Spreadex Review 2026

See the best Spreadex alternatives in your location.

Awards

- Best Spread Betting Provider - 2020 COLWMA Awards

- Best Mobile Trading Platform - 2020 ADVFN Awards

- Best Trading Alerts System - 2020 ADVFN Awards

- Best Spread Betting Provider - 2019 GMG Awards

Pros

- Spreadex has introduced trading signals to its desktop platform, powered by Autochartist, providing real-time, pattern-based insights to help traders identify potential opportunities.

- Spreadex gives UK traders the opportunity to make tax-free profits through spread betting

- A rare broker that provides access to lower market cap stocks traded on the AIM

Cons

- The lack of a demo account will frustrate prospective clients who want to test Spreadex's services

- The limited customer service can make it time-consuming to troubleshoot problems

- There's no support for expert advisors or other trading bots

Spreadex Review

The Spreadex Ltd company facilitates trading in forex, CFDs and spread betting. But whether it’s sports or financials that you’re interested in, all clients benefit from the same high-quality trading platform and excellent customer service. This 2026 review of Spreadex examines both the pros and the cons, including live accounts, mobile apps, and more.

Spreadex Headlines

Spreadex hit the digital trading and gambling scene in 1999. Originally its head office location was Dunstable, Bedfordshire. However, in February of 2008, the owners shifted the central office address to St Albans, Hertfordshire.

In 2006, the UK-based limited company launched an online spread betting service, which was swiftly followed by their financial trading platform. By the time May 2010 rolled around, Spreadex had also brought out a new fixed-odds sports betting service. This allowed users to place bets in both fractional and decimal formats.

In 2011, the firm introduced a digital casino featuring a dealer service and a range of games, including:

- Slots

- Roulette

- Blackjack

Spreadex introduced ‘Speed Markets’ in 2013. This allowed clients to place fixed risk bets on financial markets.

Recent annual reports have shown Spreadex’s turnover has topped £49 million. Unsurprisingly, dividends have led to relatively content shareholders and good investor relations. The Managing Director and senior leadership team have aimed for success offline too. The company advertises and operates a fixed odds spread betting pitch at Kempton Park Racecourse.

Those at the top of the Spreadex ownership have also been active with sponsorship deals. They have reached agreements with Burnley FC, Armed Forces charities, the Responsible Gambling Trust, and Cancer Research. All of which aim to demonstrate and promote some of their core values, including ethical dealings.

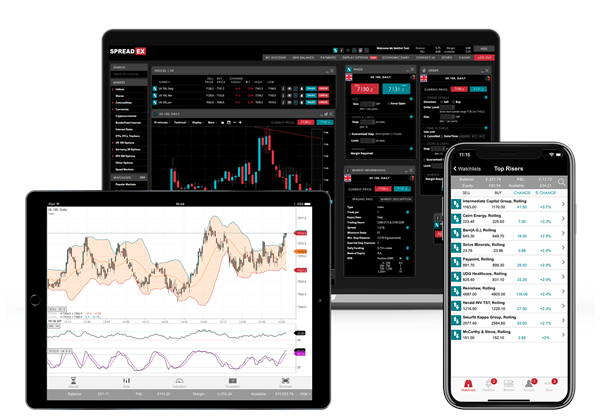

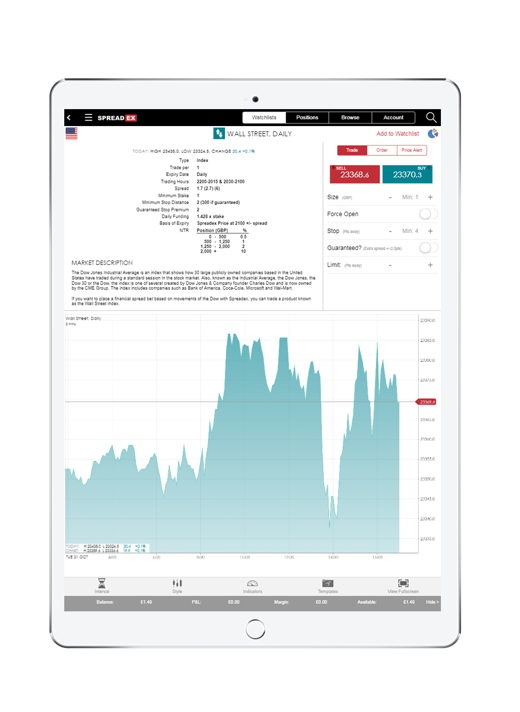

Trading Platform

You can download the Spreadex trading platform or view it as a web-based browser. Once you log in (logo located at the top of the page), you are met with a clean and intuitive platform. With that said, one of the main highlights is the high levels of customization. You can view data in a format that makes for comfortable trading.

