TradeUp Review 2026

Pros

- TradeUp’s platforms work smoothly across multiple devices based on our tests, including mobile apps for iOS and Android, a desktop app for Windows and Mac, and a web-based platform. This allows active traders to switch between devices without losing continuity, whether you’re at home or on the go.

- TradeUp runs an integrated and intuitive financial calendar that helps you track earnings, dividends, and IPOs relevant to your watchlist, enabling you to stay ahead of market-moving events.

- TradeUp offers commission-free trading on US stocks and ETFs, and support for fractional shares lets you buy portions of a share for as little as $5.This makes it a cost-effective choice for active day traders who want to minimize trading expenses.

Cons

- The platform's technical indicators have limited customization options from our use. On both mobile and web versions, you can't layer multiple indicators on the same chart simultaneously, which restricts more sophisticated chart analysis.

- TradeUp's educational resources aren't kept updated, and were over 6 months old in our latest tests. While there are articles and tutorials aimed at newcomers, the content is somewhat limited and does not cover more advanced trading strategies or deeper topics.

- TradeUp does not support popular third-party platforms like TradingView or cTrader, so traders who rely on those for advanced charting, automation, or community features won't find that flexibility.

TradeUp Review

This TradeUp review breaks down the results of our extensive tests after opening an account, using the various tools, making trades on the platform, and exploring every inch of the broker’s offerings, including customer support, research, and education.

Regulation & Trust

TradeUp was founded in 1986 and now operates as a commission-free broker in the US offering trading for stocks, ETFs and options.

Its services are offered by TradeUP Securities Inc., a registered brokerage firm with the SEC (CRD: 18483; SEC: 8-36754), a member of FINRA/SIPC, and a member of DTCC/NSCC, regulated by the US Securities and Exchange Commission and the Financial Industry Regulatory Authority.

FINRA, SEC and FINRA are all ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating, upholding strict operating standards for brokerages.

However, TradeUp has been fined several times by FINRA, with a 2025 penalty reaching up to $700,000 (part of a total $950,000 fine shared with affiliate US Tiger Securities) for violating rules related to anti-money laundering (AML) and record-keeping.

FINRA also fined TradeUP Securities $300,000 for failing to report short interest positions between August 2021 and May 2023, as well as for having weak supervisory systems. These problems indicate gaps in how TradeUp monitors risk and adheres to the rules.

When compared to top regulated brokers with strong, transparent oversight, TradeUp doesn’t look as safe. Traditional brokers, such as Interactive Brokers, face stricter controls – and if something goes wrong, you have clearer ways to seek help or recover your money.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

TradeUp offers two account options: Cash account and Margin account.

A Cash account is straightforward – you trade only with the funds you have deposited, with no borrowing allowed. The downside? You have to wait for settlement periods before reusing your money, which can slow down active trading strategies.

A Margin account require a minimum equity of $2,000 and allow you to borrow funds to amplify your positions or sell short. This increases your buying power but also magnifies losses. If your account drops below maintenance requirements, you’ll face margin calls – and you’ll pay interest on borrowed funds.

If you’re new to day trading, I strongly suggest starting with a cash account. Margin adds complexity and risk that requires experience to manage properly.You’ll need to submit personal information, upload a government ID and proof of address, then answer questions about your trading experience and finances – standard regulatory requirements. Don’t expect instant approval, as verification can take a few days, based on my experience.

Investors will also be pleased to know that TradeUP offers Traditional, Roth, and Rollover IRAs with tax advantages for retirement savings.

Traditional IRAs defer taxes until withdrawal, Roth IRAs grow tax-free, and Rollover IRAs let you consolidate funds from 401(k)s without tax penalties.

The broker sweetens the offer with up to 3% matching on transfers and contributions, plus stock bonuses for new accounts. You can invest in US stocks, ETFs, and even IPOs – not something every broker allows in IRAs.

There are no commissions or platform fees on IRA trades, keeping costs manageable. TradeUP also provides pre-filled forms and assisted transfers to streamline the setup process.

Demo Accounts

TradeUp’s demo account is frustratingly awkward to access. You can’t just sign up and start practicing. Instead, you must first open a live account, then navigate through the menus to find the paper account option. If you simply want to test the platform risk-free before committing, this creates an unnecessary barrier.

Once you’re in, you get $100,000 in virtual funds with live market data, which sounds reasonable. But here’s the problem: you can’t reset your balance. Blow through your virtual capital while learning, and you’re stuck.

I’ve opened many demo accounts at other brokers in minutes with no live account required. Many also allow you to reset balances freely or provide unlimited virtual funds, so you can continue practicing. TradeUp’s setup feels like an afterthought rather than a genuine learning tool.

