US-China Relations & Their Impact on Financial Markets

US-China relations is one of the big themes that will drive geopolitics, economies, and markets over the ensuing decades.

Accordingly, it can be highly useful to look at the current dynamics even among traders who look out over shorter-term and medium-term time horizons. What the positions the US and China find themselves in currently and what they mean for US-China relations?

What are the root causes of the current tensions? And what is the history of such conflicts to better understand what each side is interested in and how things might play out.

The US and China are now rivals in many different ways, so there are various types of conflicts or “wars” along these dimensions. And each is positioned uniquely in relation to them.

These conflicts have happened historically, so we’ll be looking to them to draw parallels. While over time, the people change, the technologies change, and the empires change, the same things tend to happen over and over again for the same reasons.

What are the things we can take away from these conflicts to understand US-China relations (and China’s relations with the West more broadly)?

We can also look at the range of possibilities that might be considered as future outcomes. These have market implications.

At the same time, we can do this without making explicit predictions of what the future might look like, though it has consequences for how you might position a portfolio.

Key Takeaways – US-China Relations & Their Impact on Financial Markets

- US-China tensions span multiple “wars” (trade, capital, tech, geopolitical, and military) each with market-moving consequences depending on how cooperative or hostile the relationship becomes.

- Cycles of rising and declining power matter: The US is financially stretched, China is rising. These dynamics influence everything from monetary policy to military posturing, and markets react to perceived shifts in power.

- Investor narratives are shaped by media and politics: Biased framing of the conflict, especially in election seasons, distorts risk perception and can drive sentiment-based price swings.

- The creditor-debtor relationship is fragile: China holds large amounts of US debt, while the US depends on debt monetization. Currency, bond, and reserve status risks follow.

- Markets must consider power, not just cooperation: Future positioning hinges on how each side uses, withholds, or tests its power, including how red lines are drawn and enforced.

Cultural Differences and How They Create Misunderstanding

First, let’s look at cultural differences and how they create misunderstandings between the US and China.

China’s governance structure is intended to prioritize qualified leadership and greater freedom to pursue long-term strategic goals.

They believe that turning that process into a popularity contest with elections risks putting the wrong people in charge and creates overly short-term, tactical decision-making. People want what they want now, and tend to not really care about future indebtedness or problems.

The culture is also more accepting of a “top-down,” hierarchical approach to governance where people more readily defer decision-making to people who are wiser and more qualified than them in those particular areas.

The US is more “bottom-up” with a flatter hierarchy that prioritizes the role of the individual and it’s more important for people to be opinionated.

Many parts of the US political system bypass public elections as well (e.g., judiciary, military, Federal Reserve), where they’re selected heavily based on specialized knowledge.

In China (and to a lesser extent, Vietnam, because they’re less talked about), it’s confusing to them why their governance approach is so widely misunderstood and distorted by Western media when it’s not all that different from how large companies are run.

Vietnam and China retain the Communist Party name for basically the same reason the two main US political parties also retain their 19th-century monikers, even though their policies have evolved dramatically over time. It’s a symbol of historical continuity and political legitimacy, even though VN’s/CN’s modern policies prioritize market-driven economics over the highly redistributionist ideology of the Cold War era.

| Category | United States | China |

| Governance Philosophy | Bottom-up, individual-centered democracy | Top-down, merit-based technocracy under centralized leadership |

| Source of Legitimacy | Popular elections and constitutional rule | Performance, historical continuity, and institutional stability through the Communist Party |

| Political Structure | Multi-party liberal democracy (primarily two dominant parties) | One-party system under the Chinese Communist Party |

| Leadership Selection | Elected through public campaigns and voting (President, Congress) | Promoted internally through Party ranks based on performance, loyalty, and expertise |

| Policy Time Horizon | Often short-term, driven by election cycles and public sentiment | Long-term strategic planning through Five-Year Plans and centralized initiatives |

