Wealthfront Review 2025

Pros

- Automated investment opportunities through robo advisors with financial advice, planning and automatic portfolio rebalancing

- A choice of accounts to suit different trading goals including retirement investing (IRAs) and individual investing solutions

- Direct indexing (a feature where individual shares in an ETF are purchased separately)

Cons

- No large-balance discounts

- Poor customer support with no live chat

- Limited human component to advisory service

Wealthfront Review

Wealthfront is a popular broker in the robo advisory investment space. The US wealth management company offers a range of account options, including individual and joint high-yield savings and investment accounts like 401ks, including for retirement and college. It is one of the largest AI-automated trading companies globally. This 2025 review will examine everything Wealthfront has to offer, including direct indexing and lines of credit, the various account options and their eligibility criteria.

Wealthfront Headlines

Wealthfront Inc. is a prominent and accessible brokerage with a robo advisory service. It was established in 2008 as the mutual fund analysis company, kaChing by its co-founders, Andy Rachleff and Dan Carroll. It officially launched as a wealth management firm in 2011, going for a name change to Wealthfront. The address of its office headquarters (HQ) is in Palo Alto, California.

The company specialises in tax optimisation, a service that helps its clients reduce the impact of taxation on their investments. You can choose an investment goal from free financial advice, high yield cash accounts, long-term investing, retirement savings or college savings.

Wealthfront has seen steady growth and has over $20 billion worth of assets under management (AUM), ranking second after its rival Betterment ($29b). The broker’s number of users also tops 440,000.

What Are Robo Advisors?

Those looking to trade stocks and shares would traditionally seek advice from human financial advisors when planning an investment strategy that considers their risk appetite. However, human financial advisors are limited as they have a finite amount of time and therefore favour high-value clients investing upfront capital to make profits through fees.

Wealthfront claims to have been founded to fill this void and its mission is to offer all investors — large and small, who may or may have no upfront capital — sophisticated financial advice. Brokers with robo advisors allow their clients to access cheaper investment planning than their human counterparts. Robo advisors are digital platforms that provide automated trading and financial planning services using algorithms. Wealthfront and other robo advisors are set up to help investors manage retirement or college funds.

Free Financial Planning

Wealthfront is a robo advisor that connects users to automated and physical financial planners that are on hand to advise clients how to benefit from their accounts. The broker’s free planning experience helps users explore and gives guidance to optimise finances like making informed decisions about stock options, equity plans and IPOs. The brokerage can provide goal setting for homeownership, retirement, college tuition and taking a sabbatical to travel.

You can link any financial information that you want to connect to your investment plan during the onboarding process. Your dashboard will show all your assets and liabilities giving you a quick visual representation of the likelihood of attaining your goals. Whilst users are prompted to link any other accounts held to establish a complete picture of their financial position, it is not mandatory. You can also export your account data to another personal finance tool like Quicken.

Wealthfront’s automated financial planning and advice tool ‘Path’ powers all the personal insights and advice that the platform provides for free, giving you financial expertise in your pocket. Path connects various financial accounts — 401k, mortgage, credit cards — and can help users project their net worth over time, calculate the cost of various scenarios to assess their impact on your overall finances and reflect costs of specific milestones as one decision can impact another:

- Mortgages

- Expected financial aid for your children

- Non-mortgage costs like property taxes and insurance

- Projected home cost by bedrooms, location and purchase date

After understanding your finances, habits and aspirations, the robot advisor can provide recommendations, such as the right account for a certain goal, and strategies, like how much to deposit in each, that are tailored to your specific needs.

Account Services

Wealthfront currently supports the following account types which we explain further in this article:

- College Savings

- High-Yield Cash Accounts – individual, joint and trust

- Long-Term Investing Accounts – individual, joint and trust

- Retirement Investing (IRAs) – Traditional, Roth, SEP and 401k rollovers

Wealthfront Cash

Wealthfront Cash is a cash management account that pays an APY of 0.10%. This was cut down from 0.35% in April 2021 and had been at a high of 2.57% in June 2019. This operates like a standard checking account but with the interest rate of a savings account. As well as being a competitive high yield savings account (HYSA), the cash account is covered by up to $1 million in FDIC insurance and has partnered with Green Dot and other banks to offer banking services.

