Brokers With MXN Accounts

The Mexican peso (MXN) is Mexico’s official currency and one of the most traded currencies, particularly in emerging markets. It’s valued for its liquidity and strong ties to the US and Latin American economies.

Opening an MXN trading account can be highly beneficial. It provides easy access to Latin American investments, eliminates currency conversion fees, and allows you to capitalize on Mexico’s economic growth and commodities like oil, which directly impact the value of the MXN.

Explore DayTrading.com’s selection of the best Mexican peso brokers tailored to various trading requirements.

Best Brokers With MXN Accounts

After our exhaustive tests, these are the 2 top brokers that support MXN accounts:

This is why we think these brokers are the best in this category in 2026:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Brokers With MXN Accounts Comparison

| Broker | MXN Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Swissquote | ✔ | $1,000 | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Swissquote

"Swissquote is an excellent choice for active traders looking for a customizable platform, such as its CXFD, which integrates Autochartist for automated chart analysis to aid trading decisions. However, its average fees and steep $1,000 minimum deposit might make it less accessible for beginner traders."

Christian Harris, Reviewer

Swissquote Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Regulator | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral |

| Minimum Deposit | $1,000 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:100 (Retail), 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, AED, SAR, HUF, THB, QAR, MXN |

Pros

- Swissquote supports powerful platforms for day trading, such as MetaTrader 4/5 and its own CFXD (previously known as Advanced Trader) which impressed during testing with customizable layouts and access to advanced charting tools and technical indicators.

- Swissquote provides advanced research services like Autochartist for technical analysis and integration of real-time news from Dow Jones. Its proprietary Market Talk videos and Morning News reports deliver expert analysis daily, appealing to active traders.

- Swissquote is built for fast-paced trading strategies like day trading, scalping and high-frequency trading with 9ms average execution speeds, a 98% fill ratio, and FIX API.

Cons

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

How Did We Choose The Best Brokers?

Our selection process for the best MXN trading platforms was meticulous:

- We assessed several hundred online brokers and trading platforms.

- We removed from consideration any platforms that did not offer accounts denominated in Mexican pesos.

- We assigned a numerical rank to each platform, considering a comprehensive set of 100+ quantitative metrics and qualitative assessments from our rigorous testing process.

What Is An MXN Account?

An MXN account is a trading account whose underlying currency is the Mexican peso.

This account type offers a suite of advantages, such as avoiding foreign exchange conversion fees, mitigating exchange rate risk, and efficient investment in domestic Mexican assets, including equities and initial public offerings (IPOs).

The convenience and advantages of an MXN account make it an excellent option if you actively participate in Mexico’s financial markets.

