ACY Securities Review 2025

See the Top 3 Alternatives in your location.

Pros

- ACY Securities has made strides to upgrade its offering with Tradingcup copy trading on MT5, weekend crypto trading, new account types, and fresh partnerships like Al-Bilad in Jordan.

- The broker offers fast execution speeds, with orders processed in under 30ms, thanks to its deep liquidity connections with major global banks. This is ideal for day traders who rely on capturing market moves quickly.

- Funding and withdrawal options are flexible and beat most brokers we've tested, now including instant crypto withdrawals and several fee-free monthly fiat withdrawals. This help to ensure traders can manage their funds efficiently and without unnecessary costs.

Cons

- Spreads can be higher than those of other brokers we've tested on some account types, especially on cryptos, which may reduce profitability for active traders aiming for tight margins.

- ACY Securities’ research is clear and consistent, but it falls short of top brokers by lacking real-time news feeds, advanced analytics, and premium signal tools like Autochartist or Trading Central.

- The education is okay but fairly limited, with useful webinars, videos, and e-books that cover the basics well, yet it lacks the depth, interactivity, and tailored content filtering offered by category leaders.

ACY Securities Review

We put ACY Securities through its paces, opening an account and testing the broker across eight areas most important to active traders. We compared it against other brokerages, assigned ratings, fact-checked our findings – and have also updated our review to reflect the latest changes.

Regulation & Trust

ACY Securities is trusted, but the level of regulatory oversight depends on which entity you open an account through.

It’s primarily regulated by the Australian Securities & Investments Commission (ASIC), a ‘green tier’ authority in DayTrading.com’s Regulation & Trust Rating, which is generally a strong indicator of a broker’s reliability.

However, ACY Securities also runs an offshore arm in St. Vincent and the Grenadines – a weakly regulated jurisdiction – allowing it to offer much higher leverage and fewer protections compared to stricter regulators.

It also holds a license from the South African Financial Sector Conduct Authority (FSCA) – a ‘yellow tier’ regulator.

While ASIC regulation ensures traders receive segregated funds and negative balance protection, European authorities have flagged ACY Securities for operating without a local license in specific markets, meaning global clients may not always be protected to the same standard as with purely ‘green tier’ regulated brokers.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | ASIC, FSCA, SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

ACY Securities’ live account lineup spans three options – Basic, Standard, and ProZero – each catering to different experience levels and trading styles.

The Basic and Standard accounts are commission-free but deliver noticeably wider spreads, especially for major pairs, and require low minimum deposits ($50-$100).

The ProZero account, better suited for active and algorithmic traders, features raw spreads from 0.0 pips and a competitive commission ($3 per lot per side), with a $200 minimum deposit.

All live accounts support micro lot (0.01 lot) minimum trading volume, MetaTrader 4 (MT4), MetaTrader 5 (MT5) and automated trading, with dedicated account management and swap-free accounts for Islamic traders (Standard account only).

In practice, ACY Securities markets ultra-low spreads and rapid execution, but we noticed during testing that real-world spreads are sometimes wider than advertised outside peak sessions, meaning scalpers and news traders may not always get the conditions they expect.

I found the registration and verification flow was intuitive and fairly swift, though document checks are standard.ACY Securities’ leverage can be extremely high (up to 1:5000 via its offshore entity), but this comes with significant risk, and not all accounts or regions allow it. Negative balance protection adds a safety net for clients, which is a solid plus.

With ACY Securities, you can also automate using its VPS service or copy trade, and benefit from industry-standard platforms—as well as its proprietary browser-based ACY Trading Platform. This gives experienced traders far more control and flexibility, but demands a deeper understanding and clear risk management.

