Bitcoin vs. Gold: Which Asset Is Better?

‘Bitcoin vs. Gold’ is an increasingly popular debate in trading, investing, and market circles as people debate a classic store of value (gold) versus a newer digitized version (bitcoin).

Cryptocurrencies, with bitcoin being the most popular, have mostly been driven by speculation. However, as they mature and have more institutional adoption, bitcoin and others could increasingly be seen as a type of alternative cash or store of value asset like gold has been for thousands of years.

A look at Bitcoin vs. Gold

Bitcoin’s rise is not only as a conduit for speculative activity but also a function of the environment we’re in.

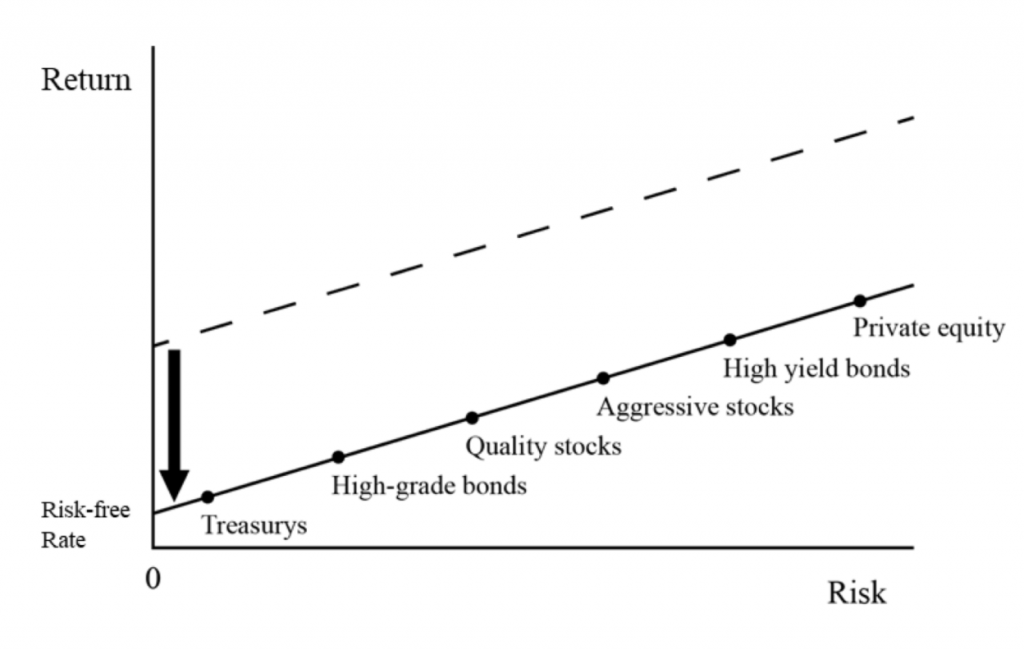

Most central banks globally have lowered interest rates down to or around zero in both the short-term (i.e., cash) and in the long-term (i.e., bonds).

This has the impact of also pushing down the forward returns of all financial assets by pulling forward more of those returns through the present value effect.

This impacts stocks, real estate, private equity, and practically all financial assets.

Falling short-term interest rates reduce the yields of other asset classes

Assets like gold and bitcoin don’t pay an outright yield. But this isn’t important when the yields of other assets fall and make alternative currencies more desirable and more competitive with traditional financial assets.

It also has the impact of depreciating currencies because fewer people want to hold the currency and assets denominated in the currency when the forward returns are so low.

So, it’s perfectly sensible for people to look for alternative stores of wealth.

This can include reserve assets like gold, silver, and other precious metals, and also commodities that are needed (oil, agricultural products, iron, copper) and the producers of them.

Cryptocurrency just happens to be another asset class that’s been developed as a type of alternative money.

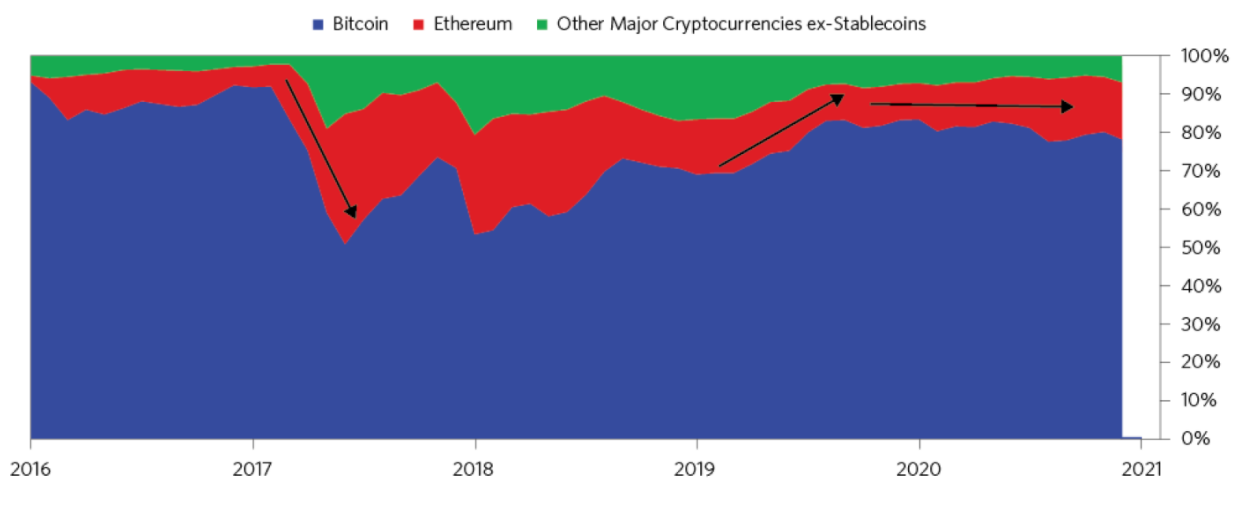

Bitcoin is a large fraction of the cryptocurrency market – still well more than 50 percent by market cap, excluding stablecoins backed by fiat currencies.

