Swissquote Review 2025

Awards

- Top Innovative Companies 2025 – Statista

- ETF Online Broker of the Year 2024 – Swiss ETF Awards

- World’s Most Trustworthy Companies 2024 – Statista

Pros

- Swissquote is built for fast-paced trading strategies like day trading, scalping and high-frequency trading with 9ms average execution speeds, a 98% fill ratio, and FIX API.

- Swissquote is highly trusted owing to its position as a bank, its listing on the Swiss stock exchange, and authorization from trusted bodies like FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote supports powerful platforms for day trading, such as MetaTrader 4/5 and its own CFXD (previously known as Advanced Trader) which impressed during testing with customizable layouts and access to advanced charting tools and technical indicators.

Cons

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

Swissquote Review

Regulation & Trust

4.5 / 5Swissquote is highly trusted with an excellent track record, banking operations, a listing on the Swiss stock exchange (symbol: SQN) and authorization from seven ‘green tier’ and one ‘yellow tier’ bodies in DayTrading.com’s Regulation & Trust Rating.

Swissquote was founded in 1996 and initially operated as an information platform offering free access to real-time stock market prices, a first in Switzerland. In 2000, it evolved into a fully regulated online bank with its headquarters in Gland, Switzerland.

Over the years, Swissquote has pioneered digital banking and trading innovations, such as being the first online bank to offer cryptocurrency trading in 2017.

The brokerage operates under a robust regulatory framework across multiple jurisdictions, reflecting its global presence and commitment to compliance:

- Switzerland: Swissquote Bank Ltd is regulated by the Swiss Financial Market Supervisory Authority (FINMA). ‘Green tier’.

- UK: Swissquote Ltd is authorized and regulated by the Financial Conduct Authority (FCA). ‘Green tier’.

- Luxembourg: Swissquote Bank Europe is licensed and supervised by the Commission de Surveillance du Secteur Financier (CSSF) and operates under European Central Bank oversight for banking activities. ‘Green Tier’.

- Dubai: Swissquote MEA Ltd is regulated by the Dubai Financial Services Authority (DFSA). ‘Green tier’.

- Hong Kong: Swissquote Asia Ltd operates under the supervision of the Securities and Futures Commission (SFC). ‘Green tier’.

- Singapore: Swissquote Pte Ltd holds a Capital Markets Services license granted by the Monetary Authority of Singapore (MAS). ‘Green tier’.

- Malta: Swissquote Financial Services (Malta) Ltd is supervised by the Malta Financial Services Authority (MFSA). ‘Green tier’.

- Cyprus: Swissquote Capital Markets Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC). ‘Green tier’.

- South Africa: Swissquote is supervised by the Financial Sector Conduct Authority (FSCA). ‘Yellow tier’.

Swissquote offers varying levels of investor protection depending on the region. In the UK, Swissquote Ltd. clients are covered by the Financial Services Compensation Scheme (FSCS) for up to £85,000 should the broker face financial difficulties.

Similarly, Swissquote Bank Europe clients benefit from the Investors Compensation Scheme (ICS) for up to €20,000.

In Switzerland, Swissquote is part of the depositor protection scheme, providing up to CHF 100,000 in the event of broker insolvency.

The level of investor protection for clients trading in other countries may differ, potentially making dispute resolution more complex.

However, negative balance protection is a standard feature across all jurisdictions, ensuring your account can’t fall below zero.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

