Could Bitcoin Replace the Dollar?

Could bitcoin replace the dollar and undermine the United States?

Bitcoin could have some role as a store of value and perhaps some type of transactional utility. Some, like Peter Thiel, have asserted that cryptocurrencies are a type of threat to sovereign fiat currencies.

A country will always want to control all the money and credit within its borders. This helps them ensure that its policy measures are producing their intended effects.

Throughout time, governments have banned alternative stores of value like gold and enacted foreign exchange controls in order to have better control over their domestic monetary systems.

The internal battle

However, the dollar’s biggest enemy is the US itself. Cryptocurrencies are not the biggest threat to the dollar, but rather the country’s economic and policy choices.

Monetary soundness is an issue. When short-term and long-term interest rates are at zero or close to zero and a lot of money needs to be printed now and going forward to fill in various funding liabilities that are only growing wider, this will be a long-term drag on the country’s currency and overall financial position.

Cryptocurrencies like bitcoin and their rise is a product of this environment. When a country’s currency and bonds don’t offer attractive returns – and in fact destroy wealth – then people will begin to look for alternatives.

This is why running negative real interest rates is dangerous.

Domestic investors, who care about real returns, don’t want to put their money in credit investments in things that destroy their wealth over time.

International investors, who care about the nominal return plus the exchange rate movements relative to their own currency, don’t want to invest in things where the nominal return is low and more of it is being created to devalue it over time.

At the same time, China’s rise as a global power technologically, economically, geopolitically, militarily, and in terms of the development of the renminbi and its capital markets are also putting a dent in the US’s influence in the world.

The capacity of fiscal and monetary policy will dictate the dollar’s status

With interest rates at zero and the United States and other Western countries blowing out their fiscal balance sheet, it’s become a mainstream question of how the US will be able to sustain its policy mix.

Traditional monetary policy is out of room when short-term and long-term interest rates are at around zero or a bit below. The economics of lending and borrowing can’t be changed when there’s no nominal return and policymakers aren’t likely to let allow for deflation. They’re always going to target an inflation rate of at least zero and likely closer to two percent.

That means more of the decision-making falls into the hands of the fiscal policymakers, or the politicians (in the US, Congress and the President). That can be a force for good or bad depending on how well the decisions are made.

Fiscal policymakers also have the capacity to tax their populations. But tax receipts are not high enough to offset spending. And a lot of that spending is locked in across many categories. Plus, it’s very politically difficult to cut spending because it’s relied on for income by many different entities.

Money creation is the job of the central bank. So whatever amount of money is needed is provided by the Federal Reserve in the US.

The public’s demand for dollars is largely a function of inflation expectations.

People are less likely to want to hold cash when its real return is negative. And that gets worse if inflation increases (or if the US were to move into a negative-rate regime, which it has avoided).

So really the limiting factor to the US’s policy mix is inflation. Low inflation and low inflation expectations maintain the capacity to keep up its spending without risking the dollar.

And the US has the world’s leading reserve currency. A lot of people globally want to save in it and transact in it, which is the most powerful advantage a country can have.

If there’s reduced demand for the dollar, the first consequence is a move toward higher yields in the bond market. This brings along higher credit costs and has a negative feed-through effect into the economy.

After a point, this causes too much pain, so the central bank wants to “print” money and buy the bonds and take it through the currency instead.

High monetary capacity to stimulate without producing higher inflation, in turn, leads to greater fiscal capacity to continue to push money and credit into the economy without the inflationary trade-off.

