Uphold Review 2026

Please see the list of similar brokers or the Best Brokers List for alternatives.

Pros

- Crypto staking is available on 30+ tokens with above-average rates up to 16%

- Uphold continues to remain ahead of the industry, often being one of the first platforms to list new crypto tokens

- Over 250 cryptos are available including major tokens like Bitcoin and Ethereum

Cons

- Uphold operates with limited regulatory oversight

- Customer service is slow based on tests, with limited contact options

- There is a 2.49% fee if you want to use debit or credit cards

Uphold Review

In this Uphold review, I share my findings after signing up for an account, testing the platform’s features and comparing the brand to popular alternatives. I carefully weigh the pros and cons of using Uphold based on my own first-hand experience with the firm.

Importantly, when reviewing crypto trading apps, there are several key factors I take into account:

- Can I trust the crypto broker based on their regulatory status and track record?

- Is it easy to fund my account and are there any fees or delays?

- Can I trade a good breadth and depth of digital tokens?

- Is the platform easy to use with the features I need to invest in crypto?

- Are the fees low compared to popular alternatives?

- Is the customer support team available when I need them?

I answer these questions in detail, and assess a whole lot more in the rest of this review.

What Is Uphold?

Before diving into the detail, it is important to understand what Uphold is and how it works. Uphold is essentially a digital platform offering crypto investing and currency exchange services.

The company operates through its ‘anything to anything’ motto to provide a complete experience, which includes user-friendly crypto trading and integrated payment facilities.

The brand aims to provide customers and businesses with fair, affordable and transparent financial amenities. How well they do or don’t do that, I will reveal in this review.

One early thing worth calling out is that I quickly discovered while using Uphold that some services are only available in certain countries. For example, where I’m based in the UK, traders can sign up for the Uphold Card, which offers low foreign transaction fees when travelling abroad. However, this isn’t available in other countries.

Assets & Markets

It is important to choose a trading app that provides access to the tokens you want to speculate on. With this in mind, I evaluated Uphold to identify the digital currencies that are available, plus those that aren’t. I also spent time comparing the investment offering with competitors.

During my tests, I was pleased to find 250+ crypto assets, which is more than alternatives like CEX.IO with 200+. I was particularly impressed to find many new tokens alongside industry giants, making Uphold a good choice if you are looking to diversify your crypto portfolio.

The assets I’ve listed below are available to UK and European clients (who signed up before 1st February 2022) under the Uphold Europe Limited (UPE) affiliate:

- Cryptocurrencies – 28 digital currency coins including BTC, ETH, DOT and XRP are available to buy, hold, sell and withdraw

- Utility Tokens – 3 tokens can be traded via the web and mobile platforms including BAT and OMG

The assets below are available to trade under the US platform. New European customers (signed up after 1st February 2022) can also access these products:

- Cryptocurrencies – Over 100 digital currency assets and trading pairs including altcoins, emerging tokens and stablecoins. Importantly, I found that token availability varies depending on the base country, with some assets tier 3, meaning you can buy, hold, sell deposit, withdraw and send while others are tier 4, such as PancakeSwap and Moonbeam, meaning you can buy, hold, sell and send

- Precious Metals – Trade Gold, Silver, Platinum and Palladium with instant liquidity in 27 national currencies

- Environmental Assets – Invest in carbon credit tokens to support certified projects in the world’s rainforests. These are the world’s first tradeable carbon credit tokens; UPC02 and Bitcoin Zero

Crypto Staking

While researching Uphold, I found the company also introduced cryptocurrency staking in 2022. This allows users to earn up to 16% in rewards, which is more than the roughly 5% to 10% I see at alternatives.

I think this is an attractive service for beginners, as crypto staking services allow you to monetize your digital assets. Blockchains essentially use your crypto to check that transactions are verified and secured, known as ‘proof of stake’. And in return for helping to stabilize the network, you receive free tokens.

Staking is available on a selection of popular coins, including Ethereum, Cardano, Solana and Polkadot. In fact, over 30 crypto tokens are available for staking. Yet the most useful feature in my opinion is that you receive a handy weekly notification of earnings through the Uphold mobile app. No action or manual intervention is required, your funds are automatically credited and your updated balance is available.