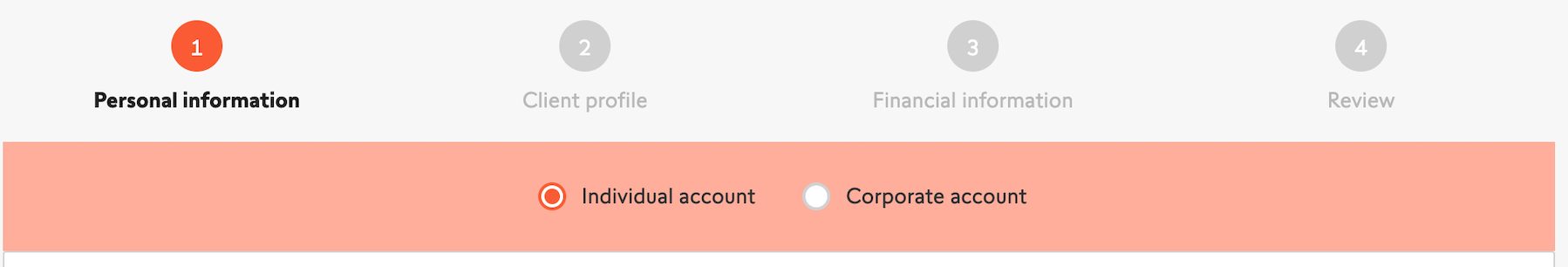

Accounts & Banking

3.8 / 5Live Accounts

Swissquote offers several types of forex and CFD accounts tailored to various active trading needs.

Each has specific features and requirements, which can be a little confusing, but they share standard features like leverage up to 1:100 and support for expert advisors (EAs) and high-frequency trading (HFT):

- Standard: This account is best suited to beginners or casual traders. It requires a minimum deposit of $1,000 and provides access to all major asset classes. Floating spreads (from 1.3 pips) are slightly wider compared to higher-tier accounts, and there is no commission on forex trading. The minimum trade size is 0.01 lot.

- Premium: Designed for intermediate traders, this account requires a higher minimum deposit of $10,000. It offers narrower spreads (from 0.6 pips) compared to the Standard account. The minimum trade size is 0.1 lot.

- Prime: Targeting advanced or high-volume traders, the Prime account demands a minimum deposit of $50,000. It features tighter forex spreads from 1.1 pips and better cost efficiency for frequent trading like day trading. The minimum trade size is 1 lot.

- Professional: Accessible to qualified professional traders who meet specific regulatory criteria. It provides the most competitive spreads and custom trading conditions. This account also includes additional risk management tools and higher leverage options.

Swissquote also offers Islamic accounts for swap-free trading, which comply with Shariah law. To open an Islamic account, you’ll need to contact Swissquote’s customer support.

All four accounts cater to varying levels of expertise, but the high minimum deposits will deter inexperienced traders with smaller balances.

A fairly unique product available at Swissquote is the addition of its integrated investing and savings solution, Invest Easy. This is available to clients who hold a bank account with the firm and offers direct interest payments on USD, EUR, GBP and CHF with competitive rates.

It also offers automated investing with four strategies that vary depending on your risk tolerance. This solution essentially allows customers to manage their trading and savings in one place, and with recurring payments available, it is quick and easy to set up.

Demo Accounts

Swissquote offers a demo account, which allows you to practice in a simulated trading environment with up to $50,000 in virtual funds. Setting up the demo account was a snap during testing, taking only a few seconds.

The demo account provides access to all of Swissquote’s instruments, including forex, CFDs on indices, commodities, cryptocurrencies, and more.

It can be used on all platforms – MT4, MT5, and Swissquote’s proprietary CFXD platform.

However, the demo account is frustratingly limited to a 30-day usage period, making it only suitable for short-term strategy testing or getting acquainted with the platform before transitioning to a live account.

Deposits & Withdrawals

The minimum deposit required for a forex account ranges from $1,000 to $50,000, which is prohibitively high for new traders.

On the plus side, 20+ currencies are supported depending on your location including: EUR, USD, JPY, GBP, CHF, CAD, MXN, AUD, PLN, SEK, NOK and SGD.

Swissquote only supports bank cards and wire transfers for deposits and withdrawals.From my experience, processing times for requests typically take up to 24 hours for bank cards and up to three working days for bank wires, although transaction times may vary depending on your bank and location.

The broker does not charge an internal fee for deposits but imposes a cost on withdrawals made with bank cards – typically 1.9% third-party fees for residents of SEPA countries (including Switzerland) and 0% for clients residing outside of SEPA countries.

I’ve been disappointed to find no support for e-wallets like Skrill, Neteller, or PayPal, although the lack of crypto (eg BTC, ETH) options is hardly surprising, given the broker’s strict regulation.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Credit Card, Debit Card, Mastercard, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $1,000 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5The selection of instruments at Swissquote varies depending on your location.

Some clients, like those in Switzerland, can access an industry topping over three million instruments, spanning short-term trading products like CFDs through to bonds, futures, options, ETFs, and more.