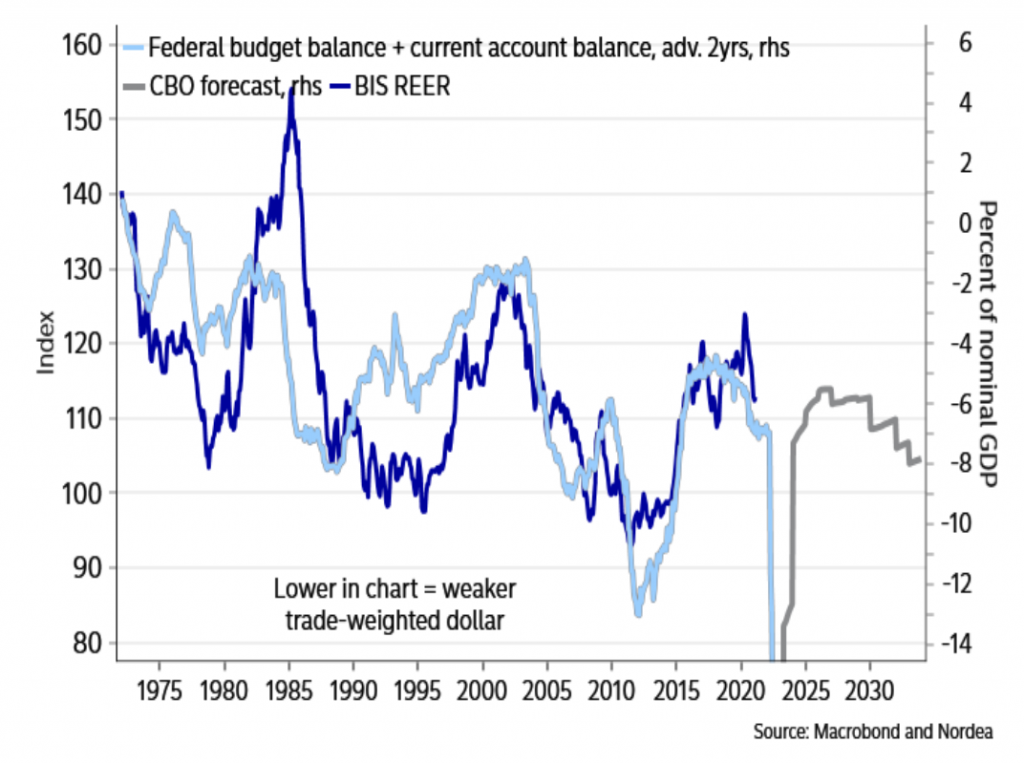

But the balance of payments issue – fiscal and current account deficits – will be more of a problem going forward.

When money is entering a country, these positive capital inflows can be used to increase FX reserves, lower interest rates, and/or appreciate the currency, depending on how policymakers choose to pull these levers.

In short, capital inflows provide deflationary pressures. They can get more growth per unit of inflation. Capital outflows provide inflationary pressures. They get less growth per unit of inflation.

The trade-offs for US policymakers will become more acute as time goes on.

Right now, the US is printing a lot of money and packaging up the revenue shortfall as debt. This debt is then sold to various domestic and international entities and some of it is purchased by the central bank through money it creates to avoid a rise in yields.

Eventually, there’s a real trade-off between inflation, currency depreciation, lower growth, and/or lower real incomes.

The US won’t be able to cut spending much and it won’t be able to collect a lot more in taxes without impacting incentives and capital flows.

The US is also at a point where fiscal metrics are likely to deteriorate further. It’s expected that the US infrastructure programs will only be partially funded. Though done well, these programs can pay themselves back over time through efficiency and productivity improvements.

We’re also at a point where China’s technological and military capabilities are expanding rapidly and it’s forging a stronger alliance with Russia. The US is going to have to continue to raise spending on defense at the same time it has rising obligations with respect to pensions, healthcare, and other unfunded liabilities.

All of this is a gradual squeeze on the financial health of the country and will make budget metrics worse over time.

The combination of the twin deficits (fiscal and current account) is expected to weaken the currency. Deficits require funding to fill, which means issuing debt. There won’t be enough free-market buyers for the debt, so currency will need to be created to buy the excess.

All of this is negative for the currency.

Fiscal and current account metrics are a good proxy for real effective exchange rates (REER):

Fiscal and current account deficits and their impact on exchange rates

Currency depreciation is inflationary taken on its own. Inflationary influences decrease fiscal capacity. Increased inflation worries, or rising inflation expectations, also lower monetary capacity as central bankers can no longer be as supportive when they have a material level of inflation to worry about.

