Betterment Review 2026

Pros

- No minimum balance makes the firm suitable for beginners

- Automated and optimized tax strategies

- Expert insights, investment articles, financial news and product guides available

Cons

- Margin trading accounts are not available

- Instruments cannot be traded separately

- Access to personalized services and guidance has a $100,000 minimum investment

Betterment Review

Betterment is a broker at the forefront of robo advisory investment. The firm is one of the largest automated trading companies in the world, offering a range of flexible portfolio options, joint checking bank accounts and tailored advisory services via an intuitive platform interface. This 2026 review will unpack all the company has to offer, from its main features to its fee structure, account options and history. Find out how Betterment could support your trading portfolio today.

Betterment Headlines

Betterment LLC is an accessible, low-cost robo advisor offering automated rebalancing and tax-loss harvesting. It uses computer algorithms to generate tailored investment advice, helping clients to get the most out of their portfolios. The system is a goal-based platform well suited to new investors, though its advanced features mean that more experienced investors are also catered for. Portfolios are transparent, as is the fee structure. There is no minimum deposit requirement for the basic account types but charges do apply to the more bespoke services.

The platform boasts a range of asset classes alongside flexible cash management options and a responsive and knowledgeable customer support team. The company was established in 2008 by Jon Stein, who continues to serve as CEO today. Over the past 13 years, Betterment has seen steady growth, moving ahead of competitors like Wealthfront, thanks to several successful funding rounds. Betterment handles over $22 billion AUM and has a community of more than 500,000 active users. The brokerage was formed in NYC, where its head office address is.

Trading Platform

Betterment was one of the first brokers to use technology to generate tailored investment and portfolio management advice. All options are automated, meaning that there is little day to day involvement required from users compared to traditional investment options. Over the years, the platform has added additional asset classes and management products. Today, the platform offers three key services: cash management, tax management and financial advisory.

The Betterment platform is easy to navigate and hosts a range of educational resources, making it a great option for those that are new to investing. There are also lots of planning tools, in addition to calculators, news articles and FAQs. There are several ways to use the platform, which will depend on your financial goals. A good place to start is to sync all of your financial accounts, which will create a complete picture of your position, from there you can establish what you have available to invest or trade and do so via the Flexible Portfolio.

The platform estimates annual savings of 0.48% or 15% over 30 years.

Professional Financial Advice

Betterment connects users with financial planners, who advise clients on how best to optimise their accounts, in addition to providing support for wider financial issues. Betterment Premium account holders can access this service for free, whilst Digital customers will be charged $199 for a 45-minute session and $299 for a 60-minute session in which clients can discuss their portfolio, long-term financial planning and even college savings plans. Asset opportunities include mutual funds, bond funds and exchange-traded funds (ETFs).

Tax Management

Tax-loss harvesting is a portfolio rebalancing process through which capital gains taxes are minimised. Tax management is a key part of the service offered by Betterment, with tax-loss harvesting offered as a standard feature available to all account holders at no additional cost.

To take advantage of Betterment’s tax coordinated portfolios, you will need to open a Taxable account and a Retirement Account. By holding some assets that generate interest income in your retirement accounts, you will minimise the amount of tax owed.

You will be able to download your tax forms directly from the Betterment platform. There are many tax considerations when investing, from dividends to capital gains, revenue and losses and the firm helps you to keep track.

Checking & Betterment Cash Reserve

There are two cash management services on offer; Betterment Checking and Betterment Cash Reserve. The checking account includes a debit card. There are no ATM fees and no foreign transaction fees. In 2020, a mobile deposit feature was added with two-way sweep enabled.

How Does Betterment Manage Your Money?

Betterment uses low-cost ETFs to build diversified investment portfolios. The exact mix of funds and percentage allocation will depend on your financial goals and risk appetite. There are five different portfolio types to choose from:

- Standard – consists of globally diversified stock and bond ETFs.

- Flexible – adopts a similar structure to the Standard portfolio but is weighted according to user preferences.

- Socially Responsible – there are three socially responsible portfolios to choose from, covering three aspects of ethical investing; the Broad Impact portfolio (impact investment), the Climate Impact portfolio (green investment) and the Social Impact portfolio (ESG investment). Each portfolio filters its holdings for stocks that are socially and environmentally responsible.

- Goldman Sachs Smart Beta – a performance portfolio that aims to outperform the market.

- All-Bond – a revenue-focused portfolio that is comprised exclusively of BlackRock ETFs.

Whilst you can customise your Flexible portfolio, it is also invested in ETFs that do not tend to be granular enough to know exactly where your money is going. If you’re passionate about investing in socially and environmentally conscious channels, we recommend you opt for the SRI option.

