Unidex Review 2026

Pros

- 50% of trading fees are distributed to UNIDX coin holders

- Native exchange token with fee rewards and governance power

- Automated trading via bots like the UniDexBot

Cons

- Relatively young technology

- No demo trading

- No desktop download or mobile app

Unidex Review

UniDex is a crypto exchange that endeavours to provide a high-quality, reliable place to trade DeFi tokens and take advantage of the rapid growth of the sector. Developed by a group of experienced investors and traders, UniDex offers an easy to use platform that maintains a rich range of features and tools.

Whether you are in the USA, the UK, Japan, the Netherlands (Holland), Warsaw or even Malaysia, the broker offers a relatively secure platform to trade crypto securities and derivatives.

This review will unpack its bot support, gas fees, website app and other key features.

What Is UniDex?

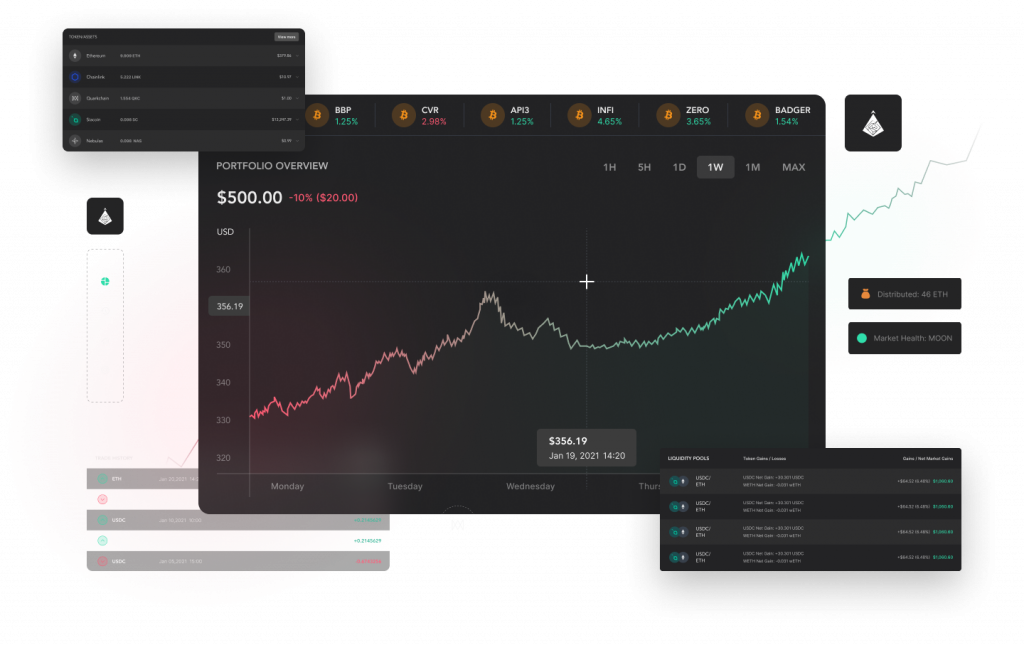

UniDex is first and foremost a DeFi exchange, facilitating the trade of digital tokens. The platform supports a range of high and low-level utilisation tools and trading operations on a streamlined platform that can be run on Windows and Mac computers via browsers. Unfortunately no desktop client or mobile and tablet (iOS or APK) downloads are available yet. That being said, the development of mobile app support is in the pipeline. The broker also has its own native exchange token, UNIDX.

UniDex’s exchange platform is based on massive liquidity, with over 75 of the top liquidity pools from other DEXs aggregated under the same roof. This ensures that clients have access to some of the best prices available and mitigates the issue of slippage that has been plaguing the sector, essentially making the broker a manipulator of a wide range of DEXs. When trading, their advanced liquidity engine is constantly re-evaluating prices while you are filling out the order. If a better price is found, the broker turns the rotary switch at the last minute, taking advantage of the enhanced trading conditions.