Share of cryptocurrency market (BTC, ETH, others ex-stablecoins)

Bitcoin offers some attractive qualities:

- It has limited supply. It can’t be printed or created like central banks do with cash, debt, and other promises to pay based on fiscal policy decisions.

- Can be exchanged globally.

- Greater adoption beyond retail speculation.

It also has drawbacks, such as:

- Its volatility.

- Limited operational capacity.

- An uncertain regulatory future.

Bitcoin’s market cap is also similar to a large cap US tech company. So, on its own, it’s not the deepest market.

So for large institutional investors it’s not particularly viable. Other big players – e.g., central banks, sovereign wealth funds – also won’t use it as a source of national reserves.

Bitcoin’s future has a wide range of outcomes. One possibility is its large-scale adoption as an institutionally accepted store of value and becoming a type of currency hedge similar to gold.

Bitcoin has the potential to be a diversifier. But at the same time, like most speculative assets it is highly liquidity-driven. So it shares a high correlation with stocks.

Of its main risks:

i) Volatility

Bitcoin’s volatility inhibits its widespread adoption. What kind of future purchasing power can be obtained from it is of paramount importance to the bigger players who could truly transform bitcoin and cryptocurrency into a mainstream asset.

Naturally, there are a lot of smaller players in the market who use it to try to make money by simply betting on its price movement.

Of any mainstream asset – stocks, bonds, gold, stable reserve currencies, real estate – bitcoin faces a much wider distribution of outcomes, reflected in its much higher volatility.

ii) Operational

Bitcoin does not have enough liquidity for big players in the market to dip their toe too far in the water.

For example, companies like Microstrategy, Square, Tesla, and some others have bought bitcoin but not in material quantity (limited to low single-digit billions at the high end, with those transactions spaced out over time to prevent disruption to the market).

So traditional institutions have constraints in how much bitcoin they can hold, unlike other assets with much deeper markets worth hundreds of trillions of dollars (e.g., bonds/credit, stocks).

iii) Regulatory

Throughout history, central banks and central monetary authorities have wanted to have control of all money and credit within their borders.

People find ways around this, such as buying assets that are money-like in nature (e.g., gold, commodities, collectibles) and/or move their money into other jurisdictions.

This is why throughout history you’ve seen governments take actions to ban gold.

In the United States, under Executive Order 6102, gold ownership was banned from 1933 to 1975 to avoid hoarding and to help get more cash into the economy. Some minor exceptions existed, such as some collector coins and jewelry. Some relaxations of the law came into place in 1964.

Banishment of monetary systems that exist outside the government’s control are always at this type of risk.

Bitcoin is part of this. It could become a victim of its own success. It has also had its own issues with being a conduit for illegal activity, which has put it on the government’s radar.

The US and EU’s top policymakers have taken note:

Janet Yellen:

“Cryptocurrencies are a particular concern. I think many are used, at least in a transaction sense, mainly for illicit financing. And I think we really need to examine ways in which we can curtail their use and make sure that money laundering doesn’t occur through those channels.”

The ECB’s Christine Lagarde echoed the same thoughts:

“[Bitcoin] is a highly speculative asset, which has conducted some funny business and some interesting and totally reprehensible money laundering activity. There has to be regulation. This has to be applied and agreed upon … at a global level because if there is an escape, that escape will be used.”

Bitcoin has significant regulatory tail risks. It does not have the faith and backing of a national government so it doesn’t have that type of safety to it.

It also lacks a long history. So it’s hard to look through decades or centuries of data to determine how it would have done in certain scenarios and what the future demand could look like.

More regulation could be beneficial to institutional demand.

But bitcoin also has many holders who like the asset because of its more private nature. Accordingly, this could trigger selling by those who own it who don’t welcome more regulatory oversight of bitcoin.

It’s very possible that due to the new paradigm we’re in – cash and bonds sporting negative real interest rates throughout much of the developed world and their markets – this has accelerated the development of alternative stores of value.

With monetary policies are what they are, cryptocurrencies can be viewed, in part, as a natural evolutionary consequence.

Whether bitcoin or cryptocurrencies more generally are the “right” expression of this instead of something else is a matter that’s widely unknown.

Government bonds – and many corporate bonds – no longer provide the same return or diversification benefits as they once did.

Currencies are also at greater risk of depreciation when they provide negative real returns, as it means “sound money” is no longer a priority.

You’re essentially telling holders of the currency and debt that you’ll destroy their wealth.

People recognize this and move toward other things, such as real estate, stocks, gold, precious metals, commodities, other types of real assets, and/or bitcoin and cryptocurrencies and other digital offshoots, which provides an additional avenue.

A large number of things will determine bitcoin’s future in terms of price and overall longevity, which is difficult to know with any confidence.

It remains less than one-tenth of the size of the global gold market (including jewelry).

