Brokers With SGD Accounts

A broker that supports a Singapore dollar (SGD) account is often the most convenient and affordable way for traders in Singapore to access the financial markets.

With an SGD account, you can manage your trading funds in a strong regional currency that is fairly stable and competitive, managed within a policy band against a basket of key partners’ currencies by the Monetary Authority of Singapore (MAS).

Explore the best brokers with SGD accounts, selected after extensive first-hand testing.

Best Brokers With SGD Accounts

These are the top 6 trading platforms supporting SGD accounts:

-

1

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

2

Moomoo

Moomoo -

3

Focus Markets

Focus Markets -

4

Gemini

Gemini -

5

Zacks Trade

Zacks Trade -

6

Exness

Exness

Here is a short summary of why we think each broker belongs in this top list:

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- Moomoo - Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

- Focus Markets - Established in 2019, Focus Markets is an Australian-based MetaTrader broker offering access to over 1,000 tradable instruments, including forex, commodities, indices, stocks, and a particularly large selection of crypto derivatives.

- Gemini - Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

Brokers With SGD Accounts Comparison

| Broker | SGD Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| OANDA US | ✔ | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | NFA, CFTC |

| Moomoo | ✔ | $0 | Stocks, Options, ETFs, ADRs, OTCs | SEC, FINRA, MAS, ASIC, SFC |

| Focus Markets | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | ASIC, SVGFSA |

| Gemini | ✔ | $0 | Cryptos | NYDFS, MAS, FCA |

| Zacks Trade | ✔ | $2500 | Stocks, ETFs, Cryptos, Options, Bonds | FINRA |

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- Beginners can get started easily with $0 minimum initial deposit

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

Moomoo

"Moomoo remains an excellent choice for new and intermediate stock traders who want to build a diverse investment portfolio. What really stands out is the broker's user-friendly app and the low trading fees."

Jemma Grist, Reviewer

Moomoo Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, ADRs, OTCs |

| Regulator | SEC, FINRA, MAS, ASIC, SFC |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Minimum Trade | $0 |

| Leverage | 1:2 |

| Account Currencies | USD, HKD, SGD |

Pros

- There is no minimum deposit requirement making the broker accessible for beginners

- Moomoo's analytics and insights are impressive and detailed compared to other brands

- There are reduced options contract fees from $0.65 to $0

Cons

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

- There is no phone or live chat support - common options at most other brokers

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

Cons

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

Gemini

"Gemini’s ActiveTrader platform and TradingView integration make it a good choice for serious crypto traders seeking a reliable charting environment, though we were disappointed by some unnecessary fees and previous security breaches."

Michael MacKenzie, Reviewer

Gemini Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | NYDFS, MAS, FCA |

| Platforms | ActiveTrader, AlgoTrader, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.00001 BTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, HKD, SGD |

Pros

- The trading app features a user-friendly, modern design and intuitive interface, with an excellent range of charting tools for day traders

- The TradingView integration delivers top-quality tools, including backtesting and algo trading capabilities

- Crypto perpetual futures are available in many jurisdictions with up to 1:100 leverage

Cons

- There is no practice profile or demo account for prospective traders

- There are high fees for some funding methods including a 3.49% fee for card transactions

- Some larger coins by market cap are not available to buy through Gemini

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Customizable proprietary trading platform and mobile app

- Regulated by FINRA with access to the Securities Investor Protection Corporation

- Demo account

Cons

- Withdrawal fees apply if removing funds more than once per month

- No MT4 or MT5 platform integration

- High minimum requirement of $2,500

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

How Did We Choose The Best SGD Brokers?

To find the best SGD brokers, we:

- Leveraged our database of 140 brokers

- Made a shortlist of brokers that support accounts in Singapore dollars

- Ranked them by examining more than 100 data points during exhaustive first-hand tests

What Is An SGD Account?

An SGD account is simply a trading account that uses Singapore dollars as the base currency.

Your deposits and withdrawals will be processed into SGD, and this is the currency that will be used when you open day trades and exit positions.

