XTrade Review 2025

See the Top 3 Alternatives in your location.

Awards

- Best Broker Middle East 2016 - Forex Report

- Best Mobile Platform 2016 - FX Empire

- Best Forex Broker 2016 - FFXPO Awards

Pros

- Good range of financial markets, ideal for those looking to build a diverse portfolio

- Commission-free trading

- Real-time market data, advanced tools and in-depth market analysis

Cons

- No Islamic account

- Below average fees with wide spreads

- Only one platform available

XTrade Review

XTrade is a CySEC-regulated forex and CFD broker. To help you decide whether to open an online trading account, this review explores the broker’s platform, mobile app, minimum deposit, payment methods, and more.

XTrade Company Overview

The CFD investment broker is owned by XTrade Group Limited and is headquartered in Limassol, Cyprus. The company has several daughter brands, including XTrade Europe Ltd. and XTrade International Ltd that service clients from Dubai to Uruguay.

The broker was founded in 2003, has 15 offices worldwide, and is registered with over 10 regulatory agencies, including in Cyprus, the Philippines, Malaysia and the UAE. XTrade does not, however, provide services to the UK, Canada and some other countries.

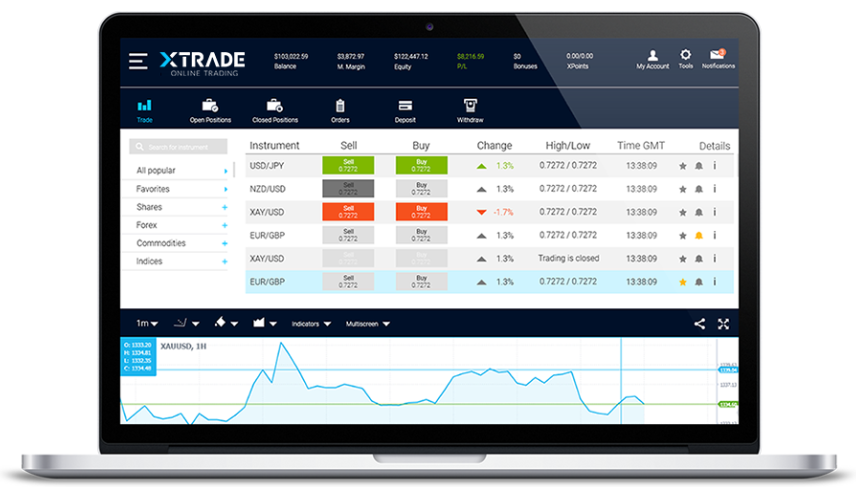

XTrade WebTrader Platform

The proprietary web-based platform requires no download or installation. Even from the login page the design is intuitive for newcomers while the effective trading tools have helped the platform pick up multiple awards. It’s accessible in 11 languages and offers 12 technical indicators, 4 chart styles, 9 time periods, and 17 analysis tools. There is also an integrated economic calendar, news thread and a signals service.

Note, the popular MT4 trading platform download is not available.

Assets & Markets

More than 200 online FX and CFD instruments are available, including:

- 56 forex pairs – 19 majors, 9 minors, & 28 exotics

- Commodities – Precious metals & energies

- Stock indices – Eight global stock indexes

- Shares – Close to 200 company shares

XTrade also offers a handful of ETFs.

Spreads & Commissions

XTrade uses a fee structure with zero commissions, only taking money from spreads. Spreads are variable, for example, GBP/USD spreads can range from 2.5 to 5 pips, EUR/USD ranges from 1.7 to 5 pips and EUR/GBP ranges from 3 to 5 pips.

Some user complaints highlight the $50 inactivity fee charged to accounts dormant for more than three months. Overnight premiums, or swaps, are also charged for positions that are held open after 22:00 GMT.

Leverage

Leverage rates vary up to a maximum of 1:400. The leverage levels for indices range from 1:20 to 1:200, commodities up to 1:10, forex pairs can be leveraged between 1:50 and 1:400 and stocks up to 1:5. Retail traders in EU-regulated markets, such as Germany, are capped at a leverage of 1:30, as per ESMA regulations.

Mobile Apps

The XTrade platform has also been developed for mobile use with iOS and Android smartphones and tablets.

Called ‘XTrade Online Trading’, the mobile app is easily installed, with a responsive user interface and much of the capability provided by the web-based platform.

The application allows one-touch trading with live prices, charting options, analysis tools, notifications and account funding options.

Many of the additional tools, such as Autochartist signals and economic calendar are also available on the mobile platform and receive good reviews.

Payment Methods

XTrade offers a wide range of payment methods that vary for clients from different countries. All clients are offered Visa and Mastercard payment card options as well as bank wire transfers.