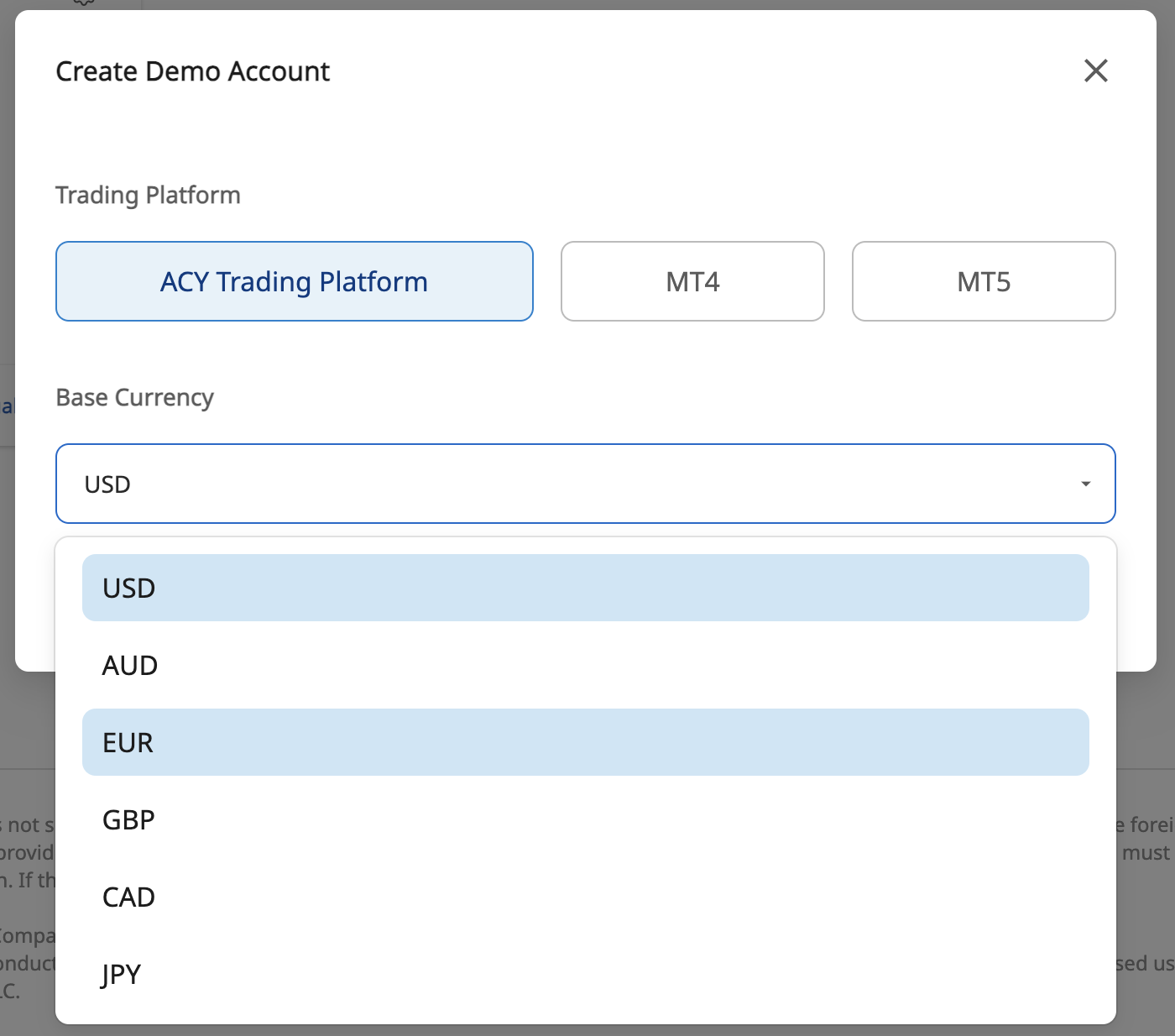

Demo Accounts

ACY Securities offers a demo trading account with $100,000 in virtual funds, available in a choice of six base currencies (USD, AUD, EUR, GBP, CAD, JPY) and on all three trading platforms.

The demo is designed to closely simulate live trading conditions across more than 2,200 markets, including forex, commodities, and indices, making it a valuable tool for both beginners and experienced traders who test strategies.

I noticed that the demo account has a default 60-day expiration, which is disappointing, as I prefer to have non-expiring accounts for testing purposes.However, opening a new account in the client dashboard takes just a few clicks, and you can have multiple demo accounts running simultaneously.

Compared to top brokers, ACY Securities’ demo account is standard but practical, supporting advanced features like Expert Advisors (EAs) for algorithmic trading and customizable account balances to reflect live portfolio sizes.

However, like most demos, it cannot replicate live trading psychology, slippage, or order execution nuances, so you should treat it as a learning tool rather than a perfect predictor of real performance.

Deposits & Withdrawals

ACY Securities offers a broad selection of deposit and withdrawal options in a wide array of currencies, including EUR, GBP, USD, AUD, USDT, PHP, VND, and JPY.

