Trade Republic Review 2026

See the Top 3 Alternatives in your location.

Pros

- The investment offering at Trade Republic is head and shoulders above most competitors, with 8000+ stocks, 500+ ETFs, 40,000+ derivatives and 50+ cryptos.

- You can earn up to 3.75% interest on unlimited cash balances with payments paid monthly and zero restrictions on withdrawals.

- Trade Republic has clearly invested in its mobile trading environment with a sleek and ultra-modern mobile app that features simple navigation and an easy-to-use interface.

Cons

- Trade Republic lacks the comprehensive financial solutions available at alternatives, notably Revolut with limited foreign exchange services, multi-currency accounts, and premium banking solutions.

- The lack of demo account and threadbare education reduces its appeal to newer traders, especially compared to brokers like eToro with its $100K simulator, zero time limit and stacked academy.

- Despite telephone and email assistance, Trade Republic still needs to improve its customer support, with no live chat available during testing and a fairly basic help centre which may deter aspiring investors.

Trade Republic Review

Trade Republic is a German-based online stockbroker that was founded in 2015 and has been making waves in the news. Labelled as Europe’s first mobile-only, commission-free broker, Trade Republic offers European, American and Asian stocks and ETFs, along with a range of derivatives and blockchain tokens. This review discusses the broker’s trading platform, asset range, regulation, fee structure and more.

About Trade Republic

Three founders in Berlin started Trade Republic Bank GmbH, a German securities trading bank and stockbroker that is regulated by the Federal Bank of Germany (BaFin). By June 2021, the bank had amassed over 4 million clients for a business of just under 400 employees.

Built on a similar business model to the US broker Robinhood, Trade Republic endeavours to offer commission-free, mobile stock trading services for European markets with a sleek trading platform. The first few years of the company’s life entailed application development, secure digital infrastructure building and license acquisition, setting itself up before launching into the industry spotlight.

Trade Republic boasts a range of impressive business partnerships and strategic investors, including SolarisBank AG, HSBC Germany, Lang & Schwarz Exchange and Sino AG.

Securities trading for the broker’s serious number of customers is carried out using either the electronic LS Exchange system on the Hamburg Stock Exchange or, in the case of its failure, Tradegate. Derivatives are traded over the counter with the asset issuers, including HSBC, Citi and Société Générale and cryptos are traded with the cryptocurrency liquidity provider B2C2.

In the second quarter of 2021, Trade Republic’s CEO put out a press release stating that they raised $900 million for their Series C development programme, which seeks to expand their services throughout Europe, including Luxembourg and the Netherlands, taking their valuation to more than $5 billion. This smashed their previous Series B funding of $75 million in 2020.

