Futu Review 2025

See the Top 3 Alternatives in your location.

Awards

- HKEX - Business Innovation Information Vendors 2017

- HKEX - Rising Information Vendor of the Year 2016

- KPMG - China Leading Fintech 50 (2017/2016)

- Bloomberg - Best Online Broker 2017

- CB Insights - CB Insights’ Fintech 250 (2018/2017)

Pros

- Investor backing from several corporations including Tencent Holdings

- Transparent pricing model with no commission fees to trade HK stocks & ETFs and free market data

- Regulated worldwide with segregated client funds, ISO27001 security credentials and investor compensation schemes

Cons

- No MT4 or MT5 access

- Forex trading not available

- High minimum deposit requirement of HKD 10,000 or USD 1,500

Futu Review

Futu is a recognised fintech unicorn and one of Asia’s top-ranking online brokers. It provides a fully digital service and advanced wealth management options to clients residing in China. This brokerage review will break down how to open a Futu account, weigh up the pros and cons of the broker’s services and detail commission charges, platform features, IPO prospectus and more.

Futu Headlines

Futu Securities International (Hong Kong) Limited is a technology corporation, running a fully digitised brokerage with a secure trading platform. Founded in 2012, the financial company has developed leading investment services. The broker is a subsidiary of Futu Holdings Limited, whose entities include Futu Inc., registered by the US SEC, and Futu Trading Broker Singapore Pte Ltd., led by CEO and founder Leaf Hau Li. A stock forecast data quote indicates an estimated share price target of £238.84 to be reached in 2022.

The broker is a licensed corporation regulated by the Securities and Futures Commission of Hong Kong (SFC). The number of Futu users exceeds 15 million, serviced by 1,315 employees. Year-end 2020 financial revenue results were particularly impressive, sitting at $427 million. Futu brokerage was listed on the NASDAQ stock exchange in 2019 and partners with AMEX and NYSE. Respected strategic investors include Tencent Holdings and Sequoia Capital.

Trading Platform

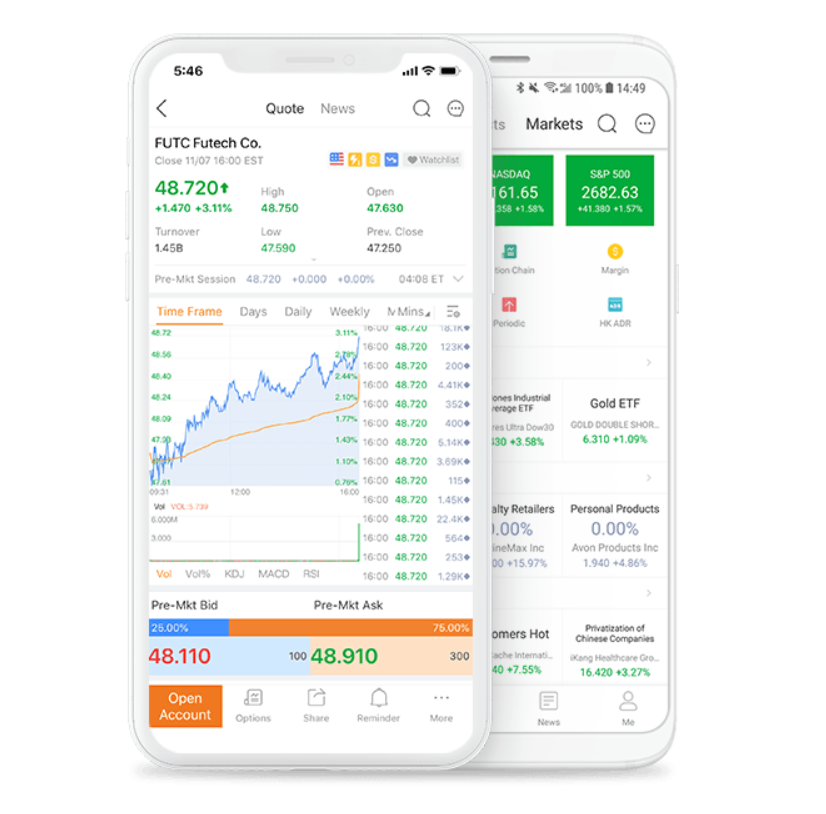

The broker only offers a proprietary digital platform terminal, Futubull, which is free for download to desktop devices running on Windows and Mac. The platform is also compatible with all major web browsers and available to open via an API, with eight supported languages, including English, Traditional Chinese, and Korean.