Funding includes bank transfer, credit card, debit card, China UnionPay, popular e-wallets such as Skrill and Neteller, and cryptocurrencies (except in Australia) like Bitcoin, USDT and USDC.

Deposits usually process within 24 hours, while withdrawals vary from instant crypto payouts to up to seven business days for bank transfers. The broker does not charge deposit fees and allows up to five fee-free withdrawals per month, promoting transparency and cost efficiency.

From personal experience, the instant crypto withdrawals have been a standout feature, offering nearly real-time access to funds, which is rare among brokers and very helpful for agile trading or quick cashouts.However, traditional bank withdrawals felt slower than I expected, sometimes taking several days longer than advertised, which can be frustrating for traders needing fast access to fiat funds.

Compared to other brokers we’ve evaluated, ACY Securities excels in crypto convenience but could improve its speed for fiat withdrawals. The variety of local payment options is helpful, but regional limits sometimes restrict larger transfers.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Alipay, Bitcoin Payments, Bitwallet, Credit Card, Debit Card, Dragonpay, Mastercard, Neteller, Paytrust, Skrill, UnionPay, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $50 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

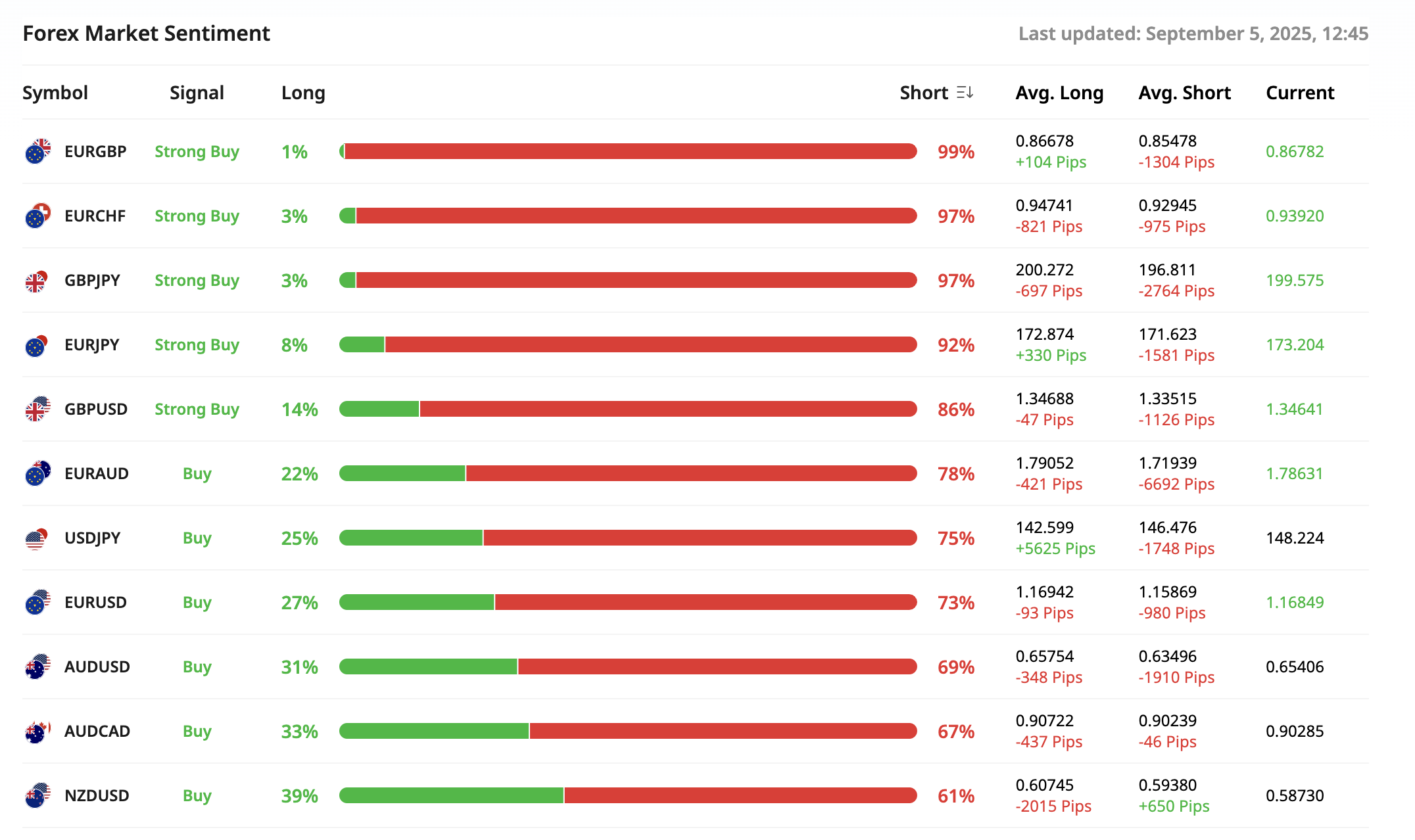

ACY Securities offers a broad and diverse tradable asset range with over 2,200 CFDs across six asset classes on MT4, MT5, and its own platform.

The forex selection comprises 43 currency pairs, covering major pairs such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, and NZD/USD. Cross pairs such as EUR/GBP, EUR/JPY, and GBP/JPY are also available, while exotic pairs like USD/TRY and EUR/ZAR offer higher volatility opportunities.

In commodities, ACY Securities covers gold, silver, crude oil, and natural gas, among others. Indices include popular global benchmarks such as the S&P 500, Dow Jones Industrial Average, ASX 200, and Nasdaq-100.

The stock CFD offering includes nearly 1,000 global shares, including tech giants such as Apple, Microsoft, and Tesla, as well as global ETFs like the SPDR S&P 500 ETF Trust and the VanEck Gold Miners ETF.

Additionally, ACY Securities offers 19 cryptocurrency CFDs, including BTC/USD, ETH/USD, and others, available for 24/7 trading.

A notable limitation is that ACY Securities only offers CFDs on stocks rather than direct stock trading or options trading, so you do not own the underlying assets and miss dividend rights or voting shares. This means you cannot engage in options strategies or long-term stock ownership, which are features offered by many top brokers.