An emergency fund portfolio holds roughly 15% stocks and 85% bonds whereas a general investing fund might hold 90% stocks. Portfolio mixes will vary, popular options include 80/20, 70/30, 90/10 and 60/40.

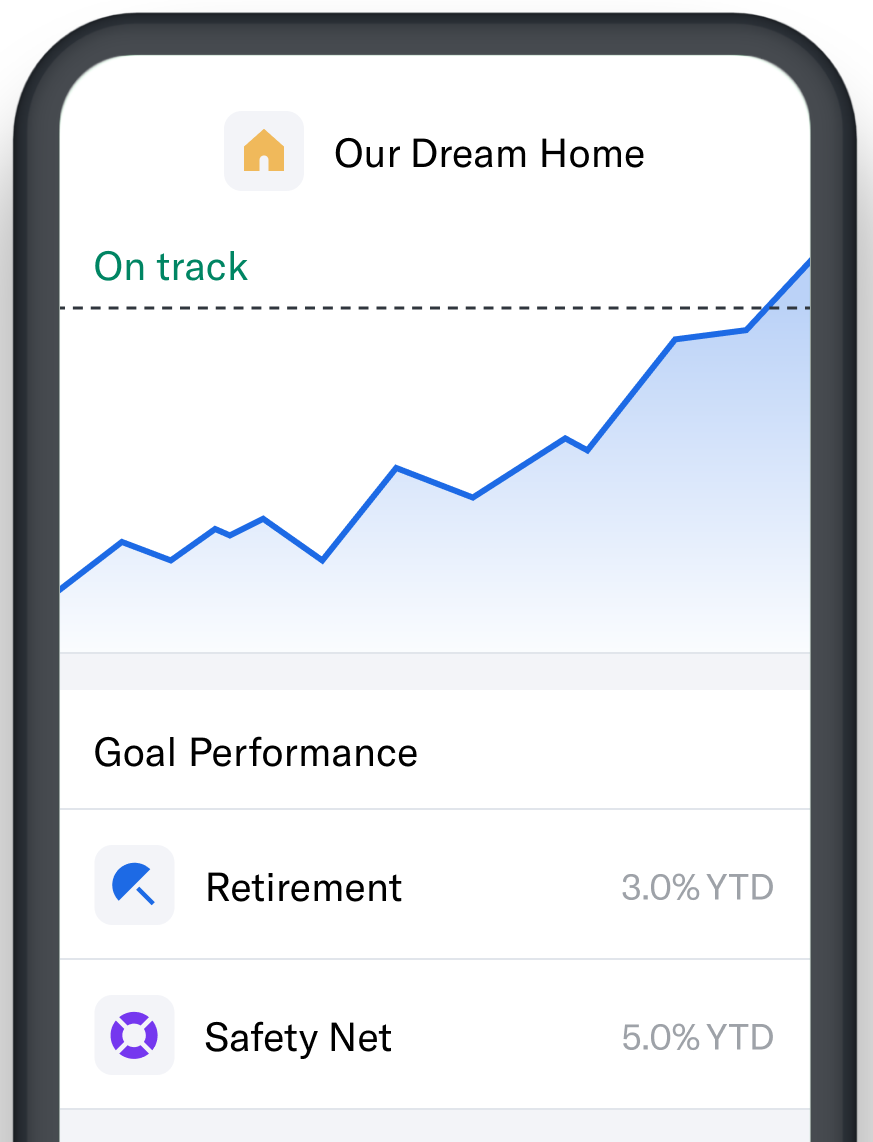

Portfolio Management

Portfolios are evaluated every month by the firm. If they are off track, they will be shifted in line with the predetermined goal. This occurs automatically and doesn’t require input from account holders themselves. This is in part what makes these managed portfolios so attractive.

Fees & Account Funding

There is no minimum deposit requirement to access Betterment Digital services but Betterment Premium has a minimum of $100,000 (100k).

Management fees are fixed at 0.25% per anum for Digital account holders, though this does drop to 0.15% for any proportion of assets that exceeds $2 million. For Betterment Premium clients, there is a charge of 0.4% per annum, which drops to 0.3% on the percentage of the balance that exceeds $2 million.

Whilst you can access Betterment’s financial planning tools at no additional charge, clients are encouraged to set up automatic deposits, which can be done during the initial account set-up process.

There are no margins available and clients cannot borrow against the assets held in their accounts. There are also no fees for closing an account or sending a cheque or wire transfer. Transfers may take between 3-5 business days to be processed.

The 2020 one-time cash transfer limit is $6,000 but clients should ensure there are no additional Traditional or backdoor Roth IRA contributions throughout the year.

