Cryptocurrency Day Trading

No asset class in history has grown as quickly as cryptocurrencies. Since Bitcoin (BTC) was launched in 2009, cryptocurrency day trading has exploded: a whopping 285,060 BTC transactions alone are carried out every day.

This guide for beginners will teach you the basics of cryptocurrencies and how they work, discuss the various ways that day traders can profit from these assets, look at what drives their prices, and evaluate the pros and cons of trading cryptocurrency.

Quick Introduction

- Cryptocurrencies are digital tokens that are secured with cryptography and operate on decentralized networks.

- They can be day traded through crypto brokers which offer derivatives like crypto CFDs. These allow you to bet on rising and falling prices without having to purchase and store digital currencies.

- Alternatively, you can buy and sell tokens directly through crypto exchanges, though many high-profile firms have gone bankrupt in recent years due to mismanagement.

- Prices of virtual assets can be highly volatile, which leaves opportunities for short-term traders to make large profits (but also significant losses).

- Crypto day traders need to take into account any regulatory restrictions in their jurisdiction.

Top Crypto Brokers

These trustworthy crypto brokers provide access to the largest tokens, user-friendly platforms and low fees:

-

1

Interactive Brokers

Interactive Brokers -

2

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

3

NinjaTrader

NinjaTrader -

4

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

Download our free Cryptocurrency PDF.

What Are Cryptocurrencies?

Cryptocurrencies are a fast-growing medium of exchange. According to crypto payment services specialist Triple-A, there were as many as 420 million global users of this new form of currency in 2023.

Similar to traditional currencies like the US dollar, British pound or Japanese yen, they can be used to buy goods and services. However, unlike other forms of legal tender, they exist only digitally and are not issued or controlled by governments or central banks.

Instead, cryptocurrencies are a decentralized form of money that are created through a peer-to-peer network rather than by a central authority. Information on transactions and ownership of the currency is stored on an electronic ledger known as blockchain.

This network is made up of computers that are called nodes. When a transaction takes place, these nodes work together to validate the information via complex mathematical calculations.

This process is known as crypto mining, and when it is completed a new block is created that is added to the blockchain. During this process new virtual coins or tokens are created.

Cryptocurrency Vs Fiat Currency

Cryptocurrencies have certain advantages over their paper equivalents. The use of blockchain technology ensures high levels of transparency and prevents problems like counterfeiting and manipulation by one centralized power.

Transactions using virtual currencies can also be carried out more quickly and cheaply than old-fashioned currencies. And because the exchange of these currencies involves a third party like a bank, users also enjoy a level of privacy.

There are also limits on the supply of certain cryptocurrencies, which can help them retain their value better than paper currencies. Total production of Bitcoins, for instance, has been capped at 21 million. Central banks and governments, on the other hand, can print more banknotes whenever they choose.

What Cryptocurrencies Can I Day Trade?

The number of cryptocurrencies out there is staggering. According to crypto data website CoinMarketCap, there were 22,932 digital currencies in existence as of early 2023.

Yet while the cryptocurrency trading market is valued at above $1 billion, only a couple of hundred different digital assets are actively traded every day. And as the table below shows, a handful of virtual tokens make up the lion’s share of the market’s value, with Bitcoin being by far the biggest and most popular.

Market Rates

What Moves Cryptocurrency Prices?

Macroeconomic And Geopolitical Developments

As with any asset or financial instrument, the price of cryptocurrencies is highly changeable according to the economic and political landscape.

Inflation readings, interest rate movements, GDP data and employment numbers from across the globe all impact the direction of Bitcoin, Ethereum et al.

Cryptocurrency trading prices often follow those of other ‘riskier’ assets like stocks and industrial commodities higher or lower.

That said, some believe that digital currencies are becoming an increasingly popular safe-haven asset in tough times like gold or the US dollar.

During inflationary periods, for instance, prices of virtual currencies can rise as the real-world value of paper currencies erodes. Cryptocurrencies with fixed supply like Bitcoin can also rise in value when central banks launch quantitative easing programmes to print more fiat money.

Regulatory News

Changes or updates to the way that digital currencies are regulated often have a significant impact on short-term prices.

Positive news on their acceptance by governments and central banks can push cryptocurrency trading prices higher, while signs of hostility by officials can have the opposite effect.

Crypto-related news concerning the Securities and Exchange Commission (SEC) in particular is closely watched by the market. From comments on regulation changes to news on crypto-backed financial products like exchange-traded funds (ETFs), announcements by the US regulator can leave a significant footprint on market confidence and by extension prices.