From personal experience using ACY Securities, the wide variety of forex options, combined with commodities and stocks in one account, allows for flexible portfolio diversification without the need to juggle multiple brokers.Execution speeds have also been fast in my testing – and latency is low – which benefits fast-paced day trading strategies.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:500 | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

ACY Securities offers three account types with distinct fee structures: Basic and Standard accounts have wider spreads (starting around 2.0 and 1.0 pips, respectively) and no commissions. In contrast, the ProZero account offers raw spreads starting at 0.0 pips with a $6 round-turn commission per lot.

Deposits and up to three monthly withdrawals are free (although third-party payment services like Skrill incur a 3% merchant fee per withdrawal), and there’s no inactivity fee, which is better than many brokers charging for dormant accounts.

Overnight swap fees can be high, although an Islamic swap-free option is available if you qualify, with varying admin fees per instrument.

I’ve found the ProZero account cost-effective for active traders due to tight spreads and fair commissions – the wider spreads of Basic and Standard accounts mean heavier costs, especially during volatile markets. The free withdrawal policy and instant crypto payouts are also user-friendly perks not always matched by competitors.

Overall, ACY’s fees are mid-tier – not the cheapest but transparent and balanced, requiring you to pick the right account type based on trading style and volume.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.8 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 1.2 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.03 | 0.25-0.85 | 0.1 |

| Stock Spread | Variable | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

ACY Securities offers three key trading platforms: MT4, MT5, and its own proprietary ACY Trading Platform, catering to a broad trader base from beginners to advanced users.

MT4 offers simplicity, rapid execution, and an extensive ecosystem of EAs for automated trading. From my own use, it’s reliable and well-suited for forex traders and those who automate strategies using MQL4 coding. However, MT4 lacks newer features, such as built-in economic calendars and detailed market depth data.

MT5 improves on MT4 by supporting more asset classes, including stocks and futures, adding over 80 technical indicators and 21 timeframes, plus integrated economic events. For traders managing diverse portfolios, MT5’s multi-asset capabilities and advanced tools like Depth of Market are invaluable.

Personally, having built-in fundamental data within MT5 enhances decision-making efficiency, eliminating the need for external tools.

ACY Securities’ proprietary platform is web-based and accessible across various devices without the need for installation. It offers multi-symbol charts, a built-in economic calendar, dynamic margin, and guaranteed stop-loss orders.

While user-friendly, the simplified platform lacks the advanced third-party integrations and deeper customizability seen in some top brokers’ platforms.