| Decision-Making Style | Decentralized, competitive, debate-focused | Centralized, consensus-seeking within Party elite |

| View of Public Participation | Civic engagement, protests, free media encouraged | Public input through controlled channels (e.g., petitions, surveys, consultative bodies) |

| Military Governance | Civilian-controlled; military reports to elected President | Party-controlled; military reports to the Central Military Commission of the CCP |

| Judiciary | Independent judiciary with lifetime appointments (e.g., Supreme Court) | Subordinate to Party leadership; courts are state organs of the CCP-led system |

| Central Bank (e.g., Fed/PBoC) | Federal Reserve is independent but appointed by elected officials | People’s Bank of China reports to State Council and coordinates with central planning |

| Media & Information | Private, pluralistic media with legal protections for free speech | State-owned or state-aligned media with strict content controls |

| Business-State Relationship | Regulatory and lobbying environment; separation of powers | State-guided capitalism; Party cells embedded in large firms to guide alignment |

| Leadership Training Pipeline | Varied backgrounds; few formal prerequisites to run for office | Rigorous Party training, career progression through local/provincial roles, Party schools |

| Constitutional Flexibility | Written Constitution with entrenched rights and checks | Constitution exists but is subordinate to Party leadership and adaptable to Party direction |

| Public Opinion Role | Highly influential; leaders must maintain popularity | Considered but filtered; focus is on stability, not popularity |

| Ideological Branding | Historical parties (Democrat/Republican) with evolving platforms | “Communist” in name, pragmatic in policy; market-driven with nationalist overtones |

| Cultural Attitude Toward Leaders | Skeptical, adversarial press; “citizen as check” | Deferential; expectation that leaders are wiser, trained, and entrusted |

| Comparison Analogy | Democracy as an open-source software project: anyone can contribute | Governance as a high-performance enterprise: leadership requires credentials and discipline |

This chart captures how both systems are structured to serve different values and historical experiences. The US model emphasizes distributed power and individual liberty. China’s model emphasizes unity, order, and expertise-based leadership.

Both systems have parts that are more similar than often recognized, such as unelected technocratic institutions, but their surrounding political cultures interpret those roles very differently.

Win-win or lose-lose scenarios

Both sides in a conflict can choose to engage in win-win scenarios. Win-win scenarios provide cooperation, seeks out mutually beneficial outcomes, and great possibilities and alternatives (e.g., technologies, consumer products).

There can also be a lose-lose relationship, where there’s non-cooperation and one or both is more threatening and less amenable to a working partnership.

It takes both to agree on what type of relationship they will have.

In a win-win scenario, both will take into consideration what the other wants and is important to them and will give it to them in exchange for something. Negotiations can be tough, but done with consideration and respect at the same time.

In a lose-lose scenario, they will primarily think about how they can disadvantage or inflict pain on the other. This path is more likely to lead to destructive conflicts than productive interchange.

Throughout history, small conflicts have eventually escalated into much larger conflicts that are worse than the leaders initially imagined. Even to the point where leadership wishes they would have turned on a more cooperative path.

Either side can force a more hostile, threatening relationship. Both sides need to agree to the win-win path.

Both parties, regardless of which path they believe is best, need to think about what they want and what their relative powers are, as will market participants trying to predict events as they will unfold and their influence on financial markets.

The media will typically conjure up images of “good guys” and “bad guys” – i.e, on domestic fronts, the ideological side they’re typically biased toward supporting is “good” while the side they don’t support is “bad” and they take their own country’s morality as superior to that of countries where relations happen to be less than favorable.

Gossip and salacious stories sell better than objectively reporting stories in a balanced way. Moreover, many journalists have their own ideological biases they’re looking to push. They have strong preferences to be critical and many will intentionally distort facts to create stories of evil people in positions in power. Because this approach sells well, and their audience typically revels in this type of reporting, it’s incentivized and further rewarded.