Industry News

There is an abundance of crypto-specific news that can significantly influence prices. Virtual currencies plummeted in late 2022 after exchange FTX went bust and concerns about the stability and security of trading cryptocurrency tokens blew up.

Technical vulnerability is another big worry for traders and investors, so news of cyber attacks or blockchain communication issues can strike market confidence.

At the other end of the scale, prices can soar if major companies start using or accepting digital tokens. This was the case in early 2021 when Tesla began accepting Bitcoin for payments (though the automaker rowed back on the idea shortly afterwards).

Crypto Market Mechanics

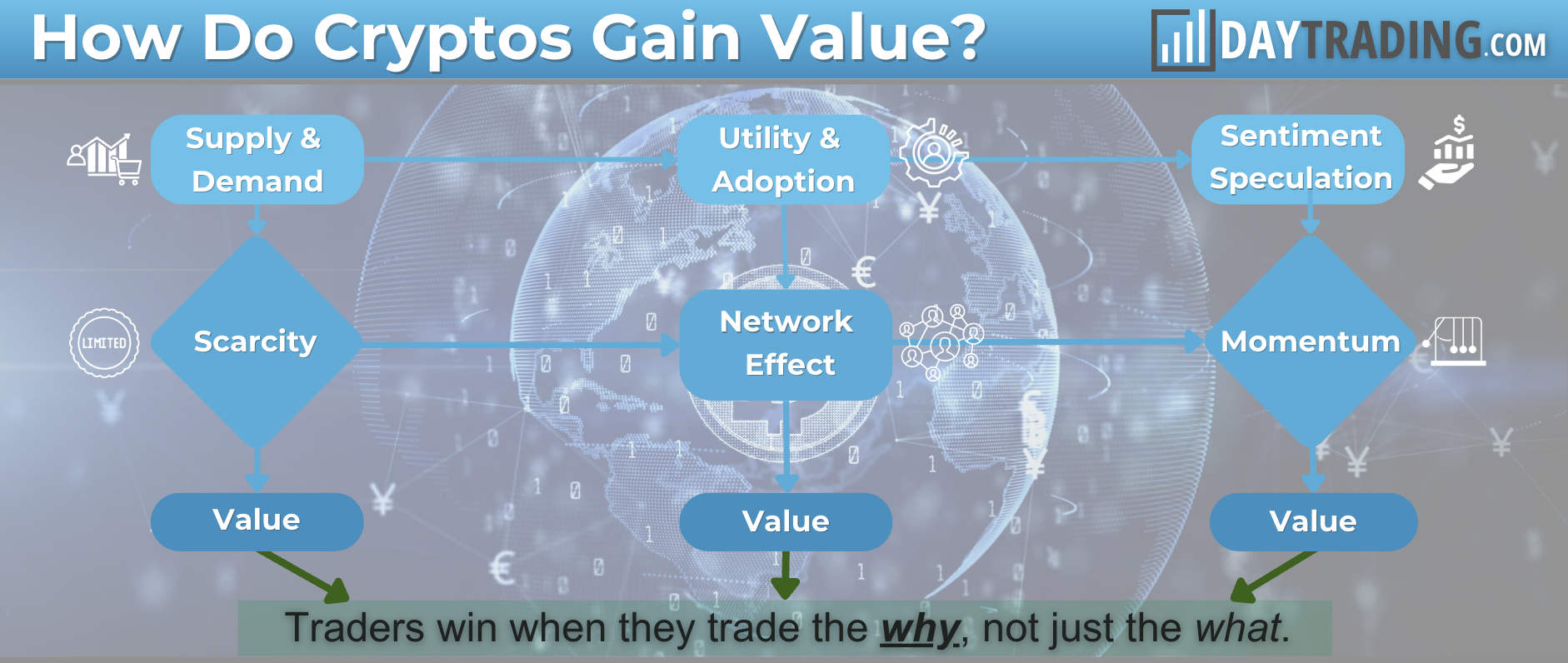

The value of cryptocurrencies is also driven by a network of core factors:

- Supply vs. Demand: Limited supply (like Bitcoin’s 21M cap) combined with increasing demand naturally drives prices up.

- Utility: The more real-world use cases (payments, DeFi, smart contracts), the stronger the asset’s intrinsic demand.

- Network Adoption: The value of a network grows exponentially as more users join — known as Metcalfe’s Law.

- Investor Sentiment: FOMO (fear of missing out) and social media hype can accelerate price action well beyond fundamentals.

- Scarcity Events: Mechanisms like Bitcoin halvings or token burns artificially tighten supply, often triggering sharp rallies.