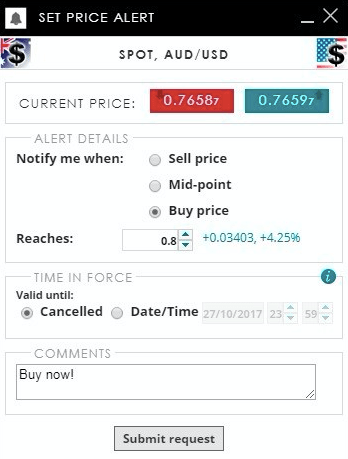

You also have one-click trading and straightforward access to edit orders. Another useful feature is their Price Alert service. This allows you to set up text or email notifications when prices reach certain levels.

The CEO has also made an effort to ensure the platform provides a comprehensive offering. As a result, you get a succinct newsfeed and easy-to-digest financial results.

Spreadex.com reviews also praise the training offering. Tutorials come in the form of a user-friendly video training center. This is ideal for new traders who want to get to grips with guaranteed stop-losses, for example.

A few other key trading tools include:

- Force open positions – You can go long and short at the same time by selecting ‘Force Open’ on your trade ticket.

- Price improvements – Spreadex takes their prices from a range of resources. But most importantly, if the price shifts once you click to trade, you will not be filled at a worse level.

- Fast execution speed – Platform execution speed is essential as an intraday trader, where every second counts. Fortunately, Spreadex was named the Best for Efficient of Taking Trades in the Investment Trends UK Leveraged Trading Awards.

So, is Spreadex any good in terms of their trading platform? Customer reviews answer that question with a resounding yes.

Note, Spreadex is not a white label.

Assets & Markets

One of the most impressive aspects of the Spreadex offering is the extensive list of products. Traders can speculate on over 60 FX pairs and have access to 10,000+ instruments, including options, shares, indices, interest rates, bonds, ETFs, commodities (such as oil), and cryptocurrency (like Bitcoin).

Customer reviews are also quick to praise Spreadex for promising among the most comprehensive AIM stock selection, including small caps down to market caps of £1 million.

The company also applies its concept of spread betting to sports events. This means consumers can speculate on all of the following:

- UFC

- Golf

- Darts

- Tennis

- Boxing

- Cricket

- Snooker

- E-Sports

- Football

- Handball

- Volleyball

- Basketball

- Ice hockey

- Greyhounds

- Table tennis

- Horse racing

- Rugby union

- Rugby league

- Virtual sports

- Motor racing (like F1)

- Football Supremacy betting

- NFL Super Challenge leaderboard

Users can also take positions on politics, such as the UK general elections.

Note, you can access all of the above trading options from a single trading account.

Spreads & Commissions

Spreadex makes money by taking a fee from the spread (the difference between the buy and sell price). The results of comparisons with competitors show minimum spreads are relatively attractive. For example, you can trade on the EUR/USD from 0.6 pips, while the industry average is around 1.5 pips.

See the full website for a comprehensive breakdown of minimum spreads. You can also find details on maximum daily payouts.

Note, you will incur rollover charges based on your position size. However, one distinct positive this guide found was that Spreadex does not charge any inactivity fees, unlike many competitors.

Leverage

Spreadex offers up to 75% leverage. Used correctly, trading on margin could help you capitalize on market opportunities and enhance your potential salary. But while Spreadex’s margins and rates are competitive, leveraged trading comes with significant risks. In fact, if you’re not careful, you could lose more than your initial deposit and quickly end up in debt.

Importantly, you can amend your credit limit by contacting customer support.

Mobile App

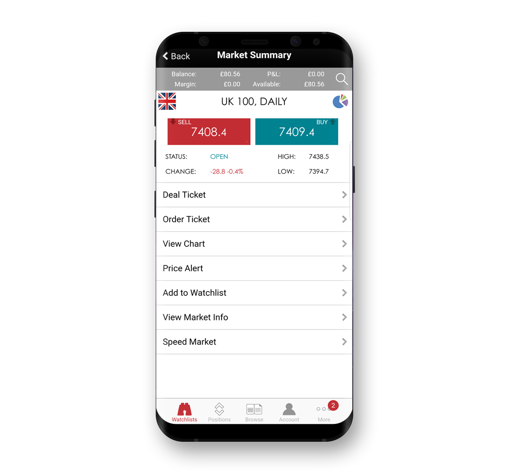

Both financial and sports trading reviews are positive regarding the mobile app offering. Consumers can download and access a website-based app for Android and iPhone devices. The mobile terminal is similar to the desktop site.