The dollar undermined by cryptocurrencies?

It seems crazy to suggest, as Peter Thiel (and others) do, that the US and its currency could be undermined by growing competition from cryptocurrencies.

There’s something to be said for the idea. Other currencies within a country are perceived as threats by policymakers.

If money and credit being created are simply going into other currencies it defeats the purpose. This is why when a country is developing and/or things get bad, foreign exchange controls are sometimes put into place.

Cryptocurrencies – with some exceptions, like stablecoins – are also inherently deflationary. Only a certain amount of them are allowed to be created and this imposes a cap on any given one.

Of course, new cryptocurrencies can be created. This undermines the limited supply argument overall, but it’s true for most cryptocurrencies. Central banks cannot create them.

This makes cryptocurrencies attractive, similar to the argument for gold, which is often desired by countries to hold as a reserve asset and something to ban when people want to use it to save in over the national currency.

If individuals and businesses wanted to increasingly hold cryptocurrencies instead of dollars, this undermines monetary capacity. Given monetary and fiscal policy capacity work in tandem, cryptocurrencies are somewhat of a threat to the system overall if it becomes material enough.

The digital yuan is another threat to the US’s monetary capacity. China’s central bank (the PBOC) started testing out its pilot program in April 2020 and has started rolling it out more broadly.

The digital yuan is known as a DCEP – digital currency, electronic payment – that uses a centralized state-owned database to control the issuance and exchange of currency.

This will be an even bigger challenge for the US. China has the largest volume of global trade. It has the second-largest economy and the second-largest debt and stock markets, behind only the US.

More and more countries sense that the world is increasingly going from a US-dominated one to a more bipolar order between the US and its allies and China and its allies.

More are aligning with China economically, especially its neighboring countries, which means they’ll start to use China’s currency both for financing and invoicing.

Both the yuan and dollar are in competition with each other. If parties agree to use one currency they aren’t using another.

The US enjoys an enormous advantage from having the world’s top reserve currency. A lot of debt in the world is denominated in US dollars because of the network effects associated with so many entities buying, selling, borrowing, and lending in a particular currency.

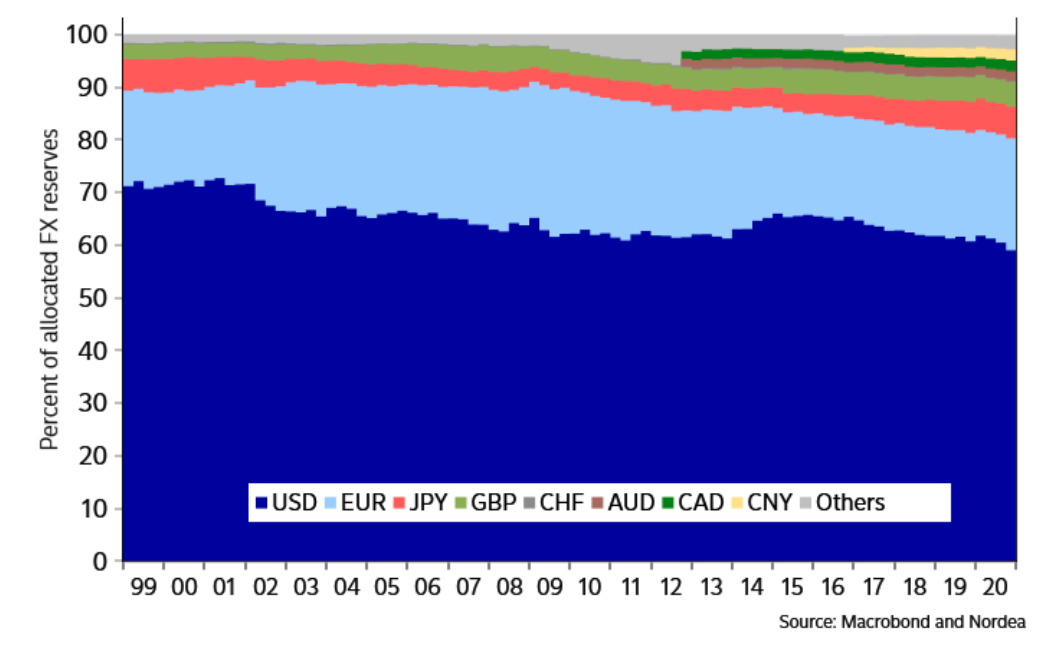

Globally, we know that US dollars are about 60 percent of foreign exchange reserves, 62 percent of international debt, and 57 percent of global import invoicing.

