Dogecoin Trading – Tutorial and Brokers

Created in 2013 as a joke, Dogecoin became the archetypal memecoin, soaring to a place among the most traded cryptocurrencies in the world as its Shiba Inu logo became one of crypto’s most recognizable brands.

As one of the most widely available cryptocurrencies, you can trade Dogecoin with many good brokers to potentially harness the volatility, high liquidity and sentiment-driven price movements of this unique market.

Top 6 Dogecoin Brokers & Exchanges In 2026

After testing 139 providers, we’ve identified the 6 brokers best for secure Dogecoin trading :

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

CEX.IO

CEX.IO -

3

Nexo

Nexo -

4

Firstrade

Firstrade -

5

Pionex

Pionex -

6

InstaTrade

InstaTrade

Why Are These Brokers The Best For Trading Dogecoin?

Here’s a brief rundown of why we believe these firms stand out for Dogecoin trading:

- eToro USA is the best Dogecoin broker in 2026 - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- CEX.IO - CEX.IO offers hundreds of popular cryptocurrencies including big names like Bitcoin, Ethereum and Litecoin. The trading platform is well-designed with sophisticated charting and analysis tools, including 50+ in-built indicators. Traders can also reduce their monthly volumes through the tiered pricing structure.

- Nexo - Nexo offers trading on an impressive suite of around 70 tokens, including Bitcoin. Digital assets can be bought, sold and swapped directly on the exchange or traded in over 500 pairs. Digital assets can also be used as collateral for fiat loans or used to generate passive income with the ‘smart staking’ tool or from interest earned via peer-to-peer loans.

- Firstrade - Take positions on dozens of leading cryptocurrencies with low fees and 24/7 investing. Traders need just $1 to start speculating on popular tokens like Bitcoin. Clients can also buy cryptos instantly in a few straightforward steps.

- Pionex - Make spot, future and leveraged trades on 120 cryptocurrencies via Pionex's proprietary platform with built-in trading bots and highly customizable automated trading options. On the negative side, the range of tokens is narrower than many alternatives.

- InstaTrade - InstaTrade offers a modest selection of around 12 cryptos against the USD, tradable via CFDs. Fees are low, especially for major assets like BTC/USD with spreads from 0. There's also a dedicated cryptocurrency blog with useful technical insights to support short-term trading decisions.

Compare The Top Dogecoin Brokers And Exchanges In Key Areas

Find the right Dogecoin trading platform for you based on our comparison of core features important to active traders:

| Broker | Margin Trading | Payment Methods | Regulators |

|---|---|---|---|

| eToro USA | ✔ | ACH Transfer, Debit Card, PayPal, Wire Transfer | SEC, FINRA |

| CEX.IO | ✔ | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Pay, Mastercard, Neteller, PayPal, Skrill, Swift, Visa, Wire Transfer | GFSC |

| Nexo | ✔ | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Pay, Wire Transfer | - |

| Firstrade | ✔ | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Wire Transfer | SEC, FINRA |

| Pionex | ✔ | Bitcoin Payments | FinCEN |

| InstaTrade | ✔ | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Mastercard, Visa, Wire Transfer | BVI FSC |

How Secure Are The Top Dogecoin Trading Platforms?

In a market known for huge volatility and risk, consider how the top Dogecoin trading platforms protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| eToro USA | ✘ | ✘ | ✔ | |

| CEX.IO | ✘ | ✔ | ✔ | |

| Nexo | ✘ | ✘ | ✘ | |

| Firstrade | ✘ | ✘ | ✘ | |

| Pionex | ✘ | ✘ | ✘ | |

| InstaTrade | ✘ | ✔ | ✔ |

Compare Mobile Dogecoin Trading

With crypto markets moving quickly, here’s how these Dogecoin brokers perform on mobile following our hands-on app testing:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| eToro USA | iOS & Android | ✘ | ||

| CEX.IO | iOS & Android | ✘ | ||

| Nexo | iOS & Android | ✘ | ||

| Firstrade | iOS & Android | ✘ | ||

| Pionex | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ |

Are The Top Dogecoin Brokers Good For Beginners?

