OnFin Review 2026

See the Top 3 Alternatives in your location.

Pros

- During our tests, both MT4 and MT5 platforms remained stable, even during high-volatility events. We experienced no platform freezes, requotes, or disconnections - which is critical for day traders relying on precise entry and exit timing.

- OnFin’s dedicated copy trading platform lets you follow multiple strategies at once, compare their profitability, and fine-tune how much capital is allocated to each. While not as advanced as eToro, it still offers a useful social trading layer for hands-off traders.

- With entry points as low as $1 on the Mini account and $50 for ECN access, OnFin is accessible to traders on a tight budget. Its fixed spreads, while not the cheapest we’ve seen, may also appeal to newer traders seeking price certainty.

Cons

- At sign-up, we were only asked to choose MT4 or MT5, with no explanation of the four account types (ECN, Standard, Mini, Fix) or how they differ. We had to dig through support pages post-registration to understand our options - a frustrating experience, especially for beginners.

- You must register for a live account before accessing the demo, unlike most brokers that offer instant access. The demo is also restricted to MT5, defaults to USD only, and doesn’t allow setting local currencies like GBP or EUR without a manual request.

- Licensed by MISA in Mohéli, Comoros, OnFin lacks oversight from major regulators. There are no guarantees on client fund safety, no compensation schemes, and no formal recourse if something goes wrong.

OnFin Review

Unlock the truth about trading with OnFin in this in-depth review that cuts through the hype. We provide an unbiased look at the broker’s key features, uncovering both its advantages and potential drawbacks.

Backed by our real-world experience using OnFin, we spotlight the elements that matter most for active, short-term traders.

Regulation & Trust

OnFin is a forex and CFD broker that began operations in 2015, initially under the name ECN.Broker. The company is registered in Mohéli, an autonomously governed island that forms part of the Union of the Comoros.

OnFin holds a licence with the ‘red-tier’ MWALI International Services Authority (MISA) according to DayTrading.com’s Regulation & Trust Rating. However, despite this licensing, it’s important to note that MISA is not recognized as a major financial regulatory body. In the broader financial industry, OnFin is generally considered an unregulated broker.

Trading with an unregulated broker like OnFin carries significant risks compared to dealing with brokers regulated by reputable authorities such as the US Securities & Exchange Commission (SEC), UK’s Financial Conduct Authority (FCA), or the Australian Securities & Investments Commission (ASIC).

Regulated brokers are subject to strict oversight, including requirements to segregate client funds, undergo regular audits, and participate in compensation schemes that protect client funds up to certain limits like the £85,000 under the UK’s Financial Services Compensation Scheme (FSCS).

In contrast, unregulated brokers like OnFin are not bound by these stringent standards. This lack of oversight means there is a higher risk of fund mismanagement, lack of transparency, and limited recourse in case of disputes or broker insolvency.

While OnFin offers attractive trading conditions, such as high leverage up to 1:3000, negative balance protection and flexible funding methods, you should weigh these benefits against the potential risks associated with its unregulated status.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | MISA | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

OnFin’s account types differ depending on whether you use MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which affects trading conditions and costs.

- ECN (MT4 & MT5): Both platforms offer ECN accounts with floating spreads from 0.0 pips, a minimum order size of 0.01 lots, and a $4 commission per lot. The minimum deposit is $50. While the tight spreads and low costs are competitive, the maximum leverage of up to 1:1000 (MT5) or 1:3000 (MT4) is far higher than what is permitted by regulated brokers, which typically cap leverage at 1:30 for retail traders. This exposes you to much higher risk than at FCA, ASIC, or CySEC-regulated firms. The $4 commission per lot is on the higher side, and without regulation, the true ECN nature of the account is hard to verify.

- STANDARD (MT5): The Standard account offers floating spreads from 2.4 pips without commission, a minimum order size of 0.01 lots, and a $100 minimum deposit. These spreads are broader than those offered by leading brokers we’ve tested, who often provide lower spreads and more transparent fee structures. Again, leverage is available up to 1:3000, which is excessive by industry standards and increases risk for inexperienced traders.