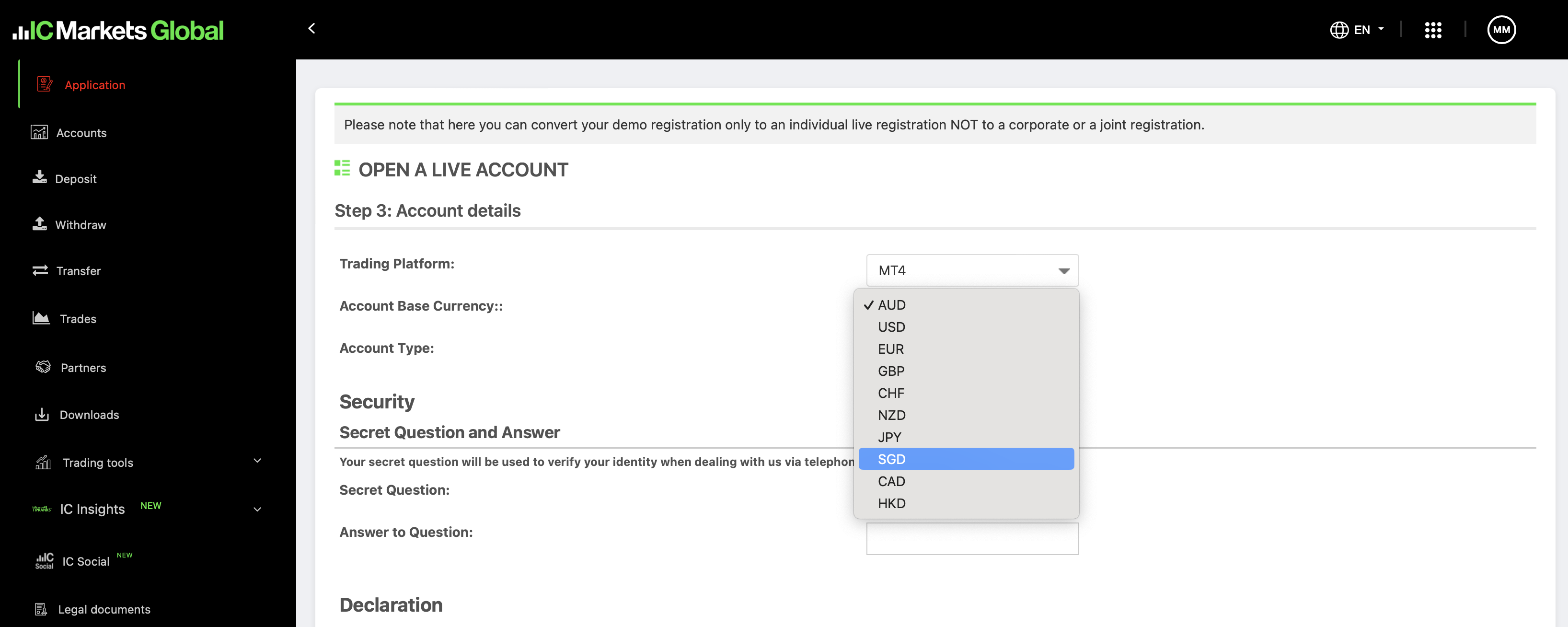

You can usually select SGD as an account currency when you open an account with a supporting broker. I opened an SGD account with IC Markets as you can see in the image below:

Do I Need An SGD Account?

You may want an account with SGD as a base currency for several reasons:

- If you live in Singapore and SGD is the main currency you earn and use, an SGD account is usually the most cost-effective as it cuts conversion fees.

- If you regularly trade stocks listed in Singapore like Wilmar International or Oversea-Chinese Bank, then it makes sense to fund your account with SGD since this is the currency used on this exchange.

- If you are looking to trade in various currencies for hedging purposes, SGD is a good bet as a relatively stable currency whose rate is loosely determined by a basket of other currencies.

How Can I Check If A Broker Offers An Account In Singapore Dollars?

We list the accepted account currencies of every broker we review, so you can quickly find brokers with SGD accounts here. Alternatively, follow these easy steps to check for yourself:

- Go to the broker’s website and navigate to the ‘account options’ setting.

- Find the scroll-down tab or list of accepted currencies and scroll down until you find SGD.

- Select SGD as the account currency when you open a live trading account.

Pros & Cons Of SGD Trading Accounts

Pros

- SGD accounts eliminate currency conversion fees if you have Singapore dollars and want to trade instruments on the Singapore Exchange.

- Traders based in Singapore will usually find it more convenient to fund and manage their trading account in their day-to-day currency.

- The Singapore dollar is considered among the world’s strongest and most stable, and the Monetary Authority of Singapore (MAS) allows it to float within the range defined by a basket of other currencies. This makes it a relatively secure currency to store funds in.

- If you file taxes in Singapore, maintaining an SGD account may streamline the reporting process as it may reduce the need to factor in various foreign exchange rate changes and fluctuations.

Cons

- Although SGD is quite popular and is supported by some top brokers, it is not as widely available as currencies like USD, EUR and GBP so you will have fewer day trading platforms to choose between.

- The ‘soft peg’ applied to SGD means it is unlikely to significantly appreciate in value against the USD or other major currencies.

- Stocks from the Singapore Exchange are not offered by most brokers, so you may have a relatively limited choice if that’s what you want to day trade.

FAQ

What Is The Best Broker With An SGD Account?

We’ve comprehensively reviewed the brokers that accept SGD accounts. Check our list to find the right platform for your needs.

How Much Does It Cost To Open A Trading Account Based In Singapore Dollars?

The amount you need to spend to open an SGD base account will depend on the broker. Of the hundreds of brokers we’ve tested, we’ve found that this amount is rarely higher than the 200 USD (around 270 SGD) minimum required by IC Markets.

However, note that many SGD brokers accept traders for considerably less than this. IG, for example, doesn’t require any minimum deposit to sign up, and you can register with XM with an initial deposit of just $5 (approximately 7 SGD).