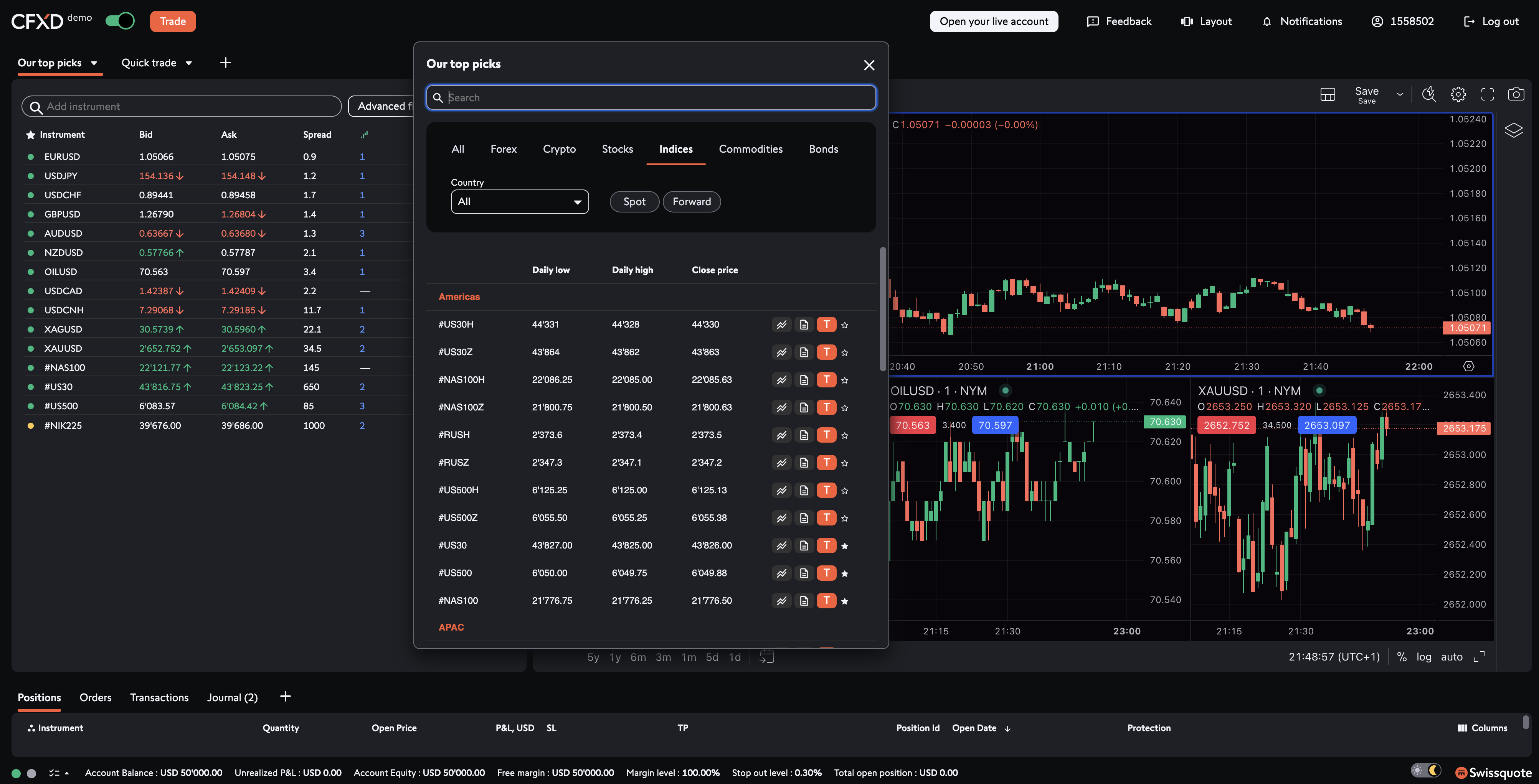

However, for traders in regions like the UK, there’s a more modest 400+ forex and CFD instruments, including currency pairs, stock indices, commodities, precious metals, and bonds. I’ve also noticed that the range of assets depends on the platform. For example, cryptocurrencies are only available on CFXD.

- Forex: 80+ pairs including majors (eg EUR/USD), minors (eg GBP/JPY), and exotics (eg USD/MXN).

- Stocks: 335+ stocks across major US and European exchanges (eg Nike, Nestle).

- Indices: 25+ covering the US, Europe and APAC (eg S&P 500 and FTSE 100).