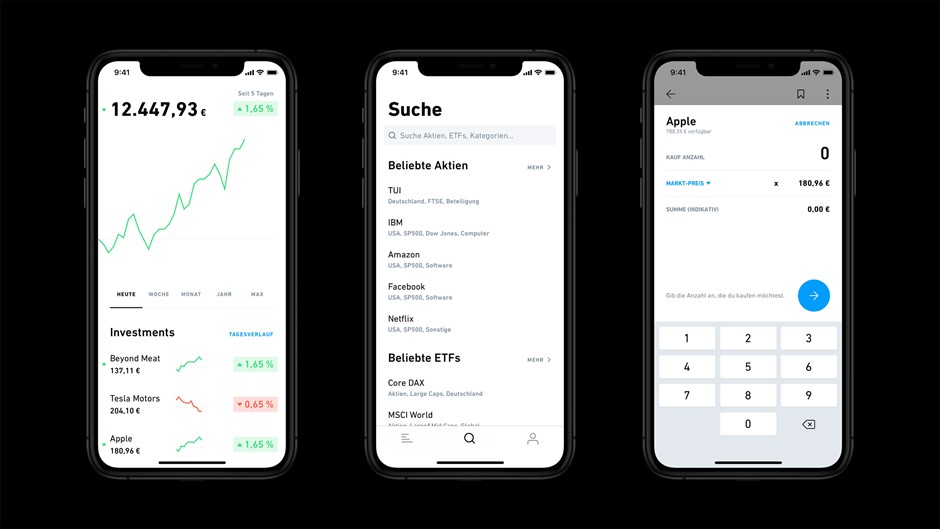

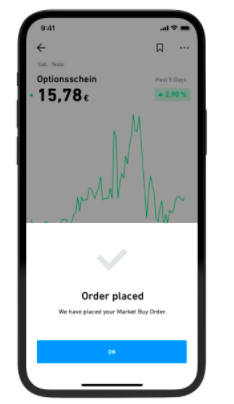

Mobile Trading Platform

Trade Republic was built with mobile-only trading services in mind, spending years crafting an application on which its clients can trade securities, derivatives and cryptos with ease. The trading platform can be downloaded onto iOS and Android (APK) devices and brings an easy-to-use interface and decent functionality. User reviews are generally positive, praising its accessibility and asset range. However, issues have been raised with the identification process and automation functionality, as well as reports of slippage and crashing during times of peak liquidity.

Unfortunately, no web interface app or desktop trading is supported by Trade Republic, which means that clients used to advanced platforms like MetaTrader 5 (MT5) or cTrader will need to get used to only using a mobile platform.

Assets

Trade Republic clients have access to three classes of tradeable assets. The first is exchange-traded securities, such as spot stocks and ETFs, of which there are over 8,000 German and international stocks and 500 ETFs based on stocks, indices, commodities and currencies. Fractional shares and penny stocks are both available for investing.

The second asset class is derivatives; Trade Republic boasts more than 40,000 derivatives, such as CFDs on stocks, indices, currencies and commodities.

Trade Republic also introduced cryptocurrency trading for German investors in the first quarter of 2021. Clients can buy and either hold or sell Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Bitcoin Cash (BCH). Despite the broker’s strong following on social media, including Twitter and Reddit, popular cryptocurrencies like Dogecoin (DOGE) and Ripple (XRP) are not offered.

All asset types can be traded using market orders, limit orders and stop orders.

Fees

Trade Republic has a transparent and competitive fee structure, claiming to be commission-free on all its assets. However, there is a €1 lump fee per trade settlement for third-party costs, regardless of volume. While this isn’t entirely cost-free, it is much cheaper than most competitors. Spreads and share prices are drawn directly from the XETRA reference market (Deutsche Börse), where applicable.

Whereas other brokers make money by marking up the spreads or charging commissions, Trade Republic earns its revenue only through payments for order flow from trading partners.

Deposits & Withdrawals

Trade Republic supports only a few options for funding and emptying their trading accounts. Bank wire transfers will take between one and three working days to clear. Other deposit and withdrawal methods include credit and debit cards (Visa or Mastercard), Google Pay and Apple Pay, for all of which your payment will clear immediately.

The broker does not charge any outright transaction fees, though some may be incurred for payments from different countries. The popular payment method PayPal is not supported by Trade Republic.

Promotions

Trade Republic currently offers onboarding clients a €15 welcome referral bonus that is credited to your account automatically after executing your first trade. Check out the broker’s website for the latest promotions and deals before opening a trading account.

Regulation

Trade Republic acquired a full banking license, allowing it to carry out savings and holding services as well as stockbroking. Both the Federal Bank of Germany and Deutsche Bundesbank supervise Trade Republic.

Client deposits are legally insured for up to €100,000 and all funds are segregated from the brokers own money in trustee accounts with their partner bank in Berlin. All financial assets are owned by the clients and held by HSBC Germany.

Additional Features

Trade Republic does not offer any additional features or services to its clients, such as educational resources or financial insights. This lowers the competitiveness of the broker against some of its closest rivals and alternatives, like Justtrade, Freetrade and eToro, as most top brokers nowadays provide learning support for newer traders and market analysis from experts.