Management fees do apply:

- $5,000 portfolio: $1.04 – Digital, $1.67 – Premium

- $25,000 portfolio: $5.21 – Digital, $8.33 – Premium

- $100,000 portfolio: $20.83 Digital, $33.33 – Premium

The 2.69% APY on Betterment’s cash management account is considered a high yield for a savings account and is nearly 27 times the national average (0.1%).

Betterment supports withdrawals to the same bank account used to make your deposits. This can be done at any time with no fees or limits and will likely take 4-5 business days.

Security

The security features offered by the platform are robust. The website is encrypted and the mobile app implements two-factor authentication (2FA). All trades are cleared through Apex Clearing, which also has risk management strategies in place.

The platform does not offer the opportunity to place risky trades, which, in itself, goes a long way to protecting clients. If you do have large sums deposited in your account, you might want to consider taking out additional coverage, as there is no SIPC insurance offered.

Mobile App

The desktop and mobile experiences are very similar, with the mobile app offering almost all the features available on desktop. We would note that the account registration process is data-heavy, so it might be best to do this part on a desktop if you have the option available.

The mobile app also implements two-factor authentication on login, helping to keep your account secure, wherever you are. The app can be downloaded from the Apple App Store and Google Play Store.

How To Set up A Betterment Account

Creating an account with Betterment is straightforward. Users will be prompted to enter their age, income and financial objectives. Based on their goals, Betterment will present an asset allocation suggestion with its associated risk.

Whilst users are prompted to link any other accounts held to establish a complete picture of their financial position, it is not mandatory, although it does make deposits easier.

Pros

Betterment is a leading robo-advisory platform and has a lot to offer, some of the best features of the platform include:

- No account minimum

- Competitive fee structure

- Options for customization

- Several portfolio structures

- Easy transfer between accounts

- Tax-loss harvesting available for all clients

Cons

Whilst there are some obvious benefits, there are also some limitations to consider:

- No crypto

- No direct indexing

- No margin lending

- No borrowing against your portfolio

- Standard account holders are charged $199-299 to talk to a financial planner

Customer Support

Customer support is available via telephone from 09:00 to 18:00 EST, Monday through Friday. You can also fill out a contact form on the broker’s website and they will email you.

- Telephone Number: (718) 400-6898

There is also a separate line reserved for 401k customers, Plus and Premium. Alternatively, speak to a representative directly via the website and app live chat feature.

The customer support team are knowledgeable and responsive and can assist with a range of issues from password retrieval, underperforming portfolios, general investing queries, historical returns and year-to-date (YTD) yield, returns and performance data.

Betterment Verdict

Betterment is a great robo-advisory platform. It offers a suite of flexible portfolio options, competitive fees and robust advisory services. Whether you’ve got 160 million dollars or 600 dollars, the Betterment team can create a tailored plan to help you achieve your investment goals. The firm outstrips many of its competitors, making it an obvious choice for USA-based investors. Unfortunately, its services are not currently available outside the US.

FAQs

Can Betterment Be Used For Investing In The UK?

No, Betterment is not available to non-US citizens, so prospective clients from London, Europe or throughout the rest of the world should find an alternative.

Does Betterment Offer UTMA Accounts?

No, Uniform Transfers to Minors Accounts (UTMA) are not offered by the Betterment platform.

What Is A Levy?

A levy is also known as a tax, a compulsory financial charge imposed on a taxpayer by a government. There are plenty of YouTube videos and blogs online defining financial terms like this.

Which Is Better, Betterment Or Wealthfront?

Betterment and Wealthfront are frequently compared, given that they offer similar packages. Whilst they both have their merits, Betterment is arguably more accessible and better suited for beginners. For those looking for more comprehensive financial advice, Wealthfront is a good option.

What Number Of Users Does Betterment Have?

Betterment has an active community of over 500,000 traders and investors.

Best Alternatives to Betterment

Compare Betterment with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

Betterment Comparison Table

| Betterment | Interactive Brokers | Firstrade | |

|---|---|---|---|

| Rating | 3.2 | 4.3 | 4 |

| Markets | Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | No |

| Minimum Deposit | $0 | $0 | $0 |

| Minimum Trade | $1 | $100 | $1 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | – | – | Deposit Bonus Up To $4000 |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | TradingCentral |

| Leverage | – | 1:50 | – |

| Payment Methods | 2 | 6 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Betterment and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Betterment | Interactive Brokers | Firstrade | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | Yes |

| ETFs | No | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Betterment vs Other Brokers

Compare Betterment with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Betterment yet, will you be the first to help fellow traders decide if they should trade with Betterment or not?