- Commodities: 25+ commodities including metals (gold) and energies (oil).

- Bonds: 3+ US and EU government bonds (USBDN, BUND, LGILT)

- Cryptocurrencies: 35+ cryptocurrency pairs (eg BTC/USD, ETH/USD).

Unlike eToro, FXTM, and Pepperstone, Swissquote offers limited passive investment options like in-house copy trading.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:100 (Retail), 1:400 (Pro) | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3 / 5Swissquote’s reputation as a reputable Swiss banking institution offers a sense of security and prestige often associated with Swiss financial services.

However, this advantage comes with a higher price point, as Swissquote’s trading costs are less competitive than those of some low-cost brokers we’ve evaluated.

This may deter you if you are a cost-sensitive trader who prioritizes tight spreads and minimal commissions.

The fees and trading conditions vary significantly across Swissquote’s regional entities.

For example, Swissquote Ltd, based in the UK, generally offers more affordable trading costs and lower minimum deposit requirements than the Swiss entity and the Luxembourg branch. However, the trade-off is a more limited range of products available through UK-based accounts.

In contrast, the Swiss entity provides a broader selection of investment instruments, including Swiss equities and wealth management options, which appeal to more sophisticated investors.

While the broker offers a notable advantage with no inactivity fees, trading fees for stocks and ETFs are generally higher, and withdrawal fees can add to the overall cost.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 1.3 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 0.9 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.03 | 0.25-0.85 | 0.1 |