Different Ways To Trade Cryptocurrencies

Buying Cryptocurrencies Via An Exchange

Traders can buy and sell digital tokens through a cryptocurrency exchange such as Coinbase or BitMEX. These companies also provide facilities for individuals to store and manage their virtual assets (these are known as crypto wallets).

The first one of these exchanges – the now-defunct bitcoinmarket.com – was launched in 2010, and the services such companies offer have grown rapidly since then.

Investors can now trade crypto-related futures and other derivatives, lend or borrow cryptocurrencies, and take part in Initial Coin Offerings (or ICOs) to help get a new token or coin off the ground.

Contracts For Difference (CFDs)

Whilst not permitted in the US, trading cryptocurrency contracts for difference (CFDs) are extremely popular with short-term investors. Like other derivatives, they provide the opportunity to profit from asset price changes without requiring an investor to own said asset.

They are widely used because they allow crypto traders to use borrowed funds (also known as leverage). The upshot is that an individual has more money to play with, thus allowing them the freedom to make more money by creating a larger position than they would have otherwise by using just their own funds.

A crypto trader who uses leverage can make much greater profits in a far shorter space of time. But that’s assuming that things go right. If crypto markets move in an unexpected direction, it can be very easy to rack up substantial losses.

Futures

These cryptocurrency trading contracts involve trading a pre-determined quantity of tokens at a particular price and within an agreed period.

Traders have two options when day trading crypto futures:

- They can go long, which involves buying the contract with the expectation that asset prices will rise.

- Alternatively, they can go short, which means selling the contract in anticipation of crypto values falling.

Crypto traders can roll over contracts to extend their futures position past their expiration dates. During this process, the existing contract is closed and a new one with a later expiration date is initiated.

From 2017, retail investors could only trade Bitcoin and other cryptocurrency futures on the Chicago Mercantile Exchange. However, the market is now opening up and fresh regulatory changes in 2023 mean that crypto exchange Coinbase, alongside exchange and clearing house CBOE Digital, can now offer these derivatives products.

Options

Options contracts are another type of derivatives instrument used in cryptocurrency trading. They provide the purchaser with the right, but importantly not the obligation, to buy or sell an agreed quantity of an underlying asset within a specified timeframe.

As with futures, options contracts are currently only available on a handful of the most popular digital currencies. These include Bitcoin, Ethereum, Solana, and Ripple.

Cryptocurrency Stocks

Just like traders can choose to buy oil and mining stocks to earn from commodity price movements, investors who want to capitalize on cryptocurrency trading markets can buy shares in companies that are heavily exposed to the virtual currency arena.

Companies in this bracket span a range of different industries and include:

- Cryptocurrency exchanges

- Blockchain technology developers

- Blockchain-as-a-Service (BaaS) providers

- Crypto and blockchain-related investment trusts

- Blockchain advisory firms

- Payment service providers

- Digital currency miners

- Software companies

Here you can see the close correlation between the share price of crypto exchange Coinbase and Bitcoin values (as priced in US dollars) during the 24 months to 12 October 2023.

Investing in cryptocurrency stocks gives individuals a chance to make even greater profits than they would by speculating simply on the price movements of digital currencies. Strong operating performances or positive industry news can lift their share prices through the roof.

Remember, though, that this strategy can be a double-edged sword. Even if virtual currency prices are rising, an investor can make losses if the company they hold a position in is having problems.

Exchange-Traded Funds (ETFs)

There are also many exchange-traded funds (ETFs) that provide entry into the world of cryptocurrency trading. These financial vehicles – which, like company shares, are traded on stock exchanges – pool investor funds in to acquire a basket of different crypto-related assets.

ETFs, therefore, help individuals reduce risk by providing diversification across a range of assets. They can hold a variety of different virtual currencies, crypto-exposed companies, or even a blend of the two.