Wealthfront Cash charges no monthly management fee, no overdraft fee or ATM fees and you only need $1 to get started. You do not need to open an investment account to use Wealthfront Cash. It is possible to open a joint cash account but only one person will be able to log into the account while the other has read-only access. You can move money to and from your Cash account as many times as you want for free. However, the broker only allows wire transfers for deposits.

As well as having zero fees, cash accounts have many other features, including a debit card, account and routing numbers for bill paying and automatic payments. Investors with a cash account can direct deposit their salary and get paid up to two days earlier. Wealthfront Cash account holders can also get their funds invested in an investment account within minutes.

However, there are some fees for the debit card. In-network ATMs are free, but other fees for out-of-network ATMs, international transaction fees and cash deposits at select retailers can range between $2.50 and $5.95.

Autopilot Account Aggregation

The robo advisor recently launched Autopilot, which works with its Path tool and is a major step towards its goal of “self-driving money”. Autopilot will monitor any account that you want (Wealthfront Cash or another external bank account) and determine the amount of money needed in it once you define a maximum balance based on monthly bills.

Any time the amount is exceeded by $100, Autopilot will move the money into another account of your choosing. You receive an email when Autopilot finds extra money and you have 24 hours to cancel it. It is a free service designed to automate your savings, much like a financial assistant. If you deposit your salary with the robo advisor, the Autopilot algorithm will automatically figure out the best path for your money.

Investment Management

Wealthfront’s methodology involves investors entering their age and income and answering a risk score questionnaire about their financial goals, which allows the company to assess their risk appetite. Using this information, the firm will measure your risk tolerance, generating a risk score from 1 to 10 and presenting an asset allocation suggestion with its associated risk. You can change your risk score at any time and the broker can reallocate your investments accordingly.

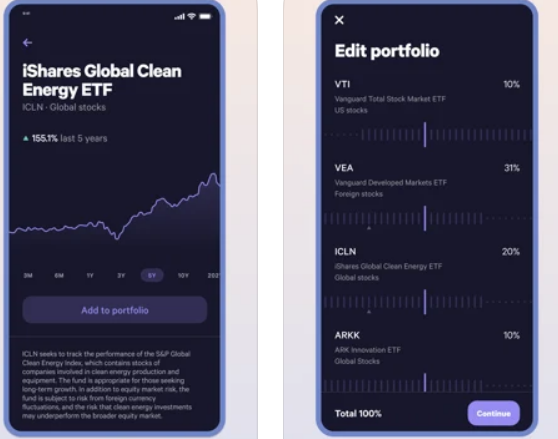

The company then uses low-cost mutual funds and a list of ETFs from 12 asset classes to build diversified investment portfolios. The exact mix of funds and percentage allocation will depend on your financial goals and risk appetite. Diversified portfolios should also be less volatile than a portfolio that just holds the S&P 500, for example.

The investment mix covers US stocks, fractional shares, foreign stocks, dividend stocks, emerging markets, real estate, natural resources and US government corporate and municipal bonds. Portfolios generally consist of 6 to 8 assets. Clients can customise their portfolios by adding and deleting their ETF holdings or starting from scratch.

Taxable accounts can opt-in for the Wealthfront Risk Parity Fund (WFRPX). These accounts will hold a mixture of three ETFs (VTI, EMB and BND) on the broker’s list until balances reach £100,000. Once they reach this amount, the WFRPX replaces the ETFs. Portfolios over $500,000 are eligible for Smart Beta.

Portfolio Line Of Credit

Once your investment account reaches a $25,000 investment minimum you can access credit with an APR of between 2.4% and 3.65%. With a Wealthfront account, a portfolio line of credit means you can borrow 30% of your account’s value.

Beware, while you can pay the loan back in your own time, there is a margin risk as you may have to repay the loan more quickly if your investment value drops.

Tax Optimisation

Tax management is a key part of the service offered by the broker and is only relevant to taxable accounts, not retirement accounts like IRAs or 401ks. Wealthfront will also offer daily tax-loss harvesting to lower your potential tax bill when your taxable account reaches between £100,000 and $500,000.

Tax-loss harvesting is an investment strategy that can significantly reduce capital gains tax. This involves selling off losing investments to offset the gains from winners. The robo advisor enhances its tax optimisation service with stock-level tax-loss harvesting or direct indexing.