| Stock Spread | N/A | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

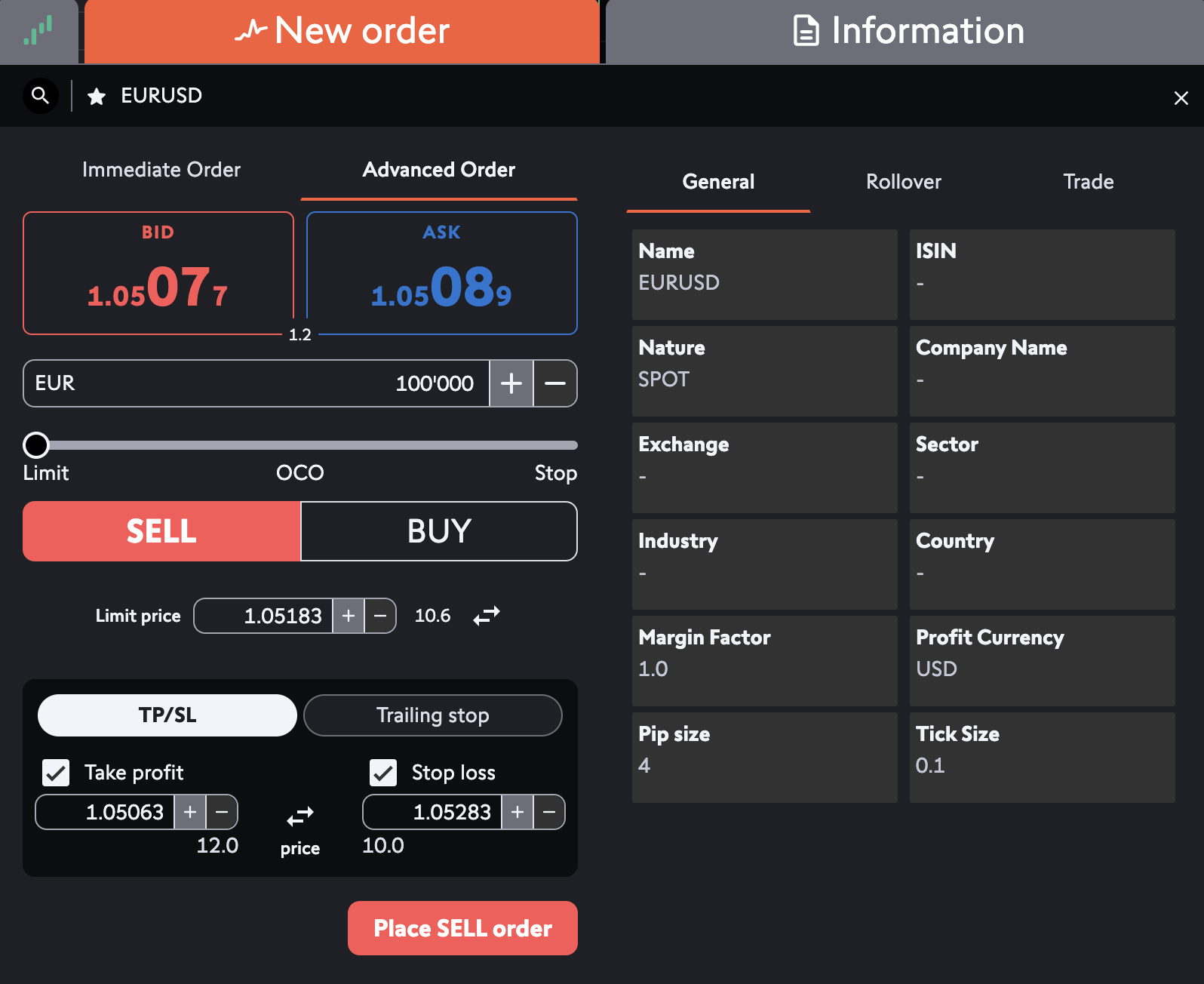

3.8 / 5Swissquote offers three trading platforms to cater to the diverse needs of active traders, considering factors like asset choice and support for automated trading.

Let’s dig into my insights in each platform:

MetaTrader 4 (MT4)

MT4, a widely used industry standard, is a solid choice for forex trading on Windows and Mac desktops, web browsers, and mobile devices.

While its dated and non-customizable interface may not be ideal for everyone, it offers advanced charting tools, nine timeframes, 30 technical indicators, and both automated (EAs) and copy trading.

I’ve found that when using MT4, I can’t trade stocks or cryptos, and Autochartist is also only available as a plug-in, which is a clunky workaround compared to its seamless integration in CFXD.

Furthermore, there’s no built-in economic calendar or API support for automated trading.

MetaTrader 5 (MT5)

MT5 builds on MT4’s strengths with additional features like 21 timeframes, 80 technical indicators, and an integrated economic calendar.

I also appreciate the multi-asset support, which includes stocks. However, cryptos are missing, and I again had to install Autochartist as a plug-in.

Compared to CFXD, there are no complex order types, either.

CFXD

CFXD is Swissquote’s proprietary platform (web and mobile) designed for intuitive and customizable trading.

Powered by the robust TradingView charting software, the platform features a customizable interface, allowing me to tailor my workspace to my individual preferences easily.

It offers 15 timeframes and 27 technical indicators, which isn’t as comprehensive as MT5, but it still facilitates detailed market analysis.

The most significant advantage based on my hands-on tests is that CFXD integrates Autochartist directly into its interface, providing automated chart analysis to assist in informed decision-making.

Based on the Autochartist setup, which automatically adds take profit and stop loss levels, I can also place trades with a few clicks.

Additionally, it supports complex order types such as Order Cancels Other (OCO) and offers FIX API connectivity for day traders seeking low-latency execution.

On the downside, there is no dedicated desktop application or support for copy and automated trading.

While all three platforms offer versatility, I would still appreciate the support for cTrader (with its excellent copy trading feature) and TradingView, which I consider the best platforms on the market.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