- MINI (MT4): Designed for beginners, the MINI account has a minimum deposit of $1, a minimum order size of 0.01 lots, spreads from 2.4 pips and no commission. While the low entry point is appealing, the trading costs are high compared to top brokers, and trading instruments are limited to forex and metals.

- FIX (MT4): The FIX account features fixed spreads from 3.0 pips, a minimum order size of 0.01 lots, no commission, and a $50 minimum deposit. Fixed spreads at this level are not competitive with top brokers, who typically offer fixed spreads below 2.0 pips. The high leverage remains a concern.

OnFin’s range of account types differ between MT4 and MT5. The lack of clarity in naming, and the absence of detailed, easy-to-understand comparisons make it harder to choose the most suitable account.

When I signed up with OnFin, the broker only asked me to choose between MT4 or MT5 and gave no explanation of the different account types available.This lack of guidance made it difficult for me to understand all the available options.

In contrast, top brokers transparently offer named, standardized account types, making the selection process much more straightforward for beginner traders.

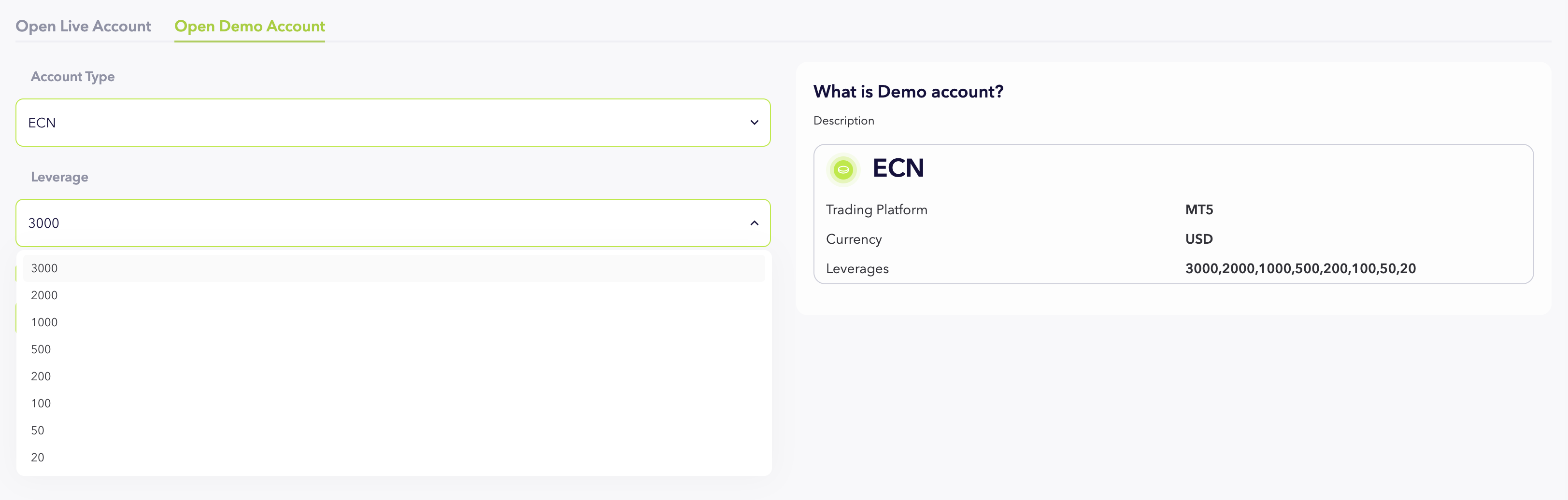

Demo Accounts

OnFin’s demo account setup is less user-friendly than that of leading brokers. I could only open a demo account after registering for a live account, which is an extra step not required by most top brokers we’ve tested – many allow instant demo access without personal registration.

Once inside, I was limited to using the MT5 platform only, with no option for MT4. The demo account could only be denominated in USD up to $10,000 by default (up to $1m is available on request) – which isn’t ideal as I wanted to practice managing risk in local currencies (GBP or EUR) – but I did have the option to open up to five demo accounts to test different strategies.