Note that staking is not available for US clients.

To show you how much you could get from crypto staking, I have highlighted the advertised rates on popular tokens below.

- DOT – 10.5% APY

- ETH – 4.25% APY

- ADA – 4% APY

- SOL – 5.1% APY

- ATOM – 10.2% APY

- XTZ – 4.25% APY

- KSM – 15.3% APY

- KAVA – 19.5% APY

- LUNA – 4% APY

- FTM – 3% APY

- ONE – 8% APY

- SKL – 7% APY

- CELR – 1.5% APY

Platforms & Tools

Uphold has one proprietary, multi-currency trading terminal which I had the chance to explore via the mobile app and desktop program. I did a thorough test of the platform to find out what works well, what needs improvement, and how it compares to other firms.

Overall, I find the platform very user-friendly, intuitive and well-suited to beginners. However, I did find it a bit disappointing that there are no advanced graphs and charting tools. This significantly reduces its suitability for serious analysis – I would stick with a dedicated third-party platform for this.

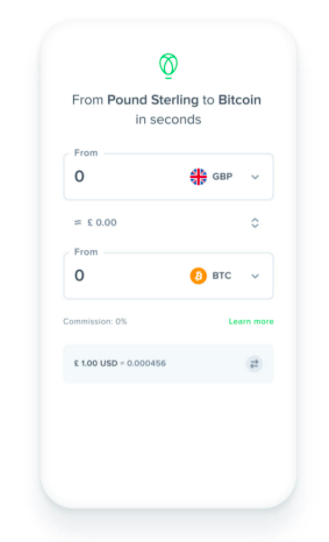

On the bright side, I like that the interface is fully customizable so I can easily view all my investments in one place. Another aspect that stands out for me is the platform’s one-step trading capability between assets. For example, I can seamlessly exchange BTC to XRP which offers a unique pricing advantage vs competitors that often require separate transactions along with two sets of fees.

Additional useful features include a customizable portfolio view, dark mode and multi-language defaults. While these aren’t going to make or break the crypto trading experience, they do mean you can create a familiar dashboard that suits your preferences.

Note, the platform only offers one order type – limit order.

Mobile App

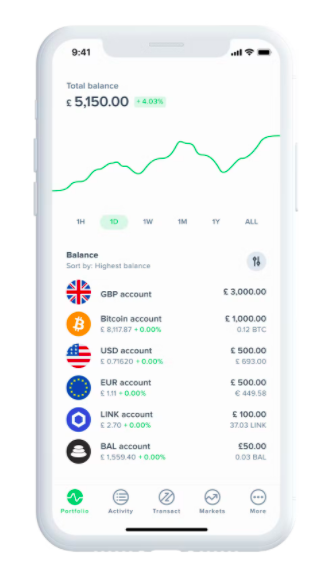

The Uphold terminal and wallet can be downloaded for free and is compatible with iOS and Android devices. Importantly, my tests have shown that I can access almost all the tools, features and functionality found on the desktop terminal including the one-step exchange functionality.

Again, I was particularly pleased with the simple and user-friendly design, making it suitable for novice investors. I was able to manage my account, open and close trades, check live pricing and transfer funds from wallets while on the go.

Other features that stand out for me include a ‘from and to’ interface to pull funds directly into an asset to purchase, plus live market data and customizable navigation tiles. These all add up to create an excellent mobile experience.

Account Types

Live Accounts

Like similar brands, I was not surprised to find one live account for retail clients. Fortunately, I found it quick and easy to open an account using the online registration form, taking me 3 minutes. Simply look out for the ‘sign up’ logo in the top right corner of each webpage to get started.

I was pleased that there are no minimum deposit requirements, again adding to Uphold’s appeal for beginners However, to access the full catalog of tools and features, I found that customers must comply with identity verification protocols. These include providing proof of residency, your social security number (US clients only) and a government-issued ID document, such as a passport. I found that unverified clients may be subject to limitations, including a $1,000 maximum transaction value.

It is good to see that Uphold trading accounts are now available to UK residents. The broker received permission from the FCA to restart services in February 2022 under the temporary registration regime for crypto firms.