This enables the US to borrow more cheaply, which helps achieve a positive income effect. If you can borrow at a lower rate, you can derive a greater spread.

If there’s rising demand for the yuan (also commonly known as the renminbi, CNY, or RMB), the appetite for dollars will decrease.

This also hurts the US’s ability to apply sanctions to actors in the world it doesn’t want money to fall into the hands of. No money means no power.

If countries like Iran and North Korea have access to funds, that goes against US interests. The currency matter and the US’s decline relative to China (in this, among other aspects) is a national security threat.

This can lead to reduced monetary capacity, reduced fiscal capacity, and so forth.

US reserves are going down gradually over time.

National currencies as a percent of reserves

The dollar is still likely to remain the world’s most important reserve currency for many years, if not decades.

Even China operates over long time horizons, being more strategic than tactical.

It doesn’t believe it will become the world’s dominant power in all the main respects – trade, economics, capital and currency, technology, geopolitics, military – until around mid-century. This is the point at which it will celebrate the 100th anniversary of the People’s Republic of China (PRC), established after the 1949 revolution.

There are many reasons to doubt the value of the dollar over the long term.

In particular, when interest rates are at zero, you have intractable debt problems and many non-debt liabilities, and you’re printing money to cover all those obligations, you’re risking your currency.

However, this development is not likely due to that much influence from cryptocurrencies.

They are largely a function of this environment where people seek alternative stores of wealth in response to the yields on everything else being terrible.

Rather, the US is its own worst enemy. The dollar is largely being undermined due to its economic and policy choices.

Starting at the beginning of the 2020s, China and the East largely controlled the virus through other means (distancing, strict control) while the US and many parts of the West created a lot of money and debt with a lot of economic destruction with liquidity expansion.

This is also going to cause more of a call for re-regulation and tax hikes. In turn, these are likely to create incentives and result in capital flows that the policymakers proposing them don’t like.

At the same time, the US and the West is looking at productivity growth rates of 0.5-1.5 percent versus around 5.0-6.5 percent over the next decade in many parts of the East.

This is causing a wealth shift from West to East and time favors China over the West.

While cryptocurrencies are important to understand, they aren’t the big factor. They’re symptomatic of the big picture forces.

