so that the exchange can confirm who is making the trades and keep your account safe. If you opt-out of using KYC, your account is not verified and you will be limited to only depositing and trading – you cannot make a withdrawal. As the KYC verification time can take up to three days and you cannot make withdrawals even when the process is pending, it is best to start the process when you first join up.

Always stay alert for any cloud mining scams and phishing attempts by always making sure that any contact from WazirX has the correct email ID or website URL.

Regulation

WazirX offers frequent audits to maintain the platform’s high standard of security. In May 2021, the online security firm, CertiK, which specialises in cryptocurrency exchanges, audited WazirX and found there were no critical, major or medium graded issues stating that the platform is safe. The full report can be read on the CertiK website. As well as CertiK, Mozilla performed an observatory test of the security and graded WazirX a ‘C’, aligned with the industry average.

WazirX has joined with the Indian Internet and Mobile Associate (IAMAI) and competitors like ZebPay, CoinDCX and CoinSwitch to form their own regulatory board specifically for the oversight of cryptocurrency exchanges.

It is important to note that the Reserve Bank of India has recently told banks to avoid cryptocurrency exchanges in the future and so Yes Bank, ICICI Bank and Paytm Payments Bank have ceased operations on the WazirX platform. This is in addition to the recent proposal by the Indian Government to levy an 18% GST (goods and service tax) on cryptocurrency trading. Furthermore, users should know that WazirX is under investigation over money laundering concerns following the issue of an ED notice due to transactions worth INR 2790 crore.

Benefits

- Simple and easy to use interface

- There are both mobile and PC apps available

- Live chat and phone call support service provided

- Rapid listing initiatives to speed up new token listing processes

- Smart Token Fund provides passive income for inexperienced or busy clients

Drawbacks

- No leverage trading

- No staking or yield farming feature

- Only crypto pairs with BTC and WRX are available

- Lack of regulation, concerns from the RBI and the ED notice

WazirX Verdict

WazirX is a great option for newcomers to begin their venture into the cryptocurrency market. The platform demonstrates competitive security features, pricing structures and bonuses. Moreover, the exchange’s interface is slick, NFT minting and trading are supported and the Smart Token Fund allows crypto copy trading. However, be sure you understand the risks before opening an account.

FAQs

Where Can I See The WazirX API?

You can see the API documentation on their Github. The link to which can be found on the WazirX website.

What Is The Name Of The WazirX Owner?

WazirX was founded and is owned by Nischal Shetty. He had previous success with Crowdfire, a social media management company and has a current net worth of $5 million.

Are There Future Token Price Predictions For WRX?

Yes, there are plenty of third-party websites online that provide coin price predictions for 2021, 2025 and 2030 with advice on whether it is a good investment. However, take any financial advice and predictions with a pinch of salt, they are only estimates.

Is WazirX A Crypto Wallet, An Exchange Or A Brokerage?

WazirX describes itself as a cryptocurrency exchange app. Users can connect their own digital wallets to trade on the exchange.

Where Are The WazirX Headquarters?

The WazirX head office address is in Maharashtra, Mumbai, India.

When Were The Previous WRX Burn Events?

The 1st burn event was July 2020, the 2nd burn event was October 2020, the 3rd burn event was January 2021, the 4th burn date was April 2021 and the 5th burn event date was June 2021.

Best Alternatives to WazirX

Compare WazirX with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Pionex – Pionex is a crypto trading platform that specializes in trading robots, offering a variety of ready made bots and strategies to traders as well as integrated AI to help customize a strategy or come up with your own. These can be used on spot crypto markets as well as crypto futures.

WazirX Comparison Table

| WazirX | Interactive Brokers | Pionex | |

|---|---|---|---|

| Rating | 2.5 | 4.3 | 3.4 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos |

| Demo Account | No | Yes | No |

| Minimum Deposit | INR 100 | $0 | $0 |

| Minimum Trade | $14.50 | $100 | 0.1 USDT |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FinCEN |

| Bonus | – | – | – |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | Own |

| Leverage | – | 1:50 | – |

| Payment Methods | 2 | 6 | 1 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Pionex Review |

Compare Trading Instruments

Compare the markets and instruments offered by WazirX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| WazirX | Interactive Brokers | Pionex | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | No |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

WazirX vs Other Brokers

Compare WazirX with any other broker by selecting the other broker below.

The most popular WazirX comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of WazirX yet, will you be the first to help fellow traders decide if they should trade with WazirX or not?