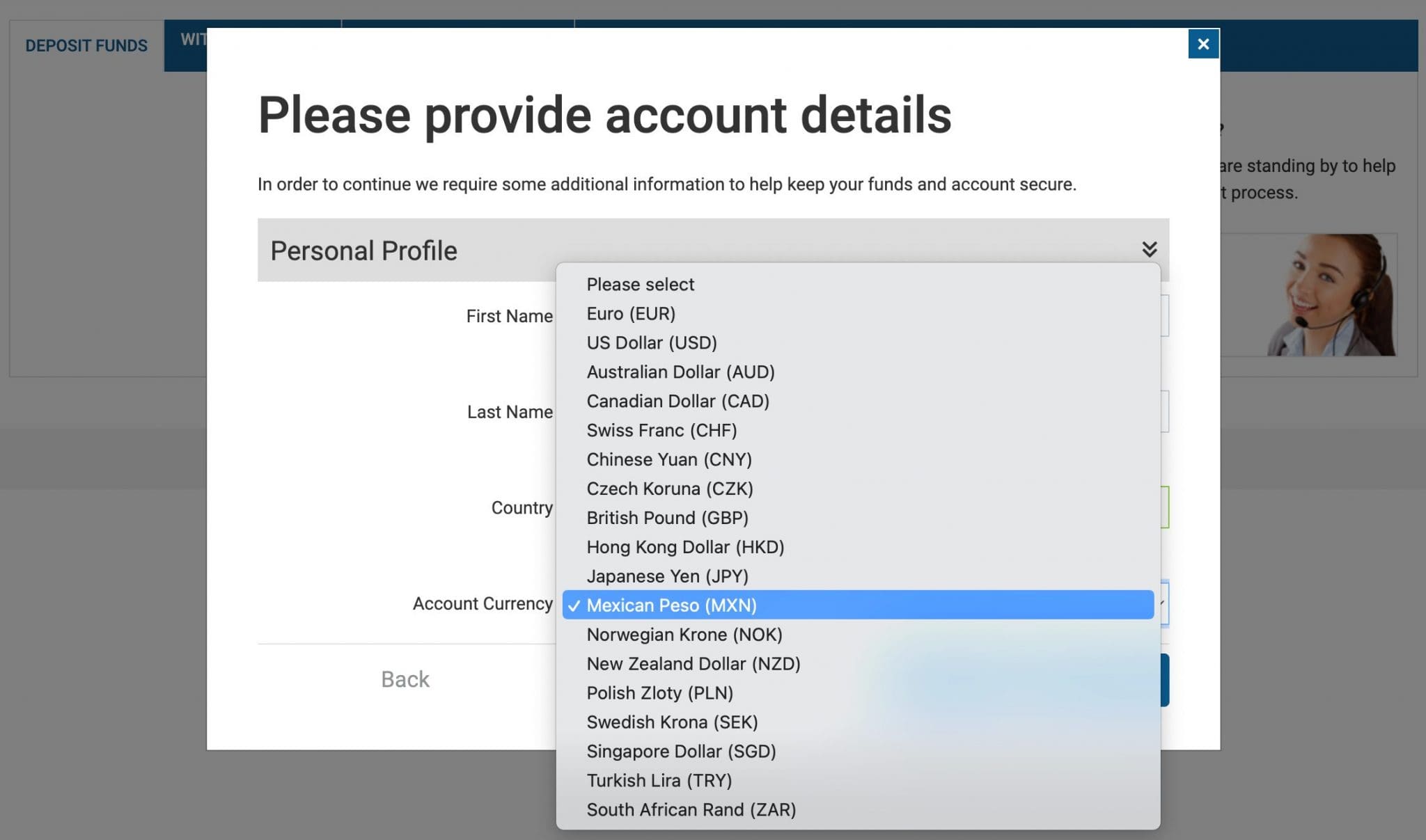

Below is a snapshot of a trading account, denominated in Mexican pesos. It took me just a few minutes and clicks to configure my currency as MXN.

Do I Need An MXN Trading Account?

Evaluate the benefits of an MXN account if:

- You reside in Mexico. An MXN trading account can significantly streamline your tax reporting process. You can simplify your accounting tasks by eliminating the need to track foreign exchange gains or losses.

- You frequently trade Mexican pesos-denominated assets, such as stocks listed on the Bolsa Mexicana de Valores (BMV) or forex pairs including the MXN, and wish to avoid the costs associated with conversion.

- You want to minimize the potential impact of foreign exchange fluctuations on your day trading profits, mainly when dealing with local assets or converting to other currencies.

How Can I Check If A Broker Offers An Account In Mexican Pesos?

To identify the top trading platforms offering MXN accounts, follow this straightforward process:

- Locate the ‘Account Options’ or similar section on the broker’s website.

- Verify that ‘MXN’ is included among the supported base currencies for your trading account.

- Create a trading account and select ‘MXN’ as your primary currency.

Pros & Cons Of MXN Trading Accounts

Pros

- Traders based in Mexico can avoid the fees and risks associated with currency exchange, particularly when trading assets denominated in Mexican pesos. This can result in substantial cost savings for active traders, as there is no need to convert funds between currencies.

- Mexico is a significant player in the Latin American economy, and a MXN trading account may provide direct exposure to Mexican equities, bonds, and commodities like oil and silver, which can offer higher returns compared to more developed markets.

- MXN is one of the most traded emerging market currencies. The peso’s volatility can offer short-term trading opportunities, especially in forex markets.

Cons

- If your investments or income are in other currencies, such as USD, having an MXN base account may expose you to exchange rate fluctuations, potentially eroding returns when converting profits back to your primary currency.

- When trading non-MXN assets (like international stocks or bonds), you may face higher currency conversion fees and spreads, as every transaction involves converting MXN to the relevant currency, increasing trading costs.

- Some international brokers or trading platforms may offer limited services or instruments denominated in MXN, restricting access to global investment opportunities and specific asset classes.

- As an emerging market currency, MXN can experience larger price swings than developed currencies, such as EUR, increasing the risks for global traders.

FAQ

Which Is The Best Broker With An MXN Account?

Our team of experts has meticulously evaluated the leading trading platforms offering MXN accounts. Explore our list to find the ideal brokerage for your trading needs.

How Much Does It Cost To Open A Trading Account Based In Mexican Pesos?

Based on our evaluations, many brokers require a minimum deposit of USD 250 (approximately MXN 5,000) to begin trading with MXN.

However, there are exceptions. OANDA, for instance, offers a much more accessible entry point with no minimum deposit requirement, making it an ideal choice for new traders.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com