Bullwaves Review 2026

See the best Bullwaves alternatives in your location.

Pros

- Registering on the Bullwaves website and setting up an account is super smooth, only taking a few minutes based on tests.

- All three accounts offer commission-free trading, which means users can execute trades without incurring costs beyond the spread.

- USDT deposits and withdrawals are facilitated, in addition to regular bank cards, bank wire transfers, and an e-wallet.

Cons

- Bullwaves has non-existent education and research tools, reducing its appeal for beginners, especially compared to category leaders like IG.

- Although relatively new, the Bullwaves website is full of dead links and holding/dummy text pages, which doesn’t instil confidence.

- There is no zero-spread trading account, which is a drawback for experienced intraday traders aiming to capitalize on small price movements.

Bullwaves Review

This review of Bullwaves offers an in-depth analysis of the day trading experience, based on firsthand usage and comparisons with suitable alternatives from our extensive database of around 500 online brokers.

Regulation & Trust

Bullwaves operates under Equitex Capital Limited, which is authorized by the Financial Services Authority of Seychelles (Seychelles FSA).

While the Seychelles FSA enforces regulatory and compliance requirements, it is less rigorous compared to more established regulatory authorities – giving it ‘red tier’ status in line with our Regulation & Trust Rating.

And while Bullwaves do hold clients’ funds in segregated accounts and offer negative balance protection, its lack of regulation means it does not provide public financial disclosures or list on any stock exchange. This sets it apart from highly trusted brokers like Plus500 or IG.

Bullwaves

Interactive Brokers

InstaTrade

Regulation & Trust Rating

Regulators

FSA

FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

BVI FSC

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Accounts & Banking

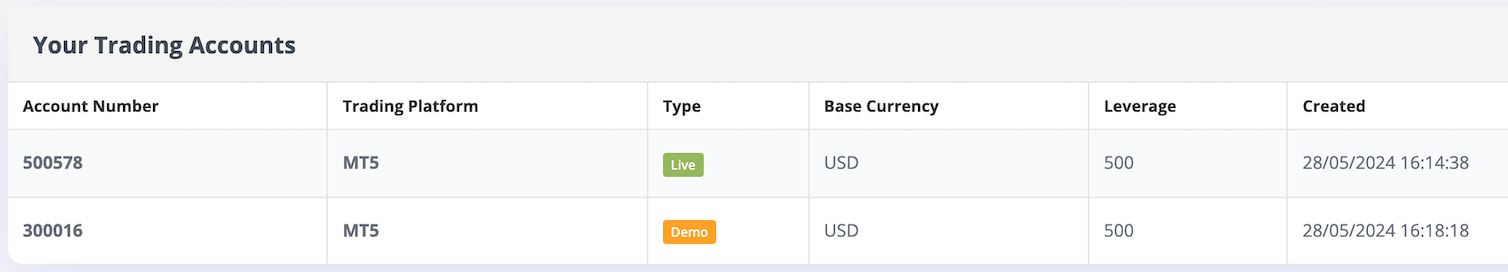

Live Accounts

Bullwaves offers three account types, all providing access to the MT5 trading platform. However, they differ in terms of spreads and leverage.

- The most accessible account is the Classic Account, which can be opened with a minimum deposit of $250. The minimum deal size is 0.01 lots, spreads are from 2.0 pips, and the maximum leverage is 1:200. Geared towards newer traders.

- Next in line is the VIP Account, which requires a minimum deposit of $10,000. This account reduces spreads from 1.5 pips, but the minimum deal size is increased to 0.05 lots. Geared towards experienced traders.

- Lastly, the Elite Account further reduces spreads from 1.1 pips and increases leverage to 1:500, but the minimum deal size is increased to 0.1 lots and the minimum deposit is a sizeable $50,000. Geared towards veteran, high-budget traders.

All accounts support EAs, scalping, hedging, and VPS. However, they differ in their stop-out levels, which are set at 50%, 35%, and 25% respectively.

What’s interesting is that Bullwaves allows up to six different trading accounts, including two Classic, two VIP, and two Elite accounts, all of which can be easily opened through the client dashboard.