The platform allows users to manage their accounts, access third-party digital wallets and carry out transactions quickly and efficiently. The beta app supports several chart and graph reviewing options plus analysis tools, which can also be used in tandem with tools like Staker, where users can lock their funds into contracts and get further rewards.

How UniDex Works

The core aim of UniDex is to allow its users to trade digital assets within their wallets, ensuring better data and capital protection. Not only does UniDex support transactions with only one blockchain, but it also allows transactions involving coins belonging to different blockchains.

UniDex Ecosystem

The UniDex ecosystem features over 200 supported protocols, which connect traders with the best lending markets and yield optimisers, including Safestar and Safemoon. The broker is in good company and has access to the largest DEX, Uniswap.

While many would think of UniDex vs Uniswap as competitive, that is not the case. Uniswap provides capital-efficient protocols for UniDex traders to help it and the DeFi industry grow and the ecosystem brings all the various protocols together into one large family, allowing users to trade on all these platforms, benefiting the entire community.

Assets

Through UniDex, users can trade a wide variety of digital assets, from stocks to NFT art. As the exchange grows, more complex services are becoming available, such as lending and borrowing, perpetuals, derivatives and other yield aggregators. The sheer number of protocols supported, in addition to the wide variety of assets available, sets UniDex up as an effective multitrade club, where users can trade almost anything they want over any DEX, CEX or chain.

Mirai Liquidity Engine

The Mirai Liquidity Engine is the backbone of UniDex. It is the software that allows the exchange to act like an API, communicating between all the protocols and aggregating all financial products. The advanced engine even aggregates other aggregators, which ensures the system is able to lift the best prices and put the best routes on the table for users.

Rewards

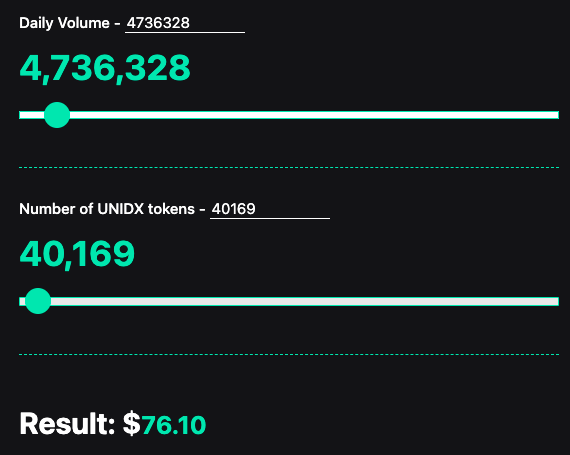

UniDex earns its revenue through trading fees and commissions charged to users. However, 50% of what it collects gets redistributed back to its token holders. This means that by just holding the token, users are rewarded with a daily injection of coins, relative to the number they hold and the daily trading volume. These rewards can be received as a wide variety of tokens and crypto coins.

Robots

UniDex supports the use of automated trading through bots, such as UniDexBot. These allow users to implement their trading strategy by way of an algorithm that can open and close positions, place stop and limit orders and take much of the work out of trading. All the same benefits of UniDex are still present, with the added security of knowing that tokens will be automatically sold if a threshold is hit to minimize losses.

Pricing

UniDex has a gas price or transfer fee, which is necessary to conduct a transaction across their extensive network. The current gas price is $43.40, though this varies and can be tracked on sites like Coingecko. 50% of these fees are fed back to the broker’s clients by way of additional digital tokens. The fee also contributes to the purchase and burn of some circulating tokens, to keep them scarce and limit inflation.

Security

UniDex is partially protected by its decentralised structure, which increases financial security and transparency. Furthermore, it reduces the risks associated with centralised exchanges getting hacked. Users also have the option to use ‘cold wallets’, such as hardware wallets, which helps stop the tokens from being hacked.

Customer Support

UniDex customer service cannot be contacted via traditional methods, such as email, post or telephone. Instead, the broker mostly uses social media, including Telegram, Discord, Medium and Twitter to talk to its clients. Additionally, you can leave your query and phone number or email address on a ticket for UniDex to contact you back.

