The Technology War: Impact on Markets & US-China Relations

The technology war is a particularly serious conflict within the scope of US-China relations.

Both countries know that whoever is superior technologically will also be superior in most other ways. Whoever wins the technology war is also very likely to win the economic and military wars as well.

For this reason, the technology war is a more important conflict than the trade war.

To briefly rehash, the US and China are mired in five broad categorical conflicts that are important for traders and investors to understand because they will ultimately determine the world order and how that plays out down the line in the 21st century.

These “wars” or conflicts include:

i) trade and economic

ii) capital (currency, debt, capital markets)

iii) technology

iv) geopolitical

v) military

The same things tend to happen over and over again historically for the same reasons.

Studying history and analogous situations in other societies and other lifetimes can help you understand how the cause-effect drivers of these conflicts tend to play out so you can anticipate them and make better decisions in the markets.

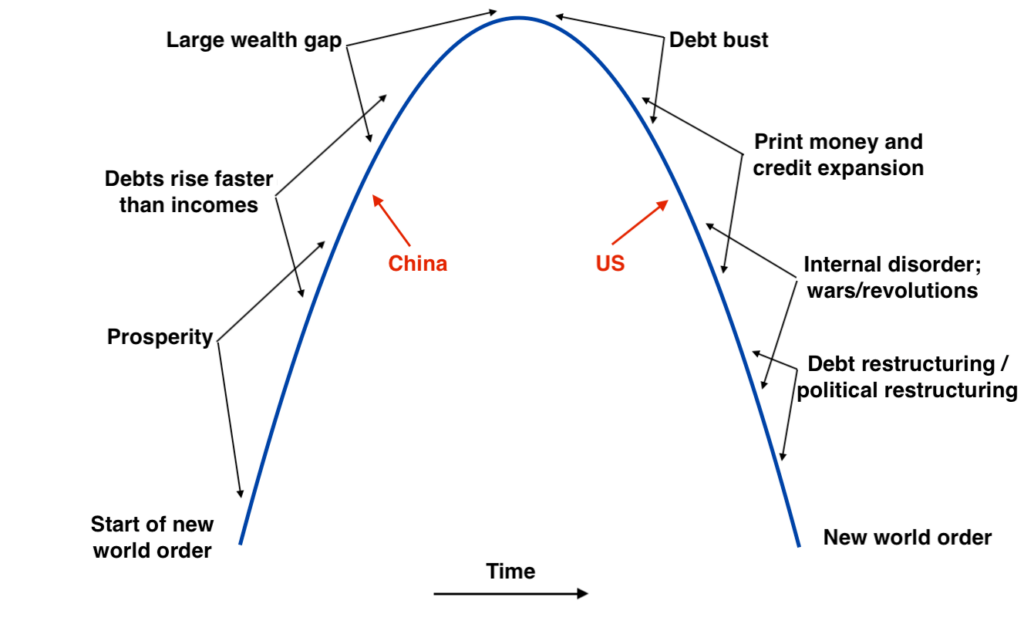

With respect to a generalized framework, we believe the development arcs of empires roughly follow this template and believe the China and US are where they are as pointed out on the following graph.

US and China and the fight for tech dominance

The US and China are now the top two powers in the world’s technology sectors.

These sectors are also the industries that will drive the big productivity improvements globally going forward.

To date, China has largely prevented US tech companies from coming onshore and instead aimed to develop its own independent technologies and platforms to fill these gaps.

For example, it has its own Google (Baidu). It has its own Amazon (Alibaba). It has its own Twitter (Weibo, the Chinese word for “microblog”). For internal payments, Ant Financial is the primary service. Xiaomi produces electronics and accessories.

China’s tech companies have become a competitor in world markets. Yet China still remains heavily dependent on the US and other countries (e.g., Taiwan) for semiconductors.

As a result, the Chinese are vulnerable to being cut off from US (or non-US) essential technologies while the US is susceptible to the increased development and competition stemming from the technologies China is producing.

Their relative positions

The US has a great overall lead in the technology race. But there is great variance by the type of technology. Moreover, the US is losing its overall lead.

One can look at the relationship in an imperfect way by looking at the market capitalization of all US technology companies versus the market capitalization of all Chinese tech companies.

The US tech industry is about twice the size of China’s based on this measure, though this gap is shrinking, as China’s market is growing faster than the US’s share.

But, in reality, China’s tech industry is already more than 50 percent of the US tech industry given some of its big technology companies are private companies where their valuations are not marked to market and reflected in official market capitalization figures.