Dogecoin beginners need trading platforms with the right learning tools - here’s what the top brokers deliver:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| eToro USA | ✔ | $100 | $10 | ||

| CEX.IO | ✘ | $20 | $1 | ||

| Nexo | ✘ | $10 | $30 | ||

| Firstrade | ✘ | $0 | $1 | ||

| Pionex | ✘ | $0 | 0.1 USDT | ||

| InstaTrade | ✔ | $1 | 0.01 |

Compare The Detailed Ratings Of The Top Dogecoin Brokers

See how the top Dogecoin trading platforms rate in vital categories following our expert-assigned scores:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| eToro USA | |||||||||

| CEX.IO | |||||||||

| Nexo | |||||||||

| Firstrade | |||||||||

| Pionex | |||||||||

| InstaTrade |

How Popular Are The Top Dogecoin Brokers And Exchanges?

Many Dogecoin traders trust platforms with the largest user base - here’s how many clients the top firms attract:

| Broker | Popularity |

|---|---|

| CEX.IO | |

| InstaTrade | |

| Nexo | |

| Pionex | |

| eToro USA |

Why Trade Doge With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- Average fees may cut into the profit margins of day traders

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

Why Trade Doge With CEX.IO?

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Coins | ZRX, 1INCH, AAVE, BTC, BCH, ADA, LINK, COMP, ATOM, DAI, DOGE, ETH, GUSD, ICP, LTC, LRC, MATIC, MKR, DOT, SHIB, SOL, XLM, SUSHI, SNX, USDT, XTZ, USDC, UNI, WBTC, ZIL |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.15% maker & 0.25% taker (Standard) |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Regulator | GFSC |

| Account Currencies | USD, EUR, GBP |

Pros

- CEX.IO continues to offer competitive pricing with 0.01% taker and 0% maker fees for high-volume traders

- The broker offers 24/7 support with fast response times during tests

- The range of 200+ cryptocurrencies is competitive and will serve more experienced traders

Cons

- Deposit and withdrawal fees are relatively high, including 0.3% + $25 for SWIFT withdrawals

- A maintenance fee applies after 12 months of no activity

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

Why Trade Doge With Nexo?

"Nexo gives crypto traders the capability to trade, invest, lend and borrow digital assets in one place, and it’s especially good for its credit functions that pay out very high yields to lenders. However, its fees are relatively high and many day traders will prefer a more tightly regulated crypto broker."

Michael MacKenzie, Reviewer

Nexo Quick Facts

| Coins | BTC, ETH, NEXO, USDT, USDC, AXS, RUNE, MATIC, DOT, APE, AVAX, KSM, ATOM, FTM, NEAR, BNB, ADA, SOL, XRP, LTC, LINK, BCH, TRX, XLM, EOS, PAXG, UNI, DOGE, MANA, SAND, GALA, SUSHI, AAVE, CRV, MKR, 1INCH, DAI, USDP, TUSD |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | N/A |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | Nexo Pro |

| Minimum Deposit | $10 |

| Account Currencies | USD, EUR, GBP |

Pros

- Nexo Pro is a user-friendly proprietary platform that suits day trading strategies with great charting features

- Traders can access perpetual futures to open long or short positions on crypto assets, increasing strategic opportunities

- Nexo’s crypto staking and credit features support crypto lending and borrowing, and the yields lenders receive are among the best going

Cons

- High deposit and withdrawal fees for cards and e-wallets will price many traders out of the most convenient payment methods

- Very few educational resources are available, reducing its appeal to beginners who can find more helpful resources at category leaders like eToro

- High maker/taker fees mean day traders will pay more to trade derivatives than they would at some rival exchanges

Why Trade Doge With Firstrade?

"Firstrade is perfect for beginners looking to trade US stocks with zero commissions. There is a wealth of free education plus premium-quality research, notably through its latest FirstradeGPT tool, plus trading ideas from Morningstar, Briefing.com, Zacks and Benzinga."