While I could select leverage anywhere from 1:20 up to a high 1:3000, there was no option for 1:1 leverage, a standard feature at many established brokers for those wishing to simulate risk-free or low-risk trading.

Top brokers typically offer demo accounts across all available platforms, a choice of several base currencies, and a full range of leverage options – including 1:1 – some even without requiring live account registration.

On the plus side, as long as I keep it active within 90 days, the demo will not expire, unlike many brokers that delete demo accounts after a few months regardless of your trading frequency.

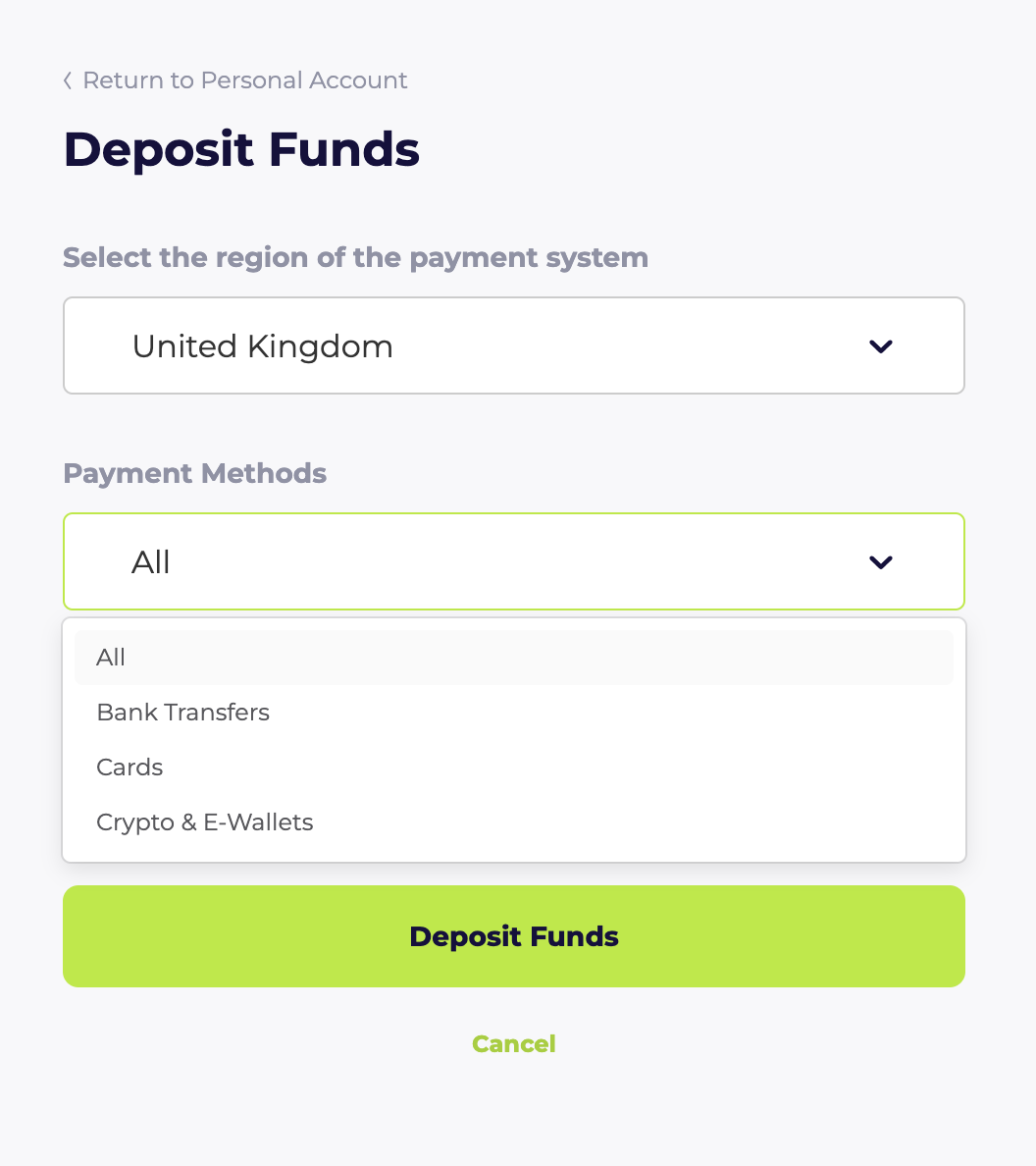

Deposits & Withdrawals

OnFin offers a variety of funding options, though currencies (EUR, USD, RUB, KZT) and methods depend on your location.