Notably, ACY Securities does not support popular platforms like cTrader or TradingView, which many leading brokers provide for superior charting, social trading, and community features. This limits your choice if you want enhanced analytics or a broader social trading ecosystem.

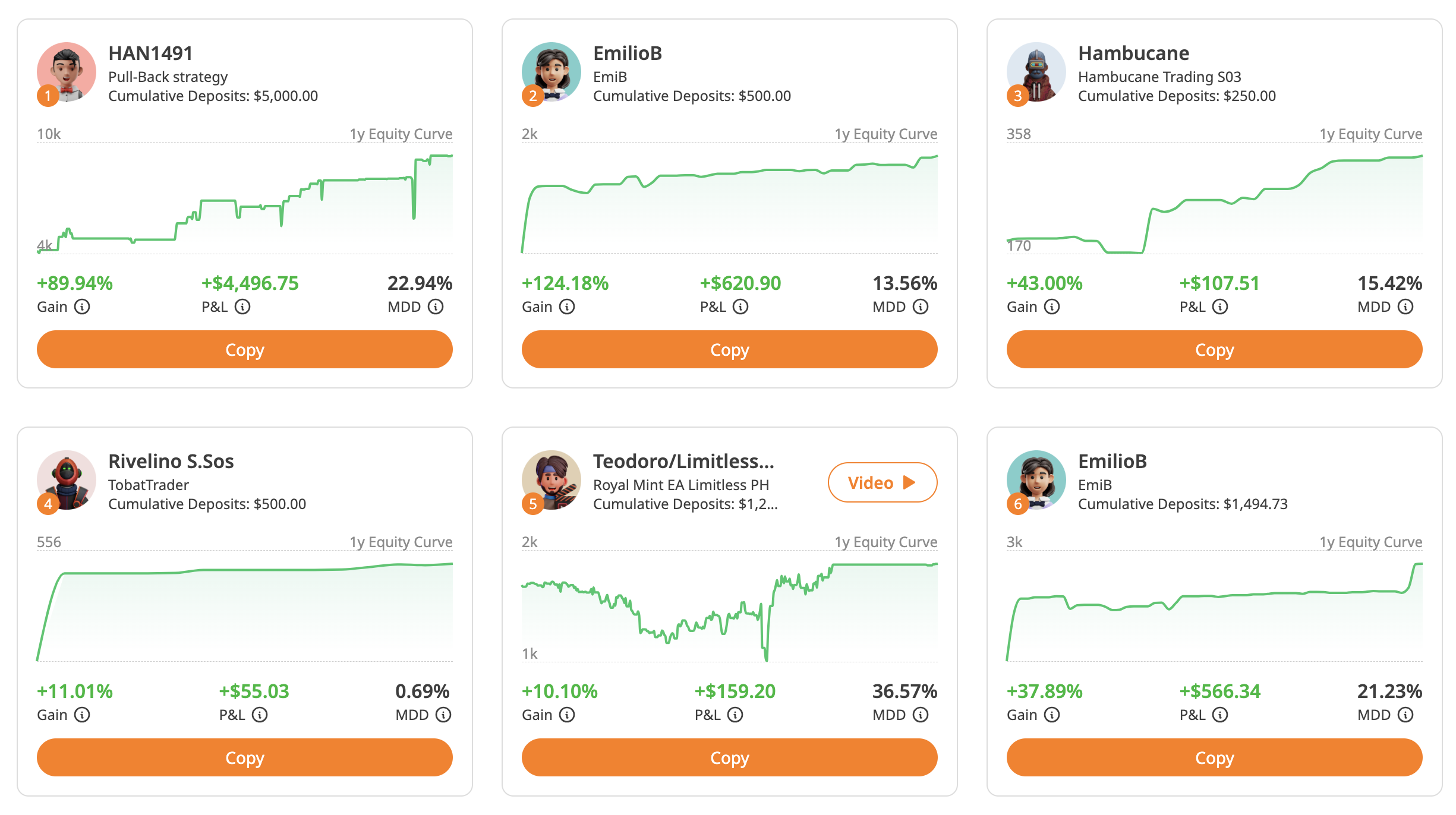

However, ACY Securities’ proprietary copy trading service, Tradingcup, has grown quickly since its 2024 upgrade, now supporting both MT4 and MT5 (ACY Trading Platform coming) and providing access to over 3,300 trading signals and a reported ~$60 million in invested funds.