Live Accounts

Trade Republic only has one account option that offers access to all of its brokerage services. Every asset type can be invested in using just one account, which makes diversifying your portfolio simpler and removes common entry barriers for lower-capital clients.

Unfortunately Trade Republic does not offer a demo account, which can be very useful for new traders to learn the ropes or more experienced clients to test new strategies and markets.

Trading Hours

Trade Republic offer some of the most extensive trading hours of licensed and regulated European stockbrokers. All securities can be traded between 07:30 GMT+2 and 23:00 GMT+2, derivatives trading is supported between 09:00 GMT+2 and 22:00 GMT+2 while cryptocurrency trading is available 24/7.

Contact Details

Trade Republic customer service is limited, with an FAQ section on their website and the team’s English and German email addresses below as their only offerings. Alternatively, you can contact the broker via post at its headquarters in Berlin, whose address is below.

- English Email: service@traderepublic.com

- German Email: beschwerde@traderepublic.com

- Address: Trade Republic Bank GmbH, Kastanienallee 32, 10435, Berlin

Client Security

Trade Republic have a high level of security as required for securities trading bank status on top of standard BaFin stockbroker regulations. Client personal data is not shared without permission and there is a contactable data protection officer. Encrypted communications and segregated bank accounts also help ensure client funds and details are not stolen.

Verdict

Trade Republic is a relatively new broker that has quickly amassed a large number of users, exceeding 4 million, thanks to the competitive fee structure and range of tradeable assets. The broker is accessible for new traders, with a sleek mobile app and no minimum deposit. Experienced traders can also take advantage of the zero-commission stockbroking and simple portfolio diversification options.

However, the mobile trading focus limits the market analysis tools available in established desktop trading platforms and slippage may eat away at profits.

FAQs

How Can I Open A Trade Republic Securities Account?

To open a securities account with Trade Republic, you must own a smartphone with iOS or Android as an operating system, be at least 18 years old and have a permanent residence in Germany, Austria or France (with tax liability). You must also have a European phone number and a SEPA (Single Euro Payments Area) bank account. If you fit these requirements, simply follow the login process on the Trade Republic app to open an account.

How Is My Money Protected With Trade Republic?

Trade Republic segregate all client capital from their own using HSBC Berlin, ensuring insolvency does not cause significant losses. Additionally, clients are insured for up to €100,000 and accounts are supervised by the BaFin and Solaris Bank AG.

No, Trade Republic does not currently have any options for leveraged trading, despite a wide range of derivatives available to be traded. Margin accounts are available with other brokers like Degiro, ZuluTrade and Trading 212.

How Does Commission-Free Trading Work With Trade Republic?

Trade Republic receive rebates from trading partners, and as a result of this can offer no commission fees through their efficient pricing structure.

Is Trade Republic A Qualified Intermediary?

Trade Republic does not hold US qualified intermediary (QI) status. This means that clients looking to invest in US stocks, like Gamestop and other NASDAQ stocks, or indices, like the S&P 500, must consider US withholding tax implications in their ETF or other cost calculations.

Best Alternatives to Trade Republic

Compare Trade Republic with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Trade Republic Comparison Table

| Trade Republic | Interactive Brokers | World Forex | |

|---|---|---|---|

| Rating | 2.8 | 4.3 | 4 |

| Markets | Stocks, ETFs, Indices, Derivatives, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | BaFin, Bundesbank | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | – | 100% Deposit Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | – | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 7 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Trade Republic and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Trade Republic | Interactive Brokers | World Forex | |

|---|---|---|---|

| CFD | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Trade Republic vs Other Brokers

Compare Trade Republic with any other broker by selecting the other broker below.

The most popular Trade Republic comparisons:

Customer Reviews

There are no customer reviews of Trade Republic yet, will you be the first to help fellow traders decide if they should trade with Trade Republic or not?