Supported deposit and withdrawal methods include SEPA bank transfers, debit and credit cards, cryptocurrencies (such as Bitcoin and USDT), and e-wallets like SticPay and Perfect Money.

These deposit and withdrawal options are notably limited compared to those of top brokers, especially for clients in certain regions.

For example, when funding from the UK, I can’t use e-wallets, and crypto is limited to USDT. This restriction can make funding and withdrawing from an account inconvenient, putting OnFin at a disadvantage if you value convenience, speed, and a seamless funding experience.

On the plus side, there are generally no deposit or withdrawal fees, and depending on the method, the minimum deposit amount can be as low as $1. The minimum withdrawal is also low at $10, ideal for those with small budgets.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Debit Card, Mastercard, Sticpay, Visa, Wire Transfer, Yandex Money | Bitcoin Payments, Credit Card, Debit Card, Mastercard, Visa, Volet, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $1 | $1 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

OnFin offers access to over 800 tradable assets across forex, metals, indices, commodities, stocks, and cryptocurrencies.

- Forex: OnFin offers over 50 major, minor, and exotic currency pairs, a solid selection for most retail traders and on par with many mid-tier brokers.

- Metals: The platform supports trading five precious metals, including gold, silver, aluminium, palladium, and platinum. This is a decent range, but some top brokers also include copper and rare metals, expanding diversification opportunities.

- Indices: OnFin covers 14 major stock indices such as S&P 500, China50, Nikkei 225, and Nasdaq-100. While this is sufficient for basic index trading, top brokers typically offer dozens more, including minor and sector-specific indices from multiple continents.

- Commodities: You can trade just three energy commodities including Brent and Crude oil and natural gas. This is a standard offering, but leading multi-asset brokers often add agricultural commodities and softs, providing broader market exposure.

- Stocks: OnFin provides access to more than 750 stocks (US only) via MT5, which drops to around 180 on MT4. However, MT4 includes tickers from US exchanges and selections from the UK, Germany, Asia, and Russia.

- Cryptocurrencies: The broker lists 21 popular cryptocurrencies, including BTC, ETH, LTC, NEO, BCH, XRP, and TRX. This is competitive for a CFD broker but still narrower than the hundreds of tokens available at leading crypto-focused platforms.

OnFin’s asset selection is broad for a low-tier CFD broker, especially with its inclusion of Russian stocks and a relatively large number of cryptocurrencies.

However, compared to global leaders, the range in each asset class is still limited, and notable omissions – such as ETFs and bonds – are standard at top multi-asset brokers.

The focus on CFDs also means you do not get direct ownership of underlying assets, which can limit long-term investment strategies and may affect costs such as overnight financing.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Metals, Commodities, Crypto | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:3000 | 1:1000 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

OnFin’s fee structure is competitive in several respects, but there are essential trade-offs compared to leading brokers. The ECN account offers floating spreads from 0.0 pips with a $4 commission per lot, which is a touch more expensive than industry standards.

Other accounts, such as FIX and MINI, have no trading commission but feature wider spreads, starting from 1.2 to 3.0 pips, depending on the account type.

In our hands-on trading at OnFin, spreads on major forex pairs were generally tight during regular market hours. Still, I noticed they could widen significantly during periods of low liquidity or high volatility, which is not uncommon but worth noting for active traders.