William Berg, Reviewer

Firstrade Quick Facts

| Coins | ALGO, AVAX, BAT, BTC, BCH, ADA, LINK, ATOM, CRO, CRV, MANA, DOGE, ETH, ETC, FTM, LTC, LRC, MATIC, REN, SHIB, SOL, XLM, SUSHI, GRT, UNI, YFI |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Firstrade Invest 3.0, TradingCentral |

| Minimum Deposit | $0 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- One of the first brokers to add AI-powered analysis through FirstradeGPT

- Improved platform offering in 2025 with Firstrade Invest 3.0, sporting a cleaner interface and faster order entry for active traders across key areas like watchlists and options chains.

- Enhanced stock trading environment with overnight trading and fractional shares added

Cons

- No demo/paper trading account found at over 90% of alternatives evaluated

- Visa credit/debit card deposits and withdrawals are not accepted

- Firstrade focuses on stocks at the expense of forex, limiting diversification opportunities

Why Trade Doge With Pionex?

"Pionex is an excellent option for crypto traders with an interest in cutting-edge AI like ChatGPT and automated trading."

William Berg, Reviewer

Pionex Quick Facts

| Coins | BTC, LTC, ETH, BUSD, EOS, BTT, TRX, NFT, DOGE, XRP, HT, ALICE, FIL, DOT, JST, AXS, UNI, AAVE, WIN, SUN, CAKE, LINK, BAKE, BCH, ETC, SNX, TFUEL, ADA, PUNDIX, ICP, MDX, FLOW, DODO, MFT, BSV, MATIC, CSPR, SHIB, ATOM, SUSHI and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Market |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Own |

| Minimum Deposit | $0 |

| Regulator | FinCEN |

Pros

- Money Services Business (MSB) license by US FinCEN

- Low trading fees compared with other major exchanges at 0.05% maker and taker

- Powerful integrated AI chatbot 'PionexGPT' helps users programme trading bots on Pine script

Cons

- Limited contact options

- Withdrawal fees and limits may apply

- No demo account

Why Trade Doge With InstaTrade?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Coins | BTC, ETH, XRP, LTC, SOL, UNI, DOGE, BCH, FIL, ADA, DOT, LINK |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Regulator | BVI FSC |

| Account Currencies | USD, EUR, RUB |

Pros

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

Cons

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

How Did DayTrading.com Choose The Best Dogecoin Trading Platforms?

We ranked Dogecoin brokers and exchanges based on total ratings after evaluating over 200 metrics across eight critical categories.

Our hands-on testing – conducted by our experts, including team members who actively trade crypto – delivers practical insights that go beyond the surface.

The result? A rigorously reviewed shortlist of the most secure and reliable Dogecoin trading platforms available today.

How To Choose A Dogecoin Broker

Don’t settle for a mediocre broker to trade Dogecoin – we’ve compiled the key features that make a great broker, based on decades of combined industry experience.

Trust

You should never risk your hard-earned cash with any Doge broker before you check whether it can be trusted.

There are simply too many scammers operating today – particularly in the crypto field, where fraudsters routinely search for victims on social media.

In 2025, the online protection company McAfee found that scammers were specifically using Doge and its association with high-profile figures like Elon Musk in their schemes.

That’s a key reason to trade with a crypto broker that has a good track record in the industry, a large clientele, and a licence from a reputable body.

- IG is one of our most trusted brokers offering Doge trading with its near-perfect DayTrading.com Regulation & Tust rating, licences from green-tier regulators including the FCA, ASIC and the CFTC, and a listing on the London Stock Exchange. This makes this one of the most secure places to trade CFDs in Doge.