For example, the US-China trade conflict (“war”) was amply used as partisan fodder in the US media, both to rail against opposing political parties and personalities, and paint China in a negative light. We can expect these types of distortions going ahead in many of the ways in which the US and China have conflicts and where they’ll become increasingly apparent.

Therefore, those who see the world through the media’s eyes will be likely to look for who is good and evil rather than looking at what the vested interests and relative powers are and how that dynamic is being played out.

In cases of one’s own country versus another, while it’s appealing to embrace stories of one’s home country being moral and the other not, most of the time these two countries simply have different interests they’re looking to maximize.

Conflicts can also be particularly bad within countries. Political leaders are often led by their ideological biases, which divide people. Even agreeing on basic facts can be difficult and working in everyone’s best interests in an environment that’s often unprincipled is rare.

Policymakers will typically pretend they’re acting in the interests of the whole when in reality they are working in the interests of themselves and their constituents.

In international relations, the only rule is that there are no rules. Countries act in a much more self-interested and less considerate way than most might imagine, especially by the standards one would expect to be appropriate between individuals.

Maximizing one’s own interests is the primary objective. Smart leaders are aware of their own countries’ weaknesses, look to exploit other countries’ weaknesses, and expect the other countries’ leaders to try to do the same.

In more cooperative scenarios, each party should recognize their own vulnerabilities and the vulnerabilities of the other side and how each can exploit the other (if only for prudent defensive purposes), while appreciating the quality of the exchange.

In more hostile paths, each side should recognize that the power each has will be determined by the relative abilities to endure pain from the other side as well as the ability to impose it.

The more cooperative path is preferable because the inflictions of punishment and how each side handles it is uncertain.

The threatening path will make clear which side is dominant and which one will be compliant and lead to various types of conflicts – trade, capital, technology, geopolitical, military – that can be highly destructive.

Power

Both sides want to have power, should respect power, and use it in a cautious and fair way.

Having power is clearly a desired goal as it helps in winning agreements, setting rules, and enforcing their own interpretation of the laws (or to set or nullify rules or laws to get what they want).

The use of power goes in a sequence:

i) When disagreements occur, those involved in the disagreement will first try to resolve them independently.

ii) If that isn’t effective, they’ll resort to established ways of operating, whether that means pacts, agreements, rules, or laws that both agree to abide by.

iii) If that doesn’t yield results, and those who value getting what they want above the respect for rules and laws, will turn toward using their own power.

When one side wants to use their power and the other side doesn’t acquiesce to these demands, there will be a conflict or war in some form.

The conflict tests the relative power between the two sides. They vary in severity. They can take many different dimensions or they can be limited.

It will involve doing whatever is required to get what one wants. Normally, it will establish one side’s superiority over another and lead to a period of peace, as no side wants to fight the most powerful entity until its power wanes and that supremacy is no longer as clear-cut.

Once this occurs, this dynamic renews and you get conflicts.

Respect power

Respecting power is important. It’s not a good idea to start a war one is clearly going to lose. Negotiating is the more practical strategic approach when one lacks the power to be impactful on various fronts (military, geopolitical, technology, economics).

Use power sensibly

Using power sensibly is also critical. Forcing others to give you what you want – essentially coercing them – is not generally wise. Trust and benevolence are important for producing mutually beneficial relationships that are more rewarding than hostile relationships.

Using power in a “soft” way is often better than using it in a harsher way.

In hostile scenarios, one has to get out of them one way or another.

That might include uncoupling or dissociation – e.g., separate supply chains, diminished (or non-existent) trade relations, independent technology development, separate global spheres of influence. It can also include a military war.

Using one’s power sensibly often means not demonstrating it openly.

To do so will typically mean others will feel threatened, including countries that are not directly involved in any tension. They will be more likely to build their defense systems, which can lead to two-way tensions and more acrimonious relations. (Consider North Korea today as an example.)