Note, EU clients are not permitted to hold accounts in base currencies such as EUR and GBP. Instead, the broker recommends purchasing stablecoins as these are pegged to fiat currencies.

Demo Account

Uphold also offers a free demo account via the ‘Sandbox’ testing environment. This is a really important feature, especially for investors new to the platform.

Clients will need to open a separate account to use the features of the demo platform, but then you get Bitcoin virtual funds to practise strategies risk-free and to view platform features and tools.

Simply enter your personal details via the ‘sign up’ section on the webpage. It’s worth pointing out that I noticed while signing up that these details will need to be different from the email address associated with the live account. When prompted for a verification code, enter ‘0000000’ to sign in and proceed.

Fees & Costs

To understand whether Uphold offers good value, I identified all the different fees you can expect to pay. I then compared these to similar firms to decide whether fees are high, average or low. My conclusion: Uphold offers below-average fees.

I encountered several fees at Uphold including a spread of up to 1.5% for cryptocurrency purchases, plus a trading commission of $0.99 for trades under $500.

The competitive pricing network is driven by the broker’s exchange model, which sources the best prices from 26 underlying platforms. This enables superior liquidity during high-volume market periods.

During my testing, I found that UK customers will face a 0.85% buy spread for BTC and a 1% fee for selling. This was much lower for fiat currencies with a 0.05% fee to purchase USD.

Importantly, I appreciate that peer-to-peer transactions are free. However, if a currency conversion is required, you will be charged. For example, if you want to transfer EUR but would like the beneficiary to receive Ethereum, you will pay the relevant conversion.

Deposits & Withdrawals

Deposits

I’m happy with the range of payment methods available, including bank wire, cryptos and bank cards. I particularly rate that both fiat and crypto funding is supported, whereas some cryptocurrency firms only support payments in digital currency.

There are some fees to be aware of, as well as minimum and maximum limits, which I’ve detailed below.

- Bank Wire Transfer – US ACH: No charges. $10 minimum limit and $2,500 maximum transaction per day

- Bank Wire Transfer – US Wire: A $20 charge applies for deposits under $5,000. No minimum or maximum limits apply

- Cryptocurrencies – No charges, however, network fees may apply, varying by digital coin. Unlimited deposit amounts

- Debit/Credit Cards – A 2.49% fee applies for card payments. The minimum deposit is £/$/€ 10 while the maximum payment is £/$/€ 500 per day. This is not available to UK or EU customers.

Importantly, you can choose to hold your account balance in a variety of currencies and precious metals. However, I did find that a currency conversion fee applies for deposits from a denominated account currency to a different base currency or peer-to-peer transactions.

For example, if you are sending GBP but would like the beneficiary to receive BTC, you will be charged a currency conversion fee of 0.85% for purchasing BTC with GBP.

Withdrawals

Based on my time using Uphold, I found that the company supports the same payment methods for withdrawals. Bank wire transfers incur no fees but crypto withdrawals are subject to network charges and credit/debit card withdrawals are charged at 2.49% which I find a little disappointing. Any dynamic network fees incurred via the crypto network, regardless of the asset, are visible to traders before confirming a transaction.

You should also know that minimum and maximum withdrawal limits apply for all payment methods. For example, there is a $5 minimum withdrawal for bank wire transfers (US ACH) and 0.25 LTC for Litecoin payments.

Processing times vary between payment methods. For example, during testing, I found that bank wire transfers typically take 1-5 working day, which is very much in line with alternatives. Cryptocurrencies are subject to their relevant network confirmation requirements, which again, is what you can expect at most competitors.

Regulation & Trust

I carefully reviewed the regulatory status of Uphold to confirm whether it is authorized by trusted regulators. I looked at whether the regulator is credible, and importantly, the activities Uphold is allowed to perform. My conclusion: Uphold is relatively trustworthy, with some permissions from respected regulators, though many of its crypto activities are unregulated in line with most of the industry.

Uphold Europe Limited is registered with the Financial Conduct Authority (FCA). The company is also a registered EMD Agent and Electronic Money Issuer. Importantly, digital currency trading is not protected by the Financial Services Compensation Scheme in the case of business insolvency.