Tradingcup’s key feature is its Money Manager Ranking (MMR), which transparently ranks traders by profitability, risk management, stability, risk-adjusted returns, draw-down levels, and longevity – a considerably more advanced ranking system compared to cTrader Copy, which I’ve also used.

The platform also offers reasonable execution (~300ms), an intuitive interface, and a wide range of strategies, though quality varies.

While less social and feature-rich than larger platforms, Tradingcup stands out for transparency, MT5 integration, and its contest-driven trader network.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | ACY Trading Platform, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

ACY Securities publishes a frequently updated blog centered on daily market analysis, economic event coverage, and in-house analyst commentary.

The blog covers global macro news, central bank decisions, and high-impact releases, such as NFP and CPI, often with actionable trade scenarios and chart-based forecasts for major forex pairs, indices, and commodities.

I find the clarity and consistency of the videos and written updates are a strong point, making it easy for beginners to get a direct read on market sentiment.

The inclusion of an easy-to-navigate economic and earnings calendar within the ACY Trading Platform (also on the blog) is convenient for tracking relevant news.

However, compared to category leaders like IG, ACY Securities’ research lacks real-time news aggregation, Depth of Market (DOM), and advanced analytics.

There are also no premium partner tools for signals (e.g., Autochartist, Trading Central, Signal Centre) or interactive market screeners.

On the plus side, ACY Securities fully supports Capitalise.ai, a code-free automation tool for creating, backtesting, and executing strategies in plain English. Integration is simple – just link a free Capitalise.ai account to your ACY Securities’ MetaTrader trading account via API.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

ACY Securities offers a well-rounded education program featuring live webinars, video tutorials, and downloadable e-books that cover trading basics and strategies, including trading high-impact news.

From personal experience, live webinars and video content are particularly beneficial, as they provide clear explanations and real-world trading examples that enhance understanding.

Compared to the best brokers for beginners, ACY Securities’ education is solid but somewhat basic, lacking interactive features like quizzes or progress tracking found in leading platforms.

The content is well-structured but could cover a broader range of topics and provide better content filtering by experience level.

Nevertheless, ACY Securities excels in delivering practical market insights alongside educational material, making it a good choice if you’re seeking a strong foundation without overwhelming complexity.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

ACY Securities provides 24/5 multilingual support via live chat, email, and phone, covering over 10 languages.

While generally accessible, I’ve found the live chat to be sometimes challenging to connect with an agent, and responses can be a bit abrupt.

Notably, there are no local phone numbers available for European clients, which can be inconvenient for traders in that region seeking quick and direct assistance.

Compared to top brokers offering 24/7 support and localized phone numbers in major markets, ACY Securities’ support is solid but leaves room for improvement in terms of availability and politeness.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With ACY Securities?

Trading with ACY Securities suits traders seeking a regulated broker with broad forex and CFD offerings, competitive pricing on commission-based accounts, and excellent cryptocurrency withdrawal speeds.

Its platform choice of MT4/MT5 and proprietary web platform covers most needs, and the Capitalise.ai integration adds automation appeal. The above-par education and solid daily research materials also provide valuable support for traders.

However, a lack of regulation in Europe, the absence of direct stock and options trading, and occasional support delays may frustrate some.

FAQ

Is ACY Securities Legit Or A Scam?

ACY Securities is a legitimate broker regulated by ASIC, ensuring strong client protections like segregated funds and negative balance protection. It also runs an offshore arm in St. Vincent and the Grenadines, which carries a higher risk.

While the broker has a solid track record since 2011, you should exercise caution, especially with offshore accounts.

Is ACY Securities Suitable For Beginners?

ACY Securities is suitable for beginners due to its well-supported platforms, low minimum deposit ($50), and solid educational resources, including webinars and tutorials.

The availability of demo accounts and a wide range of supported assets also helps newcomers explore trading safely. However, higher spreads on beginner accounts and occasional delays in customer support might pose challenges.

Best Alternatives to ACY Securities

Compare ACY Securities with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

ACY Securities Comparison Table

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 4 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, FSCA, SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 10% Equity Bonus |

| Platforms | ACY Trading Platform, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:200 |

| Payment Methods | 13 | 6 | 11 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by ACY Securities and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ACY Securities | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | Yes |

ACY Securities vs Other Brokers

Compare ACY Securities with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of ACY Securities yet, will you be the first to help fellow traders decide if they should trade with ACY Securities or not?