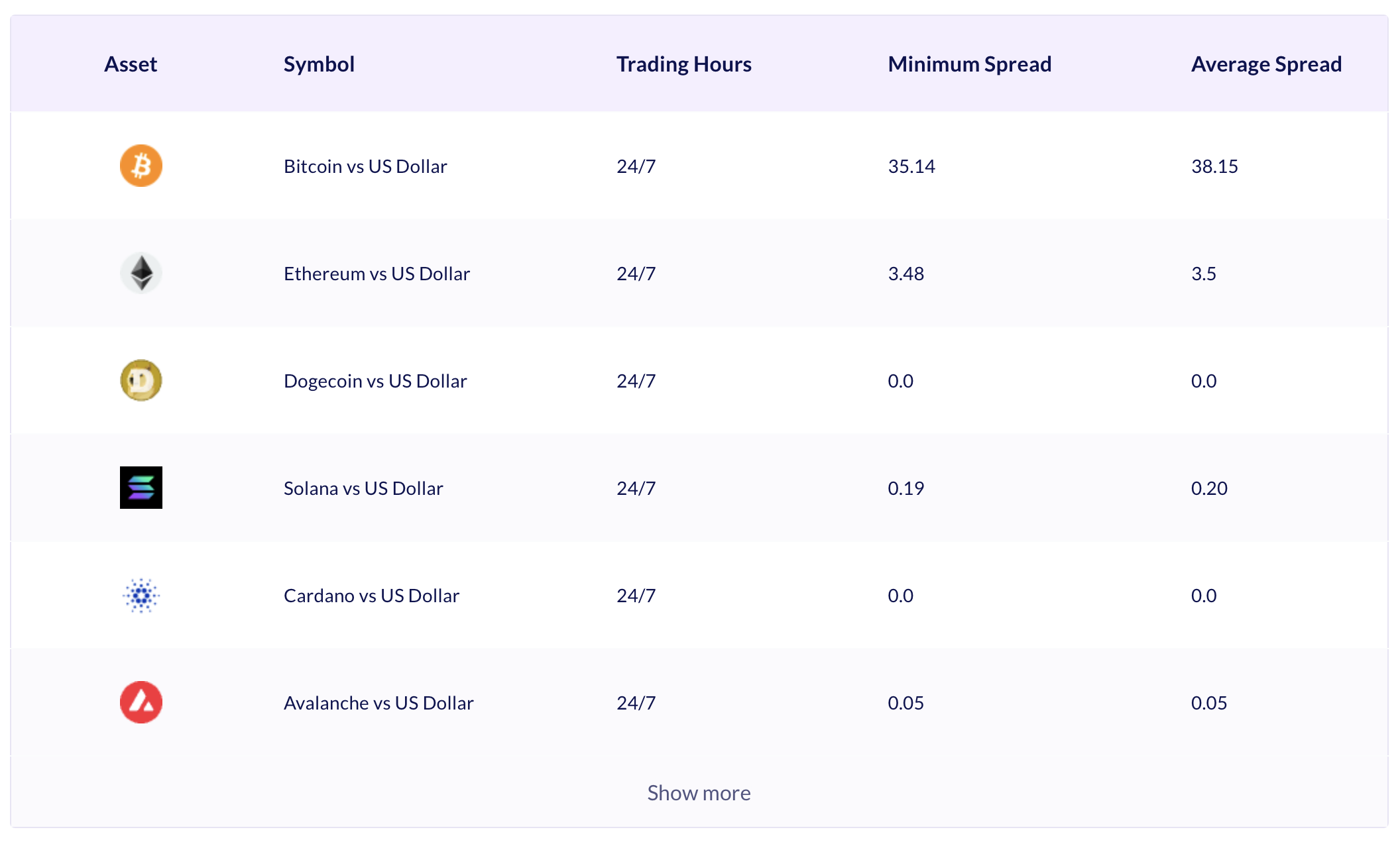

Pricing

A tight spread and low or no commission fees are crucial for day trading Doge, since fees will quickly mount on short-term trades, eating away at profits.

Choosing a broker with low pricing will make it easier for your positions to potentially turn a profit, allowing you to make the most of Doge’s volatility and benefit from more trading opportunities.

- Fusion Markets has some of the best fees we’ve encountered for trading Doge, with no commission fees whatsoever and an average spread of 0.0 pips. You’ll also benefit from access to powerful platforms including MetaTrader 4 and 5 and TradingView, and the chance to test out strategies on a demo account.

Leverage

Trading with leverage boosts the size of your position and can allow even a small position to potentially make large profits from a volatile asset like Dogecoin.

But since losses are also magnified, leveraged trading is extremely risky. As a result, many regulators have imposed tight caps on the amount of leverage available – in the EU, for example, the cap is at 1:2, while the UK’s FCA doesn’t allow leveraged crypto trading at all. If you’re looking for high leverage, this might mean you need to sign up with an offshore broker.