Disappointingly, Bullwaves doesn’t support PAMM (Percentage Allocation Management Module) accounts, which are commonly used by money managers to oversee multiple accounts.

The account opening process itself is quick, taking only a few minutes. However, I encountered several dead links on the website, including the main ‘Sign up’ link, which was frustrating. I had to search for an alternative link on the site to proceed.

Additionally, the welcome email I received was badly formatted in parts, which didn’t build confidence.

Demo Accounts

Bullwaves offers a risk-free demo account compatible with MT5. With the paper trading account, you can test strategies without constraints right from the get-go.

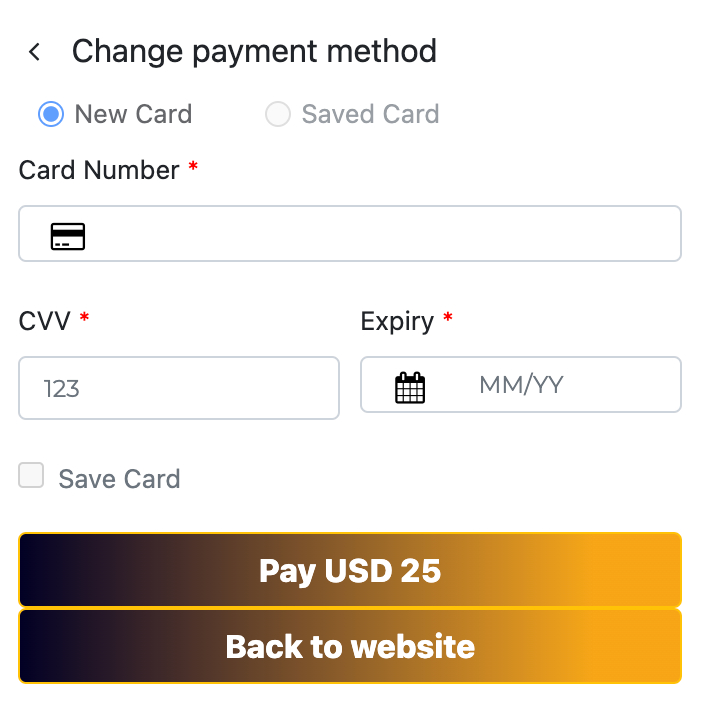

Deposits & Withdrawals

Bullwaves’ banking options are relatively flexible and include bank card (Visa, Mastercard and virtual card), Neteller (e-wallet), bank wire, and USDT cryptocurrency (TRC20 and ERC20).

It’s disappointing they don’t support other popular cryptocurrencies such as Bitcoin or Litecoin, or other popular e-wallets including PayPal and Skrill.

International bank wire deposits typically take 3-5 business days to appear in my Bullwaves account.

While Bullwaves does not levy charges for bank wire deposits, sending and correspondent banks may apply fees according to their individual fee structures. SEPA (Single Euro Payments Area) transfers typically reflect within the same business day, with very low associated fees.

It’s important to mention that Bullwaves deals in USD and EUR currencies, with GBP also now available. When depositing cryptocurrency, it undergoes automatic conversion into one of these fiat currencies.

Similarly, withdrawals follow the same pathway, returning funds to the original account and method used for funding.

Bullwaves

Interactive Brokers

InstaTrade

Accounts & Banking Rating

Payment Methods

Credit Card, Debit Card, Mastercard, Neteller, Visa, Wire Transfer

ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer

Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Mastercard, Visa, Wire Transfer

Minimum Deposit

$250

$0

$1

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Assets & Markets

Bullwaves focuses on forex and CFD trading, omitting popular asset classes such as real stocks, cryptocurrencies, or options.

Its array of tradable products is also limited compared to most other brokers, encompassing over 100 currency pairs along with CFDs in precious metals (gold and silver) and several major indices (Germany 40, FTSE 100, S&P 500, Dow Jones, Nasdaq-100, CAC 40).

That said, Bullwaves has made strides in this department, introducing popular stock CFDs like Apple, Nvidia and Tesla, commodities such as oil and gas, plus ETFs for broader market exposure.

Still, in comparison, CMC Markets provides access to over 300 forex pairs, while XTB offers a collection of over 2,100 global markets and multiple asset classes.