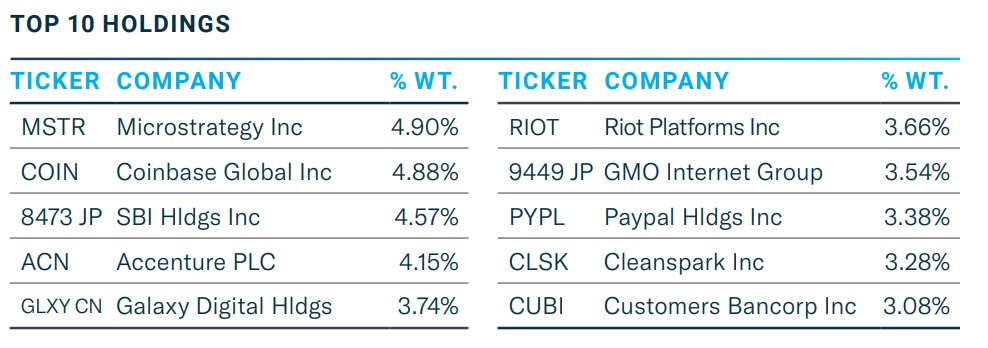

The Bitwise 10 Crypto Index Fund, for example, is designed to track an index of the 10 largest crypto assets. Meanwhile, the Amplify Transformational Data Sharing ETF invests 80% of its net assets in shares of companies that develop and utilize blockchain technologies. A rundown of its holdings can be seen in the table below.

How To Day Trade Cryptocurrencies

Quick Guide

Don’t want to miss out? Here is a quick plan to get you day trading cryptocurrency quickly:

- Decide if you want to own the cryptocurrency, or simply have a hunch that its value will go up or down.

- If you want to own the currency, you need crypto exchanges – try BitMex or Coinbase – they are simple, user-friendly apps

- If you want to speculate on the price, you need a day trading broker. Check our cryptocurrency brokers list.

- Fund your account.

- Buy the cryptocurrency you want, or open a trade on its price.

Key Considerations

Education & Research

As you can tell, cryptocurrencies are very different from other asset classes and in some ways much more complex. So it’s important to spend time learning the ins-and-outs of this market and what makes prices move in certain directions.

Because they have only been around since the late 2000s, finding information on how they work and what is happening in the markets can be challenging. Getting news and tips on older and more popular asset classes like stocks, commodities and forex is usually much easier.

However, as cryptocurrency day trading becomes more popular the quantity of educational resources and media coverage is also growing rapidly. Dedicated websites like CoinDesk and Crypto News are popular destinations for investors today.

Even traditional outlets like the Financial Times has sections that cover digital currencies.

Trading Vehicles

Once you have acquired a sound understanding of the cryptocurrency trading market, you’ll want to decide what sort of financial instrument you want to use. Will you look for Bitcoin CFDs, for example, or buy an ETF that contains various types of digital counter?

You’ll also want to decide what kind of cryptocurrency trading strategy you want to use. Examples of this include day trading and swing trading, and the one you select will depend on factors like risk tolerance and how active you like to be. Think carefully about what approach you wish to take, although remember that the method you use will likely evolve over time.

Next, it’s time to consider exactly where you’ll want to do your cryptocurrency trading. If you buy want to buy cryptocurrencies themselves you’ll need to open an account with a crypto exchange.

You can also trade certain other instruments like futures here, though other online brokerages will offer products like crypto CFDs that enable traders to simply speculate on price movements.

Digital Wallets

Traders who decide they wish to own digital currencies will need to obtain a crypto wallet. These virtual storage gizmos are split into two categories: custodial and non-custodial.

Custodial wallets are ones where a third party (usually a crypto exchange) controls your private key, which is a long alphanumeric code that facilitates the storage and trading of your electronic currencies.

A non-custodial wallet gives a user total control over their private key. Software wallets, like a PC or mobile application, are highly popular, while physical devices (known as hardware wallets) such as a USB stick are also widely used. Individuals can also choose an online wallet and even a paper wallet on which private keys and QR codes for cryptocurrency trading are printed.

When considering which exchange or day trading broker to use, the first thing to check is that they are trusted, regulated, and that they have strong security protocols in place.

Other things to consider are transaction charges and other fees, how quick and easy it is to trade on their platform, and what educational resources and tools are available.

Choosing a provider that offers a demo account is a good idea, too. These allow new crypto traders to get a feel for the market before putting any of their money on the line.

Pros And Cons Of Trading Cryptocurrencies

Pros

- High volatility: The cryptocurrency market’s frequent volatility provides many opportunities to make profits in the short-term, though remember that choppiness can also result in large losses.

- Liquidity can be strong: The biggest cryptocurrencies like Bitcoin, Ethereum and Tether have extremely high trading volumes, which means day traders can enter and exit positions quickly and easily.

- Good choice of financial instruments: As well as having the option to trade a wide variety of different digital coins, individuals can trade derivatives like futures and CFDs, cryptocurrency stocks and ETFs.

- Decentralization perks: Coin traders aren’t restricted by controls from a central authority, while the wide distribution of infrastructure and data means that even if one part of the system is compromised the entire network can continue running.

- Transparency: The use of blockchain means that transactions can be seen quickly and easily, helping to reduce the possibility of fraud and manipulation.