Additionally, crypto-asset services are not within the scope of The Financial Ombudsman Service and the FCA does not approve of its crypto asset activities.

The US affiliate is authorized by the United States Treasury Department regulator, FinCEN. Uphold Lithuania is not currently regulated by any governmental authority. This is not unusual among cryptocurrency trading firms. Still, always be cautious due to the highly volatile nature of digital assets.

Crucially, it was good to see the company provides full governing transparency. There is a specific data transparency page available on the exchange’s website with real-time transaction flows, assets and solvency information.

The proprietary Reserveledger and Reservechain technologies are also regularly assessed by independent auditors.

In addition, Uphold adheres to the Bank Secrecy Act (BSA) for record-keeping compliance. This is big because many crypto firms I have assessed offer little to no transparency about the security of client data and funds.

Security

Uphold scores well when it comes to security and data protection – I’m satisfied that security protocols are enforced across key customer touchpoints. These include conducting Anti-Money Laundering and Know-Your-Customer compliance checks during account set-up.

Bespoke technology also ensures the company adheres to local and international laws to protect Personally Identifiable Information (PII).

I also appreciate that you are provided basic guidance on security best practices including implementing two-factor authentication (2FA), associated security keys and recognizing scams. These are all nice touches that promote a secure trading environment.

Proof Of Reserves

Uphold provides proof of reserves for peace of mind. This is good to see, particularly following the collapse of FTX in November 2022, which will likely lead to many crypto firms publishing financial information to reassure customers.

I rate that Uphold publishes a real-time record of all transfers in, out and within the trading environment, which is updated every 30 seconds. The Reserveledger™ is a real-time anonymous record of the currencies and precious metals held in reserve. The publication is traceable and verifiable proof of solvency.

In November 2022, for example, I saw that the company was holding 102.2% in capital reserves. On the firm’s website, I find it particularly useful that you can view reserve status by obligation, asset currency and a breakdown of funds by holding category.

Fund Safety

I also feel reassured that Uphold offers an insurance policy to protect retail customers against theft of cryptocurrency or fraudulent transfers. This policy may cover up to the total asset value held in offline storage.

Note, that cryptocurrency investments made via Uphold are not protected by the Federal Deposit Insurance Corporation (FDIC).

Additional Features

During testing, I uncovered a range of useful educational content and tools. The Uphold website hosts a dedicated webpage of resources and insights, which I think is suitable for even the most inexperienced crypto investors. Some of the features I got the most use out of during my time at Uphold were:

- Cryptionary – A useful reference guide to common terminology and jargon

- Blog – Latest news, professional opinions and upcoming features in the crypto landscape

- Newsletters – An archive of published cryptocurrency news. Traders can sign up for an email subscription service for the latest releases including details of NFTs, automated crypto bots and more

I was also impressed to find third-party applications on offer. These can be downloaded directly from the broker’s interface and can be integrated into your existing trading software.

Some of the highlights for me include Blockreward (earn points for online activities), SkillGaming (skills-based gaming network where traders can play for free) and Unstoppable Domains (replace crypto-addresses with easy-to-remember domains).

Digital Wallets

Uphold provides a secure, cloud-based cold wallet solution which I find quite similar to that of Coinbase or Gemini. However, it is a helpful feature vs Kraken which offers exchange services only.

I find that the digital wallet can be used to designate holdings in different currencies and commodities including US Dollars, Ethereum, Bitcoin and more. I can also conveniently connect my wallet to my credit/debit card accounts.

Overall, I’m pleased with the functionality available, notably the ability to make payments to online merchants, send money to peers and instantly convert between currencies.

Customer Support

I scored Uphold down for its customer support. Firstly, I’m disappointed that Uphold offers limited customer contact options. There is no helpline phone number, live chat or office address. Instead, an email contact form is provided for clients to request help.

To test the service, I sent several trading-related queries to test the quality of responses. I received responses within the same day, which is reasonable but I did expect faster response times given the lack of support options. On the bright side, responses were friendly and helpful.

Alternatively, an FAQ page is hosted on the broker’s website for common issues, queries and step-by-step guidance.

Topics include details of margin trading, login security features, halted services and automated trading bot functionality. Still, there are other negative reviews indicating unsupportive customer service.