Leverage is available up to 1:500, which is also disappointing compared to some off-shore brokers which offer 1:1000 and 1:2000, though higher leverage significantly increases the risk of large losses.

Considering the broker offers cryptocurrency deposits and withdrawals, I’m surprised there is no support for trading any crypto even if conducted via CFDs, which means I wouldn’t acquire the underlying coins.

Traders seeking a broader range of cryptocurrencies should consider eToro, which offers a selection of over 100 cryptocurrencies.

Bullwaves does not offer passive income opportunities, such as earning interest on idle account balances, which distinguishes it from competitors like XTB and Interactive Brokers.

Bullwaves

Interactive Brokers

InstaTrade

Assets & Markets Rating

Trading Instruments

CFDs, Forex, Commodities, Stocks, Indices, ETFs

Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies

FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures

Margin Trading

Yes

Yes

Yes

Leverage

1:500

1:50

1:1000

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Fees & Costs

Bullwaves catches your attention with its fee structure, featuring no commissions.

However, the spreads offered by Bullwaves vary depending on the type of account you have. For major currency pairs like EUR/USD and USD/JPY, spreads can start from 2.0 pips with the Classic Account.

Yet day traders and scalpers aiming to capitalize on every pip might find brokers like IC Markets, which offers zero spread accounts (albeit with small commissions), more appealing.

Bullwaves charges a fixed fee of €10 for bank wire withdrawals equal to or below €100, and the same fee applies to other withdrawals (excluding card refunds) equal to or below €20.

Regarding account maintenance, Bullwaves may apply a $10 inactivity fee if there are no trades made for 30 days – kicking in much faster than most top brokers.

| Bullwaves | Interactive Brokers | InstaTrade | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | Variable | 0.08-0.20 bps x trade value | 0.0 |

| FTSE Spread | Variable | 0.005% (£1 Min) | 660 |

| Oil Spread | Variable | 0.25-0.85 | 0.0 |

| Stock Spread | Variable | 0.003 | 8 (Apple Inc) |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

Bullwaves does not have its own proprietary trading platform, which might be a concern, especially for those new to trading. However, they compensate for this by offering support for a widely recognized third-party platform: MetaTrader 5.

They also provided MetaTrader 4 for a period, but have discounted that, giving traders just one software option.

MT5 is accessible on various devices, including desktop and mobile, and can also be run directly in web browsers.

MT5 offers a comprehensive set of features, supporting a broade range of assets. It also boasts fast processing speeds and advanced backtesting capabilities. However, its interface may be slightly more complex for beginners, and its scripting language differs from that of MT4.

Unfortunately, Bullwaves does not support other popular charting platforms like TradingView and cTrader, which could be a drawback for day traders who prefer these tools.

Misleadingly, Bullwaves embeds TradingView educational content on its site, which may lead some traders to believe that the third-party platform is supported.

Bullwaves

Interactive Brokers

InstaTrade

Platforms & Tools Rating

Platforms

MT5

Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower

InstaTrade Gear, MT4

Mobile App

iOS & Android

iOS & Android

iOS & Android

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Research

Many brokers, lacking the resources to generate their own content, license high-quality analysis tools from providers like Trading Central or Autochartist. However, Bullwaves falls short in this regard and does not offer access to these tools – even though it advertises Autochartist on its website.

Furthermore, there is no economic calendar, no blog content, no technical or fundamental forecasts, and no market sentiment indicators. This complete lack of resources makes Bullwaves completely unsuitable for new traders.

To further compound the inadequacy, Bullwaves’ website is full of holding pages that display dummy text and misleading comment counts.

| Bullwaves | Interactive Brokers | InstaTrade | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Bullwaves falls short in this area, as it does not provide any educational resources. Consequently, new traders must seek out alternative sources to acquire essential skills in risk management, technical analysis, and trading psychology.

The Bullwaves website doesn’t even include an Education section, so there are no immediate plans to match the trading tutorials, webinars, and other educational resources offered by leading brokers, notably IG.

| Bullwaves | Interactive Brokers | InstaTrade | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Whereas the best brokers offer various support options available around the clock, 7 days a week, including live chat, email, and localized telephone support hotlines, Bullwaves simply offers a contact form, email address and Seychelles-based phone number.