Features include:

- Depositing funds

- Creating watch lists

- Accessing trade history

- Adding or editing orders or limits

- Monitoring and editing various trade types

Both their mobile sports and financial offering also includes access to an advanced charting suite. The proprietary charts include intelligent features, such as:

- Automated trend lines

- Pinching to zoom in and out

- Over 10 years of historical data

- Candlestick pattern recognition

- Capabilities to save and edit templates

- A long list of editable technical indicators

- High, low and change percentage is shown for today’s trading day

Overall, placing rolling trades and other orders is simple and stress-free on the Spreadex mobile apps.

Spreadex Payment Methods

There are a number of Spreadex payment options. Deposit methods include:

- Cheque

- Wire transfer

- Debit & credit cards

- Online bank transfer

The broker does not accept deposits from E-wallets, such as Neteller. It may also take some time to check bank details initially and you can only use the following currencies: GBP, USD, EUR, CHF, and CAD.

Blogs and forums show Spreadex disappoints in terms of payment options, coming in below the industry norm. Traders would also, understandably, like swift access to their profits, so an improvement in withdrawal times would be welcome.

Importantly, opening a live account with Spreadex requires no minimum deposit. The minimum bet/trade size on most markets is then just 1p, and the rest start from 15p. User reviews demonstrate that Spreadex is an attractive proposition to traders with limited initial capital.

Spreadex charges £1 on debit card deposits under £50, even on UK cards or bank transfers. In addition, CHAPS same-day payments incur a £25 charge. Finally, a fee is in place on all non-sterling card transactions.

Direct withdrawal times range from two to five business days. The minimum withdrawal amount is £50, and you can make multiple withdrawals in a single day.

Demo Account

One distinct downside this review of Spreadex found was the lack of a demo account. This is a real shame as practice accounts are a fantastic way to get a feel for a broker and platform. They are also a brilliant tool for novice traders to develop market confidence.

So traders looking for a demo account may want to consider one of the many competitors that offer this service, free of charge and for an unlimited period.

Bonuses & Promotions

Prospective clients should also consider new account welcome offers and promotions. The company has a £300 cashback or an attractive free iPad mini joining offer. The firm has also been known to run an Apple Watch Sports deal.

There are also other sign up bonuses to consider, such as risk-free bet offers. In addition, the firm sometimes coordinates a refer a friend scheme where you can enjoy up to a £100 Speed Market bet.

Regulation & Licensing

It is important that prospective clients look for regulated brokerages. This can help limit the risk of falling victim to scams and fraudulent companies. Fortunately, Spreadex receives regulatory oversight from the UK’s Financial Conduct Authority (FCA). Clients’ funds are kept segregated from the company’s operating capital via tier-1 banks.

FCA oversight also means Spreadex must adhere to regulations that aim to protect consumers. Not to mention, clients’ capital is kept secure from a range of scenarios, such as bankruptcy.

Additional Features

Spreadex offers several useful additional features. On the sports side, accumulators, coupon betting, and other options allow clients to see the same type of bets in a single place.

The company has also brought in ‘Pulse’ for those interested in the financial offering. This notification system lets you stay up-to-date with changes in stocks and other instruments on your watchlist.

In terms of education, you can find a number of useful resources, including:

- Tips

- Interviews

- OddsChecker

- Market updates

- Charting guides

- Trade examples

- Economic calendars

- Indicator explanations

- Premier League points video guides

- Essential sports information, including golf, tennis and cricket rules

On top of sports rulebooks, you will find fixed odds rules and conditions. You can also meet the Spreadex team by heading to the About Us section on their website.

On the downside, some user reviews were quick to complain about the lack of API access.

Accounts Types

With both sports and financial betting, how does Spreadex work in terms of accounts? Fortunately, you can use the same account for both. However, to comply with FCA regulations, each new customer must pass compliance checks:

- A scanned copy of either your passport, driving license or national ID

- A utility bill or bank statement from the last three months, displaying your residential address

It can take several days to pass all compliance checks and get up and running.

Some clients may also qualify for a credit limit, which you can apply for when you sign up. If accepted, you can trade immediately without depositing funds into your account. Alternatively, you can opt for the standard pay-as-you-go option.

If you wish to close an account, you can do so directly from within your account area. Alternatively, you can contact customer support. Spreadex Ltd contact details can be found on the official website.