Moreover, the public sector controls more tech development in China than in the US, where more is controlled by the private sector.

Alibaba’s largest tech companies, Alibaba and Tencent, are right behind the US and its contingent of Facebook, Amazon, Apple, Microsoft, and Google (“FAAMG”).

Nearly half of the world’s supercomputers are in China. The US leads in artificial intelligence (AI) and big data but is behind in overall 5G development.

There are also multiple dimensions of the race in AI, big data, communications, encryptions, digital security, and computing where China is ahead.

China also has more mobile financial payments and a larger volume of e-commerce transactions.

There are also, of course, other technologies that are being developed without broad knowledge of the world.

China’s potential technology lead

China is likely to develop its technologies and the types of decision making it does with them more quickly than the US.

The combination of data, artificial intelligence, and great computing power all complement each other to create better decision making. China is also committing more overall resources to these areas than the US.

China collects large amounts of data on its people and has more than 4x the population. To get the most out of this data, they need the ability to turn it into something useful. This involves using AI to detect patterns that have causal meaning and the ability to develop algorithms that can drive value-additive results. And, of course, they need the ability to process all this (computing power).

Both the government and venture capitalists provide resources in China, which are ample to those developing the technologies.

In terms of the talent pipeline, China’s culture places a large emphasis on education and careers in technology, math, science, and engineering, and they have about 8x the talent pipeline going into these fields relative to the US.

The US isn’t destined to concede in this area necessarily, though it’s already behind in some respects.

The US does have the benefit of its universities and the innovation going on at its top tech companies.

Its relative position is declining, but this is due to China’s tech capabilities developing at a faster rate. Its absolute power is still on the ascent.

Technology threats

The US is working to undermine the use of certain Chinese tech products within the US and globally. You can see such actions against Huawei, WeChat, and TikTok. This also includes potentially getting items they need for production.

There are a few main types of motivations:

i) Fears of China extracting data to spy in the US and other parts of the world

ii) Retaliation for not allowing US companies to access China’s market

iii) To retard the development of Chinese technology companies and undermine their global competitiveness

Whatever the relative merits and weights you might assign to each of these, Chinese companies are becoming more competitive at a rapid pace, which the US is looking to thwart that evolutionary process.

While the US is cutting off Chinese access to intellectual property, it would have had much more power to do so had it acted earlier because it wasn’t long ago that the US had so much more intellectual property relative to other countries.

China is also cutting off the United States from its own IP, which is hurting the US as it’s becoming superior to American IP in many ways.

IP theft is considered a big deal, with approximately 20 percent of all US companies claiming that China has stolen technology from them, according to a CNBC survey.

It is broadly considered a material overall threat to the US and the US-China relationship. At the same time, the actions taken to penalize Chinese tech companies cannot be fully explained through stolen technology alone.

If Chinese companies were breaking the law within the US through spying and espionage schemes, we would expect to see this being legally prosecuted. This would help open up the evidence to look at how it’s allegedly happening. But we don’t see this.

This means China’s increasing competitiveness is a material source of motivation behind the measures taken against these companies.

Policymakers understandably won’t say that US technological competitiveness is waning. Moreover, it’s hard to sell to Americans that the free flow of competition should be impeded (i.e., anti-thetical to most Americans and classic American culture). Doing so seems unfair and not the best tactic for producing the best results.

Stealing and copying of intellectual property has been going on since the beginning of recorded human history. It’s not easy to stop.

The British used it to aid their ascent over the Dutch empire, and the Americans did it to the British.

The word theft or stealing also implies that a law or laws are being broken.

However, when a war is going on between two countries there are no international laws, judges, or arbiters to resolve disagreements.

On top of that, policymakers don’t always have the incentive to disclose the real reasons or motivations behind why they’re doing what they are.

This isn’t to say that what the US is doing doesn’t have good reasons behind it. It simply means the reason why they’re doing them might not be for the reasons that are commonly put out there publicly.

This is why protectionism has seen a resurgence. It helps protect domestic industries from foreign competition. The US views Huawei as a threat because its technology is superior to its own.

This is why China won’t typically allow US companies to compete onshore. If they do, it’s often to learn so they can do it independently.

The American companies, if they’re permitted, often want to do business with China despite this risk because they want to tap into China’s massive market. They have shareholders to appease so they often believe the prospective rewards are worth the longer-term risks to being copied and potentially run out.