There is a maximum deposit limit of $15,000 for payment cards, though there is no limit on wire transfers. Traders can use tens of domestic e-wallets and payment providers, including UnionPay and Neteller, each with their own maximum deposits.

There is a minimum deposit of $250, though this may be reduced during promotional events.

Withdrawals must be made using the same method as the deposit. However, if a deposit was made using an e-wallet, then withdrawals can be processed via bank transfer, Skrill or Neteller.

XTrade can take up to five days to process a withdrawal, though it may take longer to reach the target account as some payment providers take extra time to process. There are no deposit or withdrawal fees charged on the part of the broker.

Demo Account

There is a fully equipped online demo account available to current and prospective clients, allowing traders to get a feel for forex and CFD trading on the platform. The account uses simulated money and once passed the login page, you can open and close positions at real prices in real markets, meaning there is no risk to capital.

Deals & Promotions

At the time of writing there are no welcome or deposit bonuses on offer. However, they do run periodic promotional campaigns and have been known to drop minimum deposits, offer deposit bonuses and even team up with international football star Cristiano Ronaldo.

Note, always check bonus terms and conditions before you begin account registration.

Regulatory Status

XTrade is a licensed forex broker authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe, and several other agencies for its international services.

XTrade International Ltd also complies with the International Financial Services Commission’s regulations for worldwide trading.

Clients’ funds are kept segregated from the company’s, meaning that the company’s and clients’ assets are clearly distinguished, providing monetary security to traders.

All client accounts are also opened under the Investor Compensation Fund (ICF), which covers traders up to €20,000, should the broker be unable to pay out winnings.

Additional Features

As well as their award-winning trading platform, XTrade offers several extra features to its clients. There is a fully populated economic calendar and news stream that can be accessed via the website or through the platform.

There are also daily market analysis videos uploaded both to their website and YouTube channel plus calculator tools available for Pivot, Fibonacci and deal size calculations.

The XTrade website also comes with an education centre that has a range of tools geared towards novices and those with years of experience. The centre covers the basics of the platform and charting to complex trading strategies and market analysis through tutorials, online courses, e-books, PDFs, and a blog. There is also an expansive glossary to help traders cut through any unfamiliar jargon.

Account Types

XTrade does not differentiate between traders, offering a single account type for all real money trading. Every trader gets access to the full range of instruments, web and mobile platforms, plus educational centre. This does mean, however, that less favourable spreads can’t be avoided like they can with many tiered account structures.

Trading Hours

The market trading hours for the instruments supported by XTrade are 21:00 GMT Sunday to 21:00 GMT Friday during daylight saving and 22:00 GMT Sunday to 22:00 GMT Friday during winter months. Some instruments may have more limited trading hours, the details of which can be found in the website’s CFD information list.

Customer Support

The customer support team can be contacted 24 hours a day, 5 days a week via several methods. There is a telephone line that opens at 22:00 GMT on Sunday and closes 22:00 GMT on Friday. There is also email support and the broker has a large social media presence.

For general enquiries and support, XTrade may be contacted using a live chat function in the lower right corner of their website. The website supports 35 languages and live chat representatives are available in six different languages. The customer support team can be contacted via:

- Email address – support@xtrade.com

- Telephone contact number – +44 2038074001

The support team can help with a range of queries, from how to delete an account, utilise the platform, or navigate account verification.

To follow the broker on social media:

- YouTube

The company’s head office address in Cyprus plus its locations in Melbourne, Australia, amongst others, can be found on the broker’s website.

Trader Security

XTrade provides a high level of cybersecurity, with 256-bit standard Secure Sockets Layer (SSL) encryptions, provided by Comodo, on all transactions and website traffic.

The broker has several identity theft and credit card safeguards in place, all of which undergo regular reviews. The website also uses True-Site identity assurance and complies with AICPA WebTrust assurance standards.

XTrade Verdict

XTrade is an award-winning provider and a strong competitor versus brokers such as eToro and Plus500. Its free signals and well-equipped education centre make it a sensible choice for clients new to trading forex and CFDs, in particular.

The ten+ years of industry experience is also a good indicator that they’re safe to trade with.

Best Alternatives to XTrade

Compare XTrade with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

XTrade Comparison Table

| XTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 1.9 | 4.3 | 3.6 |

| Markets | Forex, CFDs, indices, shares, commodities | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, IFSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 10% Equity Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:400 | 1:50 | 1:200 |

| Payment Methods | 4 | 6 | 11 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by XTrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| XTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | No | Yes |

| Gold | No | Yes | Yes |

| Copper | No | No | Yes |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

XTrade vs Other Brokers

Compare XTrade with any other broker by selecting the other broker below.