Deposits & Withdrawals

TradeUp accepts deposits via bank transfer, debit card, credit card, and other standard methods.

The minimum deposit amount is just $0.01, which is great for new day traders. However, the minimum withdrawal amount for bank wire is $100. For all other payment methods, the minimum withdrawal amount is $50.

Withdrawals must be made using your original deposit method, up to the deposited amount, with profits available through other supported channels.

Here’s where it gets problematic. Withdrawals typically take three to four business days and require identity verification, which may involve an account manager.

Expect a 3.5% fee (capped at $3,500 for a single withdrawal), with a minimum of $30 per withdrawal. Compare this to IG, where ACH transfers process faster with minimal or no fees, and TradeUp’s structure looks expensive and slow.

TradeUp supports USD, EUR, and GBP as base currencies. You should choose carefully up front, as this determines how all transactions are processed. Depositing in a different currency triggers conversion fees that erode your capital.

While many brokers, such as IC Markets, offer much greater multi-currency flexibility, TradeUp limits you to these three major options.

For active traders requiring quick access to funds, these processing delays and withdrawal fees create friction. Check the complete fee schedule and currency implications before funding your account – these costs add up faster than you might expect.

It’s also worth noting that TradeUp pays interest on cash balances over $1,000, credited monthly once you’ve earned at least $1. Small balances typically earn little or no interest (0.1%), a common feature among brokers. So, unless you hold a lot of cash idle, don’t expect much income from cash balances.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | ACH Transfer, Automated Customer Account Transfer Service, Credit Card, Debit Card, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Debit Card, PayPal, Wire Transfer |

| Minimum Deposit | $0.01 | $0 | $100 |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Assets & Markets

TradeUp’s asset selection is adequate but not comprehensive. You gain access to approximately 5,000 US and select international stocks and ETFs, such as Apple, Tesla, and SPY, which cover mainstream trading needs. US Treasuries (T-Bills, T-Notes and T-Bonds) are supported as well.

There’s also over 250 Chinese American Depositary Receipts (ADRs), including Alibaba Group (BABA), Baidu ADR (BIDU) and NIO Inc. ADR (NIO), allowing you to trade these Chinese companies listed on US exchanges as if they were domestic stocks.

Options trading is available on many US stocks, making them useful for hedging or speculation. However, the contract selection falls short compared to brokers like Webull, which may limit your strategic flexibility as you advance.

Disappointingly, TradeUp doesn’t support cryptocurrency trading. If you’re looking to trade Bitcoin, Ethereum, or any other digital assets, you’ll need to use a separate platform. This represents a significant gap compared to many modern brokers, such as eToro, which offer integrated crypto trading alongside traditional securities.

For day traders seeking exposure to multiple asset classes under one roof, this restriction means managing accounts across different platforms, adding complexity and potentially higher costs to their overall trading strategy.

For absolute beginners learning the basics, TradeUp’s range might suffice initially. But you may outgrow it quickly if you want to diversify across asset classes or explore niche markets.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Stocks, Options, ETFs, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, Options, ETFs, Crypto |

| Fractional Shares | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Fees & Costs

TradeUp offers a competitive fee structure, but it comes with some drawbacks compared to the cheapest brokers for day trading. Stock and ETF trades carry zero commission, which is good for keeping costs low.

However, options trading comes with a standard fee of $0.50 per contract, which is similar to many brokers but not the cheapest available.

There are some less obvious fees to be aware of. Wire withdrawals have a minimum fee of $30 per withdrawal, which is higher than many brokers that offer free or low-cost withdrawals. Other service fees include $2 for paper statements and $1 for mailed confirmations.

For day traders, those fees matter since regular withdrawals or transfers are a common occurrence. It’s crucial to factor these fees into your trading plan to avoid surprises, especially if you trade frequently or rely on quick access to funds.

On the plus side, TradeUp does not charge an inactivity fee, which is beneficial for traders who don’t trade frequently or take regular breaks. This means you won’t incur extra costs simply for keeping your account open without trading for extended periods.

Many brokers charge inactivity fees after 12 months or even sooner, but TradeUp lets you keep your account worry-free from inactivity charges.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Inactivity Fee | $0 | $0 | $10 |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Platforms & Tools