Bitcoin’s place among cryptocurrencies

In 2017, bitcoin had a strong rally driven heavily by retail speculation. This eventually died out and 2018 and 2019 were relatively tranquil, trading mostly within a band.

The zero-/near-zero rate environment also largely existed in 2017 in developed markets.

There are multiple cryptocurrencies in existence, but bitcoin has the bulk of the market share and also social share. So it’s the primary focus around whether it can be a type of alternative gold.

The 2017 rally was characterized by a lot of speculative interest, but it saw its share of the overall cryptocurrency market fall. Other “coins” also rose in popularity at the same, including ethereum, litecoin, Ripple, among others.

A large portion of that speculation came in the form of initial coin offerings (ICOs).

Speculators bought into new cryptocurrency tokens that were offered by new types of companies that promised new types of technologies and business models based on “permissioned blockchain” and other decentralized technologies.

Bitcoin’s share of the cryptocurrency market rose back above 80 percent in 2019. This gave bitcoin itself, as opposed to ethereum or others, the idea that it’s a type of “digital gold” and an asset that potentially prove itself as a store of value over time.

Its finite supply may give it a gold-like character

Bitcoin is not much as a medium of exchange, similar to gold. You can buy very few goods or services with it.

Moreover, bitcoin has issuance constraints. It cannot be printed by central banks and devalued in that way. Only 21 million bitcoins can be produced, with the issuance rate halving every few years.

This feature gives it a type of gold comparison. In the early days, bitcoin’s rate of growth was quite high. It has since settled to be lower than that of gold.

In 2010, bitcoin’s total supply increase as a percentage of current supply was 3.5 percent. In 2014 it dipped below 0.5 percent and is now trending under 0.25 percent in the 2020s.

Gold’s supply increase is about 1.5-2.0 percent per year.

Bitcoin can look attractive for some of the same reasons that a trader or investor might own gold.

When the yields on other assets collapse, it increases the appeal of assets that don’t pay an outright yield. That includes commodities, collectibles, and other real assets.

An economic environment where growth sags but inflation picks up (stagflation) is also a possibility. Both stocks and bonds are at risk of doing poorly in this environment. This means most people’s portfolios are at risk, being equity-centric (e.g., 60/40).

Adding assets that can do well in this environment can be useful. Gold is one of the few that can perform well in stagflation. The 1970s were a prime example.

Bitcoin lacks the track record, so it’s not known. Bitcoin’s correlation with stocks has been over 90 percent. But correlation is an outcome, not a thing of itself.

Bitcoin and stocks are different assets. The latter calculates the present values of future cash flows (i.e., corporate earnings). The former is a type of privatized digital money.

Even though they’ve both been very liquidity-driven, that may not be the case in perpetuity.

Stocks perform well in an environment of steady to high growth and low to moderate inflation. Is bitcoin conducive to environments different from that?

Institutions will want to understand whether they’re buying something that’s different from their regular portfolio.

Gold knowingly provides a diversification benefit and is not associated with the finances or credit risk of any country. It’s no country’s liability.

Bitcoin has that similarity as a non-credit-dependent asset, so you could see a case for that, at least conceptually.

Bitcoin’s portability

Scarcity is not enough to help drive the demand and price of an asset and to sustain it as a store of value. Lots of things are in scarce supply but don’t have much demand.

Other cryptocurrencies are available and many are similar to bitcoin.

Bitcoin has been able to outcompete them so far. It has a:

- longer history

- larger market size

- more acceptance as a form of payment (though it’s still very limited)

- greater social awareness, and

- some smaller level of institutional adoption

Bitcoin has outperformed bitcoin cash (a product of a fork with bitcoin), ethereum, litecoin, and monero, which are conceptually similar to bitcoin with its focus on fixing its total supply.

Stablecoins like tether are collateralized and pegged to national currencies like the dollar. But because of this nature they are not really alternative store of value assets. They are basically a form of digital fiat currencies (mostly dollars).

Quality stores of wealth are easy to access and exchange.

Compared to things like gold, real estate, art, classic cars, and other traditional stores of value, bitcoin is easy to exchange. It might be the most portable, even more than physical cash.

And many forms of cash globally don’t have value outside of their borders. Bitcoin, on the other hand, has a vast geographic reach.

With bitcoin exchanges and bitcoin ATMs proliferating globally, bitcoin is increasingly easy to convert back into cash. It’s still, however, not as easy to convert bitcoin into cash as it is USD into local currencies, excluding capital controls.

At the onset (2010-13), crypto volume was mostly in USD in terms of conversion. By 2015, it had fallen to under 80 percent and has since settled to around 45 percent since 2019. More crypto volume is actually done in yen (25 percent) than in euro (10-15 percent).

About 5-10 percent of the market is done in other currencies outside USD, EUR, and JPY.

China was a big player before 2017. But onshore Chinese exchanges had lots of fake volume. But China is much more strict about cryptocurrency activity and tightly regulated the 2017 ICO boom.

Diversification

Diversification and its benefits are broadly known and wanted throughout the trading and investing community.

It’s always a matter of if what you’re buying or what you’re doing is going to provide diversification when your portfolio most needs it.

Gold and bonds are commonly thought of as diversifiers to equity exposure. This is true. But if lots of people need to sell to raise cash to be defensive or make their payments and there are not enough buyers of them, assets that normally have different characteristics and offsetting exposures can correlate strongly.

Bitcoin could be one of those assets that people are quick to sell if they need money. It didn’t do well in the 2020 drop.