Customer Reviews

4.7 / 5This average customer rating is based on 21 XTrade customer reviews submitted by our visitors.

If you have traded with XTrade we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of XTrade

FAQ

Is XTrade a legitimate brokerage company?

XTrade Europe Ltd. is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) for services in Europe. XTrade International Ltd. is licensed and regulated by the International Financial Services Commission in Belize. We’re comfortable the broker is not a scam.

What is the minimum deposit for an XTrade account?

The minimum deposit required to open an account is $250 while the minimum position size is 0.01 lots.

Is there an XTrade demo account?

Yes, XTrade offers a demo account with all the capabilities and options available with a real money account.

Does XTrade offer a MT4 download?

No, XTrade only offers its own proprietary trading platform designed for browser-based trading. The platform has also been made into a mobile app for iOS and Android smartphones and tablets.

Can I open an XTrade account in Canada or the USA?

No, XTrade does not provide its services to traders in the USA, Canada or other countries where its services conflict with local laws. However, XTrade can be used in many countries worldwide, including India, the UAE, Australia and Uruguay.

Trading with this platform wasn’t a tough decision as they’ve been in the industry for a while, so in terms of longevity they were good. They use a proprietary trading app and I appreciate how easy it was to register most especially the verification aspect, it gave me a strong sense of security. Also there is also 2 factor authentication to help tighten my account, lol. Most importantly I would say it’s been an easy use for me as a beginner as the user interface is easy to walk around with a convenient layout.

I think the highlight of Xtrade at least for me are the asset selection and the daily technical analysis videos.

There are wide range of cool instruments that I have never traded but always wanted. ETFs are great for diversification of portfolio and plenty of stocks also useful for this purpose.

The spreads are not very narrow for ETFs specifically btu I don’t trade them on a daily basis.

Last time it was Ultrashort sp500 etf and it was last month I think.

Guys, you don’t know how good you have it here on Xtrade. I’m so tired of brokers with MT4, it’s insane. I’m gonna rant maybe, but I’ve experienced so many issues. The problems with updateing (there are examples on the web where traders lost money due to platform errors); the frequent slippages, the constant discrepancy in quotes.

Xtrade is just better platform, more stable and better run so far.

I like that Xtrade provides a high leverage on the stock market, for instance I love trading Nvidia stocks because I can predict its movements pretty easily and I can use leverage up to 1:100 but of course I don’t abuse it during real trading. Mainly I use leverage up to 1:50 and not more because the risk management is the number 1 for me!

I was hesitating to join the Xtrade company because despite the fact that I have been trading for a long time I have never heard about them but it turned out that they have existed for over 10 years and it is quite impressive.

I can imagine how many world and economic turmoil they have experienced and they are still here in this industry and that’s why I chose them. At this point I can be confident in the safety of my funds and the probability of their bankruptcy I think 0% percent. By the way, I was surprised to find out that they provide bond assets for trading and it is admirable of them.

I am encouraged and inspired by the Xtrade. Seriously, I wasn’t that proficient to get into real trading and had to stay on the demo for a while. Due to some courses I found here, I managed to start trading on the real account. I just deposit the minimum sum, started to trade minimum lots like 0.01, and didn’t use big leverage. Fortunately, there are assets where leverage is confined to just 1:50 like cryptos, so it’s cool for newcomer to test the waters.

Maybe there is still space for improvement on the platform, but these are such trifles that not every trader notices. All in all, props.

Xtrade is a reliable broker cuz if I am not mistaken they have been in this industry for over 10 years and I have no worries about the safety of my funds. There are also many types of financial assets and any trader will be able to trade whatever they want.

Anayzing the charts of several stocks and commodities, epecially gold, an idea was born!

Probably, we are in the new cycel of bull market for gold and equities.

Not delaying the action, I opened long positions on gold and several stocks. All was done here on Xtrade.

Xtrade is that broker that is ideal for such operations. The leverage is ample enough and the trading conditions are attractive.

Moreover, through the broker I learned some new concepts related to trading strategies. You can find them among offered courses.

Oh, and yes, deposit and withdrawals are fees-free and smooth!

I like the fact that they provide a lot of ways to make deposits and withdrawals. I didn’t have any problems with transferring money but transactions are kind of slow for me. Id like them to fix that.

I have been trading with the xtrade broker not for a substantial period and can’t say that I know this platform inside out, but the fact one can earn money with it is unquestionable.

Knowing how long they are in the business, I didn’t put the reliability at any doubt.

Range of assets, performance of their custom software leave no questions. Spreads & swaps are also appealing.