Futubull features include:

- Live news streaming

- Simple user interface

- Integrated customer support

- Lightning-fast trade executions

- Several powerful analytical tools

- Intelligent and conditional orders

- Real-time stock quotes and market data

- 14 reminder types with 24-hour cloud monitoring

- Social integration features including live chat room

- Data analysis tools including emotion index, AI market monitor, and screener

Futubull

In 2019, Futu launched a mutual fund platform. This accommodates a variety of targets and risk appetites of traders. Money markets, equity funds, and fixed income products from Chinese and other leading global fund houses are hosted here.

Assets

Futu offers clients worldwide investing and trading opportunities from Hong Kong, mainland China, and US markets in the following securities:

- IPOs

- ETFs

- Stocks

- CBBCs

- iBonds

- Options

- Warrants

At the time of writing, Futu does not offer trading in digital currencies, though the broker has outlined plans to expand into crypto investing. That being said, crypto futures are available, such as Bitcoin futures. Pre-IPO trading is also available, which can be accessed between 16:15 and 18:30 HKT (GMT+8) after the close of trading on the day prior.

Fees

Futu’s fee structure is transparent and competitive, regularly offering zero-commission trading periods on US and Hong Kong stocks and shares. Below is a full breakdown of standard commission charges.

- US Stocks: 0.0049 USD per share

- US Options: 0.65 USD per contract

- US Futures: 2 USD per contract per side

- IPO Subscriptions (Cash): 50 HKD per order

- Chinese Stocks: 0.03% x transaction amount, minimum 3.00 CNH per order

- Hong Kong Stocks: 0.04% x transaction amount, minimum 3.00 HKD per order

- Hong Kong Options: 0.2% x transaction amount, minimum 3.00 HKD per order

- IPO Subscriptions (Futu Financing): the annual interest rate of HK stock margin (ave. 6.8% per year)

The annual margin rate for financing is a flat rate of 6.8% for Hong Kong stocks, 4.8% for US stocks and 8.8% for China A-shares. This is comparable to Moomoo and Webull rates, though less competitive than many other brokers both inside and outside of China.

Futu brokerage fees can be either fixed, at a flat rate of 15 HKD per order, or tiered, with the price falling from 30 HKD per order with increasing trading volume.

Clients may also incur other charges, including regulatory fees, exchange settlements, trading activity costs and stamp duty.

Leverage

Leverage, or margin trading, is available to all of Futu’s retail clients, though only with a minimum account value of $2,500. Leverage is capped at 1:2 for long positions and 1:1.67 for short positions. Margin trading can magnify your profit potential and market exposure by borrowing funds from the broker, though this can also magnify losses, sometimes wiping out the entirety of your account capital. Traders intending to use margin financing should have robust risk management strategies in place to avoid margin calls.

Mobile Trading

Futu’s proprietary web terminal, Futubull, is also available in mobile format. Downloadable from both the Apple App Store and Google Play Store for iOS and Android devices, respectively, the application allows access to the full trading features of the Futu desktop platform. This includes Futu Holdings live news streams, stock forecast quotes, and transaction history up to the present day so you can trade while on the go. Premarket or after-hours price forecasts can be reviewed from your handheld devices. The mobile platform also supports real-time quotes, multiple order types, live chat and big data applications.

Payments

Deposits

Futu only accepts bank transfers as a funding method, with cash, e-wallet and joint account transfers not supported. There are no broker deposit fees, though third-party payment charges may apply. While processing times vary by bank, Futu aims to approve fund settlements within one working day. ICBC (Asia) accounts are recommended as the fastest deposit processing method.

Futu has an initial minimum deposit requirement of 10,000 HKD/1,500 USD.

Withdrawals

Futu Securities International does not charge a withdrawal fee. Clients must withdraw to an account matching the trading account owner and can be done either through cheque or bank transfer. The capital to be withdrawn must first be settled with the exchange, which can take two business days for Hong Kong and US stocks.

Processing times vary with third-party bank timings, although the broker will action the request in the same business day if received before 15:00 HKT. Withdrawals can be requested through the Futubull app.

Demo Account

Futu does not offer a demo account for risk-free trading. This limits the competitiveness of the broker, as practice accounts are a great way to test out the broker, get to grips with the platform and markets or trial new trading strategies and assets. Close competitors, such as Interactive Brokers, Robinhood and Tiger Brokers all offer demo accounts.

Regulation

Futu Securities International is registered by Hong Kong’s Securities and Futures Commission (SFC), CE number AZT137. Clients are financially protected up to 500,000 HKD through the Investor Compensation Company (ICC) in the case of losses resulting from the broker defaulting on SFC rulings. SFC regulation also brings with it data transparency through compulsory financial reports.

Futu holds 20 licenses with exchanges and financial regulatory agencies, including type 1 securities and type 2 futures contracts dealing licenses with the SFC.