Promotions

The exchange does not normally offer any bonuses or monetary promotions. With that said, my review did find historic incentives for global clients, including those in the US, UK, Argentina and Brazil.

A 10 BTC bonus was available to customers depositing $250 worth of cryptocurrency during a specified period. A referral scheme is also available with referees eligible for up to $20 worth of BTC for new account sign-ups.

Always read bonus terms and conditions and understand the thresholds before opening an account.

Trading Hours

The cryptocurrency market is available to trade 24 hours per day, 365 days per year. Digital assets are not typically subject to market closures, such as public holidays or weekends.

Company Details

Uphold was launched in 2015 and operates through three key affiliates:

- Uphold US (FinCEN money service)

- Uphold Lithuania (EEA residents, no regulation)

- Uphold Europe Limited (registered with the FCA for AML purposes but not regulated or approved for crypto asset activities)

Today, Uphold is an established multi-asset exchange with a presence in 180+ countries across 200+ currencies (crypto and fiat). I was also impressed to learn that the platform has supported more than $4 billion in transactions since its launch and has over 10 million registered customers worldwide.

The firm has several global offices with headquarters addresses in London and New York.

Uphold Verdict

Overall, I am pleased with the security features, educational content, multi-asset trading and digital wallet offerings at Uphold. Add in a huge range of 250+ tokens and extremely well-designed and easy to navigate platform, and Uphold ticks all the main boxes for me.

My only minor complaints are the average customer support and reports of account lockouts. Overall though, Uphold is a good all-round broker in my opinion, suitable for new and experienced crypto traders.

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong – Uphold Card is Issued by Optimus Cards UK Limited, a principal member of Mastercard and authorised by the FCA.

FAQ

Is Uphold Classified As A Brokerage?

Uphold is a multi-asset digital trading platform. Also known as a crypto exchange, it provides brokerage services so you can buy and sell crypto, as well as other assets like precious metals and environmental instruments.

Is Uphold Still Trading XRP?

Yes – you can buy, sell and trade Ripple (XRP). The broker is also among one of the first digital wallets to support full integration with the XRP Ledger. This means you can deposit and withdraw the crypto coin to external XRP Ledger addresses.

Is Uphold A Trading Platform?

Uphold is a multi-asset trading platform available to global investors. You can benefit from one-step trading between assets, wallet storage, a mobile app, automated trading and more.

Is Uphold Free?

The broker operates a transparent pricing model. Variable spreads are integrated into asset prices, typically up to 1.5% of the transaction value, with $0.99 charged on trades under $500. There are also some fees for deposits and withdrawals, for example, 2.49% is charged for credit/debit card payments.

Best Alternatives to Uphold

Compare Uphold with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Crypto.com – Crypto.com is one of the biggest names in cryptocurrency trading, developed with the aim to expedite the world’s transition to DeFi technologies. The crypto exchange offers token lending, pre-paid cards, NFTs and more. The firm was established in Germany in 2016 and its quality is proven by its 150 million users.

Uphold Comparison Table

| Uphold | Interactive Brokers | Crypto.com | |

|---|---|---|---|

| Rating | 3.4 | 4.3 | 3.5 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | Varies by payment method |

| Minimum Trade | $1 | $100 | $1 |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU |

| Bonus | – | – | – |

| Platforms | Desktop Platform, Mobile App | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | Own |

| Leverage | – | 1:50 | – |

| Payment Methods | 8 | 6 | 6 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Crypto.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Uphold and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Uphold | Interactive Brokers | Crypto.com | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | Yes |

| Commodities | Yes | Yes | No |

| Oil | No | No | No |

| Gold | Yes | Yes | No |

| Copper | No | No | No |

| Silver | Yes | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Uphold vs Other Brokers

Compare Uphold with any other broker by selecting the other broker below.

The most popular Uphold comparisons:

Customer Reviews

5 / 5This average customer rating is based on 1 Uphold customer reviews submitted by our visitors.

If you have traded with Uphold we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Uphold

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

customer service has improved greatly since authors post. I had never had a problem waiting for customer service ,quite the opposite they respond very quickly under normal circumstances