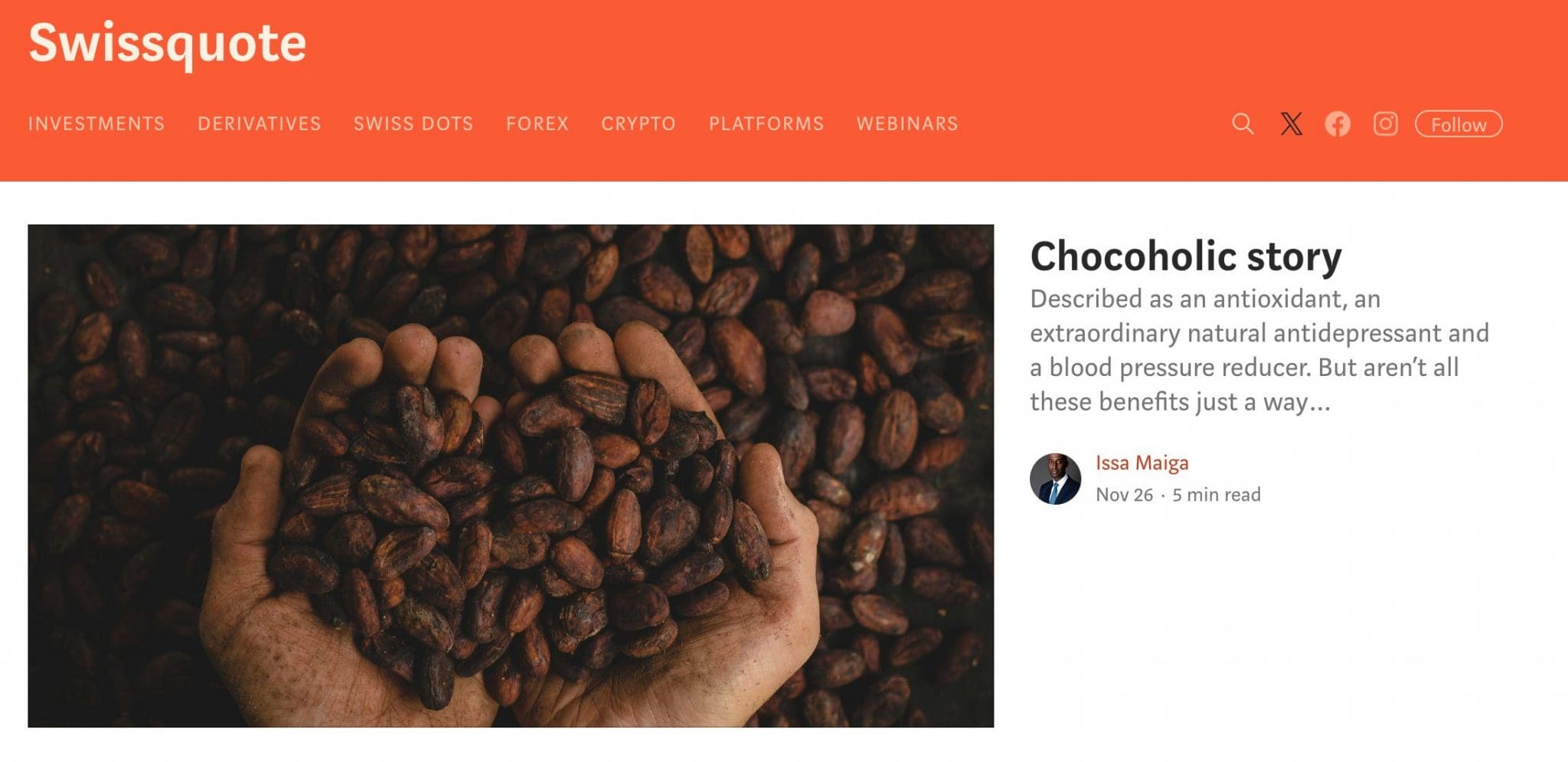

Research

4.3 / 5Swissquote provides extensive market research content for active traders.

I find the written daily Morning News particularly insightful. It delivers daily updates on worldwide market trends and insights that help me make more informed trading decisions.

The Medium-hosted Blog is interesting and features in-depth articles covering market analysis, trading strategies, and emerging financial trends.

However, I don’t find it as useful because it’s not updated frequently – during my latest tests, the most recent post was over three weeks old.

Swissquote excels at leveraging multimedia channels for research and education. Its active YouTube channel offers excellent video tutorials, market outlooks, and webinars featuring financial experts, providing engaging content for visual learners.

Additionally, its well-produced daily Podcasts delve into interesting topics such as market forecasts, interviews with industry professionals, and economic trends, offering flexible listening on the go.

Swissquote enhances the trading experience for beginner traders by offering automated chart pattern recognition and expert insights via third-party Autochartist.

I have also been pleased to see the platform integrate with Dow Jones Newswire to deliver real-time news and market analysis for MetaTrader users.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.3 / 5Swissquote primarily delivers educational materials through video content on its YouTube channel. Led by industry professionals, these videos cover topics from beginner to advanced levels in an easy-to-follow format.

In addition to videos, Swissquote offers a few eBooks that provide structured guidance on topics like stock investing, building a diversified portfolio, and an introduction to ETFs. However, the current selection lacks resources tailored to day trading or advanced strategies.