Getting Started With UniDex

UniDex has a straightforward sign-up process that involves following a simple login process and then connecting your wallet through the web portal. So long as you have enough crypto in your wallet to pay the gas fee, you can start trading cryptos.

The UniDex native currency, UNIDX, cannot be purchased with fiat money. Therefore, a major cryptocurrency like Bitcoin or Ethereum must first be bought and then exchanged for UNIDX. Alternatively, an altcoin exchange like Binance can be used to purchase the coin.

Additional Features

For those looking to learn more about UniDex and crypto trading in general, the broker’s founder and CEO, Krunal Amin, streams live on Twitch. Here he has posted demos of UniDex to showcase its features, as well as other fun and educational videos.

UniDex has also added its official user manual and support to WalletConnect, which has made it possible for traders to use almost any wallet, either on desktop or mobile, to trade on the platform. In doing this, UniDex has become the heart of a massive web that has made trading DeFi and exchanging tokens easier than ever.

UniDex Verdict

DeFi is a fast-growing and expanding sector, and UniDex has placed itself firmly at the centre of it. It is a platform built by traders, for traders, with access to many investing protocols, DEXs and CEXs. UniDex is looking to grow into the go-to DeFi trading platform, whether for cryptocurrencies, NFTs or digital derivatives. The powerful trading platform and underlying software are definite advantages, although the lack of regulation does provide some food for thought. While a regulated broker’s clients would have more legal protection, this often requires some personal data and one of the main selling points of DeFi is anonymity. Overall, UniDex is an excellent all-round platform.

FAQs

What Do I Need To Trade On UniDex?

All you require to begin using the UniDex exchange is a crypto wallet with more than the gas fee in it. However, you may require the native token to trade on certain exchanges. For example, if you are trading on the BSC main net, you may need BNB to trade any BEP20 token.

How Do I Switch Between Chains To Trade Different Networks?

Your wallet may vary, but using your wallet’s network selector and connecting to the appropriate network will let you start trading on specific non-cross-chain protocols.

Is UniDex Safe To Trade On?

While there is a risk associated with any online trading, the decentralized nature of UniDex ensures it is one of the safer and more secure platforms to trade on. That being said, the lack of regulation affords clients less legal protection in the event of financial issues.

How Can I See My UNIDX Rewards?

Look up your wallet on the appropriate block explorer, such as Etherscan or Bscscan, to view your balance history and find your recent rewards pay-outs.

Is There Staking Offered For UNIDX?

There is no staking required or offered for the UNIDX token. Instead, users simply hold tokens in their wallets and are automatically sent rewards.

Where Is The UNIDX Token Traded?

All liquidity currently exists on Uniswap and can be traded either on UniDex or directly on Uniswap.

How Does UniDex Compare To Fox Finance?

UniDex is a newer business than Fox Finance, though with a similar business model. The former has access to deeper liquidity and a much larger range of assets and markets. However, Fox Finance has lower fees and a larger trading community. Neither can be considered as the best, though, as they both have their pros and cons and the ideal broker for you is subjective.

Best Alternatives to Unidex

Compare Unidex with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Unidex Comparison Table

| Unidex | Interactive Brokers | World Forex | |

|---|---|---|---|

| Rating | 2 | 4.3 | 4 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $43 | $0 | $1 |

| Minimum Trade | $20 | $100 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | – | 100% Deposit Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | – | 1:50 | 1:1000 |

| Payment Methods | 1 | 6 | 7 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Unidex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Unidex | Interactive Brokers | World Forex | |

|---|---|---|---|

| CFD | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Stocks | No | Yes | Yes |

| Commodities | No | Yes | Yes |

| Oil | No | No | Yes |

| Gold | No | Yes | Yes |

| Copper | No | No | No |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | Yes | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Unidex vs Other Brokers

Compare Unidex with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Unidex yet, will you be the first to help fellow traders decide if they should trade with Unidex or not?