If you do, make sure you thoroughly research the broker’s reliability, and remember that losses in leveraged trades can very quickly mount when trading Doge. Never risk more than you can afford to lose.

Over years trading Doge and other cryptocurrencies, I’ve seen my share of dramatic price swings – Doge routinely rises or drops by 5% or more in a day, and it’s not unusual to see even more extreme price movements.

- On the occasions when I think it’s worth taking the risk to make a highly leveraged Dogecoin play, I use IC Trading. It’s a rare example of a well-established offshore broker and it offers leverage up to 1:200 on Dogecoin trades with no commissions and tight spreads.

Platforms & Tools

Choose a broker that lets you access a range of powerful platforms and tools at no added cost to help you analyze charts and plan Doge trades.

Doge and other crypto CFDs are often traded on the industry-standard MetaTrader 4 and MetaTrader 5 platforms, which are the most widely available and feature some impressive built-in tools and indicators.

We have been highly impressed by some newer platforms, like TradingView, that integrate data feeds and analysis tools to provide a comprehensive and seamless environment to research and execute Doge trades.

- We’ve used Pepperstone’s suite of platfoms and tools, including MT4 and MT5, cTrader, and TradingView, to trade Dogecoin during our tests. The addition of Autochartist, Duplitrade and Quantower, provides a huge amount of extra flexibility in planning and analysis. Since Pepperstone is also one of our most trusted brokers, with licences from strong regulators, a huge customer base, and some of DayTrading.com’s annual awards, it’s one of the most obvious choices for trading Doge.

Account Options

You should never overlook the importance of account options while choosing a Dogecoin broker.

Being able to deposit funds quickly and cheaply in the currency or crypto of your choice can make a huge difference to your profit margins in the long run, as deposit and conversion fees quickly build up.

Meanwhile, slow deposits can mean missing the lightning-fast rallies that come with the territory when you trade memecoins like Doge.

- XTB’s funding options are among the best out there, including traditional card and wire transfers as well as e-wallets like PayPal and Skrill. You can also choose between four account currencies, and earn interest on your cash funds, allowing you to make the most of sitting funds. And, with no minimum initial deposit and commission-free Doge trades with a fixed 0.22% spread, this is one of the most affordable ways to trade the token.

How To Day Trade Doge

Exchange Or Broker?

Dogecoin (DOGE) has become an established cryptocurrency and is available to trade from almost any crypto exchange and many crypto brokers.

While our experts have enjoyed testing reliable exchanges like OKX, we usually prefer using a crypto broker, since these more often have stronger regulatory oversight.

We’ve found that crypto exchanges may often advertise that they’ve registered with a body like the UK’s FCA that’s achieved green tier on DayTrading.com’s Regulation & Trust Rating.

But this is not the same as having a licence to offer specific trading products, and the level of protection can be much lower than you’d get from a broker.

For example, UK traders who sign up with an exchange might miss out on legal protections they would benefit from with an FCA-licensed broker, such as negative balance protection, the guarantee that client funds are segregated from business accounts, and insurance for up to £85,000 of their funds in case of business bankruptcy.

That’s why we favor crypto brokers like Pepperstone and eToro, which let traders deal in Doge directly or via CFDs while also extending important protections to customers.

Placing A Trade

It’s easy to place a Doge trade via an online broker – even if you’re a beginner, you should be able to sign up and get started on the same day. Here’s how…

First, sign up with a reliable broker for Doge trading. Once you’ve made your choice, the sign-up process is usually relatively quick, though you will usually need to upload proof of address and ID for verification in our experience.