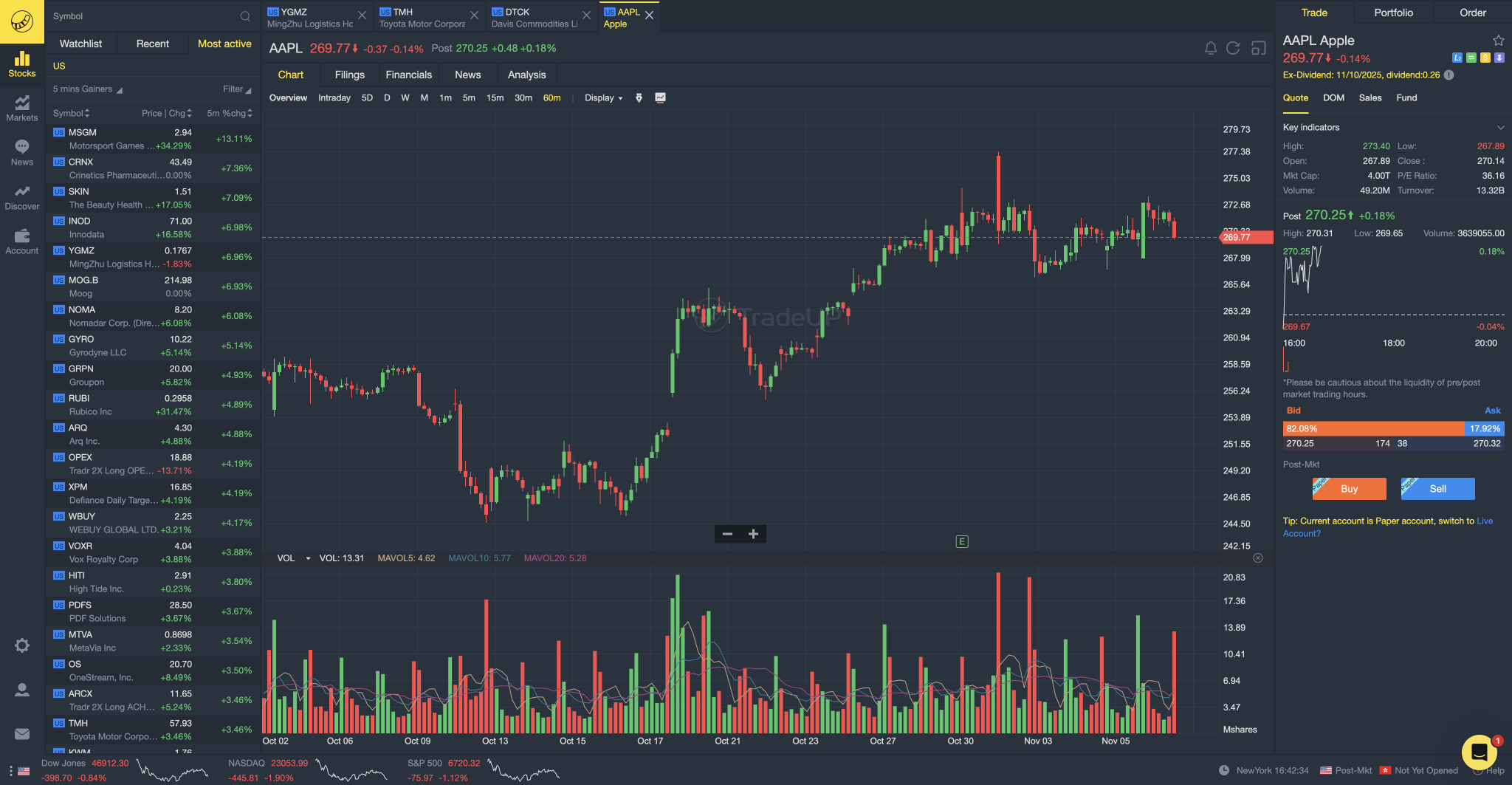

I’ve tested TradeUp across its mobile app (Android and iOS), web platform, and desktop application (Windows and Mac). All three proprietary platforms provide basic candlestick charting (no Heikin-Ashi) with 22 standard technical indicators – MA, EMA, MACD, RSI, Bollinger Bands, and others that cover fundamental analysis needs.

Unfortunately, customization options for indicators are severely limited. You can’t adjust parameters or layer multiple indicators on the same chart unless you’re using the desktop app, which offers slightly more flexibility.

The platforms include over 30 drawing tools, as well as options for corporate actions, price lines, and alerts – functional but basic.

The biggest limitation? No integration with TradingView, cTrader, or other third-party platforms. If you’ve built your trading approach around TradingView’s advanced charting or rely on automated strategies through external tools, TradeUp won’t accommodate you.

Overall, TradeUp’s platforms handle straightforward trading adequately. If you’re executing simple setups with standard indicators, you’ll manage fine.

However, for traders who require deep customization, advanced technical analysis, or integration with third-party platforms and APIs, this ecosystem feels constrained.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Desktop, Web, Mobile | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | eToro Trading Platform & CopyTrader |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Research

TradeUp’s research tools include a third-party news feed that keeps you updated on market developments, as well as a stock heatmap that filters by index or sector – useful for quickly identifying which areas are moving.