While having power and not openly displaying it is generally the best way to handle it, sometimes showing it and threatening to use it is most effective to improve one’s bargaining position and preventing a fight.

There is value in knowing what matters most to the other side and what matters least. What will they fight for and what will they not fight for, and how will they fight to accomplish these matters?

To determine what this looks like, it helps to look at how they’ve used power in the past, what they’re going after, and by testing them incrementally but sensibly.

When each tests the other, it often leads to escalations in a tit-for-tat way that can put both parties in a position where they need to fight or undermine their own power by being caught bluffing.

Tit-for-tat escalations can often take conflicts beyond where both would rationally want them to go.

This is where it can be helpful to know the relative powers of each and what that balance of power looks like. Who would gain and lose in the event of a fight?

This is what both sides will need to keep in mind because it ultimately determines an equilibrium where both entities might consider an equitable resolution of a dispute.

In other words, if there was a “world court” that interpreted what was “fair”, what might that look like when considering what the terms of a negotiated agreement might be?

Unnecessary power

While having power is useful, having unnecessary power can be a burden as well.

Maintaining power consumes time, money, and other types of resources. There’s a responsibility that is burdensome.

Countries need to maintain military power to support their interests and overall power.

Power also involves thinking about when to reach an agreement and when to fight.

There are also short-term and long-term effects to consider. Power changes over time.

When one is the most powerful, you can use it to negotiate an agreement, enforce an agreement, or fight a war when you have that advantage.

For the more powerful entity, that means it typically pays to fight first if one’s relative power is declining. Similarly, if one’s relative power is increasing, it pays to fight later and increase power without ruffling too many feathers along the way.

And naturally, there are also times when wars are rational and inevitable to get what one wants and/or needs.

War

When two sides have comparable powers that include the power to cause great harm to the other, the risk of a ruinous war is high. That is, unless the political relationships between the leadership of both sides are high such that they can trust that they won’t be intolerably harmed or killed by the other.

In game theory, the prisoner’s dilemma explains a situation where you can either cooperate with someone or kill them, and neither of you is certain what the other side will do.

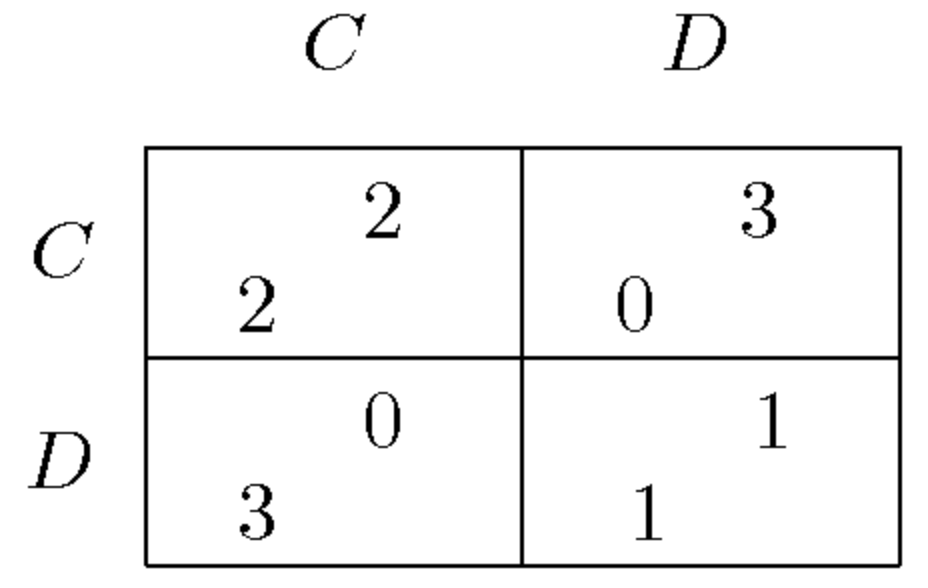

In simple academic terms, the diagram commonly appears as follows, with a “C” for cooperate and “D” for defect. The cooperative path gives the most overall value (“four points” total in the academic exercise). If you defect and the other cooperates, you get three points and the other party gets zero. If you both defect, you each get a point.