There is also no live chat option, even though the website claims ‘24/7 live support’, and the vast majority of brokers we’ve evaluated support this feature.

I really could have done with chatting to a live agent when I encountered some difficulties setting up my Bullwaves account.

I emailed support to try and help me to resolve my issue, but I never received a reply.

Bullwaves

Interactive Brokers

InstaTrade

Customer Support Rating

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Should You Trade With Bullwaves?

Bullwaves is a fairly new broker with an urgent need for improvement if it aims to compete with industry leaders.

It doesn’t charge any commissions, helping to keep trading costs straightforward. In addition, the MT5 trading platform is supported, and there’s a reasonable selection of funding options.

On the downside, the website is full of broken links (it looks like an unfinished off-the-shelf WordPress theme), there are no research or educational tools, and customer support is almost non-existent. I was also left wanting in terms of the minimal range of financial instruments offered and the basic regulatory compliance.

Overall, Bullwaves is best avoided until it becomes a better-presented package.

FAQ

Is Bullwaves Legit Or A Scam?

Bullwaves is a relatively new brand with its registered address in Seychelles. Due to the broker’s recent entry into the market, there is limited information available to evaluate its reputation. Consequently, we recommend that traders exercise extreme caution when considering this broker.

Is Bullwaves A Regulated Broker?

Bullwaves operates under Equitex Capital Limited, which is regulated by the Financial Services Authority of Seychelles (FSA). Although the Seychelles FSA enforces compliance standards, it is not a well-regarded regulator.

Is Bullwaves Suitable For Beginners?

Bullwaves is definitely not suitable for novice traders because it lacks a proprietary trading platform, any educational materials or reliable support to assist aspiring traders.

New traders may find platforms like eToro and Plus500 more suitable alternatives to consider.

Is Bullwaves A Good Broker For Day Trading?

Bullwaves is reasonably well suited for day trading because of its fast execution speeds and compatibility with scalping and hedging strategies. MT5 serves as an advanced trading platform, offering comprehensive charting tools, technical indicators, and order types designed to facilitate the execution of day trading strategies.

That said, its various shortcomings mean it doesn’t rival the best brokers for day trading.

Does Bullwaves Have A Mobile App?

No, however MT5 offer mobile applications for both iOS and Android devices. These apps enable traders to access their accounts, monitor real-time market data, execute trades, manage positions, and utilize a range of analytical tools conveniently while on the go.

Best Alternatives to Bullwaves

Compare Bullwaves with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- InstaTrade – InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

Bullwaves Comparison Table

| Bullwaves | Interactive Brokers | InstaTrade | |

|---|---|---|---|

| Rating | 3.9 | 4.3 | 3 |

| Markets | CFDs, Forex, Commodities, Stocks, Indices, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 |

| Regulators | FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | BVI FSC |

| Bonus | – | – | – |

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | InstaTrade Gear, MT4 |

| Leverage | 1:500 | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 7 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

InstaTrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Bullwaves and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Bullwaves | Interactive Brokers | InstaTrade | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | No | Yes |

| Corn | Yes | No | Yes |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | Yes |

| Options | No | Yes | No |

| ETFs | Yes | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Bullwaves vs Other Brokers

Compare Bullwaves with any other broker by selecting the other broker below.

Customer Reviews

3.5 / 5This average customer rating is based on 2 Bullwaves customer reviews submitted by our visitors.

If you have traded with Bullwaves we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Bullwaves

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’ve been trading with Bullwaves for coming up to 6 months now and here’s what I like and don’t like. As a long-time MT5 user I switched to Bullwaves for their MT5 Next Generation plug-in which is handy if you’re like me and want tighter order management and sentiment data integrated. What’s crap is their extra tools though, their Bull News should be called Bull S****. I go elsewhere for any meaningful market research and live news coverage. I’m staying with them for now as I do think they’re tryoing to get better.

I opened a Bullwaves account for the 20% deposit bonus, which meant i could practice scalping the cable. I stayed because their MT5 platform is well reliable and it has the indicators I need for me setups, ie MACD. Don’t expect the full service you get from a firm like eToro though where I had an account before – no decent insights or flashy app.