Alibaba and Tencent don’t compete in the US for the same reason Amazon and many other tech companies aren’t allowed to compete freely within China’s market.

Ongoing decoupling

Overall, it really boils down to the fact that there’s a technology war going on involving a decoupling of the two countries.

Instead of sharing resources, the two are developing new technologies independently – e.g., AI chips, quantum computing, 5G, information and data management, and others.

This will have a notable impact on what the world will look like going forward.

Market impacts

There are many unknowns, and like trading in general, the unknowns are high relative to what can be known relative to what’s discounted in the price.

Both the US and China are perfectly valid markets. China’s markets are discounted to grow faster than US markets.

Many investors believe that China will become the world’s dominant power in many ways by 2040 or 2050. China’s own plan involves grand expectations for its future and status as a superpower by the People’s Republic of China (PRC) 100th year anniversary in 2049.

Given that they are decoupling, trading both is likely to have greater than normal diversification benefits.

The US-China conflict (and West-East conflict more broadly) will be something that’s with us for practically the rest of our lives. How that transpires is likely to radically alter global capital markets.

While it may not seem like much from a day-to-day perspective, these changes will add up.

If there are two horses in the race that are neck-to-neck, you might want to bet on both to some degree.

Moreover, while flat yield curves and no nominal returns on cash and bonds (negative in real terms) might be true throughout the developed Western world, it’s a different story in the East, which has a normal interest rate, normal yield curve, and normal overall yields on its investment assets.

When the world is undergoing such changes, and with these changes having an impact on capital flows and markets, it’s important not to become too dependent on any given market or outcome. Diversification by asset classes, countries, and currencies is more important than normal.

The yuan is likely to come along as a reserve currency as China’s economy grows and its per-capita incomes get closer with those in developed markets.

Chinese markets have growth, yield, and currency tailwinds relative to Western markets.

At the same time, foreign investors will need to work their way in carefully.

China’s a bit of a different place and it will take some time to get used to their system and their way of operating.

It’s very different from what most investors have encountered in their lives and it’s important not to have preconceived notions or simple stereotypes of what China is and how they govern (e.g., “that’s what communists do”). China has a top-down industrial policy.

That will give many Western investors pause, who are used to more open forms of competition and not accustomed to a state-led type of capitalism.

Moreover, its payment system is not well-developed at this point and Shanghai is not yet a world-class financial center like what New York is to North America or London to Europe.

But with flat yield curves and the inability for central banks to stimulate policy in the normal ways, Western countries are going more toward a monetary policy and fiscal policy unification as well, which some might call MMT.

Governments protecting strategically important entities will become more of a thing in Western countries as well.

Accordingly, more traders and investors are likely to increasingly put a premium on companies that have strategic importance within the US and other countries in the realms of:

- technology (e.g., AI, computing, 5G, data and information management)

- strategically important goods (e.g., rare earth metals, oil and energy production)

- military and national defense reasons (e.g., aerospace, defense, arms, security)

Unlike the Cold War, with the divide between the US and Soviet Union, market participants can place bets on both sides.

Many US traders and investors take the stance of, “The US is going to be the dominant power for a long time and keep growing its markets like it has; US technology will continue to be better and the growth and productivity will continue to be here.”

Or you can think something like, “Why take a concentrated risk on the US only while all these various types of conflicts play themselves out with China looking increasingly strong. It’s okay to diversify some of that risk.”

China has its own monetary and fiscal policy and has its own unique economy. While some Westerners still mistake this as a classic “capitalism versus socialism or communism” divide, it’s not like that.

China may be top-down but one can’t objectively say one system is necessarily better overall. There are pros and cons to each.

How could the technology war get worse?

China is still dependent on the US for imported tech and tech components that come from both US and non-US sources that the United States can influence.

The technology war remains as something that the US can weaponize due to its ongoing control and its technological edge over China (though that’s declining).

The biggest conflict – and China’s biggest fear – revolves around semiconductors.

Taiwan Semiconductor (TSM) is the world’s leading provider of chips. It can be influenced by the US and is a key dynamic in the technology war.

At this point, there is still more in the technology domain that the US can do to hurt China than the reverse.

If the US were to try to cut off China from essential tech and tech components, that would represent a major escalation in the technology war and in the overall broader conflict.

China nonetheless has time on its side.

As it continues to progress at the rate it’s been progressing, China will be more self-sufficient on the technology front and in an overall stronger position than the US by perhaps 2030 or sooner.

And by then, we can be pretty sure the countries will be further dissociated from each other in this category.