Wealthfront US Direct Indexing is a simpler way to buy an index. It is a tax-loss harvesting strategy for accounts worth more than $100,000. The company replicates the US stocks index by buying the stocks held in it directly (up to 1,000). Its software can then look for individual tax-loss harvesting opportunities. Tax savings can then be reinvested, compounding the potential impact of the service.

To use direct indexing with account balances under $100,000, customers must hold a particular ETF (VTI).

Socially Responsible Investing (SRI) Portfolio

Investors can now consider more ethical investments that align with their morals and values through Wealthfront’s Socially Responsible Portfolio. Users have access to SRI investment options and mainstream funds like iShares ESG Aware MSCI (ESGU), which invests in large-to-mid size US companies that score well on MSCI’s ESG ratings.

Clients can choose to invest in Wealthfront’s SRI portfolio or customise any other portfolio to include socially responsible options for no added fee.

Cryptocurrency

The broker also now offers crypto traders access to hundreds of digital coins in addition to two trusts: the Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE). Investors can allocate up to 10% of their total portfolio to these two crypto trusts.

Risk Parity (WFRPX)

Wealthfront’s Risk Parity Fund is a proprietary mutual fund that claims to offer greater exposure to asset classes with higher risk-adjusted returns. Risk parity is a strategy for allocating capital across multiple asset types to diversify your portfolio. However, historical average returns data has shown that the risk parity fund has underperformed.

Smart Beta

Wealthfront offers investors with at least $500,000 access to the Smart Beta service to give their returns a boost over the market indices. This software monitors the various variables impacting your stock’s performance other than market capitalization, such as value, momentum, dividend yield and volatility to help to increase returns.

While other robo advisors offer similar services, gains can be particularly lucrative when paired with the US Direct Indexing and lower fees. If users have US Direct Indexing in their account, they will automatically receive Smart Beta when it reaches $500,000.

Wealthfront Retirement Savings Plans

Wealthfront 401k plans are retirement savings plans designed to help businesses support their employees in saving for retirement. Employers take care of all the logistics from account setup to administration. The investment options are often quite limited and companies can choose to make their plans more or less restrictive.

Contributions are taken directly from paychecks on a pre-tax basis and there is a limit to how much you can contribute annually. Withdrawals are only permitted under specific circumstances, either that they reach 59.5 years of age, become disabled or die. Taxes apply to all withdrawals on returns and early withdrawal can incur a 10% penalty. However, you can choose to take a 401k loan if your company allows it. Since you are borrowing against your own savings, there are no credit applications required.

Fortunately, self-employed individuals can also participate in retirement savings using the Solo 401k option. It is designed for small businesses with no employees other than the owner (and their spouse). Contribution limits and distribution rules are the same as a standard 401k.

A Wealthfront 403b is also a retirement saving plan that employers set up for employees. The major difference is the type of company that sponsors the plan. Employees of for-profit organisations can contribute to 401ks while employees of tax-exempt organisations, such as churches and hospitals, can save using a 403b.

401k Rollover To IRA

Wealthfront offers 401k rollover to IRA accounts. Most professionals will work for more than one employer in their careers, meaning they will have several 401k accounts. Consolidating these retirement accounts can make it easier to track your progress against your saving goals. If you choose to rollover the 401k, your funds are invested in an Individual Retirement Account (IRA).

The broker’s IRAs are popular as they also allow investors to save for their retirement. Unlike 401k plans, which involve enrolling in an employer-sponsored plan, IRAs give users more flexibility and control over the management of their funds.

Wealthfront offers several types of IRA that vary in benefits and eligibility requirements. The tax benefits of an IRA are a major draw for investors that start saving earlier in life. A Traditional IRA allows the user to make tax-deductible contributions but requires that you pay taxes on withdrawals. Roth IRAs offer the reverse: tax-free withdrawals but you pay taxes on contributions.

Most financial institutions offer several types of investments for IRA accounts. Common options include mutual funds, individual stocks and bonds. IRA options include the following:

Traditional IRA

Anyone under the age of 70 can contribute to a Traditional IRA, though they must meet certain income requirements to be eligible for tax benefits. Funds in a Traditional IRA may be subject to early withdrawal penalties of 10% before age 59.5.