The best thing is for both you and your opponent to cooperate.

But the logical thing for you to do is to kill the other before they can do the same to you. That’s because survival is of the highest importance and you don’t know if they will kill you even though you know it’s in their interest to do so before you kill them.

That means the equilibrium (i.e., the Nash equilibrium) of this game is (D, D) or to defect or kill your opponent.

This is why, among opponents who can inflict deadly harm on the other, having safeguards that are mutually established and reliable are necessary to avoid these types of wars.

Exchanging benefits (e.g., trade, capital, technology) that would be unacceptable to lose brings not only greater abundance but also helps to reinforce good relations.

Wars are extremely dangerous because:

i) the costs of wars are enormous

ii) most occur when it’s uncertain who is most powerful and what the outcomes will be, and

iii) losing wars is extremely devastating

Wars should only be entered if there is confidence that there will not be losses that are intolerable. Therefore, leaders need to fully crystallize what they are really willing to unconditionally fight for.

International relations involves a wide range of considerations

Though this article primarily focuses on US-China relations, it applies to all countries in various ways.

Leaders and policymakers must consider the various positions, strengths and vulnerabilities, and possible moves of a number of different countries in a multilateral way – some more important than others relative to an individual country’s scenario and relative to the world.

Many countries are also playing the international relations game and have a wide range of considerations to evaluate across different dimensions – e.g., economics and trade, politics, military, technological, and so on.

Moves have to be weighed across a variety of different dimensions.

Other players in the game that we’re broadly calling US-China relations include European countries, Russia, other Asian countries, India, Japan, Australia, and others to a lesser extent.

Each of these countries has many factors and different constituents that impact their decision-making and how things play out.

Traders and investors will have to consider everything relevant to make winning decisions in the markets.

This will include:

– trade (as it already has in the past)

– technological development and what companies will benefit

– how much to allocate to various countries and their markets

– what companies are strategically positioned to benefit, and so forth.

While the job of one trying to place winning bets in the markets will be difficult, being a policymaker in a position of power in these situations will be even more difficult.

They will also have information that market participants will not have access to. So, traders will need to approach their decision-making in a cautious and humble way and not presume they are more insightful about what’s going on and what the best way to handle everything is.

With that said, we will aim to provide what we think of US-China relations and the world in light of these conflicts.

Where the US and Chinese stand across several dimensions

Everything tends to transpire in cycles.

The US has gone through many types of cycles that have led to its upswing across various dimensions – economics, trade, capital markets, reserve currency status, military.

This also led to excesses in various ways. For example, protecting your interests requires military strength, which is costly.

Having a reserve currency makes it easy to issue debt and “print” money when running into financial problems (e.g., 2008, 2020) and, in general, when you need to perpetually spend beyond your means. This describes the US’s situation with respect to its military expenditures and additional unfunded obligations related to pensions, healthcare, among others.

These excesses lead to a weakening in their various ways.

China has also gone through their cycles over time, which has led to unacceptably poor conditions during parts of their history and the big transformations and reinforcing upswings that have led to its current position as a growing world power.

The US debt cycle

The US finds itself in the classic situation where it has too much debt relative to income (which, in turn, is produced from productivity outcomes).

It also has had to rapidly produce a lot more debt because of the aforementioned factors related to pensions, healthcare, and other unfunded liabilities that are coming due.

Even though these unfunded obligations don’t show up in the headline “national debt” number, they are very much cash flow driven and at a magnitude much higher than that overall national debt figure.

The US can’t service this debt with hard currency. So it will have to monetize the debt in the classic way of the Fed (central bank) “printing” money to fund the government’s deficits.