It fell more than 40 percent in a few weeks, comparable to equities:

BTC/USD Price

(Source: Trading View)

So there’s not sufficient evidence to say that bitcoin can reliably provide portfolio diversification benefits.

As still mostly a speculative asset, its price doesn’t correlate well with the prices of the things one needs to buy in order to help preserve spending power.

Bitcoin shows some positive correlation with breakeven inflation expectations – as inferred from the US TIPS market – but it’s not reliable.

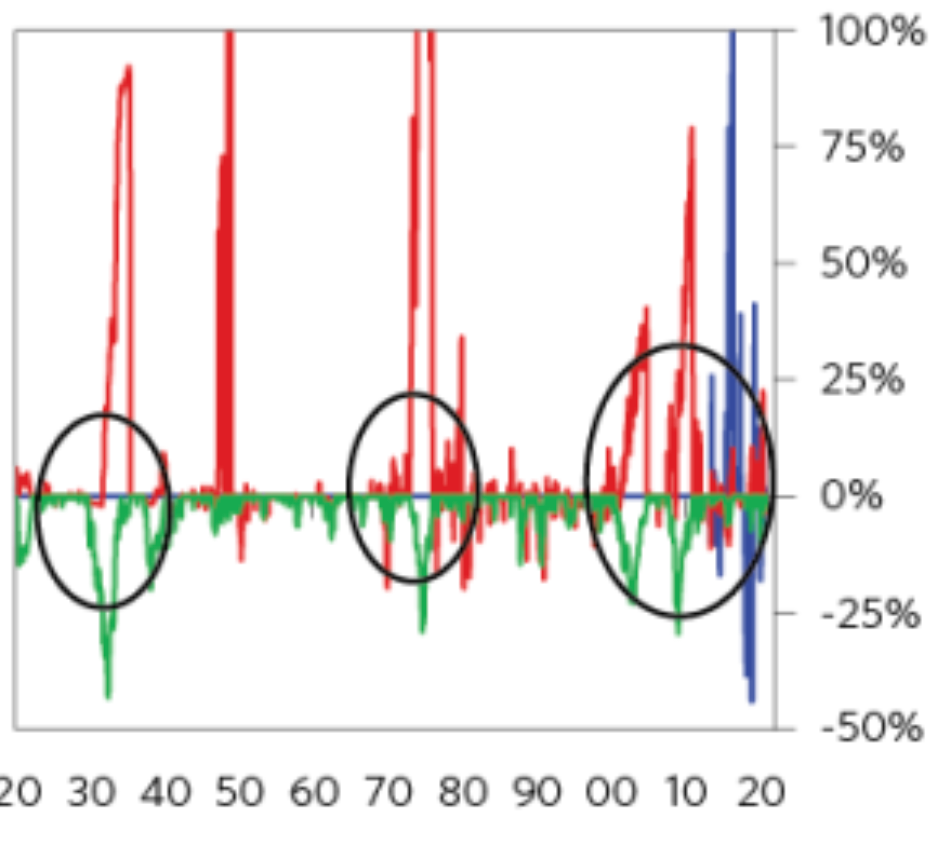

Gold (red line in the chart below) has reliably offset a traditional 60/40 stocks/bonds portfolio (green) since 1920. Bitcoin (blue) is not yet reliable enough to know.

Gold (red) vs. US 60/40 (green) vs. Bitcoin (blue): 1920-present

Given how the cryptocurrency asset class is changing and the small sample size since bitcoin’s inception in January 2009, we can’t really draw many conclusions.

Bitcoin’s developing infrastructure, volatility, and uncertain regulatory future hold back institutional adoption

If you’re going to buy an asset like bitcoin, you expect it to at least preserve your purchasing power over time and preferably increase it.

Bitcoin remains volatile and speculative.

It is not widely used to save in. It’s not a reserve asset held by governments, sovereign wealth funds, or broadly by big institutional investors and capital allocators.

Even among private institutional purchases, most of it is still being traded for speculative purposes and not to save in, like the central purpose of gold.

How do you determine between how much bitcoin is used for speculative purposes and how much is used as savings/to store wealth?

You can look at accounts that are, for example:

- beyond a certain age – e.g., pre-2017 accounts or accounts that are at least several years old (say 5 years)

- Accounts that have bought bitcoin but haven’t yet sold any

About 25 percent of bitcoins have been held for five or more years. The number of accounts that have bought bitcoin but haven’t sold is around just 15 percent (up from 11 percent at the beginning of 2019).

Most of the bitcoin supply still appears to be used for trading purposes. Naturally, this accounts for a lot of its volatility.