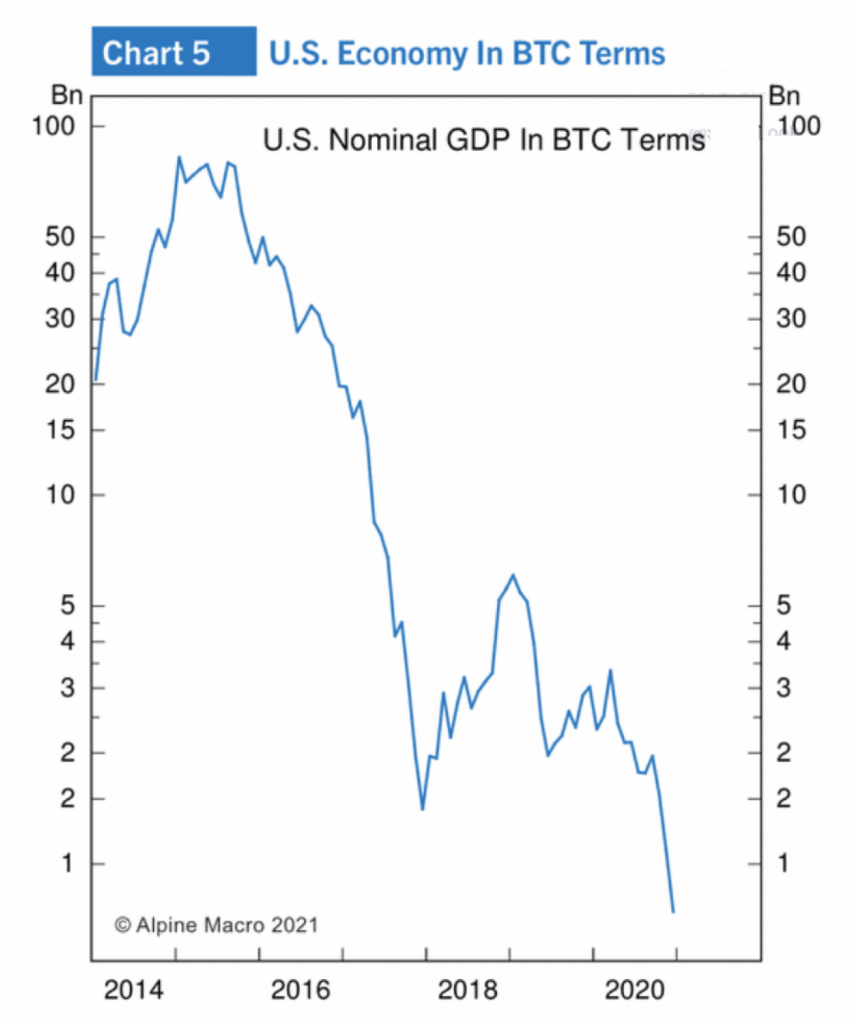

The US economy in bitcoin

If the US economy were priced in bitcoin terms, the entire US GDP would be worth around 500 million BTC.

Bitcoin’s supply cap is 21 million, so bitcoin’s priced would need to be around 20x higher for BTC to match nominal economic activity, or the US economy would need to deflate by 95 percent if BTC were used as the standard currency.

(Note that this is not an argument either way for bitcoin’s future price direction.)

Will the US launch a digital currency?

There’s been speculation whether the Federal Reserve launches a digital dollar, sometimes termed Fedcoin (more officially, a central bank digital currency, or CBDC).

It’s something the Fed is seriously considering, as it can be a way to target policy more directly. It can put money in the hands of specific people and entities and also give certain incentives for it to be used, such as disappearing after a certain period of time.

But an e-dollar would have big implications for the central bank’s already large balance sheet, expanded greatly during the 2008 financial crisis.

A Fed CBDC could draw money out of private banks in bad economic times. To help prepare and alleviate the stress of swings in reserve balances and to accommodate for the demand for an electronic dollar, the Fed would have to maintain a larger balance sheet.

The Fed balance sheet is already over one-third of GDP. It would likely have to elevate beyond that.

The size of the Fed’s holdings would need to remain larger for longer. At this point, Fed officials hope to shrink the size of the central bank’s holdings.

Naturally, it should want to hold a lower balance sheet total. A central bank buying its own country’s debt is a signal of a lack of free-market demand.

Rolling off holdings means a stronger dollar and higher yields, holding all else equal. It means more policy room overall.

But with the monetization of deficits and more debt needing to be issued to cover incoming larger obligations, a smaller-sized balance sheet – especially without roiling Treasury markets – is unlikely.

Impact on Portfolios and Trading/Investing Strategy

Currency diversification is more important than ever.

The entire purpose of trading or investing is to convert your assets into more spending power down the line. Your returns are not just nominal returns, but nominal returns plus the effects of your currency.

Most people place a lot of focus on whether their assets are going up or down, but not much attention to what’s going on with their currency. This is another reason why policymakers like to depreciate their currencies during times of stress if they can. It’s discreet and a type of hidden tax.

Strategic alternatives can represent various different things for traders and investors.

Cryptocurrencies are popular, but highly speculative. Bitcoin and others can be a sliver of a portfolio. But a small amount, even less than one percent of your allocation (or net worth), is still a lot of volatility and risk that’s not appropriate for everyone.