These excesses and long-run financial problems are a consequence of the US’s success.

Because the US became the undisputed world power in 1945, the US dollar became the world’s top reserve currency upon the establishment of the Bretton-Woods monetary system.

Why reserve status is so important

Within a country, the government can declare that only the money that it prints is legal tender. However, between countries the only money that’s acceptable is the currency that those who are transacting in agree to is acceptable.

This is why gold and reserve currencies have been so important in transactions between countries over time and why every great power wants – and eventually has – a reserve currency.

People within countries typically exchange paper currency with others to do transactions in the country, but don’t recognize that the money is not valued much outside the country.

That enabled the US to borrow a lot from other countries who wanted that currency. The demand for the currency also kept the borrowing rates down. Debt conveys spending power. One person’s spending is another person’s income.

So the US derived a great income effect from this, which shows up in GDP per capita numbers.

The US-China creditor-debtor relationship

This borrowing also came heavily courtesy of China’s demand for the debt. As China grew its income and monetary reserves starting in the 1980s and more forcefully in the 1990s, it wanted to hold the world’s dominant currency through US dollar-denominated debt (US Treasuries).

This put the US in a type of situation where it owes other countries, like China, a lot of money over time. Bonds (debt) are a promise to deliver currency. It’s also put these countries in the awkward position where they hold the debt of a country that’s financially stretched.

That debt is increasing and the US is having to monetize the debt over time (i.e., the central bank prints money to buy it because of insufficient demand from international entities and its domestic private sector).

This makes US debt and currency less attractive. It can even get to a point where it endangers the US’s reserve status.

To domestic investors, US debt is largely unattractive because it pays a negative real return, which is the nominal interest rate it’s denominated in minus the inflation rate. If inflation is about two percent or so, then any yield on the debt under that gives it a negative real return.

For international investors, US debt is unattractive because the yield on it is low and the need to produce a lot more debt over time and print a lot of money to cover it devalues the currency.

So, because of the US’s reserve currency status, that made China want to save in the US dollar, and led to Americans wanting to borrow a lot, which made the US overly and perpetually indebted and China holding a lot of low-yielding and devaluing money.

This has led to a delicate creditor-borrower relationship between the US and China at the same time various other types of conflicts are coming to the surface over time.

The role of the US’s and China’s systems and how they’ve led to their current positions

The US economic system that prizes the role of the individual and economic liberalism led to a system that prizes innovation and led to Americans producing great advances and wealth.

At the same time, this led to larger wealth gaps within the country. If a company comes up with technology that enables people to do something better and/or faster, that’s good for the whole but disadvantages some in the process. Some jobs also went offshore and hollowed out some local economies.

These larger wealth gaps now cause domestic conflicts and disrupt domestic order. They also threaten the productivity advances that are necessary for the US to remain strong.

In previous times, China’s former collapses came via internal conflicts, excessive debt and money weakness, and external conflicts with other empires. China’s influence dropped at the same time the US’s influence was expanding.

The dreadfulness of the conditions produced by communism, where the lack of incentives led to widespread poverty and insufficient progress, produced changes that led to more market-based approaches.

The creation of incentives and a more capitalist approach produced advances in China’s wealth and influence on a global scale. It’s also produced wealth gaps that are understandably a concern for China’s leadership, given the source of friction they’ve been in the Western world.

US: Fighting vs. Ceding Ground

The US is in a position where it will need to defend its position in the existing world order versus giving up ground.

Because the US won the war in the Pacific during World War II, it now has military bases all over the world to defend its position in the world order even though it’s not economical to do this.

It also gives the US the role of defending certain islands – including the geopolitically sensitive matter of Taiwan.

If China expands its territory in the Pacific, the US has a decision to make it terms of how it responds. Small islands in “the middle of nowhere” don’t mean much strategically. But the precedent ceding any ground sets is a big deal.