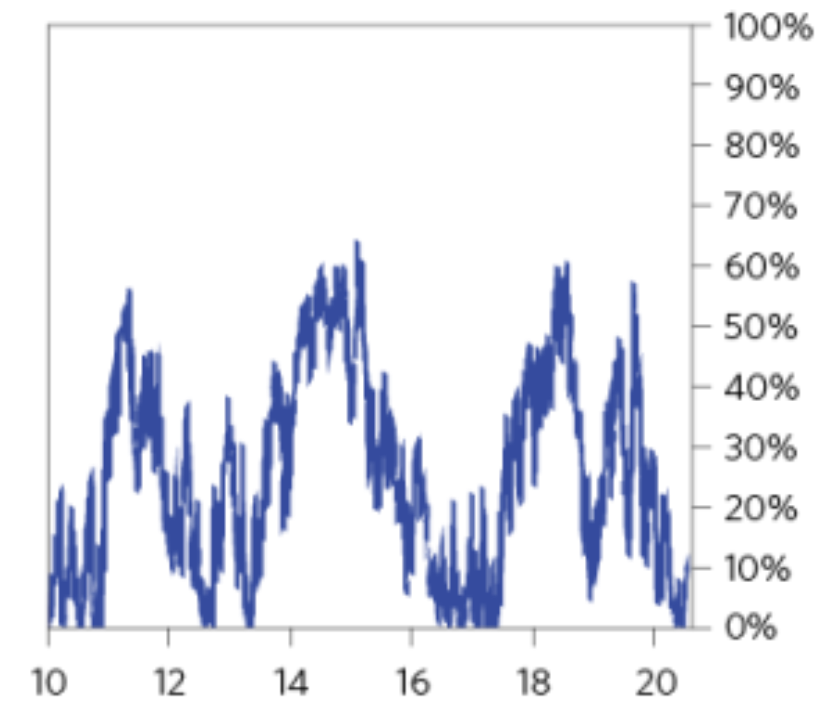

Turnover is another common measure to determine the degree to which a market is being used for speculative purposes versus being used as an investment or reserve.

Bitcoin’s turnover is much higher in relation to gold.

Turnover in the gold market is very low, only about one percent of the amount outstanding. This is because central banks hold a large supply of the global gold stock. It’s the third-largest form of reserves behind dollars and euros.

Bitcoin’s turnover varies wildly – typically between 20-50 percent, measured as the average daily of the percentage outstanding.

This is due to high-frequency trading, new instruments that trade against bitcoin, new exchanges, and also because of the development of bitcoin derivative markets.

The volume data reported by unregulated exchanges is dubious. It gives the illusion of higher liquidity in the bitcoin market. But it’s realistically demonstrative of higher churn and speculative trading rather than longer-term holdings.

2020-21 bitcoin bull run

In the 2020-21 bitcoin run, the asset showed some of the common sign of an asset bubble:

- Very expensive call option pricing

- High bullish sentiment

- Increasing amounts of purchases on leverage

Bitcoin call options priced in a set of very high future returns, analogous to other speculative assets like Tesla (TSLA) and Gamestop (GME).

Bitcoin’s 10th-90th percentile price outcomes for January 2021 options priced in an outcome anywhere from $10,000 per BTC all the way up to $85,000 per BTC.

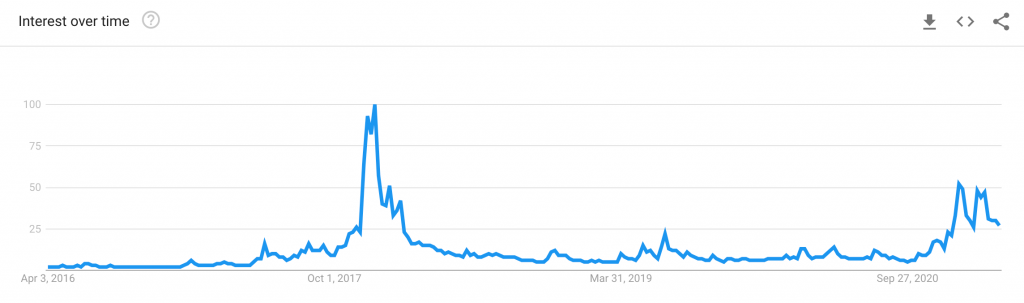

The 2020-21 run was less leveraged and overall had less overall froth to it than the 2017 bubble. But the run also re-invited retail speculative interest in the asset and more leveraged buying.

Bitcoin’s interest on Google went up significantly.

Google Trends data for ‘bitcoin’

These speculative bullish dynamics can make a case for wanting to do the opposite. However, shorting assets in a bubble can be ruinous, as these dynamics can persist over large periods of time and give short-sellers liquidity issues if their timing is bad.

Even if you feel confident that an asset is very overpriced – either in the short-run or possibly on an indefinite basis – a lot can transpire between now and when that new equilibrium is reached.

All of these influences resulted in bitcoin being much more volatile than other riskier forms of financial assets like equities and commodities. And of course much higher than traditional store of value assets like gold.

The rolling monthly volatility for US equities typically runs from 3-6 percent, about 1 percent for shorter- to mid-duration US Treasury bonds, and 4-6 percent for gold.

There have already been many times in bitcoin’s history where a significantly large share of bitcoins were held at a loss, and of course the converse where the majority are held at a profit.

From 2010 to 2021, there were four periods where 50 to 70 percent of all bitcoins were held at a loss.

Percent of BTC supply held at a loss

(Source: Glassnode)

However, for an asset to act as a store of value, avoiding large drawdowns is much more important than having the potential for large speculative upside.

Bitcoin is essentially very option-like in character – i.e., it acts like an option on a store of value.

What could help bring down bitcoin’s volatility?

The market is full of different buyers and sellers who all buy and sell for different reasons based on different goals.

If bitcoin has a greater diversity of owners beyond the traditional speculators and has greater liquidity it could help lower bitcoin’s volatility over time.

Right now, bitcoin’s volatility is too high relative to what one would consider a quality store of value.

At the same time, markets evolve and different assets are adopted by different types of market participants who all have different goals, motivations, and time horizons.

Future regulatory outcomes create favorable and unfavorable dynamics for bitcoin

For bitcoin and/or other cryptocurrencies to develop into a mainstream store of value, the regulatory environment will be important.