To enhance its educational offerings, Swissquote could benefit from incorporating interactive courses, diversifying content formats, and expanding its reach with more localized, multilingual content, mirroring the approach of brokers like XM.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.8 / 5Swissquote offers decent 24-hour customer support, offering multiple communication channels such as email, live chat, and phone support.

Swissquote’s social media presence complements its customer support efforts. It actively engages clients on platforms like X, Instagram, LinkedIn, Facebook, TikTok, and YouTube, sharing market updates, educational content, and important announcements.

I’ve found the support team is generally responsive during business hours and offers multilingual services, making it accessible to a wide range of clients globally.I also appreciate the Help Center’s detailed FAQs that address common queries managing accounts and accessing platforms.

However, Swissquote has room for improvement compared to some other brokers. For instance, firms like Exness provide 24/7 customer support, ensuring I can get assistance at any time, which Swissquote needs to improve.

I’d also love to see more interactive features, such as video tutorials within customer support channels, to elevate the user experience.

| Swissquote | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Swissquote?

Swissquote presents a compelling day trading proposition with both strengths and weaknesses.

The broker’s robust regulatory oversight by multiple international authorities instils confidence in its financial stability. Its diverse account types, including commission-free options and professional accounts with lower spreads, cater to a wide range of active trading strategies.

However, Swissquote’s trading instrument selection is relatively limited, and fees can be high for smaller transactions, especially in foreign exchange.

While its educational resources provide valuable insights, they could benefit from further expansion.

Despite its user-friendly interface, I also think the CXFD platform needs to catch up to competitors like cTrader and TradingView regarding charting capabilities and news integration.

In conclusion, Swissquote offers a balance of regulatory security, versatile account options, and accessibility, but its higher fees and limited educational tools make it less competitive than other leading brokers.

FAQ

Is Swissquote Legit Or A Scam?

Swissquote is a legitimate and reputable financial institution. It is a publicly traded company on the SIX Swiss Exchange.

It operates under strict regulation from multiple ‘green tier’ authorities, including FINMA in Switzerland, the FCA in the UK, and CSSF in Luxembourg.

Its operations are transparent, and it has established itself as a leading provider of global online trading and banking services.

Swissquote’s long-standing presence since 1996 and compliance with international regulatory standards further affirm its credibility.

Is Swissquote Suitable For Beginners?

Swissquote is moderately suitable for beginners. It offers educational videos, eBooks, and demo accounts to help new traders get started.

Its user-friendly proprietary CXFD platform should further appeal to less experienced users.

However, compared to brokers like eToro, which offers a more community-oriented experience with social trading, Swissquote may feel less intuitive for absolute beginners.

A minimum deposit of $1,000 is also prohibitive.

Top 3 Alternatives to Swissquote

Compare Swissquote with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Swissquote Comparison Table

| Swissquote | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1,000 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:100 (Retail), 1:400 (Pro) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 5 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Swissquote and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Swissquote | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | Yes | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

Swissquote vs Other Brokers

Compare Swissquote with any other broker by selecting the other broker below.

The most popular Swissquote comparisons:

- Coinbase vs Swissquote

- Dukascopy vs Swissquote

- DEGIRO vs Swissquote

- Bybit vs Swissquote

- Swissquote vs Trade Republic

Customer Reviews

4 / 5This average customer rating is based on 1 Swissquote customer reviews submitted by our visitors.

If you have traded with Swissquote we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Swissquote

Article Sources

- Swissquote

- Swissquote - SIX Swiss Exchange

- Swissquote Bank Ltd - FINMA License

- Swissquote Ltd - FCA License

- Swissquote Bank Europe - CSSF License

- Swissquote MEA Ltd - DFSA License

- Swissquote Asia Ltd - SFC License

- Swissquote Pte Ltd - MAS License

- Swissquote Financial Services (Malta) Ltd - MFSA License

- Swissquote Capital Markets Ltd - CySEC License

- Swissquote South Africa PTY Ltd - FSCA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I really very much like Swissquote’s CFXD platform. It’s one of the eaisiest I’ve learned and I’ve spent too many hours on others. The charts are crisp, setting up a watchlist takes a second in the top menu and you have Autochartist signals right there at a click. I set Autochartist to my watchlist then filter for “breakout”. It’s a really clean trading software and have Swissquote have clearly thought about the user experience of the active trader.