OnFin stands out by charging no deposit or withdrawal fee, which is a clear advantage over brokers that may impose charges for certain funding methods. However, if you don’t make a trade within 60 days, an extremely high inactivity fee of USD $50 per month applies. This is disappointing, as many brokers offer no inactivity fees.

Minimum deposits are very low – starting at just $1 on the MINI account – making the broker accessible to beginners. However, all accounts are denominated in USD, which can lead to conversion costs if you fund your accounts in other currencies.

OnFin’s trading costs are generally low for ECN-style trading but less competitive for fixed or wider-spread accounts. Top brokers often offer tighter spreads across all account types, more currency options, and additional transparency around overnight financing and inactivity fees.

Based on my tests, OnFin’s cost structure is favorable for active forex traders using the ECN account but less so for those trading less frequently or seeking the lowest possible spreads on a broader range of assets.The lack of hidden fees is a plus, but the trade-off is higher risk due to leverage and less regulatory protection.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 2 | From 0.6 | 0.08-0.20 bps x trade value |

| FTSE Spread | 13 | NA | 0.005% (£1 Min) |

| Oil Spread | 1 | NA | 0.25-0.85 |

| Stock Spread | 11 (Apple) | From 0.03 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

OnFin offers traders a choice between MT4 and MT5, both industry-standard platforms known for their reliability, advanced charting, and support for automated trading.

MT4 is widely appreciated for its user-friendly interface and a robust ecosystem of custom indicators and expert advisors, which make it suitable for both beginners and experienced traders.

While not as universally adopted, MT5 provides additional features such as more order types, timeframes, and an integrated economic calendar, catering to those seeking greater analytical depth.

However, OnFin’s platform selection is limited to MT4 and MT5, whereas leading brokers often provide a broader range of options.

For example, I prefer cTrader due to its intuitive design and perfectly integrated economic calendar and news feed. At the same time, proprietary platforms from established brokers often include seamless mobile experiences, integrated news feeds, and exclusive trading tools.

From my hands-on experience, OnFin’s MT4 and MT5 execution is fast and stable, with no noticeable requotes or lag even during periods of high volatility. Chart customization and the ability to run automated strategies are considerable strengths.

A unique aspect of OnFin is its dedicated copy trading platform, which automatically allows you to follow and copy strategies from other traders in real-time. You can also compare strategies by profitability, subscribe to multiple strategies at once, and customize your allocations.

While this adds a social trading dimension, it is not as deeply integrated or as feature-rich as the social trading environments offered by other leading brokers.

While OnFin’s reliance on MT4 and MT5 ensures access to proven, reliable technology, it falls short of the versatility and innovation seen at leading brokers that offer a wider platform selection and proprietary solutions primarily aimed at beginner traders.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT4, MT5 | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android via mobile web trader | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

OnFin’s research tools are primarily those built into the MetaTrader platforms, especially MT5. The economic calendar is helpful, but no contextual guidance or strategy suggestions are tied to news events.

OnFin also maintains a blog that offers market updates and trading-related content. However, the blog is not positioned as a comprehensive research hub and lacks the depth, frequency, and actionable insights in leading brokers’ research portals.

Top-tier brokers typically provide in-house research, live analysis, trading signals, and access to premium third-party analytics, giving you a much richer and more actionable research environment.

Some even integrate advanced equity research tools, portfolio analytics, and AI-driven insights – features that exceed what OnFin currently delivers. This gap is particularly noticeable for traders who rely on comprehensive macroeconomic analysis, sentiment data, or actionable trade ideas.

Additionally, there is no integration with external research platforms like Autochartist, Trading Central or Signal Centre, which are increasingly standard at top-tier brokers. This makes OnFin less suitable for those who value deep market insights and curated research.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

OnFin’s educational offerings are minimal and fall short of industry standards set by leading brokers.

The broker does not provide structured educational resources such as webinars, e-books, tutorial videos, or comprehensive courses for traders at any level.

This lack of formal education is a significant drawback for beginners relying on broker-provided materials to build foundational knowledge and trading skills.

While OnFin has a blog that occasionally features articles like guides to leverage and basic trading concepts, the content is limited in scope and frequency.