Cash and bonds in most of the developed world yield less than the rate of inflation. Your wealth is being destroyed in those so you probably don’t want to hold much, if any. They provide some level of diversification, but holding your money in them will erode your buying power over time. Plus, there are asymmetric risks in holding bonds if there’s an uptick in inflation or normalization in real interest rates.

Stocks normally yield a bit over three percent extra return – a risk premium of a bit over three percent – over 10-year bonds, using the past 50 years of US financial data.

| Name | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | ||

|---|---|---|---|---|---|---|---|---|

| US Stock Market | 10.39% | 15.60% | 37.82% | -37.04% | -50.89% | 0.42 | ||

| 10-year Treasury | 7.21% | 8.03% | 39.57% | -10.17% | -15.76% | 0.34 | ||

| Cash | 4.69% | 1.01% | 15.29% | 0.03% | 0.00% | N/A |

But if 10-year bonds only yield 0.5-2.0 percent, that’s 3.5-5.0 percent in stocks while taking on a lot of volatility and left-tail risk.

East vs. West

Nothing is that attractive, especially in the West.

But traders and investors also tend to be very Western-centric when they don’t necessarily need to be. While the low-yield environment is characteristic of the West, it’s different in the East. (And cyclical emerging markets are an option as well.)

In much of Southeast Asia (not only China), they have:

- a positive cash rate

- a normal bond yield, and

- an upward-sloping yield curve

An upward-sloping yield curve means duration (e.g., buying bonds over cash, or stocks over bonds) pays out in a normal way unlike in the flat or inverted yield curve situations that are increasingly common in Western economies.

So, as a trader, investor, or anybody trying to make money in liquid markets, you have to genuinely think about playing both sides.

How you get that access is up to you. There’s an ETF for just about everything, if you wish to stay as simple as possible in getting exposure.

Diversifying

Over the past 200 years of financial history, there’s never been a decade where at least one major asset class didn’t decline by 50 to 80 percent or more.

That includes stocks, bonds, gold, commodities, and even cash. Though cash isn’t thought of as risky because it isn’t volatile it loses its value over time through inflation.

So, there is no one single answer about what to hold. You can’t necessarily be sure what’s going to do good or bad. But you can be pretty sure that financial assets will outperform cash over time.

So you have to have balance. Done efficiently, it will reliably capture risk premiums without too much of the big ups and downs, especially the large drawdowns and left-tail risk.

There are also the circumstances surrounding the central focus of this article (e.g., could bitcoin replace the dollar?), which involves the dollar and the various threats coming at it. These aren’t necessarily short-term threats, but they are material over longer time horizons.

This includes US policy and economic choices, as well as other threats from the yuan and private currency projects.

So increasingly you can benefit from a well-diversified portfolio that:

a) shifts away from seemingly “safe” low-yield debt assets that provide low to negative real returns, and

b) moves away from a portfolio concentrated in US dollars – or any Western currency, as all largely share the same fundamental structural issues – to one that is more diversified by different currencies, including various store of wealth assets.

This can include, but is not limited to:

- some stocks (especially those that don’t rely on interest rate cuts to keep their earnings up)

- gold

- inflation-linked bonds

- precious metals

- commodities

- collectibles

- tangible assets

- income-producing assets that can be held privately

- bitcoin and cryptocurrencies

- real estate, and other alternatives

Balancing by risk, rather than dollar amounts, is going to improve your return to risk ratio more than anything else you can feasibly do.

For example, if you own gold and commodities, you’re probably not going to want to own as much of either of them as you would stocks.

And if you want to own bitcoin and cryptocurrencies, those have so much volatility relative to everything else, so you need to be careful about concentrated crypto allocations. So you probably don’t want to own a ton of those relative to things that are less volatile and more reliable at generating income.

Bitcoin and crypto can be a small store of wealth alternative because things like cash and bonds are so bad, but not in a big way when it comes to prudent allocation. Even one to two percent of a portfolio in bitcoin or cryptocurrency can be a lot.

Institutional adoption of digital alternative assets will be a process that plays out over time as liquidity and regulation play out, as well as the need for these entities to observe the track record and general volatility level of assets in this space.