Your contributions towards a Traditional IRA account are capped at $6,000 if you are under 50 and $7,000 for 50s and over. No contributions can be made after 70.5 years old. Your modified adjusted gross income (MAGI) must be less than $75,000 for individuals and $124,000 for those filing jointly.

Roth IRA

A Roth IRA holds investments that you choose using after-tax money. Unlike a Traditional IRA, there are no age limits on contributions to a Roth IRA, nor are there mandatory withdrawals. With Wealthfront, these are only available to individuals with certain income limits – less than $139,000 for individuals and $206,000 for joint filers, i.e., you cannot contribute if you make too much money. Your contributions towards a Roth IRA account are taxed up front.

Similar to a Traditional IRA, your contributions towards a Roth IRA account are capped at $6,000 if you are under 50 and $7,000 for 50s and over. Withdrawals can be made anytime and are tax-free. One benefit is that you will not pay tax on your retirement fund’s growth and tax-free withdrawals are available once you reach 59.5 years old if the account is at least five years old.

Wealthfront allows backdoor Roth IRA conversion from a Traditional IRA to a Roth. This is a way for people with high incomes to sidestep Roth’s income limits.

SEP IRA

These are retirement savings plans aimed at SMEs, offering tax benefits to both employees and employers. Contributions to SEP IRAs are made by employers for every eligible individual at the business. Withdrawals are tax-free.

SIMPLE IRA

Our review has found that the broker does not offer HSAs or SIMPLE IRAs but you can transfer a SIMPLE IRA to a Wealthfront IRA tax-free through a “trustee-to-trustee transfer” if it has been at least two years since your employer first contributed to your SIMPLE IRA.

These are designed for companies with fewer than 100 employees that do not want to take on the complex setup of a 401k. It requires employers to make fully vested contributions that match a percentage of employees’ contributions. Employees pay no taxes on contributions, only on withdrawals.

Wealthfront 529 College Savings Plan

A 529 plan is an account specifically designed to save for college. It can help users with tuition fees funding, accommodation and education resources. Most robo advisors do not offer tax-free college savings accounts. However, the Wealthfron 529 has been touted as one of the better 529 plans out there.

Wealthfront 529 savings account fees are slightly different from its normal pricing. This review found that there are no charges on your first $5,000, while the total fees can range from 0.42% and 0.46% per year, which includes the standard 0.25% advisory fee, plus expense ratios and admin fees. Withdrawals are also tax-free.

Residents from the state of Nevada are only charged the broker’s advisory fee on amounts over $25,000, making the Wealthfront 529 the lowest cost advisor-sold 529 plan. However, outside of Nevada, you may get a better state-sponsored 529 if your state offers one, as it may offer tax deductions or credits.

Fees & Costs

Wealthfront does not charge any fees for opening or closing an account, nor does it charge withdrawal fees, trading/commission fees, account transfer fees or inactivity fees. Some other robo advisors do charge additional fees.

Minimum Deposits & Withdrawals

To open an investment account, users need to pay a minimum deposit of $500. Cash accounts can be opened with $1. Financial planning is completely free.

The minimum withdrawal from an investment account is $250. Wealthfront’s withdrawal process will likely take 3 – 4 business days from investment accounts and 1 – 3 days from cash accounts.

Management Fees

For its investment accounts, the broker charges an annual advisory fee of 0.25% on all assets under management, which is deducted monthly. The 0.25% advisory fee is equal to 1/365 of the annual rate multiplied by the net market value of your invested assets as of the close of markets for each day in the month, multiplied by the number of days in a month your money was managed.

Expense Ratios

On top of this, Wealthfront users must pay expense ratios charged by the ETFs and mutual funds that comprise your portfolio. An expense ratio is an annual fee that mutual funds, index funds and ETFs charge as a percentage of your investment in the fund. These are paid in addition to your asset management fee.

For example, if you invest in a mutual fund with a 1% expense ratio, you will pay the fund $10 per year for every $1,000 you invest. This rate is pretty standard in the robo advisory space but Wealthfront has a higher initial contribution requirement than most of its peers, ranging from 0.03% to 0.39%.

Security & Regulation

Wealthfront is regulated by the US Securities and Exchange Commission (SEC). Additionally, the security features offered by the platform are robust. Your cash is insured by the FDIC for up to $1 million. Your investments are also insured by the SIPC, protecting assets up to $500,000.