Additional Features

Clients of Futu automatically have access to NiuNiu, a 13 million-strong global investment community that embeds social media tools to create a network of users exchanging investment opinions, ideas and insights. Additionally, the interactive community provides educational and skill-based content, plus live broadcasts of corporate events and training courses through the NiuNiu Classroom. Content includes US stock fee calculators, IPO subscriptions and information on how to transfer, buy or sell stock on the trading platform. This is suitable both for new and experienced traders.

Live Accounts

There are four different types of Futu accounts, each geared for different trading preferences:

- Fund Account

- US Margin Account

- Hong Kong Margin Account

- Northbound Margin Account

Accounts with Futu can be opened through the Futubull trading platform and are relatively quick, though KYC compliance checks are still required. The processing of an account opening request can take one to two business days.

Trading Hours

Futu follows standard local office hours but supports trading 24-hours a day between Monday and Friday. However, different instruments may have specific opening and closing times, often dependent on their respective exchange’s trading hours.

Contact Details

Futu brokerage’s customer service team can be contacted via the email address, phone number or postal address below. No live chat option is available, meaning clients cannot get immediate answers to their questions.

- Email: BD@futunn.com

- Telephone: (+852) 2523 3588

- Address: Unit C1-2, 13F, United Centre, No.95 Queensway, Admiralty, HK

Account Security

The Futubull trading platform assures high-tech encryptions and industry-standard data privacy across all touchpoints. Third-party witness verification is required for all account opening requests for global clients without either a Chinese or Hong Kong ID or bank account. Deposit and withdrawal transactions must be verified by a one-time dynamic password, creating a new verification code for every exchange.

Futu Verdict

Overall, Futu Securities International provides a secure investment environment for both new or experienced traders. The Futubull platform is technology-focused with intuitive analytical tools and a user-friendly dashboard. Although the product portfolio is limited, there is a good range of assets from US, Hong Kong and Chinese markets, with low commission charges and margin trading support. However, the lack of accessibility for foreign clients will deter prospective investors.

FAQs

Is Futu Securities Internationally Regulated?

Yes, Futu Securities International is registered with Hong Kong’s Securities and Futures Commission (SFC), CE number AZT137. The broker also holds licenses across the world with some of the strictest financial agencies, including the UK Financial Conduct Authority (FCA), the US Securities and Exchange Commission (SEC) and the Financial Industry Regulation Authority (FINRA).

What Customer Service Options Does Futu Offer?

Futu can be contacted via telephone, email or post, using the details above. No live chat support is available.

Can I Open A Futu Securities International Account In The UK?

Futu trading accounts are currently only available for Chinese residents, meaning that prospective clients from the UK and other countries cannot open accounts.

What Is The Futu Withdrawal Holding Period?

Futu’s processing time for withdrawal requests is 09:00 to 15:00 HKT on Hong Kong stock trading days. Before cash becomes withdrawable, closed trades must be settled with the exchange, which can take up to two working days.

How Can I Change My Futu US Stocks Trading Password?

You can reset your Futu trading password via the Futubull app. Select the ‘Me’ tab and then the ‘Settings’ section (upper right-hand corner).

Futu brokerage has a reward scheme whereby existing customers that refer new clients will be rewarded with free stocks. A range of major companies is available for clients to claim a free stock in, including Apple and Tesla. One Futu account can earn up to $2,000 worth of free shares.Top 3 Alternatives to Futu

Compare Futu with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Moomoo – Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

Futu Comparison Table

| Futu | Interactive Brokers | FOREX.com | Moomoo | |

|---|---|---|---|---|

| Rating | 2.7 | 4.3 | 4.4 | 4.3 |

| Markets | Stocks, ETFs, IPOs, CBBCs, iBonds, Options, Warrants | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stock CFDs, Futures, Futures Options | Stocks, Options, ETFs, ADRs, OTCs |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1500 | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | $0 |

| Regulators | SFC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | SEC, FINRA, MAS, ASIC, SFC |

| Bonus | – | – | VIP status with up to 10k+ in rebates – T&Cs apply. | Get up to 15 free stocks worth up to $2000 |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView | Desktop Platform, Mobile App |

| Leverage | – | 1:50 | 1:50 | 1:2 |

| Payment Methods | 2 | 6 | 8 | 2 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Moomoo Review |

Compare Trading Instruments

Compare the markets and instruments offered by Futu and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Futu | Interactive Brokers | FOREX.com | Moomoo | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | No | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Futu vs Other Brokers

Compare Futu with any other broker by selecting the other broker below.

The most popular Futu comparisons:

Customer Reviews

There are no customer reviews of Futu yet, will you be the first to help fellow traders decide if they should trade with Futu or not?