Cons

- Not all markets are highly liquid: Some crypto asset classes (like options) are fairly young and therefore have low liquidity, which can be problematic for traders when opening and closing positions.

- Technological dangers: The digital nature of cryptocurrencies exposes investors to technological failure and cybersecurity risks including hacking, fraud and theft.

- Regulatory uncertainty: Worries over price volatility, consumer protection and money laundering mean the long-term future of crypto remains uncertain.

- Password problems: Investors who store their digital currency in a non-custodial wallet could lose access to their assets if they misplace their private key.

The Future Of Crypto

It is believed by many that the use of these virtual currencies will gain momentum as the digital revolution clicks through the gears. However, the long-term durability of these new currencies is by no means guaranteed.

Regulatory restrictions remain an ongoing problem as countries wring their hands over price volatility, cybersecurity issues and the use of these assets in criminal enterprises. China, for instance, moved in 2021 to ban all transactions involving virtual currencies and prohibit crypto mining.

The industry remains largely unregulated, though authorities in some countries are debating how to introduce governance frameworks. At the moment therefore consumer protection is pretty poor.

Concerns over the environmental impact of crypto mining also cast a shadow over its widescale adoption. The US government estimates that cryptocurrency activity in the States produces between 25 million and 50 million tonnes of CO2 each year. That is equivalent to total annual diesel emissions from the country’s railroad network.

Bottom Line

Crypto trading markets can be highly volatile, and there are many financial instruments short-term traders can use to profit from price changes. As an asset class digital coins and tokens have advantages over traditional currencies, and demand for them could soar as technology takes over our everyday lives.

However, buying and selling cryptocurrencies also has some specific drawbacks for investors, while the longevity of these cutting-edge currencies as an asset class remains unknown as regulatory questions persist. For these reasons, cryptocurrency trading is not suitable for risk-averse traders.

FAQ

What Is A Cryptocurrency?

A cryptocurrency is a digital currency that relies on distributed ledger technology, commonly known as blockchain. Unlike traditional currencies, there is no central authority in control of the money.

What Cryptos Can I Day Trade?

Thousands of virtual currencies are in existence today, though cryptocurrency day trading is dominated by just a handful (20 to 30). Bitcoin is by a long distance the most popular, followed by Ethereum.

How Can I Make Money With Crypto Markets?

As well as buying and selling the digital coins themselves, individuals can also deal in cryptocurrency stocks or trade derivatives instruments like CFDs, futures, and options. The derivatives market constitutes around 80% of all cryptocurrency trading.

What Drives Cryptocurrency Prices?

Prices of Bitcoin and other tokens are highly influenced by the same macroeconomic and geopolitical factors that influence wider financial markets. However, crypto-specific news (such as regulatory developments and technological news) can also cause market volatility.

Are Cryptocurrencies Safe?

The decentralized nature of cryptocurrencies offers advantages like good transparency and limited central intervention. High market liquidity also gives traders plenty of opportunity to enter and exit trades.

That said, owning and trading crypto-related assets isn’t without risk and dangers including technological failure, lost passwords, a lack of consumer protection, and long-term regulatory uncertainty. History shows that crypto prices can also fall sharply.

Can I Day Trade Crypto Where I Am?

Digital currencies can be used and day traded in developed countries and regions including the US, UK, Australia and the European Union. However, at the moment transactions involving the assets and related financial instruments are banned in parts of Africa and Asia.

Check the latest regulatory guidance in your jurisdiction before you start cryptocurrency trading.

How Is Crypto Trading Taxed?

This will depend on your time horizon (day trading or longer-term investing), trading vehicle, jurisdiction and the latest tax rules, which change quickly as governments scramble to govern digital assets.

The US in 2014, for example introduced cryptocurrency trading rules that mean digital currencies will fall under the umbrella of property. Traders will then be classed as investors and will have to conform to complex reporting requirements. Details of which can be found in the IRS notice 2014-21.

Beginners in particular should make sure they understand local taxes and rules before they start day trading cryptocurrency.

Recommended Reading

Article Sources

- Cryptocurrency Investing For Dummies - Kiana Danial, 2019

- Bitcoin and Cryptocurrency Trading For Beginners: Basic Definitions, Crypto Exchanges, Tools And Practical Trading Tips - Mark Zuckerman, 2021

- The Crypto Trader - Glen Goodman, 2019

- International Monetary Fund - Regulating Crypto

- FINRA - Digital Assets

- IRS 2014-21 - Notice On Crypto Taxes And Rules

- YCharts - Bitcoin Transactions

- CoinMarketCap - Crypto Market Data

- Financial Times - Cryptocurrency News

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com