Both the website and mobile app require two-factor authentication (2FA), a security feature that helps give your account an extra layer of protection.

Trading Platform

Wealthfront uses automated technology to generate tailored investment and portfolio management advice. The platform offers key services: cash management, tax management and financial advisory. Users merely answer some questions and the platform learns how much risk you can handle, customising your portfolio.

The Wealthfront software automatically readjusts through a threshold-based rebalancing technique where it reallocates your investments. The platform, both mobile and desktop is easy to navigate and hosts a range of resources via its blog, making it a useful tool for those new to investing. The platform also offers articles and many FAQs which will help with financial planning.

Mobile App

Wealthfront was initially created to be a mobile experience. The mobile app can be downloaded from the Apple App Store for iOS devices and the Google Play Store for Android. The mobile app is designed to be straightforward to use, providing drop-down menus or sliders to avoid typing errors. The application also implements two-factor authentication on login, helping to keep your account secure, wherever you are.

Customer Support

Wealthfront takes the ‘robot’ part of being a robo advisor very seriously, meaning there is no live chat on its website or mobile app. The firm also has a customer service phone number, available between 08:00 to 17:00 PDT but you must log in to your account to view it.

There is a 24/7 email address at support@wealthfront.com as well as a contact form for enquiries like how to delete your account on the website.

The company also provides news updates and help on various topics on its Twitter and YouTube accounts.

Wealthfront Verdict

As hands-off trading becomes more popular as an investment strategy, brokers with machine learning-powered robo advisors like Wealthfront are becoming more prominent. The broker is a good option for traders that want to make fewer financial decisions but also enjoy playing with graphs and charts. This review considers Wealthfront an experienced and trusted robo advisory platform, offering a vast range of accounts, including IRA and ISA savings accounts, joint funds, retirement funds and college and university fee accounts, as well as advisory services. Unfortunately, our review found that its services are only available to US citizens.

FAQs

Is Wealthfront A Bank?

No, Wealthfront is not a bank. The cash account acts as a checking account but stores your money across several legitimate banks, including Green Dot Bank.

Is Wealthfront A Fiduciary?

No. Wealthfront is not a fiduciary. However, current SEC regulations allow for investment advisors like this broker to assume full fiduciary standards of service for its clients.

Can Wealthfront Be Used For Investing In The UK?

No, unfortunately, Wealthfront is only available to US citizens. Users must provide their US social security number and a permanent US residential address, making it impossible for non-US citizens or residents to use the platform. Clients from the UK, Germany, Canada and Europe, as well as countries further afield like Hong Kong and Australia, must look elsewhere. The broker’s UK equivalent could be InvestEngine.

Does Wealthfront Offer UTMA Accounts?

No, Uniform Transfers to Minors Accounts (UTMA) are not offered by Wealthfront.

Which Is Better, Wealthfront Vs Betterment?

Wealthfront and Betterment are frequently compared to each other as they offer similar services. Despite both having their strengths, Betterment is often considered to be more accessible and well suited for beginners. For more comprehensive financial advice, Wealthfront is a better option and therefore, a good investment.

Does Wealthfront Offer A Demo Account?

Yes, Wealthfront offers a demo account along with its other investment competitors like Betterment, Fidelity and Vanguard.

Can I Transfer The Securities In My Wealthfront Account To Another Firm?

There is no fee to transfer in-kind from your Wealthfront account to another broker. However, account information must match and the transfer is initiated by the receiving firm.

Best Alternatives to Wealthfront

Compare Wealthfront with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

Wealthfront Comparison Table

| Wealthfront | Interactive Brokers | Firstrade | |

|---|---|---|---|

| Rating | 3 | 4.3 | 4 |

| Markets | Stocks, ETFs, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | Yes | Yes | No |

| Minimum Deposit | $1 | $0 | $0 |

| Minimum Trade | $1 | $100 | $1 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | – | – | Deposit Bonus Up To $4000 |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | TradingCentral |

| Leverage | – | 1:50 | – |

| Payment Methods | – | 6 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Wealthfront and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Wealthfront | Interactive Brokers | Firstrade | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Wealthfront vs Other Brokers

Compare Wealthfront with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Wealthfront yet, will you be the first to help fellow traders decide if they should trade with Wealthfront or not?