Trading Hours

Spreadex is open during normal market hours. However, they also offer out-of-hours trading. The company will quote prices on UK 100 markets between 21:00 Sunday until 21:15 Friday during extended hours.

This allows you to react promptly to market events. It also means you have increased risk management during periods of volatility. Finally, out-of-hours trading will enable you to offset standard share positions usually open only during the day.

See the customer agreement on the official website for further details. There you can also find Christmas opening hours and other upcoming holiday times.

Customer Support

Reviews of Spreadex’s customer support are mostly positive. You can seek help and lodge complaints via email or telephone. Head to the Contact Us section on the website. There you will find financial and sports contact telephone numbers.

You can also pick up the relevant email address or the postal address for the Spreadex Ltd St Albans office, located at Churchill house. Spreadex does not have a London office, so all communications must be sent to the St Albans address.

Employees are courteous and knowledgeable, while response times are around the industry average. Customer service agents should be able to help with sports or financial login problems, while you can also have betting rules, plus terms and conditions explained.

Spreadex has earned a BrokerNotes double AA support rating for promising assistance in over three languages, as well as phone and email support.

Unfortunately, Spreadex does not offer a live chat service. As customer reviews demonstrate, this is a serious drawback. Live chat assistance usually promises fast and effective support. This is an area Spreadex could improve in, especially as most competitors now offer such a service.

Security

Spreadex takes personal security and privacy seriously. They use advanced encryption technologies and follow a number of security protocols. This should help keep your data safe from:

- Loss

- Destruction

- Falsification

- Manipulation

- Unauthorized access or disclosure

Spreadex Verdict

Both financial and sports trading reviews are positive. In addition, the extensive financial and sporting product index allows for speculation on a vast range of events. Furthermore, their bonus programs means you can pick up generous welcome offers. Overall, they are a good choice for traders of all experience levels. In fact, it is predominantly only those seeking a free demo account or a live chat service that may want to look elsewhere.

FAQ

Does Spreadex Have Binary Options?

No, the broker does not currently provide binary options. However, it has over 10,000 instruments, including forex, stocks, and commodities.

Is Spreadex Legit?

Yes, Spreadex is a reputable broker. They implement industry-standard encryption technologies to protect users’ funds and are regulated by the Financial Conduct Authority (FCA).

What Is The Minimum Deposit At Spreadex?

There is no minimum deposit. Payments of less than £50 incur a £1 charge while deposits over £50 are free.

Does Spreadex Have A Demo Account?

The broker doesn’t provide a free demo account, but it does offer low bet/trade sizes of 1p – 15p. This could make an initial investment of £50 go very far.

Can I Use MetaTrader With Spreadex?

Spreadex doesn’t support either MT4 or MT5. Instead it has a proprietary platform, which can be downloaded from the official website.

Can You Still Trade On Spreadex?

The broker is restricted when it comes to the regions it can provide fixed odds and casino services. They are licensed for fixed odds betting in the UK, Ireland, and Denmark; and casino gaming in the UK and Ireland.

Best Alternatives to Spreadex

Compare Spreadex with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Spreadex Comparison Table

| Spreadex | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 3.8 | 4.3 | 4.5 |

| Markets | Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | £0 | $0 | $100 |

| Minimum Trade | £0.01 | $100 | 0.01 Lots |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | £300 cashback | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | Spreadex Platform, TradingView, AutoChartist | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 | 1:50 | 1:50 |

| Payment Methods | 6 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Spreadex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Spreadex | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | No |

| Futures | No | Yes | Yes |

| Options | Yes | Yes | Yes |

| ETFs | Yes | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | Yes | No | No |

| Volatility Index | Yes | No | No |

Spreadex vs Other Brokers

Compare Spreadex with any other broker by selecting the other broker below.

Customer Reviews

4 / 5This average customer rating is based on 1 Spreadex customer reviews submitted by our visitors.

If you have traded with Spreadex we would really like to know about your experience - please submit your own review. Thank you.

Spreadex gets it right where it matters for active traders like me. The platform is super intuitive and definitely has its own look and feel from many trading softwares I’ve used. I like that once you locate an instrument you have all the icons next to easily add to your watchlist, pull up news or set up an alert. They are also brill for charting with loads of stuff you don’t see at most brokers these days just using a generic TradingView option. Eg there’s point and figure charts whcih really home in on the price action. Only bug bear I have is that whenever I press on the financial calendar it takes you out the platform and into a seperate tab – why? I want all the info in one view! Otherwise would be a 5.