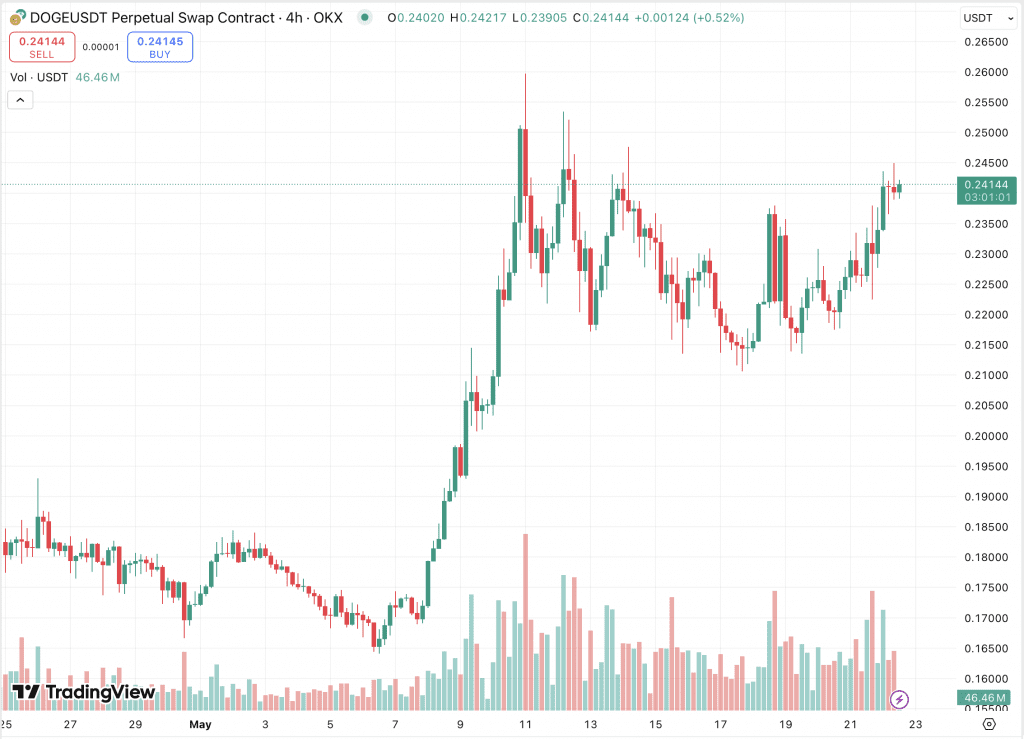

Once you’ve chosen your broker and they’ve verified your ID and activated your account, log into the platform and search for Dogecoin (symbol DOGE). This should bring up data on this market, usually presented on a chart.