How the US might handle the risk of setting precedents versus avoiding escalation is an important matter of consideration as US-China relations evolve in a geopolitical way.

What defines success for countries

Countries’ success depends on bolstering and maintaining the elements that strengthen them without producing the excesses that make them susceptible (internally and externally) and lead to their relative declines.

Successful empires tend to maintain their “top power” status for 2-3 centuries. No empires have done it in perpetuity.

The grainier details in US-China relations

Though this article focuses more on the big picture, the smaller details are also important and worth considering without losing sight of the big picture.

Matters like Huawei, Hong Kong sanctions, roving battleships, monetary and fiscal policy unification in the US, greater social and political discord, closing consulates, TikTok, and others are appearing with greater frequency. They are all part of this process of two powers butting up against the other.

The types of conflicts

There are five main types of categorical conflicts (“wars”) that countries have:

i) trade and economic (usually the first domino to fall)

ii) capital (currency, debt, capital markets)

iii) technology

iv) geopolitical

v) military

All these need to be considered. While it would be nice if such conflicts didn’t occur and cooperation was always the central guiding force, we must also be practical in acknowledging that they exist.

Past history can be a guide to how current events are likely to transpire as the same things tend to happen over and over again for the same cause-effect reasons.

We can also use our own understanding of developments playing out in real-time to think about what’s most likely to happen next and how to deal with it from a trader’s, business person’s, or policymaker’s perspective.

We can see the various types of conflicts going on currently in various ways and to varying extents.

They are not just individual things going on but conflicts that are related to each other that make up a larger evolving conflict.

As they play out, we need to look at and try to understand the strategic goals of each.

For example, if you’re the stronger power (but declining in relative terms) you typically want to fight first. Will this apply to the US?

China is the weaker power but gaining strength in relative terms. China fears the US military, US dollar and the geopolitical and economic power that it provides, and US semiconductors and the broader US technological advantage.

Or does the US believe that easing conflicts is better even as China works its way into a bigger power where such conflicts will be inevitable anyway?

What will the “red lines” between each side look like?

Both leaders will have to make clear what they consider unacceptable for the other to transgress.

At the 2021 World Economic Forum in Davos, Chinese President Xi Jinping issued a veiled warning against the Biden administration’s intention to build an alliance (likely with the US’s European allies, most notably) in order to boost its power in challenging an increasingly powerful Beijing on a range of global issues.

Xi instead encouraged multilateral coordination instead of hardline factionalism to cooperate on tackling various global challenges.

Xi called for increased global macroeconomic policy coordination and asserted that nations should abandon “ideological prejudice” regarding forcing other countries into a single governance style, where China and Western democracies have differing approaches.

The Chinese president called for more coordination through the Group of 20 (G20) economies, the World Trade Organization (WTO), the United Nations (UN), and the World Health Organization (WHO). These are all organizations where China holds material influence.

Xi asserted that overall financial policy should be unified globally, but didn’t reference organizations like the International Monetary Fund (IMF) or the World Bank, both located in Washington.

He said history has shown that no country would win in a confrontation between warring sides, whether that be a “Cold War, hot war, trade war, or tech war.”

His message of multilateralism and coordination at Davos has contrasted with what Xi has said within China, where the president has emphasized the superiority of China’s way of governance. Xi recently told a party assembly that “the times and trends are on our side.”

__

In the following parts of this series, we’ll look through each of these conflicts individually – trade and economic, capital, technology, geopolitical, military armament, and internal conflicts – the template involved in each, and how they’re likely to transpire.

Parts in this series

- Part II: The Capital War’s Impact on Markets & Role in US-China Relations

- Part III: The Technology War: Impact on Markets & US-China Relations

- Part IV: The Geopolitical War: Impact on Markets & US-China Relations

- Part V: Military War: Role in US-China Relations & Impact on Markets

- Part VI: The Internal War: Conflicts Within Countries & Impacts on Markets