For example, I like how the ‘S&P 500’ or ‘Energy’ sector views give you visual snapshots of market performance at a glance.

You’ll also find an economic calendar that tracks earnings releases, dividends, and IPOs, alongside stock analytics tools that show company financials, depth of market (DOM), and institutional holdings. These cover fundamental research needs adequately.

However, TradeUp doesn’t provide in-house webinars, technical analysis, or integrate trading ideas from providers like Autochartist or Trading Central.

Leading brokers for short-term traders, such as IG and IC Markets, offer automated pattern recognition and trade setup alerts that help you identify opportunities more quickly. Without these, you’re doing all the analytical heavy lifting yourself.

For basic research – checking news, reviewing financials, monitoring upcoming events – TradeUp’s tools work fine. However, if you’re seeking advanced technical scanning or automated opportunity detection, you’ll find the platform lacking.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Education

I’ve explored TradeUp’s educational offerings, and honestly, they’re underwhelming. The Help Centre on its website covers fundamental questions and basic guides, which are helpful for initial orientation but provide only surface-level information.

Most concerning is that, at the time of our last tests, the Newsletter and Blog had not been updated in six months. That’s a lot of stale content in an industry where market conditions, regulations, and strategies are constantly evolving. You’re essentially learning from outdated material.

Compare this to leading brokers like IG who invest heavily in trader education—think interactive webinars, updated market analysis, video tutorials, and progressive learning paths from beginner to advanced levels. They understand that educated traders are more successful and stay longer.

If you’re serious about developing day trading skills, TradeUp’s limited resources will leave you searching elsewhere for guidance.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Customer Support

TradeUp provides customer support primarily through live chat on its website and within the trading platform. You’ll find a help center on its website with FAQs and guides, but notably, there’s no email address or inquiry form. There’s also no phone support line, which significantly limits your contact options.

In my experience using TradeUp, the live chat has been excellent – responsive and helpful for resolving questions efficiently.

However, compare this to industry leaders offering phone support, email addresses, and dedicated account representatives, and TradeUp’s infrastructure feels restrictive. Top-tier brokers also provide comprehensive video tutorials that accelerate problem-solving.

For day traders, responsiveness to support matters significantly. When dealing with time-sensitive trades or account issues that affect your capital, having multiple contact options provides peace of mind. TradeUp’s live chat performs well, but the absence of phone and email support may concern you during urgent situations.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Should You Day Trade With TradeUp?

TradeUp is a decent option for those seeking commission-free day trading on US stocks, ETFs, and options, along with a user-friendly mobile platform.

However, it lacks the same clean regulatory record as some top-tier brokers, which raises concerns about potential risk.

It offers solid trading tools but has limited asset choices and higher fees for withdrawals and transfers compared to larger brokers. Customer support is also basic, with no phone line, which can be frustrating for beginners who need quick help.

Overall, TradeUp suits casual or cost-conscious traders, but it doesn’t match the features, safety, or support of leading brokers for active day trading.

FAQs

Is TradeUp Legit Or A Scam?

TradeUp is a legitimate broker registered with the SEC and a member of FINRA and SIPC, providing brokerage and trading services under regulatory oversight.

However, it has faced regulatory fines totaling over $1 million due to deficiencies in its anti-money laundering programs, record-keeping, and supervisory practices.

While these issues don’t make it a scam, they highlight gaps in compliance and risk management. TradeUp operates transparently within legal frameworks but requires caution, especially if regulatory stability and strong oversight are top priorities for you.

Is TradeUp Suitable For Beginners?

TradeUp’s platform offers a mix of strengths and weaknesses for beginners. It provides basic tools and access to commission-free trading, which helps lower entry barriers. The $0.01 starting investment is also low.

However, the platform isn’t the most intuitive and has limited educational and research resources, which can make learning harder.

Beginners who want a straightforward start might find it usable, but should be prepared for a steeper learning curve and fewer support options compared to brokers with richer, beginner-focused features.

Best Alternatives to TradeUp

Compare TradeUp with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA – eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

TradeUp Comparison Table

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Rating | 3.5 | 4.3 | 3.4 |

| Markets | Stocks, Options, ETFs, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, Options, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0.01 | $0 | $100 |

| Minimum Trade | $1 | $100 | $10 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | – | – | Invest $100 and get $10 |

| Platforms | Desktop, Web, Mobile | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | eToro Trading Platform & CopyTrader |

| Leverage | – | 1:50 | – |

| Payment Methods | 5 | 6 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

eToro USA Review |

Compare Trading Instruments

Compare the markets and instruments offered by TradeUp and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TradeUp | Interactive Brokers | eToro USA | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

TradeUp vs Other Brokers

Compare TradeUp with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of TradeUp yet, will you be the first to help fellow traders decide if they should trade with TradeUp or not?