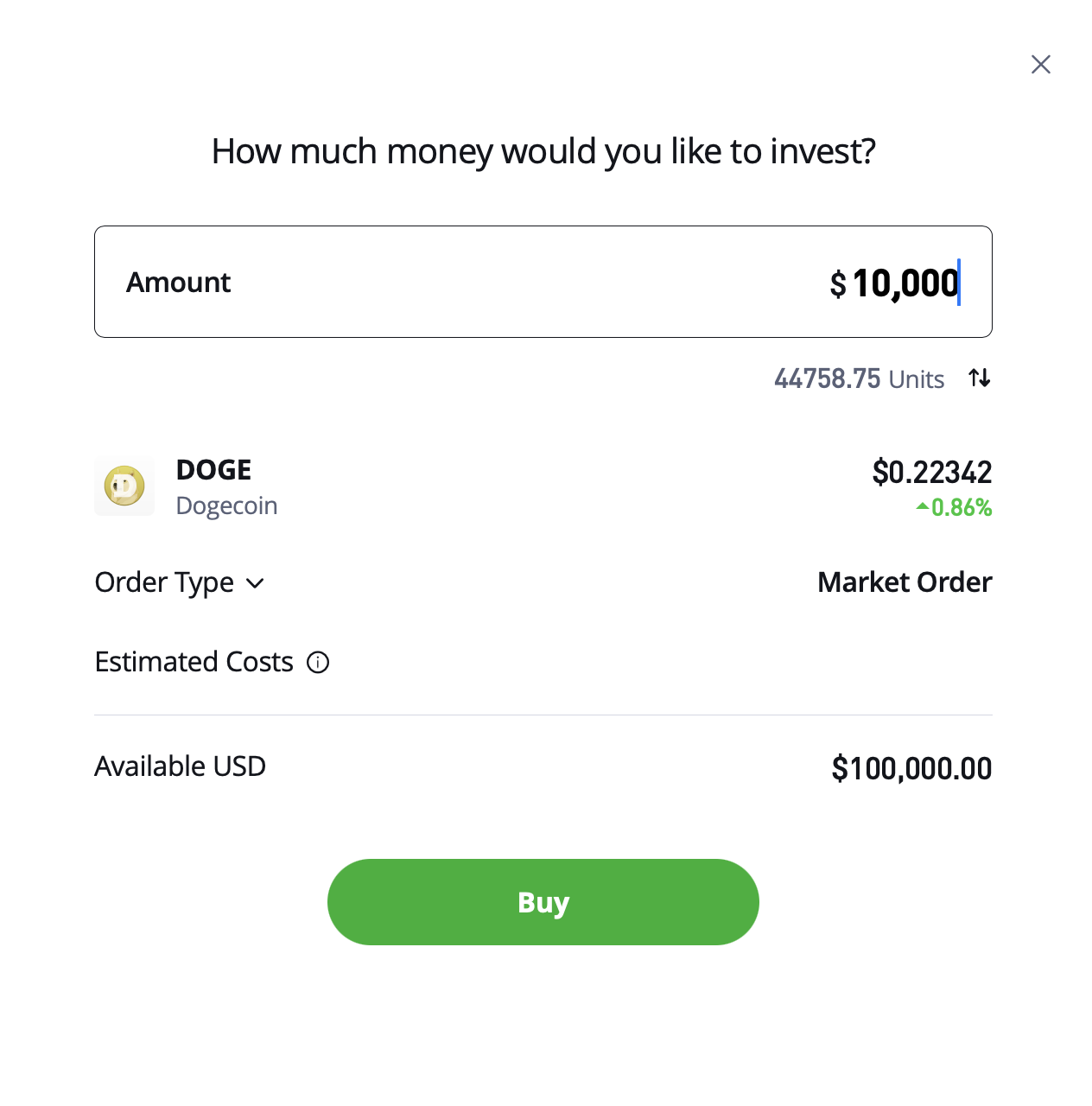

As you can see in the images above and below, I’ve navigated to the DOGE chart on my eToro brokerage account. Now I can check the price and conduct analysis to decide if and when to open a position.

To do so, I click the ‘Trade’ button and enter the size of position I want to open. I can either open a position immediately with a market order, or wait for the price to reach a specific level with a limit order.