Will better trust be developed in the asset class?

If there is more oversight it will reflect favorably for larger-scale institutions and less favorably for others who prize its more private nature.

This makes it more attractive for some and less attractive for others.

Of course, with the situation the US and other developed markets are in with very low yields in traditional asset classes and the need to monetize debt and debt-like obligations over long periods of time, this creates the risk of capital flight into other stores of value and into other countries and currencies instead of into credit.

Traditionally governments have responded by doing one or more of the following:

- Banning gold ownership

- Establishing foreign exchange controls

- Occasionally implementing price and wage controls

Bitcoin could be outright banned if it becomes too successful as an alternative wealth storage asset.

Bitcoin will naturally receive increasing focus from policymakers and there are a wide distribution of potential outcomes. This includes bitcoin most prominently because of its share of the market but also other cryptocurrencies as well.

And policymakers will likely want to agree to something at an international level to try to prevent people from taking advantage of more lax regulatory environments.

The main two ways regulation is likely to transpire

- More draconian measures to avoid undermining the use of fiat currencies to help central banks control all domestic money and credit. This could hamper the development of “private money” projects in their current form.

- Create regulation that provides more trust in the asset, but also create more volatility as the desire for the asset shifts among different buyers and sellers who all have different wants and motivations.

China’s regulatory actions toward bitcoin

China has already taken a more proactive approach toward the asset class.

China decided to ban ICOs (i.e., cryptocurrency fundraising) in September 2017. Bitcoin shed 8 percent on the news.

The US is less likely to follow that path, but it’s a possibility.

Moreover, bitcoin purchases heavily rely on bank debits and wire transfers. (It’s very difficult to buy any amount, modest or otherwise, on a credit card due to its speculative nature and the risk that lenders won’t be paid back if bought on credit.)

So if the US wanted to ban bitcoin purchases it could attempt to shut down that process.

Central banks are also increasingly looking to come out with their own digital currencies – e.g., digital USD, digital EUR, digital RMB, etc.

These are officially sanctioned by governments and they might want to limit the competition that private currencies pose.

A full outlawing of bitcoin in the US is probably unlikely. But there are many things that could potentially damage bitcoin’s value and its broader adoption.

The US regulatory environment has been welcoming to cryptocurrencies, blockchain, and decentralized technologies in ways where no harm is being done. However, there have been crackdowns in places where cryptocurrencies have helped support illegal activity or in ways designed to undermine existing laws and regulations.

For instance, US banks can use stablecoins and blockchain technology to make payments.

At the other end of the spectrum, the US Treasury is looking to curb the use of self-hosted cryptocurrency wallets (i.e., wallets that are not hosted by a financial institution or cryptocurrency service) and ban the use of coins with built-in privacy features that enable anonymous online commerce, such as:

- Zcash

- Monero (XMR)

- DASH

- Verge

The proposed self-hosted wallet regulations resulted in a drop in bitcoin’s price.

The most prominent stablecoin on the market, Tether (USDT), is also under investigation by the US DOJ, New York State Attorney, and CFTC for issuing more of the coin without backing them by US dollars as claimed.

The liquidity across cryptocurrency markets is highly interconnected. So a fallout in one major cryptocurrency can have reverberations in others, including bitcoin.

If more large institutions adopt cryptocurrency, it could still result in increased volatility due to the motivations of large existing holders.

Many bitcoin holders have a more libertarian belief system and prefer less government encroachment on the bitcoin and cryptocurrency markets and other blockchain technology.

At the same time, regulation could benefit the asset class over the long-term.

More institutions participate in the cryptocurrency market as opposed to 2017, with better market liquidity, better custodial services, and improved trading infrastructure.

The development of bitcoin derivative markets (both on crypto exchanges and traditional exchanges) has helped.

Increasing numbers of flows into bitcoin have come from larger transactions than those seen in 2017 when retail participation was highest.

Institutional participation in bitcoin is nonetheless still limited to smaller corporations and hedge funds and family offices with smaller asset bases. Larger institutional funds are still a very small part of the market.

An estimated 10 percent of the bitcoin market is comprised of “lost coins” where forgotten login credentials have essentially prevented their owners from accessing them.

Bitcoin’s valuation

Bitcoin’s valuation has a very wide set of potential outcomes, which shows up in its volatility.

One can run a simple exercise.

What if you took global gold reserves and those holding them wanted to diversify a percentage of that amount into bitcoin?

What if 20, 30, 40, or 50 percent went from gold and into bitcoin?

What if those invested in bitcoin – due to, e.g., regulatory changes or the desire to realize gains – wanted to be less concentrated in it and wanted to move more into equities and other assets (which would decrease the price of bitcoin)?

What would happen to the price of bitcoin if various governments started outlawing it?

Or if government regulation became more strict but didn’t go so far as to threaten its existence outright?

Would more regulatory oversight help institutional adoption? It would depend on how it’s regulated

Would more public oversight also trigger selling by those who value its more private nature?

There are various different possibilities you can come up with that are all within the realm of possibility. All of these can build out a very wide range.

There’s a big left- and right-tail.

Bond flows

The largest asset class globally is bonds. The size of the global bond market is over 300x the size of the bitcoin market.

Because of bitcoin’s limited liquidity, it lacks the capacity to take in big flows from bonds but could move the price materially if such a shift were to occur.

Bond yields are very low in much of the world, including all the markets where there is large institutional demand for their debt.

Accordingly, their diversification properties have narrowed. And national currencies are at risk of depreciation. This is aiding the demand for alternative assets.