The blog does not substitute for a dedicated education portal or a curriculum that systematically covers trading strategies, risk management, or platform tutorials.

I found little to no guidance for new users beyond basic platform navigation and no interactive content or community support to help traders progress.

This makes OnFin unsuitable for novice traders or those seeking to advance their trading knowledge through broker-led education.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

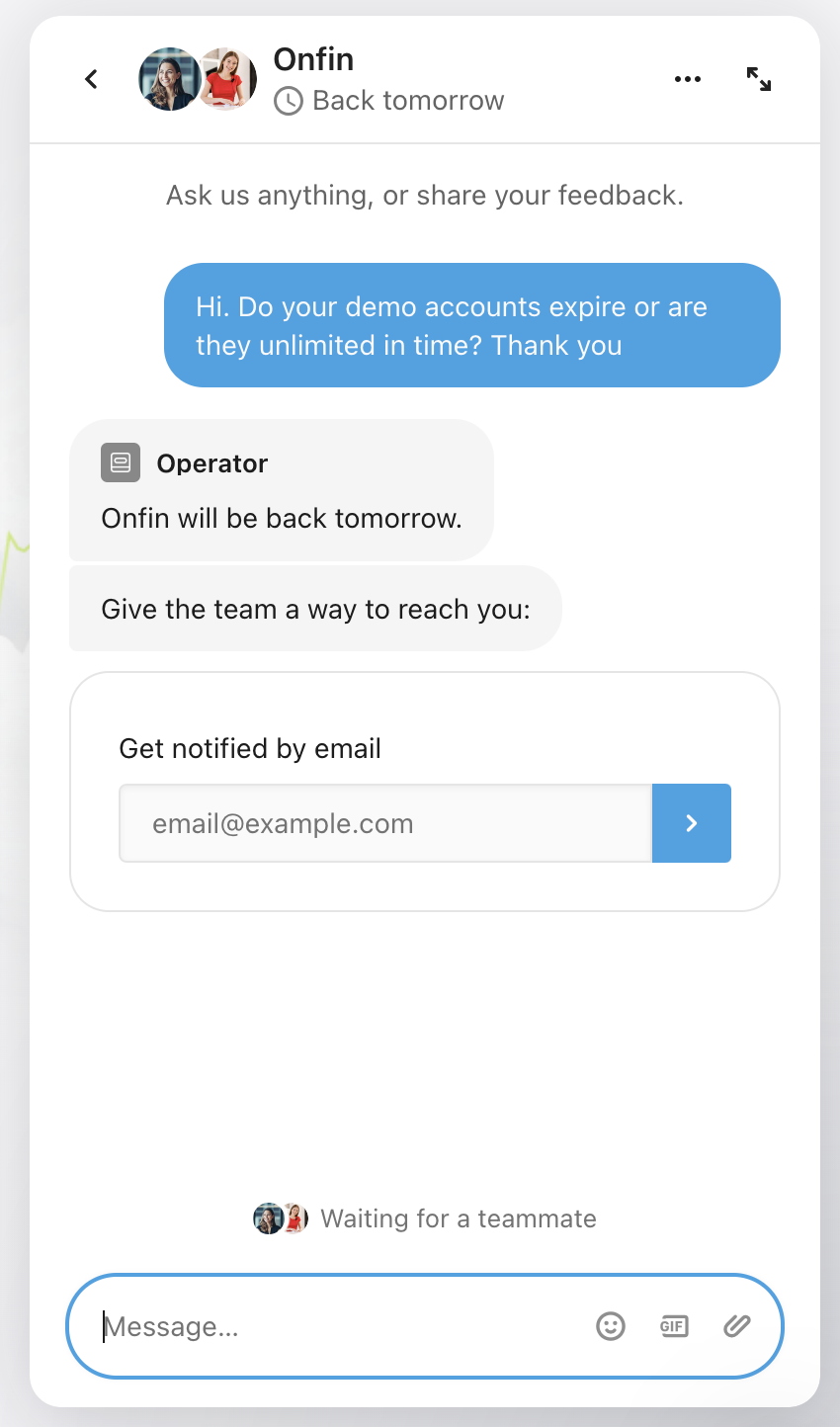

Customer Support

OnFin offers a range of customer support options, including phone, email, live chat, and social media. It also provides regional contact details for Europe, Russia, Georgia, the Philippines, Hong Kong, and Africa.