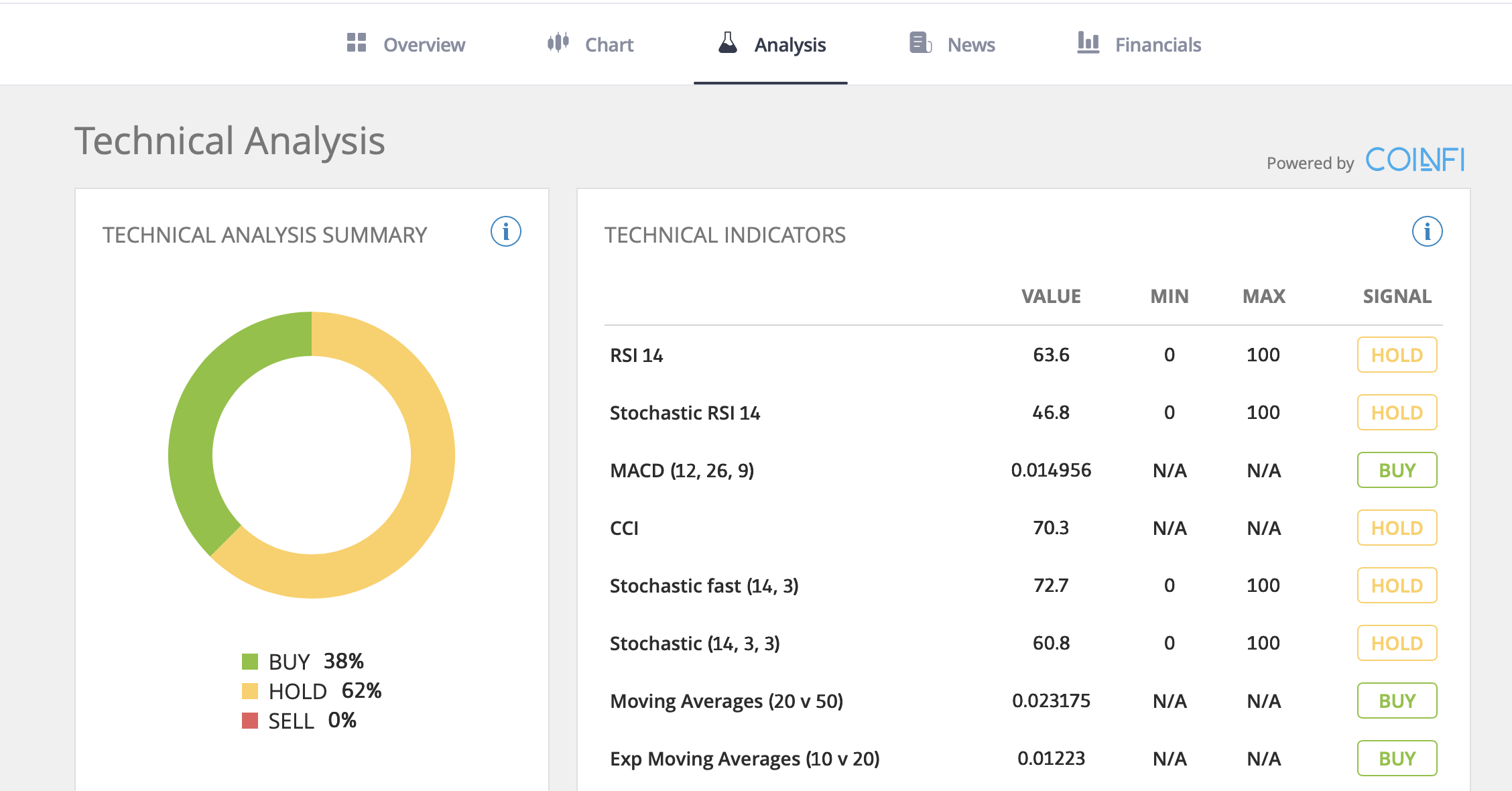

As you can see in the images, eToro’s platform includes some useful features including an Analysis tab with a summary of technical indicators such as RSI, and a News tab with recent stories on Doge.I can use these to conduct technical and fundamental analysis before I open a position. Similar tools can be found integrated into many good platforms nowadays – TradingView is a great example of this.

Pros & Cons Of Day Trading Dogecoin

Pros

- Doge can be traded at a wide range of reliable brokers, as well as crypto wallets and exchanges

- Hugely popular and highly liquid crypto asset, allowing short-term traders to enter and exit positions quickly

- Very volatile, with rapid price swings that appeal to day traders looking to profit from short moves

- Its status as a memecoin can lead to large rallies (and falls) driven by social media engagement

- Backed by some high-profile figures such as billionaire businessman Elon Musk

- Doge can be used as a payment method, providing some utility in the real world

Cons

- The high volatility we see in Doge’s price can lead to increased risk and the possibility of large losses

- Doge is less practical to use than cryptos like Bitcoin, Ethereum and Ripple

- Its unlimited supply may reduce its value in the eyes of some traders and investors

- Price movements may be based on hype rather than real-world news events, and this can make it difficult to plan trades

- Doge is already an established token, so it potentially has less potential to make the kind of eye-watering gains it did in years past

FAQ

Is Dogecoin Trading A Joke?

Dogecoin is a real cryptocurrency, though it was originally created as a joke using the Shibu meme logo. One of its strengths is the ability to make fast internet payments without transaction fees.

Is Dogecoin A Good Buy?

Dogecoin may be attractive to day traders because of its high volatility. However, its potentially high reward comes with equally high risk and is difficult to predict using technical and fundamental analysis. Traders should therefore be very careful when entering a Dogecoin trade and should take steps to manage risk.

Is Dogecoin Trading Halal?

Muslim traders generally avoid trading instruments where they need to pay interest. Dogecoin doesn’t necessarily involve overnight swap fees or other interest, but you should ask an informed religious scholar their advice before you start trading if you have any doubts.

How Can I Start Buying Dogecoin?

Dogecoin can be purchased on an exchange or traded using a top Dogecoin broker.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com