Bitcoin’s price moves around a lot, but it is typically 4-10 percent of the size of the global gold market. This includes jewelry and miscellaneous gold items.

We know that bitcoin has a much wider range of potential valuations relative to something like real estate, gold, or other traditional safe-haven sovereign currencies (e.g., dollar, yen, franc).

Gold to Bitcoin conversions

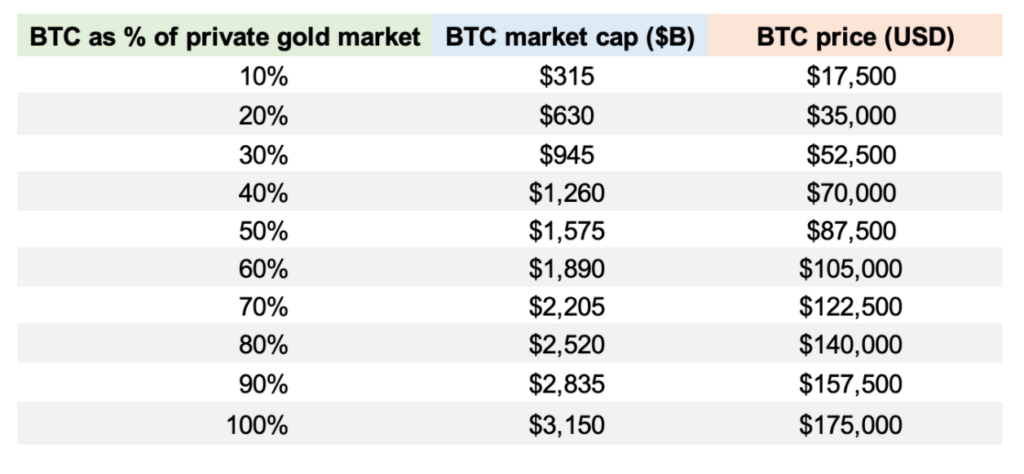

Can bitcoin become more gold-like in the way it’s perceived as a store of value?

If more people and important private and public sector institutions wanted to convert more of their gold into bitcoin, or bitcoin became a certain fraction of the gold market, how might that affect bitcoin’s price?

Bitcoin’s market cap at the beginning of 2021 was already around 20 percent of gold’s privately held market cap.

That came to a market cap of around $630 billion for bitcoin or about $35,000 per BTC.

A rise to 30 percent would put bitcoin over $50,000 per BTC.

If 40 percent of gold was hypothetically converted into bitcoin, then that’s about $70,000 per BTC.

If 50 percent, then around $87,500 per BTC.

If bitcoin became as big as the market of the private holdings of gold, that’s about $175,000 per BTC.

Figures can be seen in the chart below.

Bitcoin price, if approximating certain valuation levels of the private gold market

Less than ideal liquidity and/or momentum-chasing behavior this could drive bitcoin’s price higher.

Additionally, at what point would central banks consider moving some of their reserves (gold and fiat currencies via sovereign bonds) into bitcoin and how might regulators respond at various price levels of the cryptocurrency?

Regulatory action on a holding of the central bank – national savings – presents an interesting dynamic. Regulation often involves a group of agencies and bodies that are independent of the central bank.

Note that central banks buying bitcoin and other cryptocurrencies is still highly unlikely at this point.

Bitcoin’s market cap would approximate $1 trillion at around $72,000 per BTC.

For comparison’s sake, that’s close to five percent of US GDP and about one percent of global GDP.

Regulation: Best-Case

Greater cryptocurrency regulation and around decentralized technologies, in general, could provide assurance to various market entities that there’s oversight and could provide better access to the asset.

For example, the ability to buy bitcoin outside of cryptocurrency exchanges is not easy. There are certain companies that are plays on bitcoin.

For example, there’s a bitcoin trust GBTC that’s been popular since the 2017 bubble, Microstrategy (MSTR), Riot Blockchain (RIOT), and various microcap companies (e.g., MGTI) are now popular.

More flows into bitcoin itself could create a squeeze on fixed a supply and result in momentum dynamics that could theoretically drive the price even higher.

Moreover, there’s much right now that we aren’t aware of that could drive bitcoin higher or lower.

The range of possible outcomes mentioned above is not so much about making a specific forecast but rather showing a range of possible outcomes.

Bitcoin’s operational issues and matters regarding long-term robustness of the currency

Bitcoin lacks regulatory clarity and there are operational constraints. For example, larger institutions – those who could be most influential in supporting it long-term – have greater custody requirements.

Most instruments are of registered form. This means the security’s issuer records ownership and sends them any distributions or dividends they’re entitled to.

Bitcoin, however, is a bearer instrument. No record is kept. Ownership of bitcoin is determined by private key possession only.

So, safeguarding is an important consideration. There are insurance considerations. Getting custodial arrangements for digital assets is more expensive than traditional stock and bond holdings.

The regulation for digital asset custodianship is still underway.

Insurance underwriting for digital assets is still in its nascent stages. Custodial services for institutions are still being developed and rolled out.

For the large institutional entities to own bitcoin there needs to be adequate liquidity in the market to make trades in size without rattling the market.

It still remains a relatively small market despite improving liquidity. Most institutions don’t want to become a material part of their markets to avoid the potential that somebody could squeeze them.

And there are entities that may only want or be able to access the market through channels like the equity markets and derivatives. They are constrained even further.