Support is available 24 hours a day, five days a week (Monday to Friday), which is standard for the industry but falls short of the true 24/7 support.

In my experience speaking to OnFin, responses via email and live chat are generally prompt and courteous, and support staff can handle basic account and platform queries efficiently.However, more complex or technical issues sometimes require escalation, leading to slower resolution times.

Compared to top brokers, OnFin’s support lacks some of the advanced features found elsewhere, such as dedicated account managers, multilingual support teams available around the clock, or integrated help centers with extensive self-service resources.

Leading brokers often provide educational webinars, interactive FAQs, and community forums as part of their support ecosystem, making it easier for you to resolve issues independently and learn from others.

While OnFin’s support is accessible and covers multiple channels, it sometimes feels fragmented. For example, the lack of a ticket-tracking system can make following up on unresolved issues more challenging.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With OnFin?

OnFin offers a reasonable range of tradable assets, high leverage, and competitive trading conditions, but it is ‘regulated’ offshore and lacks the strong client protections found with top-tier brokers.

Payment options, research tools, and educational resources are also limited compared to those of industry leaders based on our tests.

OnFin may appeal to risk-tolerant day traders seeking flexibility, but caution is advised. If you prioritize safety, transparency, and strong regulatory oversight, a more established broker is likely better.

FAQ

Is OnFin Legit Or A Scam?

OnFin does not appear to be a scam – it is a functioning offshore broker with a real license – but it operates in a high-risk regulatory environment with limited transparency.

Caution and thorough due diligence are strongly advised, and traders seeking maximum safety should consider brokers regulated by more reputable authorities like the SEC, FCA, or ASIC.

Is OnFin Suitable For Beginners?

OnFin can be suitable for beginners due to its low minimum deposit of just $1 and a demo account that allows risk-free practice. The broker also offers copy trading, which can help new traders learn by following experienced traders.

However, OnFin lacks structured educational resources such as webinars, courses, or comprehensive tutorials, which are often crucial for beginners to build solid trading skills. Limited research tools and minimal guidance during account setup may also steep the learning curve for new traders.

Best Alternatives to OnFin

Compare OnFin with the best similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

OnFin Comparison Table

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| Rating | 2.8 | 4 | 4.3 |

| Markets | CFDs, Forex, Stocks, Indices, Metals, Commodities, Crypto | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $1 | $1 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFDs) | $100 |

| Regulators | MISA | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | – | 100% Deposit Bonus | – |

| Platforms | MT4, MT5 | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:3000 | 1:1000 | 1:50 |

| Payment Methods | 7 | 7 | 6 |

| Visit | – | Visit | Visit |

| Review | – | World Forex Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by OnFin and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| OnFin | World Forex | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | Yes | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | No | No | Yes |

| Bonds | No | No | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

OnFin vs Other Brokers

Compare OnFin with any other broker by selecting the other broker below.

Customer Reviews

5 / 5This average customer rating is based on 1 OnFin customer reviews submitted by our visitors.

If you have traded with OnFin we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of OnFin

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

have had a great experience with Onfin as my broker. The platform stands out for its user-friendly interface, which makes it easy for both beginners and experienced traders to navigate the financial markets. The availability of a wealth of educational resources and webinars allows investors to enhance their trading skills effectively. The customer support team is also commendable, always ready to assist with any inquiries, which fosters a sense of trust and reliability.

Additionally, Onfin offers a diverse range of trading instruments and competitive trading conditions. With the opportunity to trade various assets, including forex, stocks, and cryptocurrencies, traders can easily find strategies that suit their goals. I am truly impressed by the transparency and reliability of this broker, and I wholeheartedly recommend Onfin as a fantastic partner for anyone looking to invest.