Bitcoin’s liquidity remains a fraction of gold’s (about 10 percent), silver’s (about 30 percent), and even smaller commodity markets like iron or copper.

Big institutions run into size constraints in markets like gold and silver, so will be even more constrained in trying to transact in bitcoin if they would like to.

Final Thoughts

Bitcoin can potentially be a store of value. It has lasted since 2009, so it has proven its resilience. At the same time, its track record is small, so it’s more of a speculative bet on a future store of value rather than one that can be determined with reasonable confidence.

The regulatory picture lacks clarity and it could run into issues or roadblocks (or beneficial outcomes) that we haven’t imagined yet.

There will be competing cryptocurrencies, “private money” and digital money projects, and new technologies (e.g., quantum computing) that will alter its trajectory and test its robustness over time.

Bitcoin vs. Gold: Pros and cons of each

Gold Pros

Track record

Gold has been used as currency and a store of value for thousands of years around the world.

Because of its visual appeal, unique characteristics (melting point), and scarcity it’s been used by various cultures for trading and value attribution.

Gold has been used for nearly as long as human society has been around. So we know that it’ll probably continue to hold its value.

While currencies come and go, companies come and go, and empires come and go, you can be sure that gold won’t lose all its value (though it will go through great and terrible periods like every other asset class).

Stability

Gold has increased in value, in real terms, by 1.6 percent annualized since 1850 in US dollar terms. That’s a bit better than cash.

As shown earlier in the article, gold has done a pretty good job of offsetting losses in a traditional 60/40 portfolio.

Gold is not perfect, but it is relatively stable and diversifies a portfolio well, including to currency exposure where most portfolios tend to be concentrated.

Relatively low insurance costs

Gold can be stored relatively safely. There are investment accounts known as precious metals IRAs, which are insured up to a certain amount.

If you buy it through the futures market or through an ETF, these prices are priced in. It’s the reason why gold is a structurally contango market – i.e., an upward-sloping futures curve to factor in storage and commissions costs over time.

Gold Cons

Storage

Gold is a physical possession, so it must be stored somewhere safe, either in a vault or safe.

Limited transactional use

Gold is traditionally a currency that’s used to back bank notes. Gold is effectively priced as the inverse of money and tends to go up when fiat currencies cease to do as well.

However, gold cannot buy much on its own, so its ultimate ability to purchase goods and services lies in its convertibility.

Intrinsic value doesn’t change

Gold is forever just gold. Unlike some other investments in which you can make improvements to them to increase their value or earnings, gold is always going to be the same.

Gold is essentially a type of alternative cash and simply reflects the value of the money used to buy it. When gold goes up, it simply means the value of money in gold terms is going down.

Bitcoin Pros

Portability

Bitcoin is completely digital, so it can be transferred between wallets easily. It can be transferred in person using a QR code or through the use of a third-party exchange service that can connect you with a buyer.

Fixed supply

Bitcoin is similar to gold in that it has a fixed supply. Nonetheless, other cryptocurrencies and other technologies and digital money (private or public) can challenge it, so the supply argument is not robust.

Potential upside

Depending on regulation and institutional and big player adoption, bitcoin could have significant upside. Right now, it’s essentially an option on a store of value.

But it can go both ways. Potential regulation can be more draconian than favorable to institutional adoption, it may never catch on as a source of reserves for central banks and other technologies and projects will evolve over time that may supplant it.

Bitcoin Cons

Volatility

Bitcoin is speculative and has high turnover. Many of the participants in the market use it to make a bet on its price movement over relatively short time horizons, not in its use as a long-term store of value.

Speculative instruments have high potential upside, but also a lot of downside. Anyone who owns bitcoin needs to be comfortable with the idea of losing at least 80 percent of their investment.

Limited transactional use

Like gold, bitcoin has limited transactional utility. Some merchants may accept it, but its volatility makes it risky to do so.

Bearer asset

Ownership of bitcoin is conveyed by a private key. You can own bitcoin offline in what’s known as “cold storage” though it’s difficult to do and few do it.

So the question is whether bitcoin is sufficiently protected against cybersecurity risks? Cyber offense generally tends to be more advanced than cyber defense. Bitcoin has done well so far, but it’s something that’s hard to overlook.

It’s a risk that can be extended to all financial assets that mostly exist in the form of digits.

Web wallets can be hacked, leaving your bitcoin and other cryptocurrencies vulnerable to being stolen. A physical wallet (e.g., flash drive) can be physically stolen.

Uncertain regulatory environment

The downside is that bitcoin could be outlawed entirely, resulting in a potential crash of its price. Governments could also prevent purchases by cutting off the ability to make bank wire transfers or bank debits.

Tightly correlated liquidity across cryptocurrency markets

Trouble in one cryptocurrency market affects all markets due to the tightly intertwined liquidity.

The evolution of other cryptocurrencies, money projects, government digital currencies, and other technologies

If you look at the best companies over time – e.g., those in Dow Jones Industrial Average – they change.

Decade by decade the top companies shift around. New companies come up to take on the incumbents, the incumbents fail to evolve adequately, new innovators take their place, and the process repeats itself.

Bitcoin itself is based on the sound money concept. Only a limited number of bitcoins can be created. It’s relatively fixed technologically.

Whether it’s other cryptocurrencies, other private money projects, digital currencies issued by national governments, or emerging technologies (e.g., quantum computing), there are evolution risks facing bitcoin, like every technology.

Bitcoin could withstand these challenges, rise with them, or lose relevance over time.